Japan

Wood Products Prices

Dollar Exchange Rates of 25th

November

2018

Japan Yen 113.781

Reports From Japan

¡¡

Trade tensions a risk to

growth

Japan¡¯s Cabinet Office in its November Economic Report

has maintained its assessment that the economy "is

recovering at a moderate pace" citing positive private

consumption and capital spending despite weakening

exports in the third quarter. However, it does warn

heightened trade tensions are a risk to growth.

The November report says:" Attention should be given to

risks including the effects of situations concerning trade

issues on the world economy, the uncertainty in overseas

economies and the effects of fluctuations in financial and

capital markets."

See:

http://www5.cao.go.jp/keizai3/getsurei-e/2018nov.html

In contrast to the Economic Report the OECD has

downgraded its growth projections for Japan in 2018 from

1.2% to 0.9% and in 2019 from 1.2% to 1.0% as there is

likely to be a negative response to the October 2019

consumption tax increase.

Fragile consumer sentiment

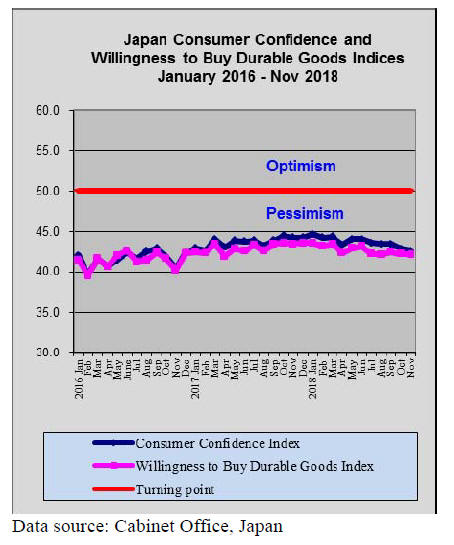

The latest consumer confidence indices based on a survey

by the Cabinet Office points to growing a growing sense

of pessimism amongst consumers with the main October

sentiment indices dropping from a month earlier.

Concern is growing that if this persists then the rise in

consumption tax scheduled for late 2019 could seriously

undermine the advances the economy has made in 2018.

When the consumption tax was raised in 2014 domestic

demand collapse and caused the economy to fall into

recession.

The government is eager to avoid a repeat of and has

outlined measures it hopes will support consumer

spending after next year¡¯s consumption tax increase

promising ¡°extraordinary measures¡± to stabilise private

consumption.

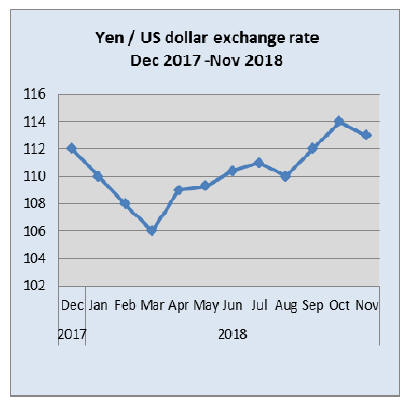

Be prepared for a stronger yen

As a result of a slowing of growth in the US, coupled with

heightened uncertainty in the global trading system,

analysts are forecasting money will again move to the Yen

as a safe haven and that this could drive the yen to as high

as 108/110 to the dollar.

For most of this year the yen has weakened against the US

dollar but this is likely to change with the yen possibly

tipping to below 110 to the US dollar in the medium term.

No spark in housing market

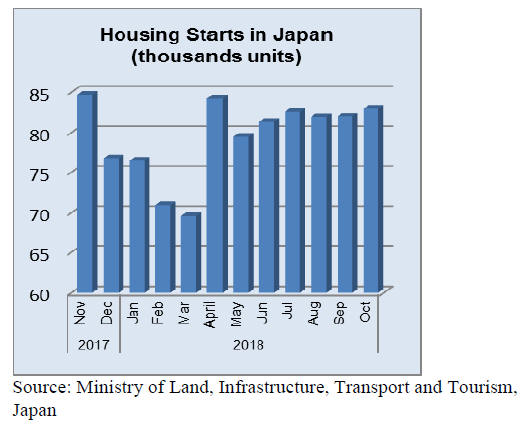

The latest housing statistics from the Ministry of Land,

Infrastructure, Transport and Tourism portray a steady but

stagnant demand. October 2018 starts were a mirror of

those in October 2017 and month on month there was

virtually no change.

After the surprising crash in housing starts in March this

year demand recovered such that between May and July

there was a steady increase in building activity. However,

this growth was not maintained into the third quarter of the

year. Prospects for a recovery in the final quarter are dim

as winter weather disrupts building work.

Import round up

Doors

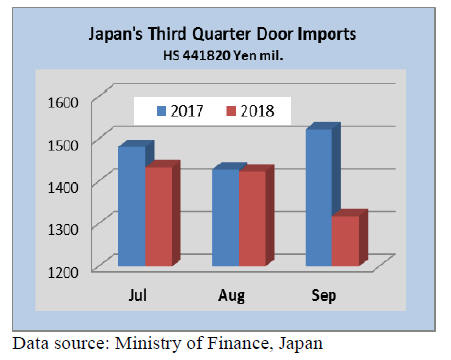

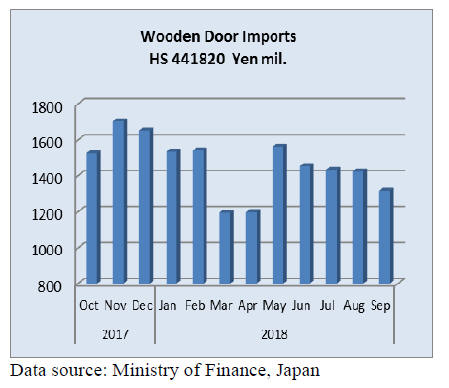

Third quarter 2018 wooden door imports

Japan¡¯s wooden door imports tend to tail-off in the third

quarter (September 2017 was an anomaly) of each year

only to rise again towards year end and this pattern is

emerging for 2018.

Third quarter 2018 wooden door imports were down 6%

compared to the same quarter in 2017 and year on year

September imports were also down 11%.

The 7% decline in imports in September compared to a

month earlier follows a pattern seen in earlier years such

that a rebound can be expected.

September wooden door imports

Over 90% of September 2018 wooden door imports were

from 4 sources, China (60%) followed by the Philippines

(21%) with Indonesia and Malaysia at 6% each. Other

significant suppliers of wooden doors to Japan in

September were Finland, Canada and the US.

Windows

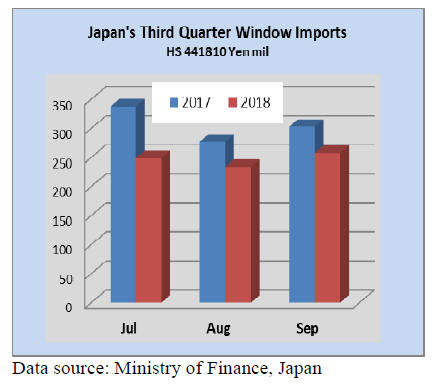

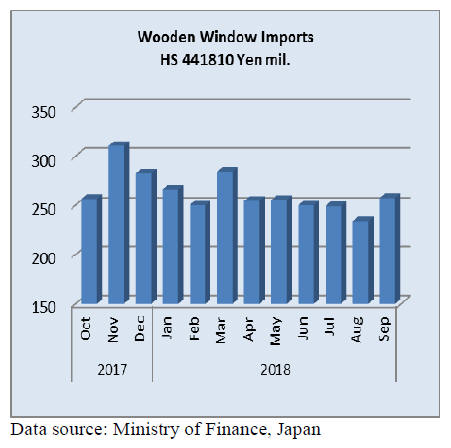

Third quarter 2018 wooden window imports

Wooden window frames are not widely used in either

domestic or commercial buildings in Japan so import

values are small compared to other joinery products.

In the third quarter of 2018 imports of wooden windows

dropped 18% compared to the third quarter of 2017.

Unlike the import pattern for wooden doors, Japan¡¯s

imports of wooden windows do not exhibit any significant

cyclical trend.

September wooden window imports

September 2018 wooden widow imports were down 15%

year on year but compare to a month earlier, the value of

September imports were up 12%.

In September three suppliers accounted for over 90% of

the value of Japan¡¯s wooden window (HS441810) imports

namely China (37%), the US (35%) and the Philippines

(21%). The value of imports of wooden windows from the

US jumped in September from the 23% import share in

August.

European shippers (natably Finland and Estonia) increased

shipments of wooden windows to Japan in September.

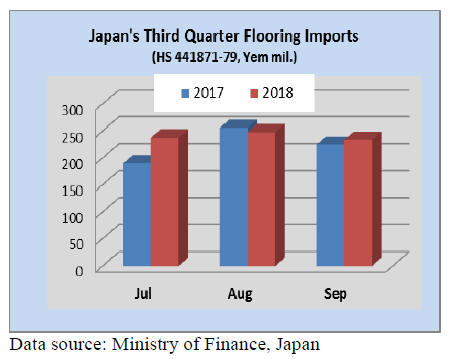

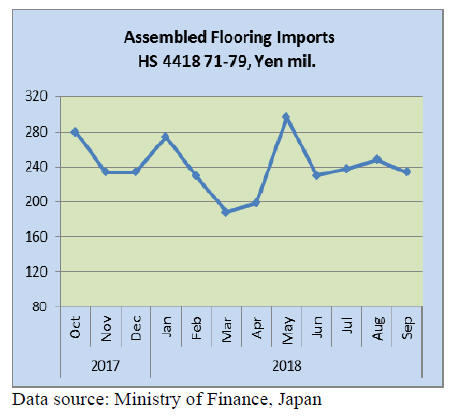

Third quarter 2018 assembled flooring

imports

Most of Japan¡¯s assembled flooring imports are in the

range of HS441871-79. The value of third quarter 2018

imports of these categories of assembled flooring was

around 7% higher than the corresponding quarter in 2017.

In the third quartet imports were dominated by HS441872

which regularly accounts for around 70% of all assembled

flooring imports.

September assembled wooden flooring imports

Year on year the value of September 2018 imports of

assembled wooden flooring were higher by around 4% but

September marked a decline (-6%) in the value of imports

compared to a month earlier.

In September, as in the previous month, HS441875

accounted for over 70% of all assembled wooden flooring

imports with most coming from China followed by

Indonesia, Malaysia and Thailand. HS441873 made up

around 13% of September imports with China being the

main shipper. For HS441879 three shippers, Thailand,

Vietnam and Malaysia accounted for most shipments.

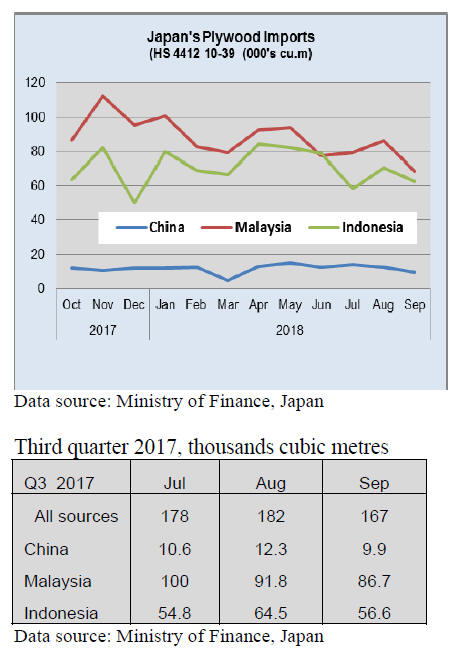

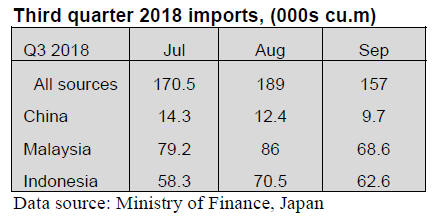

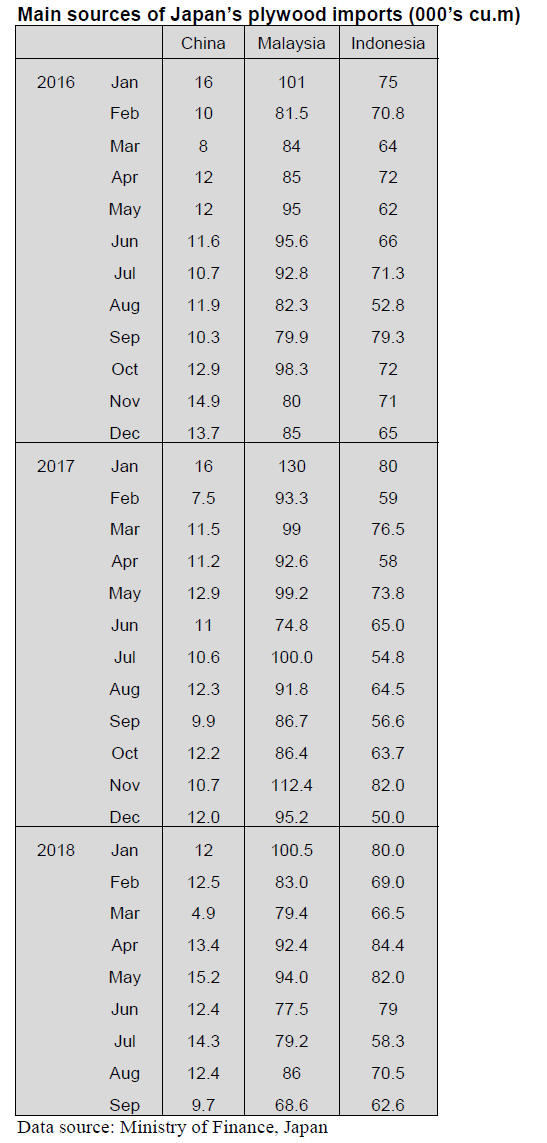

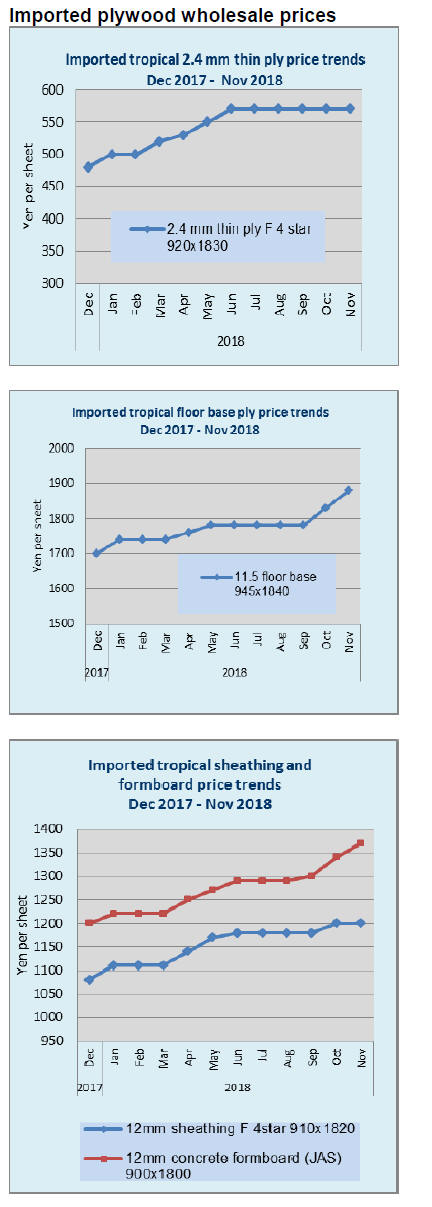

Third quarter 2018 plywood imports

There has been a steady decline in the volume of plywood

imports from Malaysia this year with the steepest fall

beginning in mid-year as the supply of logs to plywood

mills in Sarawak were sharply reduced.

In the third quarter of 2018 total volumes of plywood

imports were down 2% from the same quarter in 2017.

Comparing the third quarter 2017 and 2018 volumes of

imports shipments from China were up 11%, from

Indonesia shipments rose 9% but there was a 16% decline

in shipments from Malaysia. Third quarter 2017 and 2018

import volumes are shown below.

September plywood imports

Year on year September 2018 plywood imports dropped

6%. Shipments from China were at around the same level

as in 2017, arrivals from Indonesia in September were

11% higher but Malaysia saw a 21% decline in year on

year shipments in September.

As in previous months HS441231 is the main category

of

plywood imports into Japan accounting for over 90% of all

arrivals in September 2018. Shipments of HS441231 are

domnated by suppliers in China. It is noteworthy that

plywood manufacturers in Vietnam are capturing a greater

share of the Japanese plywood market.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

South Sea (Tropical) plywood

Log shortage in Malaysia and Indonesia is grave and

plywood mills struggle to keep the operation.

Korindo in Indonesia stooped the operation then Sinora

Sdn Bhd in Sabah, Malaysia stopped the operation by log

supply shortage.

Korindo is the only supplier of concrete forming panel for

Japan with monthly volume of 7,000 cbms from two

plants.

One of two mills, KAS stopped the operation so that the

supply volume for Japan will be half. . Both Malaysia and

Indonesia, log supply got tight since summer of 2017 then

after rainy season arrived in late 2017, log inventories of

plywood mills dried up, which when Korindo shutdown.

Log supply did not recover even in summer of 2018.

In Sabah, Malaysia, log export was banned in May this

year so plywood mills were expected to have more logs

but because of restriction of illegal logging by the

government, log supply continued tight and Sinora had to

shut down.

Sinora had been supplying about 4,000 cbms of 12 mm

structural and concrete forming panel a month. Reason of

log supply shortage is not only by weather but tighter

restrictions of harvest control by the government. Plywood

manufacturers in both Malaysia and Indonesia offer much

higher export prices because of high log cost, which

discourages overseas buyers so mills¡¯ operation is slower,

which deteriorates mills¡¯ profitability.

In Japan, imported cost of JAS 3x6 coated concrete

forming panel prices are over 1,600 yen per sheet FOB

truck with exchange rate of 113 yen per dollar but the

market prices are about 1,500 yen.

Korindo is cornered

Korindo, plywood mill in Indonesia is in tough shape with

operational loss for three consecutive terms. It stopped the

operation of KAS plant on October 23. High log cost and

low sales prices put all the plywood mills in Malaysia and

Indonesia in life or death situation.

Korindo has been supplying about 10,000 cbms of

concrete forming panel for Japan a month. By KAS plant

shutdown, the volume is reduced to half. . Korindo

shutdown in late 2017 and early 2018 by log supply

shortage but to continue payment of wage for the workers,

it restarted the operation despite unprofitable operation.

Since then log prices have been climbing and after loss for

three terms became definite, it decided to stop KAS

operation. By operating only one plant, necessary log

volume will be less and loss will be half.

Korindo has been buying small low grade logs for

manufacturing concrete forming panel but availability of

low cost low grade logs is getting tight because the

government restricts clear logging to develop palm farm

and selective harvest makes it hard to buy logs under 60

cm in diameter.

Another blow for Korindo is decreased sales to the Middle

East market. Korindo¡¯s coated concrete forming panel is

higher than others in price but the quality was good so it

had good reputation but continuous price hike sent buyers

to low cost Russian and Chinese products.

Wage payment problem is not solved but definite

condition of restart is profit making. For that, cost

reduction or higher sales prices are necessary but there is

slim chance that log prices would be down and further

hike of sales prices are also difficult.

Plywood

September production of softwood plywood was 252,300

cbms, 4.0% less than September last year and 0.1% more

than August. In this, structural panel was 236,100 cbms,

6.9% less.

The shipment of softwood plywood was 241,500 cbms,

9.7% less and 0.3% more. With the production exceeding

the production, the inventory increased by 12,300 cbms to

196,800 cbms.

The inventory of structural panel was 171,400 cbms,

14,400 cbms more. The movement of softwood plywood

for precutting plants hit the bottom in September and is

recovering in October.

In Western Japan, rehabilitation works for the area, where

abnormal heavy rain in July and passing typhoons in

September one after another, is getting busy and

transportation of materials is active so that securing truck

becomes difficult so delivery of plywood is delayed for a

week or so. The movement in distribution channels

continues dull.

In September, due to mid-term book closing month, some

disposed of the inventories so that the low price offers

were around and the market turned to bearish and buyers

tightened purchase but such mood disappeared in October.

Market of imported plywood continues stagnant. Despite

announcement of Korindo¡¯s mill closure, there is no panic

buying due to weak demand but the market prices are

generally moving up because the cost of arrived cargoes is

much higher. The importers try to push the sales prices

seriously now.

Panel market in Hokkaido

Since last August, supply of imported concrete forming

panel in Hokkaido became tight because Malaysian

plywood mills¡¯ production is dropping by log supply

shortage and shipment to Hokkaido is limited.

Concrete forming panel market in Hokkaido is different

from the main island of Japan, where coated concrete

forming panel is now the main item.

In Hokkaido, green concrete forming panel is the main

item so the prices of JAS 3x6 are slightly higher than

Tokyo market at 1,380-1,400 yen per sheet FOB truck and

firming. Coated concrete forming panel prices are also

higher than Tokyo market at about 1,550 yen.

September earthquake was limited in the area so there is

not much rehabilitation works. While general construction

market in Hokkaido is quiet, shortage of only concrete

forming panel is the topic in the market.

Since middle of 2017, log production in Malaysia sharply

dropped. Green concrete forming panel needs smooth

surface to some extent and with limited log supply, such

suitable logs are hard to obtain.

In Hokkaido, OSB is heavily used for panel for housing.

Canadian OSB manufacturer, Norbord has been pushing

OSB prices and present prices the importers are asking on

JAS 9 mm 3x10 are 1,200 yen per sheet FOB truck.

Softwood plywood is not popular and only manufacturer,

Marutama, is basically sending the products to Tokyo

market. The prices of 12 mm 3x6 panel are firmly held at

1,050 yen per sheet delivered in Hokkaido.

Domestic log and lumber market

It is log harvest season now but log production stays low.

Particularly in Western Japan, where suffered heavy rain

and landslides during summer months, log production has

been low. In other areas, weather after September has been

unfavorable so overall log production continues low.

Meantime demand for logs by sawmills, plywood mills

and laminated lumber mills is active so log supply for

these mills stays tight. Normally June and July are rainy

season so that log production is low but even in fall, there

is no recovery.

In this situation, log market prices have been edging up

everywhere.3 meter post cutting cedar log prices are

12,000-13,000 yen in average but they are higher in the

area where many sawmills concentrate like Northern

Kanto.

4 meter sill cutting cypress log prices vary by the area but

average prices are 19,000-20,000 yen and the highest is

22,000 yen. 3 meter post cutting cypress log prices are

almost the same as sill logs but in other areas, the prices

are 16,000-17,000 yen so gap between sill logs and post

logs is widening.

Meantime, lumber market is not so active. Lumber market

prices remain unchanged although sawmills try to push the

sales price up because of higher log cost.

Nationwide average prices of 3 meter KD 105 mm cedar

post are 50,000-52,000 yen and 4 meter KD 105 mm

cypress sill square are 64,000-66,000 yen. Orders for KD

cedar post, purlin, green cedar 90 mm square and retaining

board are active. KD cedar post movement is slowing in

October while cypress sill continues firm. The most

demanded item is 4 meter green cedar 90 mm square.

In Tokyo regional market, supply of green cedar lumber

has been tight since last spring. Supply source

is mainly the North East sawmills and the supply is always

slow in winter because of snow but this supply did not

increase even after spring this year. Prices of 4 meter 90

mm green cedar lumber had been 20,000 yen or less until

last year but the prices escalated over 20,000 yen and now

they are 25,000 yen to 28,000 yen and the highest spot prices

are30,000 yen.

Reason of tight supply is expanding demand. 4 meter

green cedar 90 mm square is mainly used for not only

construction but rehabilitation works by natural disasters

then increasing redevelopment demand for the 2020¡¯s

Tokyo Olympic Games.

Substituting demand for roof sheathing to replace high

priced softwood plywood is also another new demand.

Sawmills suffer high log prices and say that it is hard to

procure logs when lumber prices are less than 30,000 yen.

In Kanto region, there are very few mills producing green

cedar lumber because small cedar log supply is not much

in this region. The log prices started climbing since last

December and they are high at 10,000-12,000 yen, which

is too high for lumber prices so mills are not willing to

produce.

|