3.

MALAYSIA

Bumiputera timber companies assisted

to secure

contracts with major corporations

As is the case in most Asian countries which celebrate

Chinese New Year, business activity slowed in early

February in Malaysia. It may take a week or two for some

industries to rev-up production.

The Ministry of Primary Industries has established a

dedicated mechanism termed the Special Purpose Vehicle

(SPV) within the Certified Timber and Credit Suppliers

(CTCS) programme operated by the Malaysian Timber

Industry Board (MTIB).

The aim of the SPV is to assist Bumiputera companies

secure contracts to supply wood products to corporations

in the construction sector. In Malaysia the term

Bumiputera refers to Malays, Orang Asli and natives of

Sabah and Sarawak.

The CTCS programme was featured in the ITTO Market

Discussion in November 2015 when the International

Tropical Council met in Kuala Lumpur.

Teresa Kok, Minister of Primary Industries, has said the

government has identified key performance indicators for

the purpose of monitoring the programme which aims to

boost the contribution to the economy of Bumiputera

entrepreneurs.

Sarawak pushes forward plantation target

The Sarawak State government has issued 43 industrial

plantation forest licenses to meet its target of one million

hectares of plantations by 2020 however, due to the slow

progress in planting by the private sector, the deadline to

achieve the plantation target has been pushed forward to

2025.

As of the end of January just over 420,000 hectares have

been planted according to the Sarawak Chief Minister.

Harvesting of industrial forest plantation in Sarawak began

in 2011 with log production of 44,000 cubic metres but in

2018 log production from the planted forests was about

1.72 million cubic metres.

Sabah researches cross laminated timber

Joint research by a student team from the University

Malaysia, Sabah (UMS), Wood Technology and Industry

Unit and the Sapulut Forest Development Company has

shown plantation timbers such as ‘laran’ and ‘batai’ are

potential species for use in the production of Cross

Laminated Timber (CLT) products.

CLT is not a new product concept internationally but has

not found application in Asia. The first high rise CLT

building is said to be under consideration by the Nanyang

Technological University in Singapore.

Dr Liew Kang Chiang, Associate Professor in the Faculty

of Science and Natural Resources at UMS, said the team

focused on timber strength and durability and that the

results were promising. Looking to the future, Dr, Liew

said the challenge will be to adapt building regulations to

accommodate this new product.

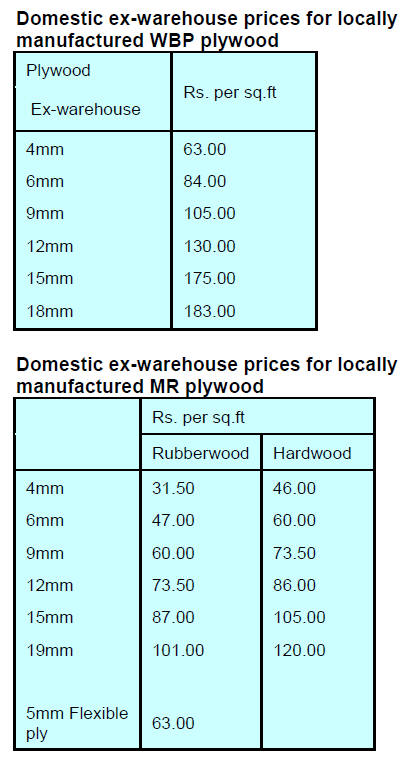

Plywood traders based in Sarawak reported the following

export prices for mid-January 2019:

4.

INDONESIA

Urgent need to boost exports

– regulations to be eased

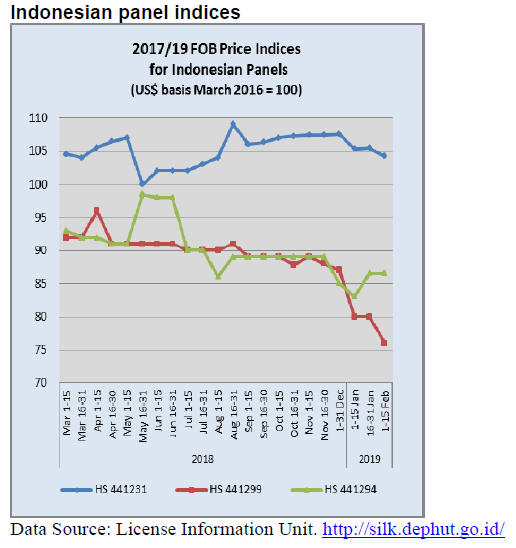

Darmin Nasution, Indonesian Coordinating Minister for

Economic Affairs, said the government will simplify and

ease regulations governing exports in order to boost the

current account so as to address the 2018 US$8.57 billion

trade deficit.

While this is only a short-term measure Darmin indicated

the government was also developing medium-term and

long-term strategies to enhance exports.

Exporters welcomed this move by the government saying

the number of the commodities requiring surveyor reports

(LS's) delays exports and adds to costs. In praising the

government’s initiative, Exporters Association

(GPEI) chairman, Benny Soetrisno, expressed concern that

this short-term measure will help but is seeking a longer

term solution.

In related news, the deputy chairman of the Indonesian

Employers Association (Apindo) called for a continuous

review of regulations and the introduction of better

incentives to encourage exports, pointing out that while

incentives in the form of tax breaks exist the process to

secure the incentive is so cumbersome and time

consuming that many companies do not take advantage of

this.

Beginning February 2019 it is planned that four export

commodities will exempted from surveyor’s reports

namely crude palm oil and its derivatives, gas, semifinished

rattan and logs from industrial plantations. It is

unclear yet when wood products will be exempted.

Success in peatland restoration

The Ministry of Environment and Forestry has reported

that in 2018 some 3.1 million hectares of degraded

peatland was been partly restored through securing an

adequate level of moisture in the peat.

A spokesperson from the Ministry said initially it was

difficult to get companies to cooperate with the restoration

effort but now companies are aware of the significance of

the peat eco-system. The Ministry of Environment and

Forestry has a database for monitoring groundwater levels

and rainfall in restored areas.

Increased employment in manufacturing will benefit

economy

Indonesia’s manufacturing sector can be the new engine of

growth according to the National Development Planning

Agency (Bappenas). A joint report by the Asian

Development Bank (ADB) and Bappenas estimates that

Indonesia could achieve a growth rate of 6.3% between

2020 and 2024 in a scenario where employment in the

manufacturing sector increases. The report says if jobs are

not created in manufacturing then GDP will be around 1%

lower.

Developing the manufacturing sector is vital to efforts to

shift the country away from its lift dependence on raw

materials. To achieve this new direction the government

will now stress the value-added manufacturing sector to

diversify exports.

More than 30% of Indonesia’s exports in 2018 were of

commodities such as coal, vegetable oil and fats, natural

gas and petroleum products.

5.

MYANMAR

MTE to help meet demand of cottage

industries in

Mandalay

The Myanma Timber Enterprise (MTE) office in the

Mandalay Region has announced it will sell 5,400 tons of

logs and sawnwood to local mills and cottage industries.

The purpose of the sale is to ensure local processors have

access to legally harvested raw materials and thus do not

have to revert to illegal logging. One of the drivers of

illegal logging, say analysts, is the inadequate supply of

timber to local industries.

The Forest Department has indicated it plans to demolish

much of the road network used by illegal loggers in the

Bago Mountain range. Analysts report that illegal logging

is still rampant in remote areas despite the 10-year logging

ban in the mountain range.

Industrial zone report announced

A press release from Businesswire has introduced its

research into more than 100 active, developing and

proposed industrial zone projects across Myanmar,

surveying details such as size, pricing, infrastructure,

occupancy and tenants.

Businesswire says research conducted over three months

through site visits and interviews provides a

comprehensive analysis of an aspect of the Myanmar

economy that holds significant future growth potential but

has remained relatively opaque. The review is being

promoted as resource for manufacturers, investors,

contractors, suppliers, lenders, developers and a range of

other organisations active in the manufacturing sector.

See:

https://www.businesswire.com/news/home/20190215005186/en/

Myanmar-Industrial-Zone-Review-Project-Profiles-2019

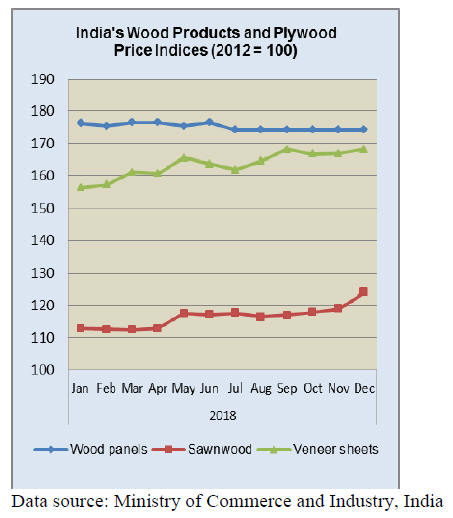

6. INDIA

Price indices confirm staedy demand

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for December 2018 released by the

Office of the Economic Adviser to the government rose to

133.9 from 133.5 for the previous month due to higher

prices for sawnwood, wooden crates, panels and veneers

however, particleboard prices declined slightly in

December.

The annual rate of inflation based on monthly WPI in

December 2018 was 3.84% compared to 4.64% for the

previous month.

The press release from the Ministry of Commerce and

Industry can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Gujarat eliminates license

requirement for timber

industries

In an effort to boost investment in processing the State

government in Gujarat has removed the license

requirement for factories utilising imported wood raw

materials.

The official notification from the State Forest Department

explains that sawmills, veneer mills, plywood plants, MDF

plants and other factories using imported wood will only

need to register with State authorities. Analysts write that

this move will especially benefit plywood factories using

imported veneers.

The change in license system also applies to companies

utilising domestic raw materials from plantations and

farms, a move aimed at encouraging agro-forestry.

Ikea tie-up with local real estate company

The construction company Rustomjee Group has secured

an arrangement with IKEA, the Swedish home furnishings

company, for the supply of ready-to-assemble furniture for

a building project near Mumbai. The Indian media are

quoting the management of the Rustomjee Group as

saying if this pilot arrangement is a success it could be

extended to cover other residential developments.

In October last year IKEA had a ground-breaking

ceremony for its third store in India in Nagasandra,

Bengaluru. This followed the opening of its first store in

Hyderabad two months earlier.

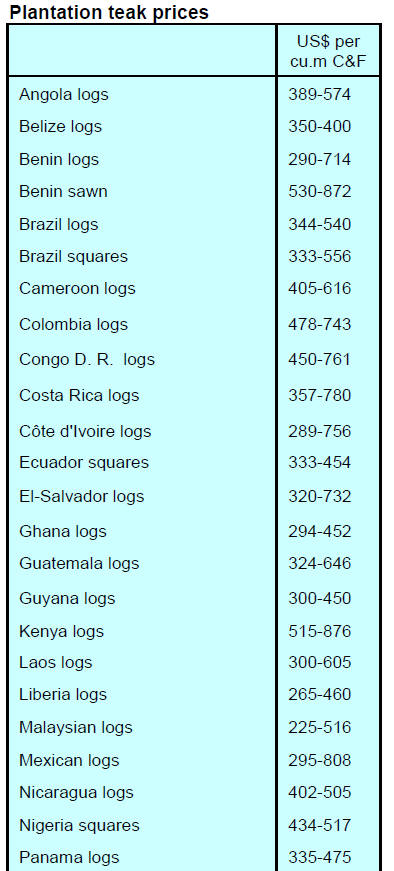

Plantation teak prices

In the current quiet housing market builders have been

trying to lower costs and this is beginning to affect the use

of teak, even plantation teak. Analysts write that recently

sales of apartments have risen but new builing projects

have been delayed until the market picks up.

With slow housing sales, demand for wooden furniture has

been depressed.

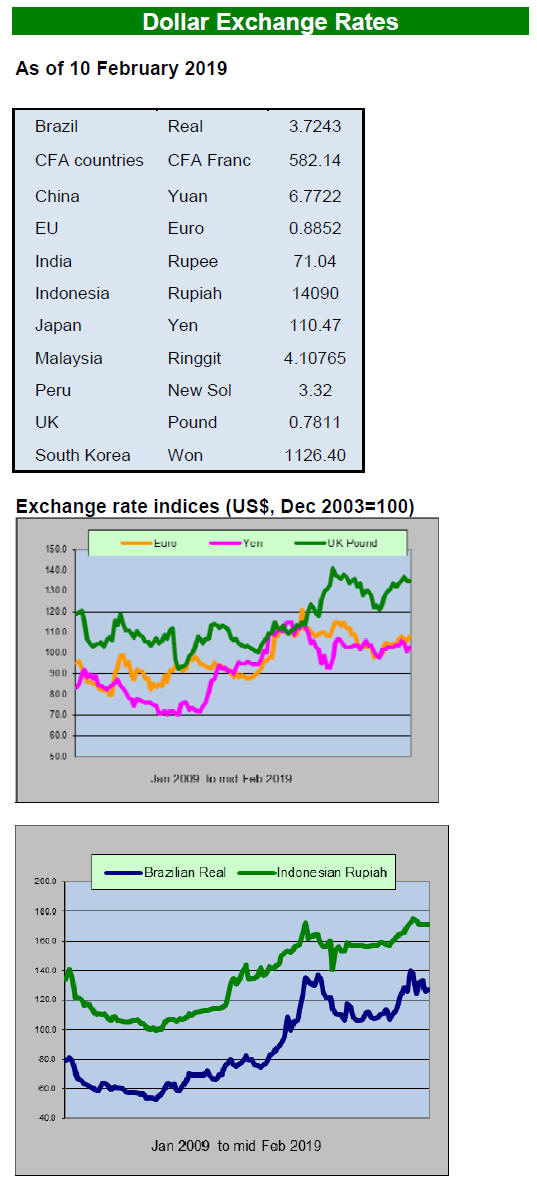

The Rupee/ US dollar exchange rate is holding steady at

around Rs.71 to the dollar and importers anticipate this

rate will be sustained for the time being.

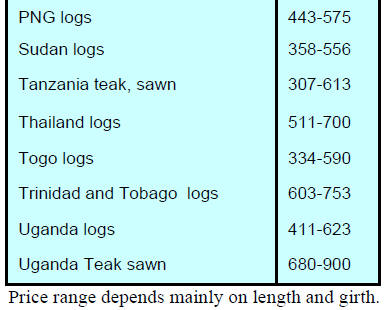

C&F prices for plantation teak landed at Indian ports are

within the same range as shown in the previous report.

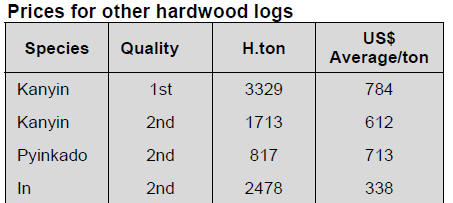

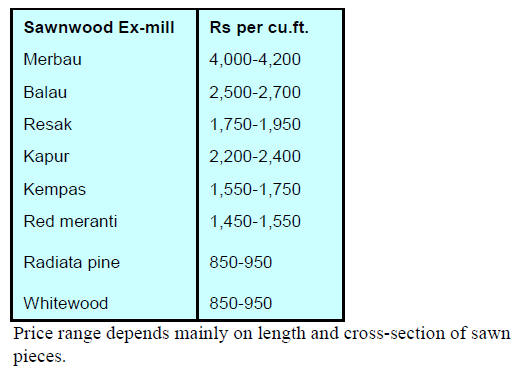

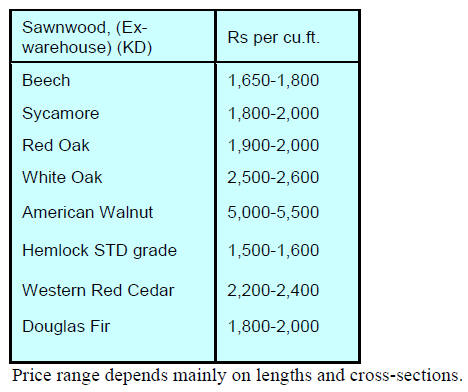

Locally sawn hardwood prices

Prices for imported hardwood sawnwood remain

unchanged from a month earlier.

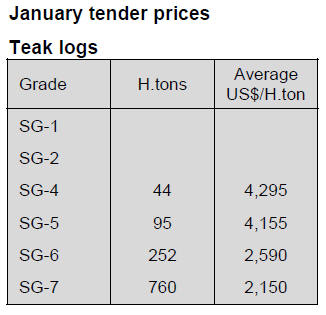

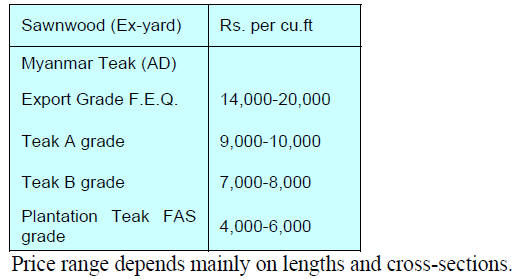

Myanmar teak prices

The market in India for high quality Myanmar teak joinery

and furniture products is limited to high net worth clients

such that demand is little affected by trends in the

economy. Never-the-less this niche market is small. Much

of the teak from Myanmar is processed in India for export

and exports remain firm.

Sawn hardwood prices

Prices for sawn hardwood imports remain unchanged.

Plywood

Plywood mills in India that are dependent on imports of

face veneer from Gabon are facing problems in that

shipments are delayed because of the port congestion.

Analysts report that some have been lucky to secure

alternative sources in SE Asia.

At the end of last year there were already signs of

oversupply of composite panels and this continues. Prices

for both MDF and particleboards are under downward

pressure in the local market.

Weakening prices and rising production costs are

becoming a serious issue for manufacturers.

Several states have encouraged expansion of the panel

sector but this has put pressure on raw material supply. In

these circumstances it is even more imperative that the

industry seeks a reduction in GST from 12% to 8%.

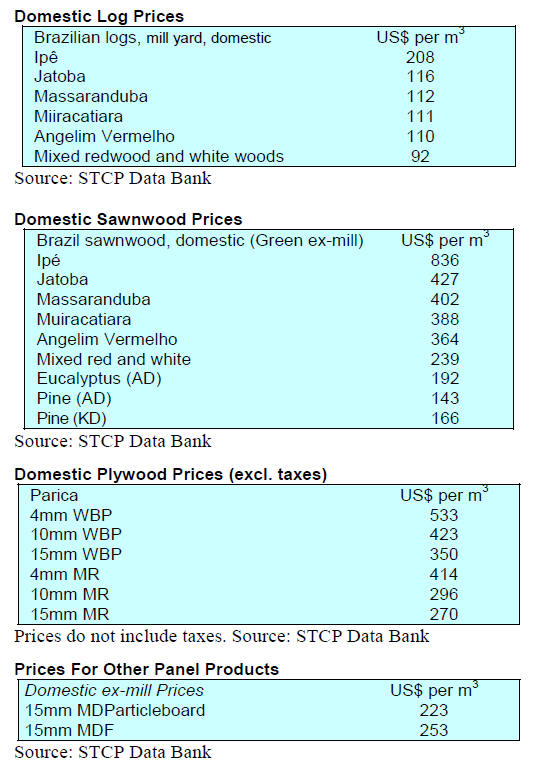

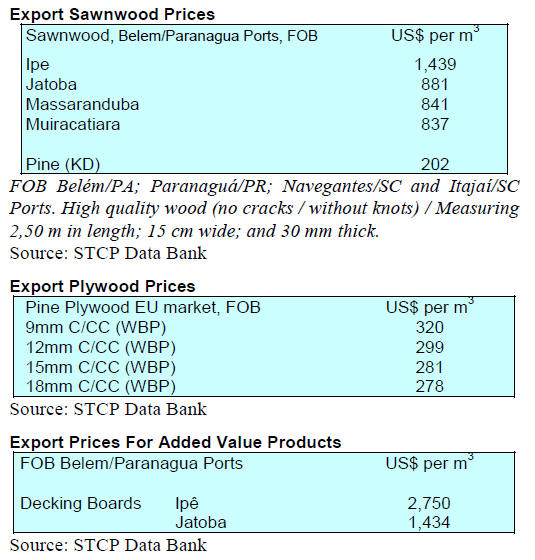

7. BRAZIL

Refinements made to strengthen

‘Control of Origin’

system

The National System for the ‘Control of Origin of Forest

Products’ (Sinaflor) has been strengthened with the

addition of three new tools that will make it easier to

check production chain information across the country.

The new system can be accessed from mobile devices and

tablets.

In addition, beginning in December last, a Business

Intelligence (BI) portal that allows analysis of data

generated by Sinaflo was established allowing real time

decision making.

The BI platform already offers analysis of data related to

timber species, forest products and transportation in

addition to information on users and wood stocks

registered in the Document of Forest Origin (DOF)

system.

Another tool to support Sinaflor is a mobile application

that facilitates field data log-in and reporting of wood

harvesting. Sinaflor is currently developing a Distance

Learning Platform (Ensino a Distância - EAD) that will

enable new operators and public servants to be trained

remotely.

Upward trend in furniture prices

Price volatility in the furniture industry was slightly lower

in December from the previous month according to

Brazilian Institute of Geography and Statistics (IBGE).

Over the same period 13 out of the 24 sub-sectors

examined reported positive price changes compared to 10

out of 24 in the previous month. IBGE has reported that

prices of furniture rose almost 10% in 2018. Over the past

9 years the average price adjustment in the furniture

industry was +8% per year.

Feasibility of shipping from Imbituba Port to the EU

A delegation of importers and traders from Sweden

recently visited Santa Catarina in Southern Brazil and paid

a visit to the Imbituba Port complex. The purpose of the

visit was to assess the feasibility of importing wood

products through the Imbituba Port. If it turns out to be a

viable option shipments of wood products to Europe from

the port could be arranged every 45 days.

The Administrative, Commercial and Financial Director of

the Santa Catarina (SCPAR) Imbituba Port pointed out

during the meeting with the Swedish delegation that

timber shipments from Imbituba Port began last year when

the first ship loaded with pine and eucalyptus logs was

shipped to China. The Director also mentioned that the

port can handle many types of cargo and has top class

storage and handling equipment.

Forest product exports help eliminate trade deficit

According to the Ministry of Agriculture, exports of paper,

pulp and other wood products, totalled US$14.2 billion,

23% more than in 2017 and the export of forest products

reached a highpoint last year lifting the ranking of the

sector to second place in the ranking of agribusiness

exports. In past years forest product exports were fourth

ranked.

The volume and price of pulp help boost the performance

of the timber sector exports driven by firm international

demand in 2018. For example China increased its pulp

imports from Brazil.

In the final quarter of 2018 China purchased 1.7 million

tonnes of pulp from Brazil, 38% more than in the same

period of 2017. However, analysts anticipate a decline in

pulp prices in 2019.

Pulp price has been rising since January 2017 but

increased stock levels in China will eventually lead to

softening prices.2018 was good for pulp producers but not

so good for other sectors. The increase in exports by the

forestry sector helped the country eliminate its trade

deficits which had lingered since 2000.

8. PERU

Imports of composite panels

exceeded US$100 million

in 2018

Peru’s imports of composite panels (particleboard and

MDF) totalled US$103.2 million in 2018 an increase of

19% year on year.

Shipments from Ecuador were valued at US$40 million up

22% year on year. Imports from Chile were worth US$31

million and this represented a rise of 12% year on year.

While imports of composite panels from Brazil were only

worth US$16 million there was a massive increase in 2018

shipments surging 46% compared to a year earlier. For the

first time shipments from Brazil surpassed those from

Spain (2018, US$15.5 million).

Support for regional investment in plantations and

restoration

The new Multi-annual Investment Programme 2019-2021

established by the National Forestry and Wildlife Service

(Serfor) provides an opportunity for central government,

regional and local government entities to submit proposals

for financing of investment projects in the areas of

commercial forest plantations, restoration of degraded

ecosystems and implementation of forest zoning.

A major aim of this initiative is to expand the accessible

resource base and create the supply of around 1.4 million

cubic metres of raw material for the production of

sawnwood, furniture, flooring and panels. Regional and

local governments have been invited to formulate

investment projects oriented to forest plantations.

The Serfor initiative also aims to achieve the restoration of

around 750,000 ha. of degrade forest especially in

watersheds and areas susceptible to landslides and floods,

fragile ecosystems and wetlands.

The intention is to bring a much larger area than

at present

under professional management.