3.

MALAYSIA

2018 exports likely to be lower than

last year

Malaysia’s Primary Industries Minister, Teresa Kok, has

said wood product exports are expected to decline slightly

this year from the RM23 billion recorded in 2017 due to

the impact of the trade dispute between the US and China

which has caused a weakening of the global economy.

Between January and August this year wood product

exports declined 5.7% year on year to RM14.6 billion.

This year the changeable weather was partly to blame. A

major contributor to export earnings was wooden furniture

which brought in almost RM5 billion.

Calls for more research on oil palm stem utilisation

Calls have been made for more research to be directed at

utilisation of oil palm trunks (OPTs) as an alternative

material for plywood production. It has been estimated

that Malaysia produces about 22 million cubic metres of

OPTs annually.

Current efforts to find the best use for OPTs are being

undertaken by Malaysian Timber Industry Board and the

Malaysian Palm Oil Board as well as other agencies such

as the Forest Research Institute Malaysia (FRIM) and

Universiti Putra Malaysia (UPM).

On the occasion of the signing of a memorandum of

understanding between the Malaysian Panel-Products

Manufacturers’ Association (MPMA) and China’s Linyi

Panel Products Chamber of Commerce the Minister of

Primary Industries called for more research on

downstream OPT products. In 2017 exports of woodbased

panels accounted for around 30% of all wood

product exports. China was the sixth largest importer of

Malaysian wood products last year.

Sabah amends forest law

The Sabah Legislative Assembly has passed a bill to

amend the Forest Enactment 1968 and the amended law

will come into effect 1 January 2019.

The new law includes reference to REDD+ initiatives and

other projects in Sabah involving production in forest

reserves, on state land or alienated land whether for either

regulated or voluntary carbon market.

When the new law comes into effect projects will be

required to secure written approval from the State

government.

Arifin Asgali, Assistant Minister to the Chief Minister, is

on record as saying this amendment could result in more

income for the state via carbon marketing.

The current price for carbon is US$5 per metric tonne in

the voluntary market but US$30 per metric tonne in the

compliance market. Sabah has been part of the REDD+

initiative since 1992 through collaboration with Yayasan

Sabah and the Face foundation from Holland. In 2013, the

EU has provided around euro 4 million for the EUREDD+

projects in Sabah.

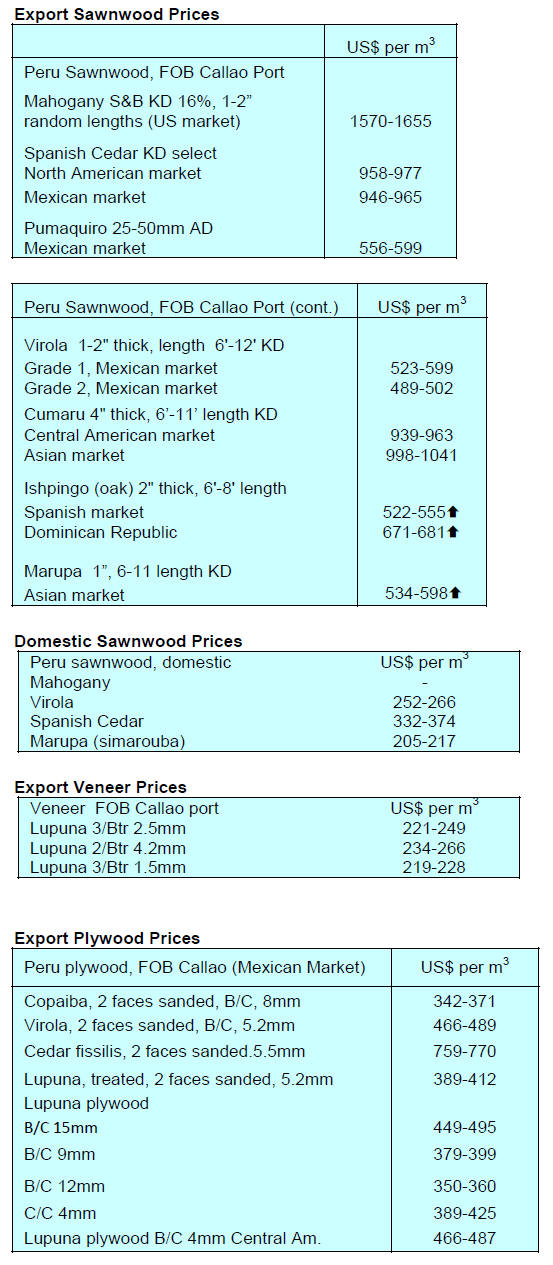

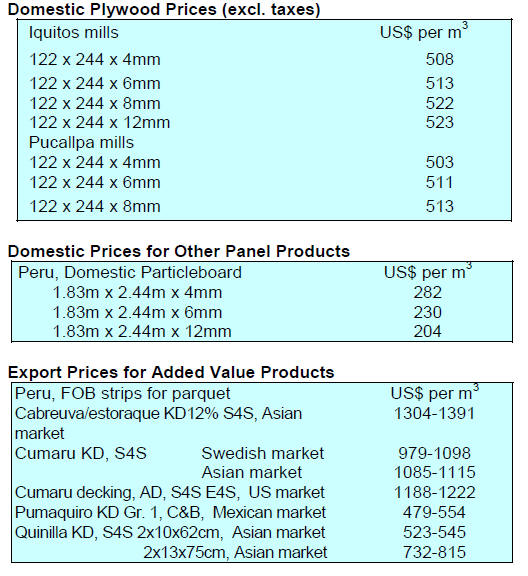

Plywood prices

Traders based in Sarawak reported the following plywood

export prices for October:

4.

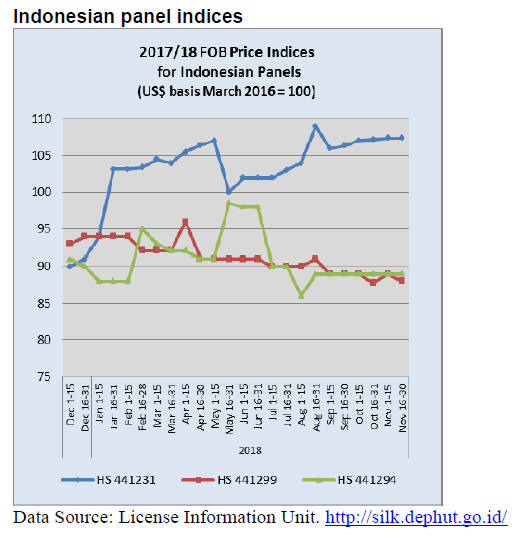

INDONESIA

Optimistic projection for

2019 exports from industry

association

The Chairman of the Association of Indonesian Forest

Concessionaire (APHI), Indroyono Soesilo, has forecast

an 8% increase in forest products exports next year which

would lift export earnings from the sector to around

US$13 billion.

Behind this positive assessment is the introduction of the

Indonesia Timber Exchange (ITE) an online marketing

and trading system for forest products all of which are

certified under the Indonesia Timber Legality Verification

System (SVLK).

Indroyono has expressed optimism that investment in the

forestry sector will continue to grow as the issue of forest

fires is being addressed seriously and the management of

peat lands, frequently subject to fires, has improved.

In a recent meeting with APHI, Siti Nurbaya Bakar, the

Minister of Environment and Forestry commented that

timber sector exporters performed well this year despite

global uncertainties. She noted that the value of processed

timber exports in 2017 was US$10.94 billion but that by

October this year that figure had been overtaken.

In Indonesia log production from plantations is around 6

times more than from the natural forest and was 38 million

cubic metres in 2017.

Natural forest logs come mainly from the provinces of

Central Kalimantan, East Kalimantan, North Kalimantan,

Papua, and West Papua.

Industrial plantations are found in Riau, Jambi, East

Kalimantan, West Kalimantan and Central Kalimantan

provinces.

Wood processing sectors now open to foreign

investors

The government has reduced the number of business areas

closed to foreign investment in what is viewed as a

relaxation of the list of negative investment sectors. The

Minister of Industry, Airlangga, has confirmed that those

sectors removed from the list are now open for foreign

investors.

One of the sectors eliminated from restrictions is wood

processing and this has drawn praise from local

companies. Purwadi Soeprihanto, Executive Director of

APHI reported that the sawmilling sector is now open to

FDI as are the plywood, LVL, wood chip and wood pellet

industries.

Perhutani's Corporate Secretary, Asep Rusnandar, stated

that the new policy is expected to be an incentive for

investors and that the forestry sector will benefit from the

introduction of advanced technologies.

Indonesia’s President, Joko Widodo, has asked the various

ministers to review current policies on investment and tax

incentives in order to find ways to attract more investors.

Seven trade agreements ratified

It has been reported that the government has ratified seven

bilateral and multilateral trade agreements in an effort to

boost trade.

The ratified agreements, include the ASEAN-Australia-

New Zealand FTA (AANZFTA), ASEAN-India FTA

(AITISA), ASEAN-Korea FTA, ASEAN-China FTA,

ASEAN agreement on medical device directive, the ninth

protocol of the ASEAN framework agreement on services

and the Indonesia-Pakistan preferential trade agreement

(IP-PTA).

5.

MYANMAR

Settling confusion over the

MTLAS and the ‘Dossier’

The Myanma Timber Enterprise (MTE) recently made

available online its publication “Myanmar Timber Chain

of Custody Process, Documents and Actors”, the so-called

‘Dossier’. This describes the documents and procedures

applied at every step of the entire supply chain from

harvesting to port of export. The aim of making this

available was to enable exporters and authorities in

importing countries understand how Myanmar manages

information in the timber supply chain.

Some exporters expressed confusion as to whether the

Myanmar Timber Legality Assurance System (MTLAS)

and the ‘Dossier’ are different systems, are the same

system or inter-dependent. Their confusion stems from

the June 2018 submission of the ‘Dossier’ to the EU

Competent Authorities by a Myanmar Delegation.

It will be recalled that the Myanmar Timber Certification

Committee has launched a third party certification

procedure under the MTLAS.

According to Barber Cho, Secretary of the Myanmar

Forest Certification Committee, MTLAS is a system to

ensure the legality of timber while the ‘Dossier’ is a

comprehensive compilation of the documents applied

along the entire supply chain.

He said the MTLAS will be definitely strengthened with

the integration of ‘Dossier”. However, he expressed

concern that EU Competent Authorities may

misunderstand and misinterpret that all documents

mentioned in the ‘Dossier’ are to be provided with every

export consignment.

The ‘Dossier’ defines 32 tracking documents some of

which are not provided for every export consignment. It is

understood that the Myanmar Delegation informed the EU

during the June meeting that Myanmar intends to provide

11 of 32 documents with shipments and that others are

available for inspection.

FLEGT activities to continue without UK assistance

In a related development, the FLEGT-Myanmar

Secretariat Office will be closed at the end of November

because the UK agency DIFID suspended funds allocated

for FLEGT Activities.

However, Myanmar will continue with its VPA/FLEGT

activities. As the national and sub-national level MSG

(Multi-Stakeholder Groups) have been formed so FLEGT

activities in Myanmar will proceed.

To-date there is no official statement from Myanmar

Government on this matter.

Parliament has approved the formation of a new Ministry

of Investment and Foreign Economic Relations. The aim

of the new ministry is to boost domestic and international

socially and environmentally responsible investment. The

move will facilitate domestic and foreign businesses to

rapidly obtain investment-related information and data.

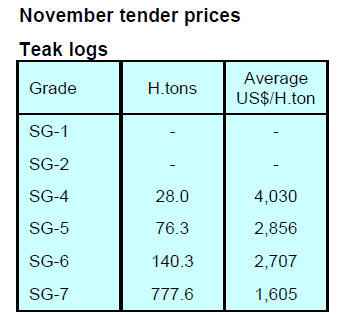

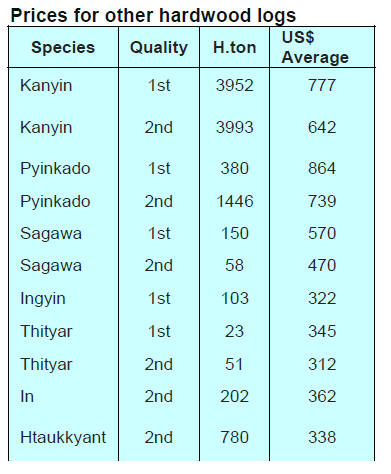

A large volume of teak logs did not attract bids at

the

November auction. SG4, 32 H.ton unbid, SG5, 43 H.ton

unbid, SG6, 22 H.ton and SG7, 1,334 H.ton. The reason

reported for the lack of bids was the poor quality of logs

and the weak demand from buyers especially in the EU.

6. INDIA

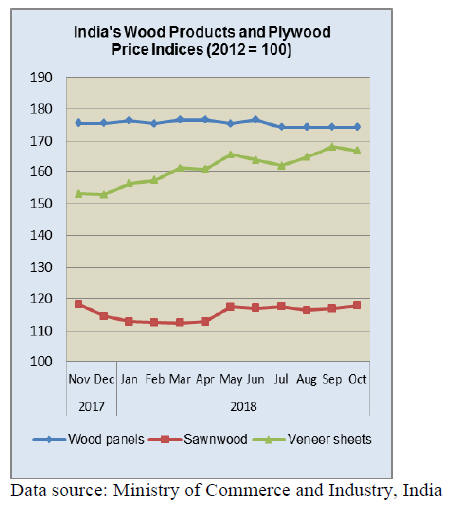

Sawnwood prices higher in October but overall price

index dips slightly

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for October 2018 released by the

Office of the Economic Adviser to the government rose by

0.7% to 121.7 from 120.8 in September. The annual rate

of inflation based on monthly WPI in October 2018 was

5.28% compared to 5.13% for the previous month.

The October index for ‘Manufacture of Wood and of

Products of Wood and Cork ‘ group declined by 0.7% to

132.7 from 133.7 for the previous month due to the lower

price of wooden box/crates, particleboard and veneer

sheets. However, prices for sawnwood rose in October

pushing up the index.

The press release from the Ministry of Commerce and Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Rupee firms against the US dollar, timber importers

gain respite

In the last weeks of November the rupee strengthened

against the US dollar providing some relief for timber

importers. Behind the 4% strengthening was falling crude

oil prices and an increase in foreign fund inflows. In the

seven days up to 25 November the rupee gained marking

its longest winning streak since February 2017.

Strong economic growth but widening inequality

India is now one of the world's fastest-growing major

economies but, despite impressive growth, wealth has not

been evenly distributed according to economists at IHS

Markit interviewed by CNBC. This is borne out by Credit

Suisse's Global Wealth Report which says overall

inequality appears to have increased.

Oxfam has said "On most indicators, India is now among

the countries with the highest level of inequality. But the

analysis also shows that unlike most countries which

started with high inequality, inequality in India has

continued to rise."

The strength of the Indian housing market and related

wood product consumption depends very much on an

expanding middle class but if the benefits from economic

growth are not being felt by consumers then consumption

will stall.

See: https://www.cnbc.com/2018/11/15/india-economy-modifaces-

inequality-black-money-and-taxes.html

and

https://www.oxfamindia.org/blog/15-shocking-facts-aboutinequality-

india

Importers heartened by strengthening rupee –

returning to the log market

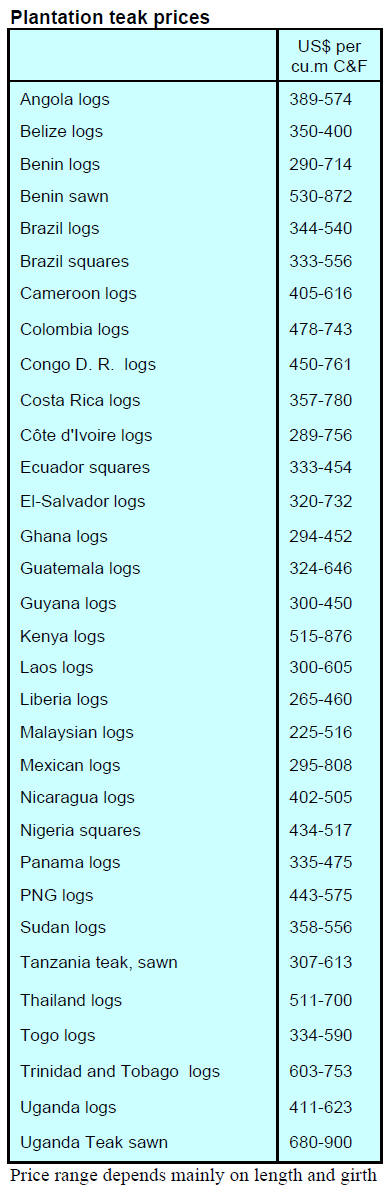

The strengthening of the rupee against the US dollar has

brought relief to importers who are now, on the back of

improving domestic demand, beginning to open

communications with plantation teak shippers.

There are indications that on-going negotiations will result

in changes in plantation teak C&F prices which, up to the

end of November, remained unchanged from a month

earlier.

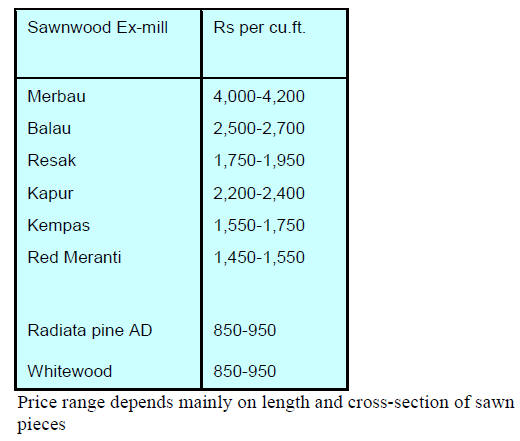

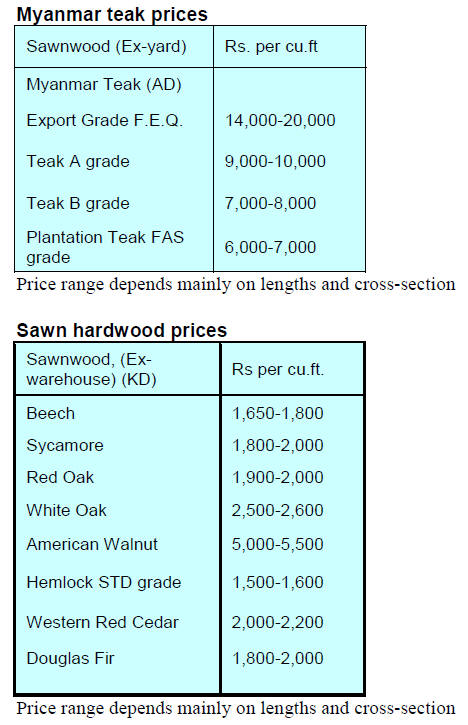

Locally sawn hardwood prices

Analysts report that while demand for hardwood

sawnwood milled locally from imported logs is good there

are no reports of millers raising prices. The recent

exchange rate changes will, if sustained, encourage

importers to expand log purchases to replenish stocks.

Myanmar teak prices

Myanmar teak is of a much higher quality than imported

planatation teak and as such attracts higher prices. The

demand in India for Myanmar natural forest teak is

primarily from high income earners for whom the steadily

rising prices, the result of dimininishing teak log stocks,

does not dampen demand.

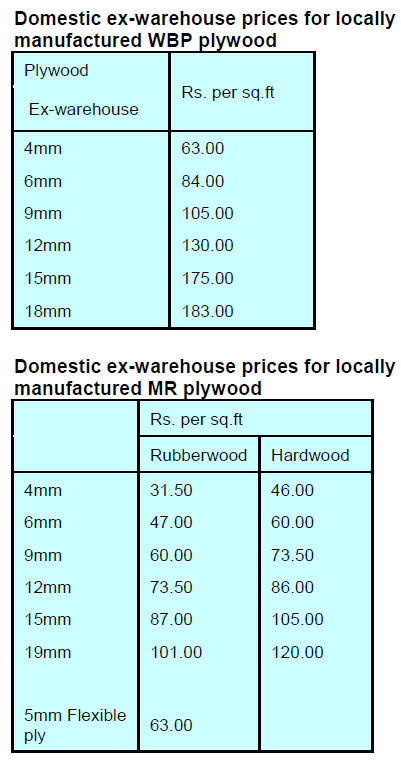

Plywood price update

Analysts report that the supply of plywood has risen faster

than demand. Plywood manufacturers anticipated a faster

pace of consumption driven by government initiatives in

the housing sector and the new middle class and singles

trend towards smaller units and studio houses.

Across the board there has been an improvement in

consumption of building materials so it is just a matter of

time before plywood supply and demand balances out say

analysts.

7. BRAZIL

Highest Amazon forest clearing

in a decade

According to preliminary data released by the ministries of

the Environment (MMA) and Science, Technology,

Innovation and Communications (MCTIC), deforestation

in the Amazon increased almost 14% between August

2017 and July 2018. An area of 7,900 sq. km was lost, the

largest annual area loss in past ten years. The forest area

lost last year was the largest since 2008 when 12,911 sq.

km were cleared.

The states experiencing the highest rates of deforestation

in 2017 were Pará, Mato Grosso, Rondônia and

Amazonas. In the state of Pará alone, 2,840 sq. km were

deforested.

In responding to this news the Ministry of the

Environment said, in addition to expanding enforcement,

action needs to be taken to alert all levels of government,

society and the productive sector of the continuing forest

loss so as to secure support to step up the fight against

illegal activities.

CIPEM guidelines for the Mato Grosso forestry sector

The Center for Timber Producers and Exporters of Mato

Grosso (CIPEM) and the Brazilian Institute for

Environment and Renewable Natural Resources (IBAMA)

recently produced guidelines for the forest-based sector

which focuses on current environmental/forestry

legislation.

The guidebook prepared by CIPEM addresses improving

forest operations and expanding the understanding of

legislation that affects the forest sector. Topics covered

include environmental licensing, timber transportation

control, forest product commercialisation, industry

operations and enforcement processes among others.

In related news, IBAMA has taken the initiative to prepare

a similar guidebook in partnership with local unions, State

Secretariat of the Environment (SEMA-MT) and the

Forest Engineers Association of Mato Grosso state

(AMEF).

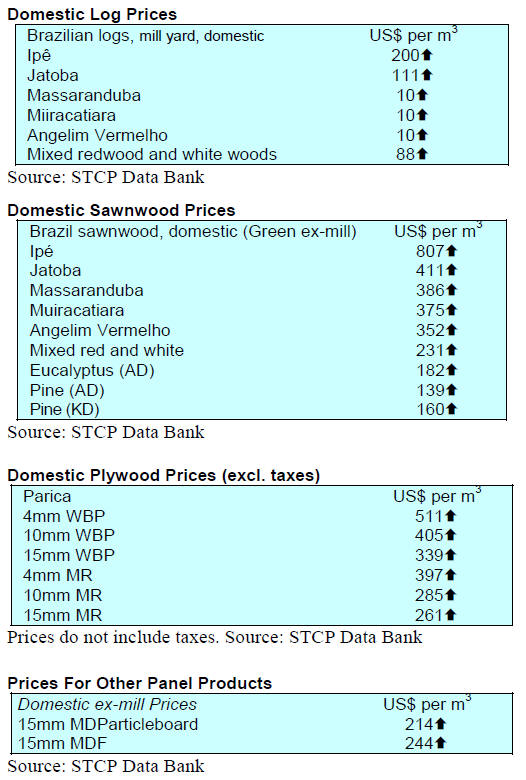

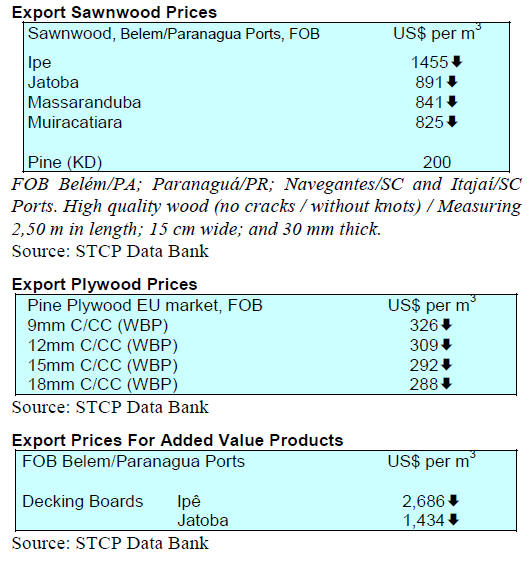

Export update

In October 2018 the value of Brazilian exports of wood

products (except pulp and paper) increased 1.8%

compared to October 2017, from US$268.9 million to

US$273.7 million.

Pine sawnwood export values increased 18% between

October 2017 (US$42.6 million) and October 2018

(US$50.4 million). In terms of volume, exports increased

by a similar amount (17.9%) over the same period, from

207,100 cu.m to 244,100 cu.m.

The volume of tropical sawnwood exports increased 20%

year on year, from 43,600 cu.m in October 2017 to 52,400

cu.m in October 2018 but there was only a 6% increase in

the value of exports from US$19.6 mil. in 2017 to

US$20.7 mil. in 2018.

The value of pine plywood exports increased almost 8% in

October 2018 year on year, from US$51.8 million to

US$55.8 million. In terms of volume, exports dropped

slightly over the same period from 172,900 cu.m to

172,400 cu.m. As for tropical plywood, exports declined

16% in volume, from 15,200 cu.m (US$6 million) in

October 2017 to 12,800 cu.m (US$5.4 million) in October

2018.

Brazil’s wooden furniture exports in October 2018 rose to

US$48.3 million from US$44.5 million in October 2017,

an 8.5% rise.

ABIMÓVEL releases furniture production staistics

ABIMÓVEL (the Associação Brasileira das Indústrias do

Mobiliário) has released details of furniture production for

July and August showing that 36.2 million pieces were

produced in July, some 5% higher than in June. Between

January and July 2018 there was a 4.5% increase in

production and for the 12 months to July there was an

almost 8% rise in production.

In August 2018 exports totalled US$70.4 million up 11%

month on month. Imports also increased in August rising

19% to US$69.5 million. The trade balance in August was

positive at US$918,000. The share of imported furniture in

the Brazilian domestic market was estimated at around 3%

in July. Between January and August 2018 exports

increased 11% year on year and were worth US$461

million.

The main furniture export market was United States with a

share of 31% followed by the United Kingdom with a 10%

share. Argentina was the third ranked export market

accounting for 9% of total furniture exports.

The three southern states are the largest furniture exporters

in Brazil. Together, Santa Catarina (40.8%), Rio Grande

do Sul (26.2%) and Paraná (13.7%) accounted for over

80% of Brazi’s furniture exports between January and

August 2018.

See: http://www.abimovel.com/

8. PERU

Exports rise but shipments to China slide

According to information provided by the Association of

Exporters (ADEX), as of August 2018 exports of Peruvian

wood products totalled almost US$80 million FOB. Over

the same period in 2017 exports were worth US$77

million.

Of the US$80 million exported up to August this year

China was the main export destination for Peru’s wood

products with a 43% share but this year exports to China

dipped 11%. The United States market was the second

most important market (11% share) but in this case exports

up to August were higher by 20% year on year.

Mexico is the third ranked market just behind the US with

a 10% share of total wood product exports and as with the

S there was a rise in year on year exports of around 24%.

Exports of sawnwood in the period January-August 2018

were worth US$14.8 million FOB up just 1% year on year

with most being shipped to the Dominican Republic,

China and Mexico.

SERFOR surveys cedar and mahogany resources

The National Forestry and Wildlife Service (SERFOR) in

its capacity as CITES Management Authority inspected

nineteen applications in the Madre de Dios, Ucayali and

Loreto regions to ensure the sustainable trade in cedro

(Cedrela odorata ) and mahogany (Swietenia

macrophylla).

Inspection makes it possible to verify the origin of the

timber and can identify the forest management plan under

which the timber was harvested to guarantee the legal

origin of the products.

Authorisation for trade in 7,089 cubic metres of cedar and

2,497 cubic metres of mahogany was granted.

In related news, twenty-four SERFOR units conduct field

inspections in fifteen forest concessions and four forest

permit areas managed by native communities. This team

of professionals located 1,673 cedar trees and 313

mahogany seedlings in an area of 65,000 hectares.