3.

MALAYSIA

Exports down in first 8 months of

2018

Malaysia’s Minister of Primary Industries, Teresa Kok,

recently reported that wood product exports in 2018 are

likely to be lower than the RM23.21 billion in 2017.

Between January and August 2018 the value of exports

declined almost 6% to to RM14.6 billion compared with

the same period in 2017. Wooden furniture contributed

almost RM5 billion to 2017 export earnings.

The decline in 2018 exports has been put down to the

weak global economy, the trade dispute between the US

and China and because weather conditions in the main

production area of the country were bad for much of the

year.

In related news, Awang Tengah Ali Hasan the Second

Minister for Urban Development and Natural Resources,

disclosed that for the period January to August 2018 the

Sarawak timber sector registered export earnings of

RM3.58 billion. This was a decline of around 14% from a

year earlier.

The Minister said the decline in Sarawak export earnings

was mainly due to the reduction in the supply of natural

forest logs and the inability of current mills to process

smaller diameter plantation logs.

He also said that up to August 2018 the production of logs

from the natural forest fell 18% from 3.8 million cubic

metres in the first eight months of 2017 to 3.1 million

cubic metres in the same period of 2018.

Large scale reforestation planned for Sabah and

Sarawak

Sabah Chief Minister Mohd Shafie Apdal has announced

that the State Government will undertake large scale

reforestation to ensure wood supplies for industries in

Sabah.

The aim is to create a resource base that will attract

investors especially furniture makers in Peninsular

Malaysia. Plans are being drawn up for planting a mixture

of valuable hardwoods such as red seraya, meranti as well

as fast growing timbers such as eucalyptus and acacia.

Shafie said the State Government would play a role in

supplying wood for furniture manufacturing and priority

would be given to furniture factories in order to encourage

more high quality furniture manufacturers to Sabah.

In related news, the Sarawak Forest Department has

announced they will begin a large-scale forest landscape

restoration (FLR) programme this year. Director Hamden

Mohammad said the priority is to plant indigenous species

such as belian, meranti, keruing, selangan batu,

engkabang, kapor and other local species on degraded

areas within licensed harvesting areas. The state

government has RM10 million for this initiative.

Plywood traders based in Sarawak reported the following

export prices:

4.

INDONESIA

No duty relief for Indonesian

panel exports to US

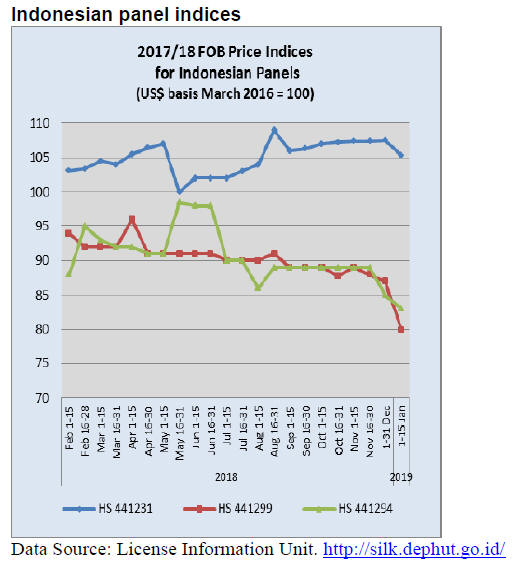

The US has rejected Indonesia’s request for import duty

relief for woodbased panel products citing its review of the

Generalized Systems of Preference (GSP).

The Director of Bilateral Negotiations in the Indonesian

Ministry of Trade, Ni Made Ayu Marthini, said that the

US has informed him that a further review will be

conducted this year. Indonesia had requested that some

commodities be re-introduced into the GSP facility.

In response to the US decision Gunawan Salim of the

Indonesian Wood Panel Association (APKINDO)

explained that Indonesian woodbased panel products are

very competitive in the US and as such the revocation of

the GSP facility is not expected to have much effect on

export volumes.

US$12 billion forestry sector export earnings

Siti Nurbaya, the Minister of Environment and Forestry

(KLHK), reported that the timber trade and forestry

activities in 2018 contributed US$12.17 billion in foreign

exchange earnings. This, she said, was the highest

recorded over the last 10 years.

She expressed satisfaction with this achievement figures

and applauded forestry sector enterprises for improving

their management and marketing.

Siti announced that in 2019 efforts will be focused on

several issues including maintaining the balance of

environmental sustainability in development, increasing

the economic contribution of the sector through new

business developments and a circular economy as well as

strengthening the foundation for development of the

sector.

See: https://www.wartaekonomi.co.id/read209918/sektorkehutanan-

sumbang-devisa-us12-miliar.html

Export volumes rise but earnings remain flat

The Chairman of the Indonesian Sawmill and Wood

Working Association (ISWA), Soewarni, has pointed out

that while export volumes are increasing export earnings

remained stagnant in 2018 because of weaker price

structures in international market for processed wood

products from Indonesia.

Soewarni forecast that 2019 exports earnings from

processed wood products are likely to be little changed

from the previous two years.

Soewarni hinted that part of the explanation lies in the

falling prices for timber from Indonesia’s domestic

Industrial and community plantations. However, he

pointed out that prices for products from natural forest

timbers remain firm.

‘Common but Differentiated’ responsibilities concept

agreed in PAWP

Nur Masripatin, Indonesia’s chief negotiator said the

government welcomes the adoption of the Paris

Agreement Work Programme (PAWP), the outcome of a

meeting in Katowice, Poland.

Indonesia pushed for a balanced and comprehensive work

programme and supported the concept of ‘common but

differentiated’ responsibilities and capabilities. Indonesia

hopes the PAWP will address the many threats from

climate change including threats to efforts to alleviate

poverty, to achieve sustainable development and to protect

the environment.

See:

https://en.antaranews.com/news/121372/indonesiawelcomes-

agreement-to-adopt-paris-work-programme

Trade deals a way to minimise impact of tariffs on

competitiveness

Indonesia’s trade deficit, which topped US$7.5 billion in

November, is of great concern and the government is

searching for new ways to boost exports. Part of the

problem, said Enggartiasto Lukita the Minister of Trade,

are the tariffs are imposed by importing countries on

Indonesian products. To address this the Minister called

for the negotiation of more trade agreements.

Currently the government is negotiating trade deals with

Mozambique, Tunisia, Morocco and the European Union

but he pointed out that negotiations are progressing

slowly.

The Trade Minister estimated that year on year

export growth in 2018 would be only 7.5% noting that this

is well below the 11% target for 2018 which was already

well below the 16% growth in 2017. The main reason

cited for the poor performance was the global

economic turmoil.

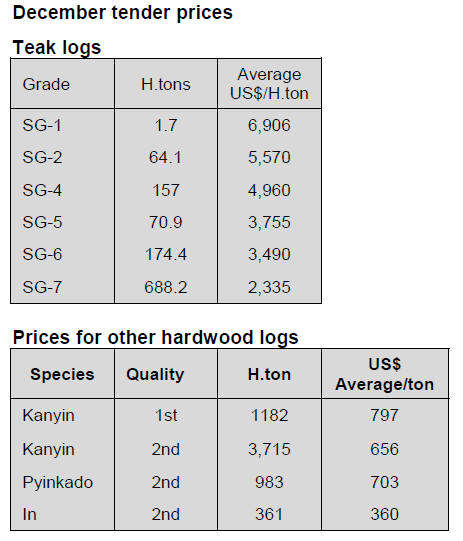

5.

MYANMAR

Reduction in log harvest will take account

of domestic

needs

Ohn Win, Minister for Natural Resources and

Environment, has said the government plans to reduce teak

and hardwood production by the end of the 2019-20

financial year but the reduction will take account of

domestic raw material needs and also the requirements of

the Myanma Timber Enterprise (MTE).

Forest cover only 40-plus percent

According to the Central Statistic Department forest cover

in Myanmar was 44.54% in 2013-14 but had declined to

41.3% by the end of the 2017-18 financial year.

A continuous decline has been observed in recent years.

Forest cover was recorded at 44.54% in the 2013-14 FY,

43.73% in the 2014-15 FY, 42.92% in the 2015-16 FY,

42.11% in the 2016-17 FY and 41.3% in the 2017-18 FY.

Peace in Kachin and Shan states opens way for more

illegal logging

The local media in Myanmar has quoted people living and

working in the Kachin and Shan States as saying the

illegal timber border trade became more apparent since the

Myanmar Armed Forces announced a 4-month truce in the

two states.

Separately, it has been reported that during the financial

year of 2016-17 over 50,000 tons of illegal timber was

confiscated of which 20% was in Kachin State. From 2000

to 2014, 119,298 tons of illegal timber was seized in

Kachin.

Analysts are of the opinion that timber buyers in Yunnan

Province, which borders Myanmar, were not aware that

Myanmar had banned the export of logs and hand-sawn

flitches so continued to buy these products and process

this timber for the domestic and international markets.

Exporters in Myanmar face many hurdles with exports of

teak products to the EU and question why the authorities

in the EU are silent on teak exports from China.

New road and bridge to China

The Myanmar Ministry of Construction has announced a

deal has been negotiated for construction of a new road

and bridge near the existing Goke Hteik railway viaduct in

western Shan State which will boost trade between China

and Myanmar.

The Ministry says a local company, Oriental Highway Co.

the China Harbour Engineering Co. Ltd. and the China

Communications Construction Co. Ltd. will undertake the

work at an approximate cost of US$100 million.

6. INDIA

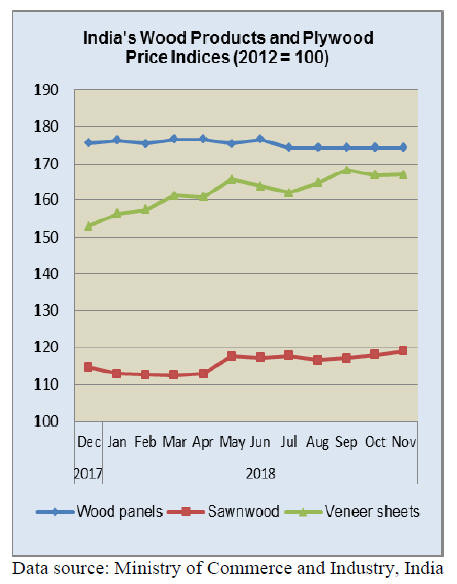

Sawnwood price index moves higher

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for November 2018 released by the

Office of the Economic Adviser to the government rose to

121.8 from 121.7 for the previous month. The annual rate

of inflation based on monthly WPI in November 2018 was

4.64% compared to 5.28% for the previous month.

The November price index for ‘Manufacture of Wood and

of Products of Wood and Cork ‘ group rose by 0.6%

to 133.5 from 132.7 for the previous month due to higher

price of sawnwood particleboard and other panel products.

The press release from the Ministry of Commerce and

Industry can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Surge in sawnwood imports

The Indian trade magazine ‘Plyreporter’ recently carried a

story on the rise in sawnwood imports in 2018.

Data from India’s Directorate General of Commercial

Intelligence and Statistics (DGCI&S), says Plyreporter, is

showing that sawnwood imports in 2018 were over 40%

more than in the previous year. In previoius years Indian

manufacturers relied on imported logs for raw materials

largely because of the high duties on imported sawnwood

but since 2015 the value of sawnwood imports has almost

doubled.

The Plyreporter article says that much of the good quality

imported sawnwood finds its way to southern India.

Hardwood sawnwood is imported from Malaysia,

Vietnam, Myanmar, USA and African countries whereas

softwood sawn is shipped from Canada, Europe and the

USA.

While sawnwood imports have shown impressive growth

imports of logs have also increased registering an almost

7% rise in the last fiscal year.

For more see:

http://www.plyreporter.com/article/30474/sawn-timber-importposts-

44-growth-in-fy-2018

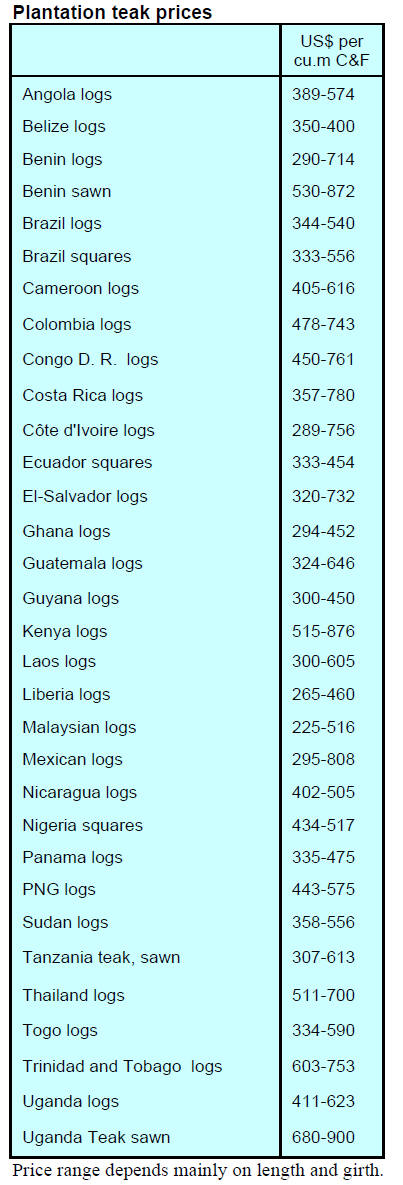

Plantation teak prices

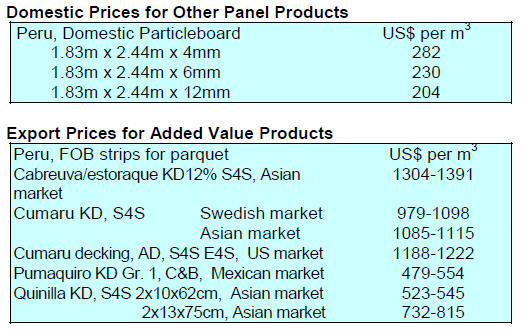

The Rupee/US dollar exchange rate has held steady at

Rs.70 to the US dollar and traders are anticipating that the

Rupee will stay at around this level bringing some relief

after the period of exchange rate volatility at the end of

2018. CIF prices for imported plantation teak remain at

levels reported at the end of November.

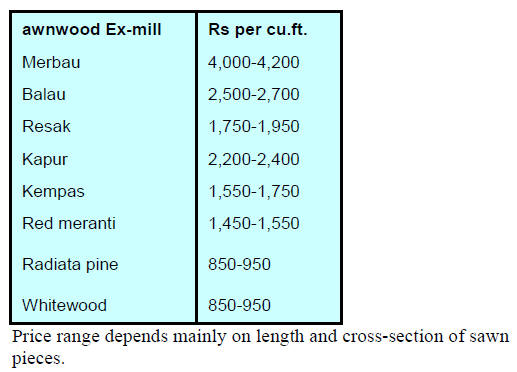

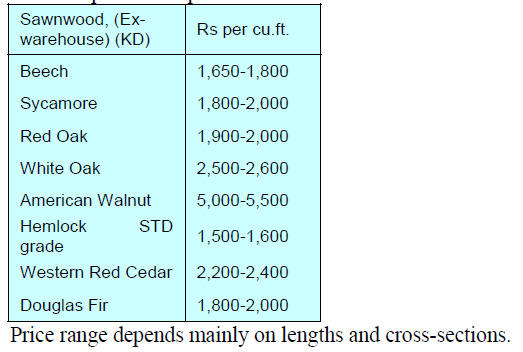

Locally sawn hardwood prices

Demand for imported sawnwood is firm and the

stabilsation of exchange rates has widened margins made

by importers. Prices for imported hardwood sawnwood

continue as previously reported.

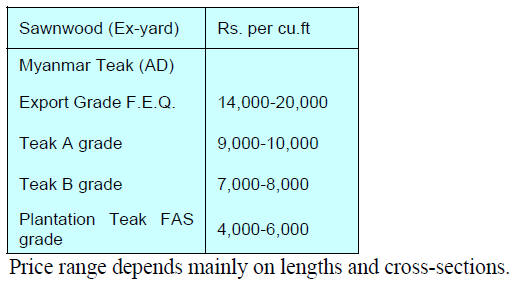

Myanmar teak prices

In an effort to secure steady supplies of good quality

Myanmar teak several importers have visited suppliers in

Myanmar only to find that the business environment is not

conducive for expanded shipments. The importers hope

that the Myanmar authorities will introduce policies and

export rules that boost trade.

Indian millers operating in Myanmar are shipping mainly

to international markets with only small volumes being

available for Indian buyers but complain that the business

environment is tough in Myanmar.

Sawn hardwood prices

Prices for sawn hardwood imports have remained steady

since the previous report.

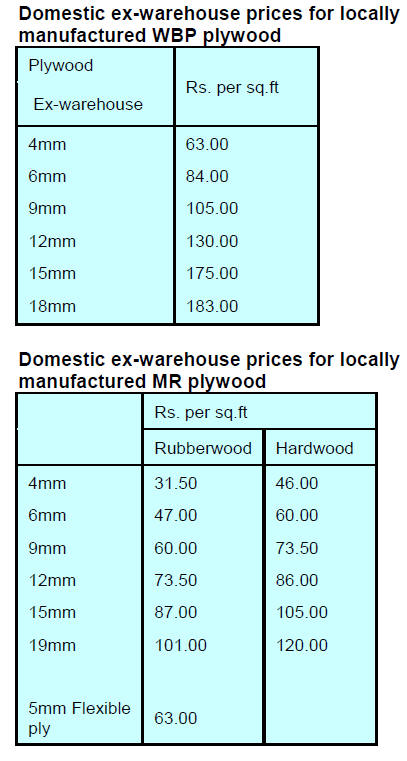

Plywood market

Analyst report that the supply and demand for wood based

panels is still out of balance such that supplies are

increasing faster than the growth in demand. While there

is firm activity in the real estate and construction sectors

panel production has expanded too fast. Part of the

problem is that while the number of new housing units

may be increasing but the floor area of these new homes is

getting smaller.

In the medium term there is enough activity in the

rehabilitation of slum dwellings and the government’s

Housing for All scheme that panel demand should steadily

increase.

It is not only plywood manufacturers who are under

pressure; MDF and particleboard makers face the sam

situation with new factories coming on stream before there

is a market.

Severe air pollution problems in major

cities

The state-run Central Pollution Control Board (CPCB) has

reported that air pollution has reached emergency levels in

New Delhi.

At one point in early January the PM2.5 reached 440 about

11 times higher than the safe level. According to the

CPCB, an Air Quality Index (AQI) level from 201 to 300

is considered poor, 301 to 400 is very poor and 401 plus is

severe.

The situation is alarming in many other cities such as

Mumbai, Kolkata and Pune.

See: https://weather.com/science/environment/news/2019-01-04-

new-delhi-india-air-quality-emergency-pollution

Activists are promoting the creation of micro forests in

200 medium and major cities of India as a means of

boosting oxygen in the air but this will not lower the

PM2.5 levels.

7. BRAZIL

1 billion trees by 2030

Brazil aims to restore 12 million hectares of forest by 2030

to partially address the loss natural vegetation on around

20 million hectares especially on the border of the socalled

Legal Amazon, the Mata Atlântica forest and

Cerrado ecosystem region.

To support the government’s aim a campaign led by the

Nature Conservancy (TNC) wants to plant one billion

trees in the country.

The TNC campaign called "Restaura Brazil" aims to

generate public interest and seek support from the private

sector through partnerships and support from other NGOs

and government agencies.

Wood preservation companies advancing selfregulation

Brazilian wood treatment companies will be adopting a socalled

Self-Regulation Programme (Qualitrat) in order to

provide better services to consumers.

The Qualitrat initiative was developed by the Brazilian

Association of Wood Preservers (ABPM) in partnership

with the Technological Research Institute (IPT) and the

Totum Institute.

Under the Qualitrat programme participating companies

agree to introduce internal control procedures and accept

rigorous evaluation in order to secure a seal of approval.

According to the Totum Institute certification criteria

includes legal integrity, quality management,

environmental management, labour, health and safety

management as well as ethical commitments and social

responsibility.

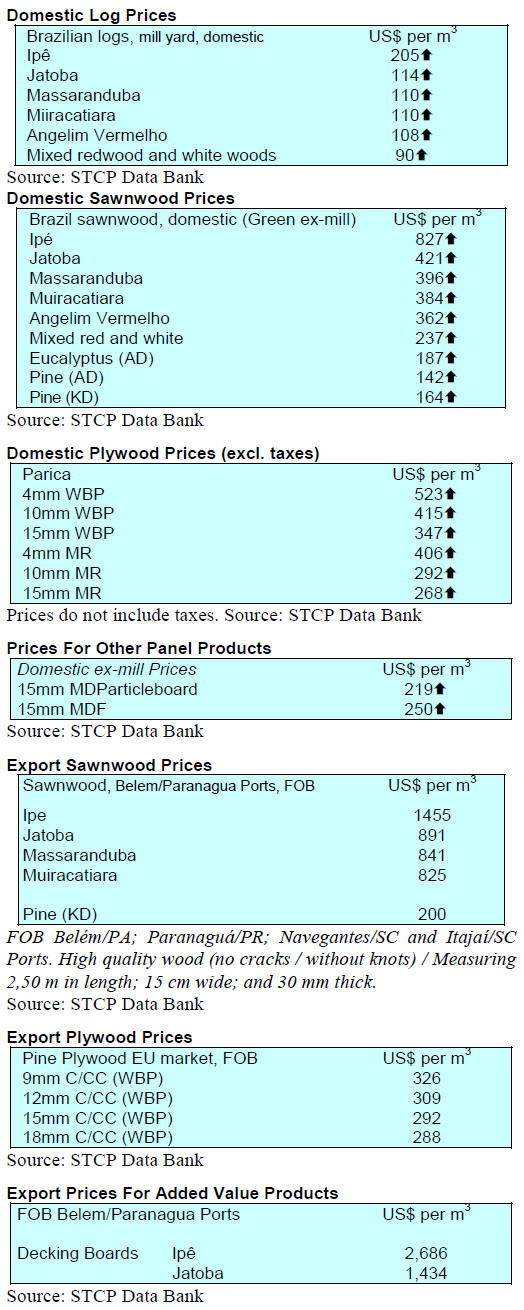

Export turn-around in 2018

According to the Brazilian Association of the

Mechanically Processed Wood Industry (ABIMCI), the

Brazilian solid wood industry experienced positive signs

of recovery towards the end of 2018, a major turn-around

after consecutive declines over the past eight years. This

was achieved despite an uncertain global economic

environment and the devastating Brazilian truck drivers'

strike in mid-2018.

However, while export volumes have been rising profit

remain flat because of rising production costs and poor

infrastructure.

Regardless these difficulties ABIMCI says exports in 2019

are likely to continue to grow especially as a high

proportion Brazil’s wood products for export are certified

legal.

8. PERU

Improving forest management with

DataBOSQUE

software

After more than three years of work supported by the

German Corporation for International Cooperation (GIZ)

Peru’s National Forestry and Wildlife Service (SERFOR)

was handed DataBOSQUE software which will facilitate

reliable timber tracking. DataBOSQUE was developed in

close cooperation with the private sector and public

forestry institutions at the national and regional levels.

Distribution of this software will be free and a series of

training events have been arranged jointly by SERFOR

and GIZ aimed at training trainers in the different

Amazonian regions (Loreto, Ucayali, Madre de Dios, San

Martín and Junín).

Most deforestation occurs in plots under 5 hectares

Peru’s Ministry of Agriculture and Irrigation, together

with the Ministry of Environment, reported in December

last year that deforestation in 2017 in the Peruvian

Amazon was 155,914 hectares. Compared to a year earlier

this represented a 5.3% decline.

It was reported that the majority of the forest loss occurred

in plots under five hectares and 60% of the deforestation

was concentrated in the Departments of Ucayali, Madre de

Dios, Huánuco and Loreto. The area of Peru’s Amazonian

forest in 2017 was reported as 68,577,351 hectares.

Wikipedia writes “Most Peruvian territory is covered by

dense forests on the east side of the Andes, yet only 5% of

Peruvians live in this area. More than 60% of Peruvian

territory is covered by the Amazon rainforest, more than in

any other country.”

See:

https://en.wikipedia.org/wiki/Peruvian_Amazonia

Chilean officials share experiences in forest

management

In order to share and exchange successful experiences in

the forestry sector of Peru and Chile, officials of the

National Forestry Corporation and the National Forestry

Institute of Chile, visited officials and producers in the

forestry sector in Cajamarca the capital and largest city of

the Cajamarca Region as well as an important cultural and

commercial centre in the northern Andes.

During their stay in Cajamarca, Chilean officials presented

the history of their country's forestry development, from

the depredation of their forests to the installation of forest

plantations, as a resource to improve the environment,

generate ecosystem services and contribute to improving

the quality of life of the Chilean producers.