|

Report from

North America

USTR requests consultations with Peru over OSINFOR

The Office of the U.S. Trade Representative has requested

consultations with Peru under the Environment Chapter of

the U.S.-Peru Trade Promotion Agreement (PTPA) to

"discuss and attempt to resolve" concerns about Peru's

decision to move its Agency for the Supervision of Forest

Resources and Wildlife (OSINFOR) under its Ministry of

Environment.

Some observers, including Democratic members of the

U.S. House of Representatives Ways and Means

Committee, believe this action goes against Peru's

commitment to maintain OSINFOR as an "independent

and separate agency."

Article 18.12.1 of the PTPA calls for consultations to

begin promptly after a request and provides 60 days for

the parties to resolve the dispute. If the dispute is not

resolved, the U.S. may trigger a range of other dispute

settlement procedures under the PTPA.

In response to this action, Democratic leaders of the

Senate Finance and House Ways and Means Committees

supported the move.

Partial shutdown of government stalls reporting of

economic and trade data

The inability of US President Donald Trump and the US

Congress to agree on funding levels has resulted in a

partial shutdown of several U.S. government agencies that

has lasted for weeks.

Among the government operations affected are the

Department of Agriculture, the Census Bureau and the

Department of Commerce, which are responsible for the

collection and reporting of extensive economic and trade

data. November data scheduled to be released January 8

on US imports including hardwood plywood, veneer,

moulding, flooring, and furniture will not be made

available until the shutdown has ended.

Additionally, crop reports, housing reports, and other US

government reports on the economy may be delayed as the

shutdown continues. The shutdown was triggered in

December due to a dispute over the Trump

Administration¡¯s demand for funds for a wall along the

U.S.-Mexico border.

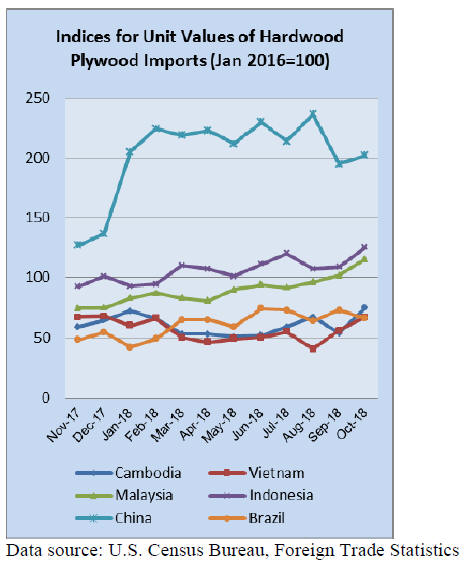

US hardwood plywood imports plunged in October

The volume of U.S. imports of hardwood plywood

decreased by 79% in October to 50,876 cubic metres, by

far the lowest amount imported in any month this decade.

Declines were across-the-board, with Chinese and Russian

imports both falling over 90% from September as well as

compared with last October. Year-to-date imports by the

U.S. are down 19% versus 2017, with imports from China

down 77%.

Veneer imports slide

US imports of tropical hardwood veneer fell off by 18% in

October to a level just below that of October 2017. While

the pace has slowed, year-to-date imports still outpace

2017 by 37%. Imports from China gained 31% in October

and are ahead by 51% year-to-date over 2017.

Flooring rebounds after weak September data

U.S. Imports of hardwood flooring rose by more than one

third in October, returning to strong levels after a lull in

September. Year-to-date imports are up by 37% over

2017 with Chinese imports up by 60% and Brazilian

imports up by 70%.

Assembled flooring rose more modestly in October,

gaining 10% from September. Year-to-date imports are

9% above 2017.

New furniture orders remain strong

New furniture orders in October 2018 increased 7% over

new orders reported in October 2017, according to the

most recent Smith Leonard survey of residential

manufacturers and distributors.

While September¡¯s 9% increase compared to a 10%

decrease in the previous year, the October results

compared to an 8% increase reported for October 2017

versus October 2016.

The 7% increase for October followed increases of 9% in

the last two months as well as 5% increases in the previous

three months.

Year to date, new orders remained 6% ahead of the same

period a year ago, with some 68% of survey participants

reporting increased orders year to date.

Shipments in October were 3% higher than October 2017

shipments. Shipments remain 3% ahead of last year

through October. Some 66% of the participants reported

increased shipments year to date.

Backlogs increased 5% again in October, the same

increase as reported in September. Backlogs were 14%

ahead of October 2017, the same level as reported last

month. With orders exceeding shipments through the 10-

month period and backlogs this high, Smith Leonard

expects shipments to make up some ground in the last two

months of the year.

See: http://www.smith-leonard.com/2018/12/27/december-2018-

furniture-insights/

Cabinet sales down

According to the Kitchen Cabinet Manufacturers

Association¡¯s monthly Trend of Business Survey,

participating cabinet manufacturers reported a decrease of

9.4% in November sales compared to October. Every

category took a hit with stock sales down 4.1%; semicustom

sales down 12.2%; and custom down 10.4%

compared to October.

Cabinet sales showed an increase of just 0.3% for

November 2018 compared to the same month in 2017.

Stock sales increased 7.4%; semi-custom sales decreased

significantly at 8.1%; and custom sales increased 2.2%

compared to November 2017.

Year-to-date cabinetry sales through November 2018 are

up slightly, at 2.1% according to participating

manufacturers. Stock sales are up 4.7%; semi-custom

sales continue to decrease with a downturn of 1.5%; and

custom sales up 4.6%.

See: https://www.kcma.org/news/pressreleases/

november-18-trend-business-press-release

US Job growth surges

The U.S. economy added 312,000 jobs in December. Job

growth nearly doubled from November, when the

economy added 176,000 jobs. Wages rose with average

hourly earnings up 3.2% over the previous year, up from

3.1% in November.

It was the third consecutive month that wages rose more

than 3%, strengthening evidence that the tightening

economy is delivering bigger payouts to workers.

Unemployment ticked up slightly, to 3.9%, up from 3.7%

in November, as more people began looking for work. The

labor force participation rate in December was 63.1% in

December, up slightly from 62.9% in November, signaling

that rising wages might be starting to draw prospective

workers from the sidelines.

|