US Dollar Exchange Rates of 10th November 2018

China Yuan 6.9561

Report from China

China¡¯s forestry industry in 2017

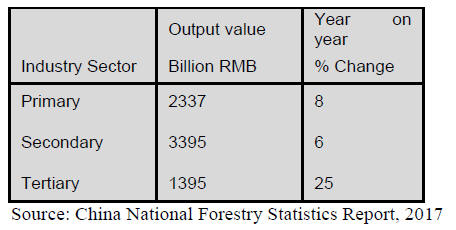

The value of China¡¯s domestic forestry output in 2017 was

just over RMB7 trillion, up 9.8% from 2016.

The leading sectors with an output value of exceeding

RMB1 trillion were plantations, harvesting, wood

processing, bamboo product manufacturing and the

forestry tourism and leisure sectors.

The value of the forestry tourism and leisure service

industries exceeded RMB1 trillion for the first time. The

number of people participating in forestry tourism and

leisure reached 3.1 billion in 2017.

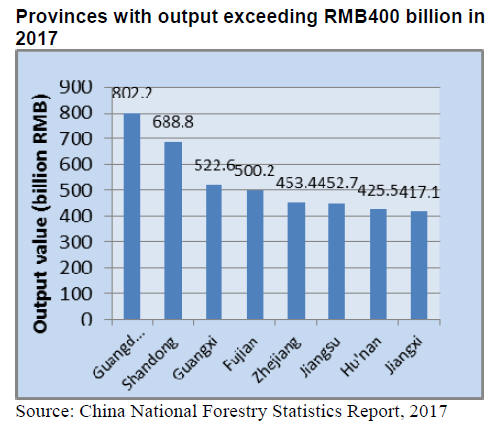

Eight provinces had an output value exceeding RMB400

billion, namely Guangdong, Shandong, Guangxi, Fujian,

Zhejiang, Jiangsu, Hu¡¯nan and Jiangxi provinces of which

Guangdong province was the top.

The output of national commercial timber in 2017 rose 8%

to 83.98 million cubic metres and the output of large

diameter bamboo grew 8.5%. Wood-based panel output

totalled 294.86 million cubic metres, a year on year

decline of 2%.

Of total woodbased panel output plywood was 171.95

million cubic metres, fiberboard 62.97 million cubic

metres, particleboard 27.78 million cubic metres and other

woodbased panels 32.16 million cubic metres.

For more see:

http://www.forestry.gov.cn/main/304/20180606/1532291729212

34.html

Trends in China¡¯s furniture industry

The furniture industry in China is a traditional industry

and it has developed rapidly over the past 30 years. Large

scale furniture enterprises are mainly concentrated in

Guangdong, Zhejiang, Fujian, Sichuan and Shandong

Provinces and 5 major furniture manufacturing zones have

been established in the Pearl River Delta, the Yangtze

River Delta, Circum-Bohai-Sea region, Western region

and Northern region, accounting for 50%, 15%, 10%, 10%

and 5% respectively of the total output value of national

furniture industry.

However, the number of unprofitable furniture enterprises

has been increasing in recent years due to a slowdown in

the domestic economy and to increased competition in the

sector.

The number of furniture manufacturing enterprises in

China had increased to 6,217 by the first half of 2018, but

15% of these are assessed as unprofitable. Across the

sector it has been estimated that profit fell 6% in 2017.

The output value of wooden furniture enterprises

(including solid wood furniture and wood-based panel

furniture), metal furniture and other furniture account for

64%, 19% and 17% of the national total respectively.

According to the China Furniture Association output from

China¡¯s furniture manufacturing sector rose about 1% to

435 million pieces between January and July 2018. Of the

total, the output of wooden furniture grew 2.2% to 144

million pieces, metal furniture fell 0.5% to 219 million

pieces and soft furniture increased 2.4% to 32 million

pieces. Wooden furniture manufacturers were the most

profitable according to the Association.

Wooden furniture is manufactured in 28 provinces. The

top 10 provinces are Guangdong, Zhejiang, Fujian,

Jiangxi, Shandong, Sichuan, Liaoning, Jiangsu, Henan and

Beijing in terms of output in the first half of 2018.

The output of top 3 provinces, Guangdong, Zhejiang and

Fujian are 27 million pieces, 15.7 million pieces and 14.5

million pieces respectively in the first half of 2018.

The Jiangxi Nankang furniture industry cluster continues

to maintain a high growth trend and the total output value

from the industrial cluster reached RMB73.14 billion in

the first half of 2018, up 16% over the same period last

year.

China¡¯s furniture industry is passing through some

difficult times at present especially in respect of domestic

regulations on environmental protection and safety. Many

small and medium-sized furniture enterprises are ceasing

operation or are totally re-tooling to meet the new

regulations.

China¡¯s Industrial Green Development Plan (2016-2020)

points out that the concept of green development will

become the guiding principle of the whole industry.

¡®Green¡¯ manufacturing industry has become a new engine

of economic growth and is providing an advantage in

international markets.

In summary, the furniture manufacturing industry is

changing from overcapacity, high resource consumption,

simple production to high productivity and high valueadded

production. The next step will be low carbon,

environment friendly and intellectualization of production.

¡¡

Export and import of China¡¯s wooden furniture

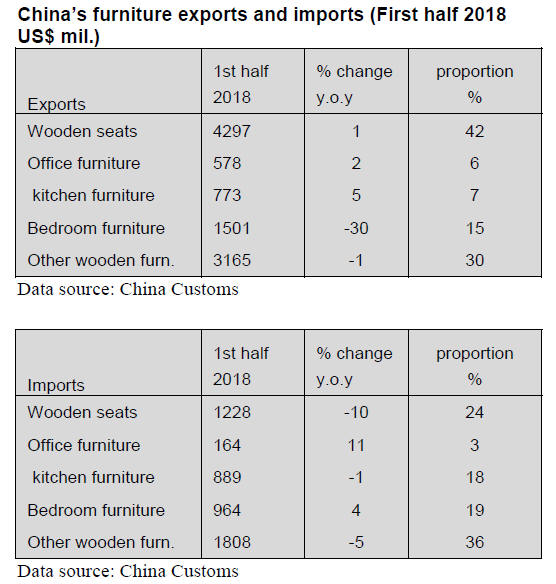

According to data from China Customs, in the first half of

2018 the value of China¡¯ s furniture exports was US$10.3

billion, down 5% from the same period last year.

China mainly exported wooden seats and wooden furniture

for bedrooms which accounted for 42% and 15%

respectively of exports. The value of wooden furniture for

bedrooms fell dramatically by 30% in the first half of

2018.

In the first half of 2018 the value of China¡¯s furniture

imports was US$5 billion, down 3% from the same period

of last year. China mainly imported wooden seats (24%),

wooden furniture for bedrooms (19%) and wooden

furniture for kitchens (18%). The value of wooden seat

imports declined by 10% and imports of wooden furniture

for kitchens declined by 1% in 2017.

Both export and import value of natural lacquered wooden

furniture for bedroom rose dramatically in the first half of

2018. Chinese consumers now favor environmentally

friendly wooden furniture.

Chinese government has formulated strict standards for

environmentally friendly furniture to protect consumers.

The Code of Management for the Sales and After-sales

Services of Rosewood Products (SB/T 11147-2015) came

into force on 1 September 2016.

The purpose of this standard is to regulate the sales and

after-sales service of rosewood products. For example,

rosewood products should be accompanied by information

such as tree species, grade and material inspection labels.

This standard also lays down detailed requirements on the

sales personnel and sales venue for rosewood products and

there are also specific requirements on the warranty

period.

In addition a Technical Requirement for Environmental

Labelling Products - Furniture was introduced on 1

February 2017. Compared with the previous edition, the

new edition requires the classification and disposal of

wastes by furniture manufacturers. The direct discharge of

sawdust and dust is prohibited.

In the course of painting, enterprises must also take

effective gas gathering measures and carry out

standardization treatment of the waste gas collected.

China¡¯s on imported rosewoods from tropical countries.

However, more and more tropical countries have

forbidden or limited export of logs such that Chinese

furniture makers have seen a dramatic decline in

¡®redwood¡¯ furniture production.

|