|

Report from

North America

Plywood and veneer imports move in opposite

directions

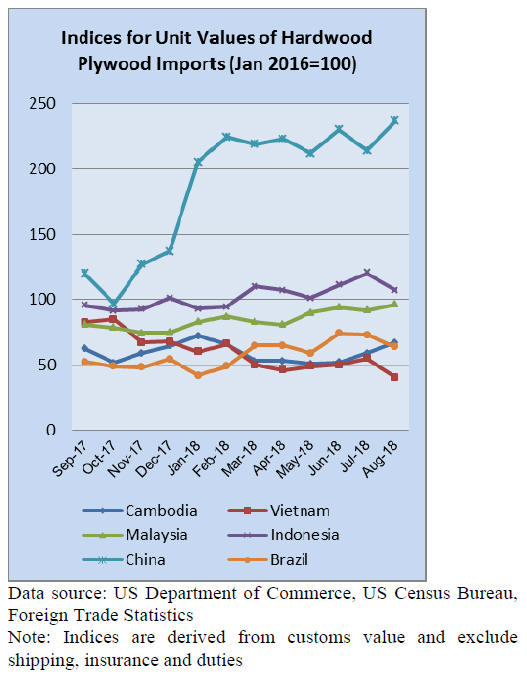

US imports of hardwood plywood increased by 17% in

August as Asian countries increased their volume to make

up for the decline in trade from China. Imports from China

were down an additional 15% in August and are now

down 78% year to date from 2017.

Meanwhile, Indonesia, Vietnam and Malaysia are all

seeing considerable increases in volume exported to the

US, both for the month and year-to-date. Imports from

Cambodia decreased 21% in August, but to-date they

remain more than double that in 2017.

US imports of tropical hardwood veneer continued to

grow, surging 26% in August while year-to-date imports

are now up 39%. Italy, by far the largest US supplier, saw

its exports to the US up by 24% in August.

Imports of veneer from African suppliers fell sharply in

August and are now relatively flat for the year for

Cameroon and Ghana. Imports from India were also down

sharply in August but are still outpacing 2017 year-to-date

numbers by more than threefold.

Flooring and moulding imports from Indonesia slow

Hardwood flooring imports grew for a fourth straight

month, climbing 5% in August. The strongest growth was

in imports from Brazil and China. Imports from Malaysia

declined, but year-to-date imports from Malaysia remain

nearly double those of the same time last year. Imports

from Indonesia also declined in August and are now down

nearly one third from last year.

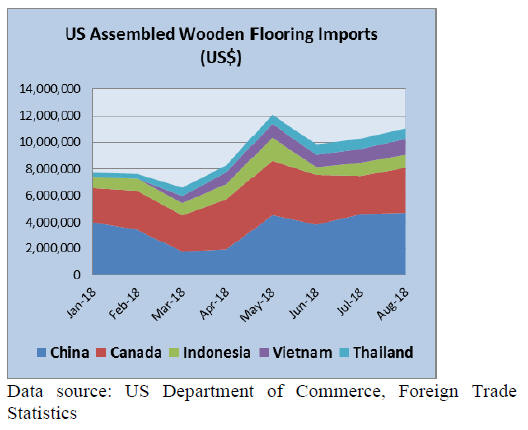

Assembled flooring imports grew for a third month in a

row, rising 11% in August. Imports from Canada and

Vietnam fueled the gain. Imports in this area are up 7%

year-to-date.

Hardwood moulding imports grew 7% in August. The

strongest growth was in imports from Brazil and Malaysia.

Imports from China were down sharply, but year-to-date

imports were 8% higher than in August 2017.

Furniture imports from China and Vietnam rise again

US imports of wooden furniture fell 7% in August,

however, August numbers historically lag behind July.

The US$1.6 billion total for the month came in at 5%

percent above imports for August 2017 and imports

remain about 6% above the 2017 year-to-date. Imports

from the largest suppliers, China and Vietnam are both up

6% year-to-date.

Cabinet sales and furniture orders rise

According to the most recent Smith Leonard survey of

residential furniture manufacturers and distributors new

furniture orders in July were up 5% over July 2017.

The 5% increase was notable one considering July 2017

orders were 11% higher than July 2016. This July increase

marked the third straight month that orders were up 5%

over the same month a year ago.

See: http://www.smith-leonard.com/2018/09/27/september-2018-

furniture-insights/

A press release from the Kitchen Cabinet Manufacturers

Association (KCMA)¡¯s monthly Trend of Business Survey

says participating cabinet manufacturers reported an

increase in cabinet sales of 4.4% for August 2018

compared to the same month in 2017. Stock sales

increased 5.1%; semi-custom sales increased 3.1%; and

custom sales increased 6.2% compared to August 2017.

Compared to last month (July 2018), sales are up 8.3%.

Stock sales are up 8.4% compared to July; semi-custom

increased 9.5%; and custom is up 4.2% after a large drop

from June to July.

Year to date cabinetry sales through August 2018 are up

1.8% according to participating manufacturers. Stock

sales are up 3.5%; semi-custom sales are down 0.5%; and

custom sales are up 4.2% so far this year.

See: https://www.kcma.org/news/august-2018-trendbusiness-

press-release

US to negotiate trade agreements with Japan, EU and

UK

US Trade Representative Robert Lighthizer formally

notified Congress that the Trump Administration intends

to formally enter negotiations toward three new trade

agreements with Japan, the European Union, and the

United Kingdom.

According to the letters of notification, Lighthizer intends

to begin negotiations as soon as possible, but there will be

at least 90 days of consultation with Congress, US

stakeholders, and industry advisory committees such as

those on which IWPA Executive Director Cindy Squires

serves.

See: https://ustr.gov/about-us/policy-offices/press-office/pressreleases/

2018/october/trump-administration-announces

Manufacturing sector expands, but business

executives concerned about tariffs

Economic activity in the manufacturing sector expanded in

September, and the overall economy grew for the 113th

consecutive month, say the nation¡¯s supply executives in

the latest Institute for Supply Management¡¯s

Manufacturing (ISM) Report of Business.

Demand remains strong and production and employment

continue to expand, but respondents are overwhelmingly

concerned about tariff-related activity, including how

reciprocal tariffs will impact revenue and current

manufacturing locations.

https://www.instituteforsupplymanagement.org/ismreport/mfgrob

.cfm?SSO=1

|