Japan

Wood Products Prices

Dollar Exchange Rates of 25th

October

2018

Japan Yen 111.88

Reports From Japan

¡¡

Little risk of recession when

consumption tax goes up

next year

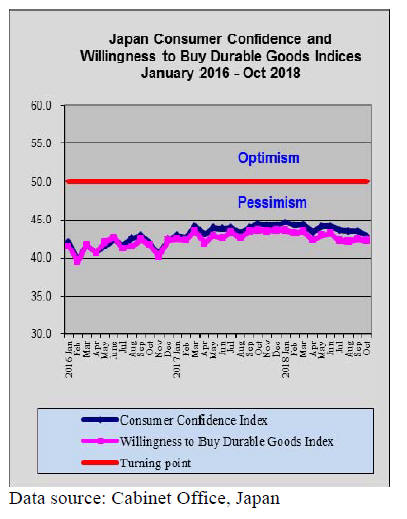

The Japanese government has confirmed its intention to

raise the consumption tax to 10% from the current 8% in

October 2019 as planned. The rationale for the increase is

to address the rapidly rising social security costs as the

population ages.

While GDP numbers look healthy, GDP for the

April-June

period increased at an annualised rate of 3%, reversing a

slight decline in the earlier quarter, consumer spending

continues to be weak.

However, the government has concluded the risks to

private consumption from this 2% rise in consumption tax

should not seriously dampen consumption for long.

The government argues that the impact on consumption

will be small as tax on food and drinks will not be raised.

Exports to China and US slip

Ministry of Finance data show that, for the first time since

2016, month on month exports fell in September.

Shipments to the US dropped due to falling exports of

construction and mining machinery, auto parts and

medicines. Also car exports were down around 7% year on

year.

The US administration is pressuring Japan to address its

almost US$70 billion trade surplus with the United States,

much of which stems from car exports.

Analysts report Chinese businesses are delaying new

investment fearing the US/China trade frictions will

further impact export opportunities. This cut-back by

Chinese companies has resulted in falling machinery

orders placed with Japanese companies who report orders

have been falling for around six months.

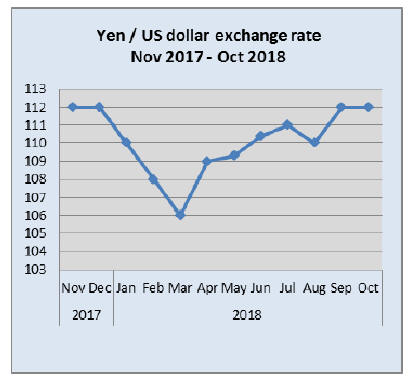

Strong dollar helps keep yen/dollar exchange rate in

check

The US dollar continues to strengthen and towards the end

of October was at an 11 month high against the Japanese

yen which touched 114 to the dollar at one point. A weak

yen boosts the profits made abroad when they are

repatriated by Japanese companies.

There are concerns over the pressure being exerted on

Japan to reduce its trade surplus with the US but for now

no drastic action is expected from the US side. Speaking to

the media recently the Japanese prime minister said he and

the US President had agreed to continue talks to resolve

the surplus issues.

However, recent losses first in Wall Street and then in

Europe and Asia caused the yen to rise against the dollar

because investors sought a ¡®safe-haven¡¯. This tipped the

yen back to its more recent level of 112 to the dollar.

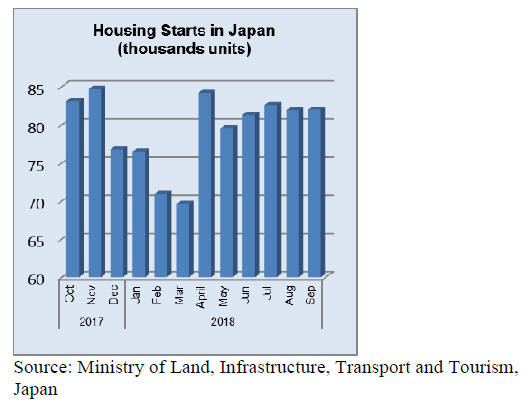

September Housing starts

September housing starts came in at the same level as in

August but were down year on year by around 2%. On the

basis of the first nine months housing data, annual starts

for 2018 will be in the region of 945,000.

The domestic housing market in Japan is shrinking fast

due to the declining population. The number of new

homes built in fiscal 2017 dropped to 950,000 from a peak

of 1.29 million in fiscal 2006. Analysts estimate that by

2030 annual housing starts will only be around 550,000.

Import round up

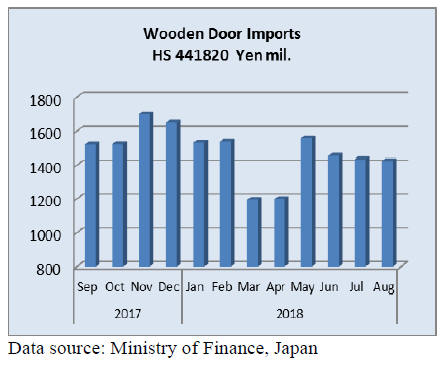

Doors

August door imports

Japan¡¯s August wooden door (HS441820) imports

continued the decline that began in June after the peak in

May imports.

Year on year, August 2018 wooden door imports were

unchanged from a year earlier down slightly and were just

slightly down from levels in July.

Over 90% of August wooden door imports were from 4

sources, China (61%) followed by the Philippines (20%),

Indonesia (7%) and Malaysia (8%). In July there was a

shipment of wooden doors from Sweden worth around 7%

of total monthly import values.

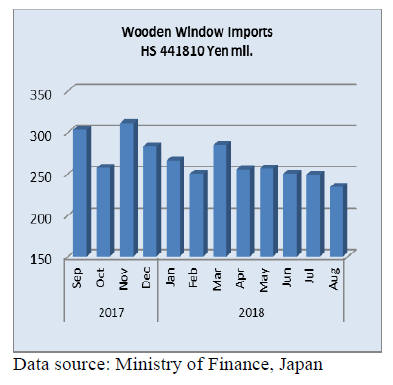

Window imports

August window imports

After a peak in March this year Japan¡¯s imports of wooden

windows (HS441810) declined for the following 6

months. Year on year, August imports of wooden

windows were down 16% and compared to the previous

month there was a 4% drop.

In August three suppliers accounted for 85% of the

value

of Japan¡¯s wooden window (HS441810) imports namely

China (38%), the Philippines (24%), the US (23%) and

Sweden (8%).

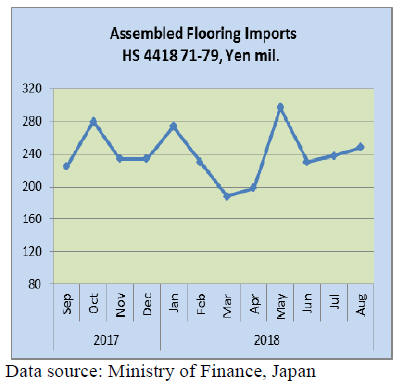

Assembled flooring

August flooring imports

Import values for wooden flooring entering Japan in

August confirm that HS441875 is the main product

followed by HS441879.

In August, as in the previous month these two categories

of assembled flooring accounted for around 90% of the

value of all assembled wooden flooring imports. The top

three shippers of HS441875 in August were China (43%),

Indonesia (23%) and Malaysia (15%).

In contrast, for HS441879 the main shippers in August

were Indonesia (50%) and Vietnam (17%).

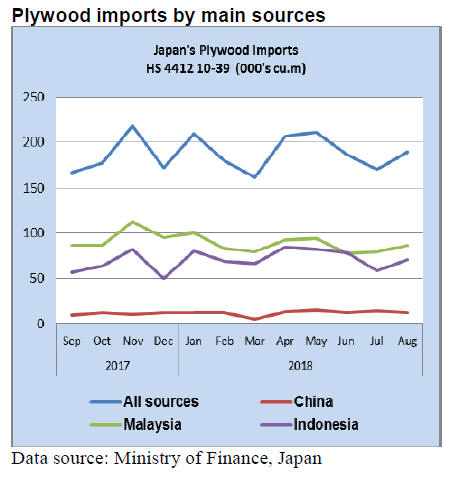

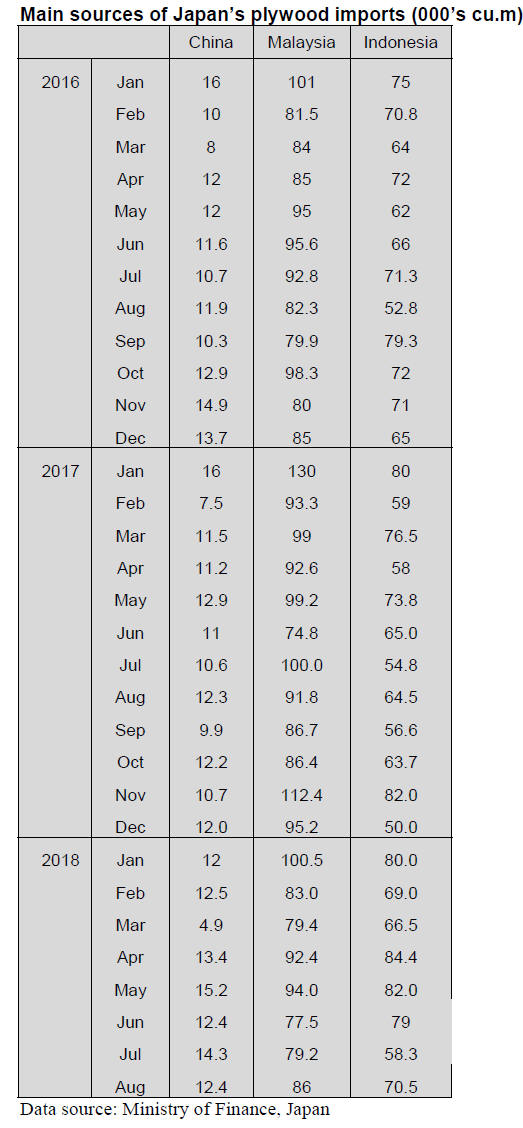

Plywood

August plywood imports

After two consecutive months of decline there was an uptick

in the volume of plywood imports with both of the

two major suppliers Malaysia and Indonesia posting

month on month gains.

August imports of plywood (HS441210-39) were flat

year

on year but there was a significant year on year decline in

the volume of imports from Malaysia with some of the

slack being taken up by shipments from Indonesia which

jumped around 8% in August compared to August 2017.

Plywood imports from China still fall within a narrow

range which has been fairly consistent for the year to

August.

Imports of HS441231 dominte Japan¡¯s plywood imports

accounting for over 89% of imports in August with

Malaysia and Indonesia being the main shippers. In

August shippers in Vietnam built on the gains recorded

with the July plywood shipments.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Influence of U.S.-China trade war

What kind of influence on-going U.S.-China trade war

would give to wood industry is everybody¡¯s concern.

On September 24, U.S. decided to impose 10% sanctions

duty on Chinese wood products while China announced to

impose 5% or 10% retaliatory tariff on imported wood

products from the U.S. However, duties China imposed

initially of 20-25% are reduced to 10% except for

Southern pine logs. China obviously tries to solve the

issues by the end of this year.

In 2017, import of wood products by China from the U.S.

was 6,096,000 cbms of logs, 15% more than 2016 and

3,205,000 cbms, of lumber, 9.8% more. About one third of

the imports on both logs and lumber is estimated Southern

pine so 25% duty on logs would give serious impact on

log import.

Duty on lumber is 10% (initially 20%) but it is hard to see

what kind of impact hot North American lumber market

would give to supply and prices to China. Soaring North

American lumber market is negative factor to the trade

with China but the fact is that softwood log export to

China in 2017 was 7.2% more than 2016 and softwood

lumber was 21.2% more.

Through July this year, softwood log import was 15.3%

more and softwood lumber was 39.4% more so growth

continued. Although grade and prices of export are

different from U.S. domestic products, there must be some

connection between the two. Weighted average prices of

15 structural lumber dropped by US$159, 27.4% in

September from the peak in June so even with 10% duty,

the prices are lower than the peak time.

On softwood logs, duty on hemlock is 5%. If China shifts

to Canada to buy hemlock logs, it would influence supply

of logs and lumber for Japan. Duty on Alaskan logs is

10%. If China slows down purchase of Alaskan logs,

Japan will have more chance to buy but if low grade logs

China buys lose sales outlet, log harvest itself would be

reduced.

Trade of wood products by both countries is about US$3.1

billion. If the war is over within this year, there is very

little impact to Japan but if the war prolongs, various

impacts should give to worldwide wood trade since two

countries are major supplying and consuming countries.

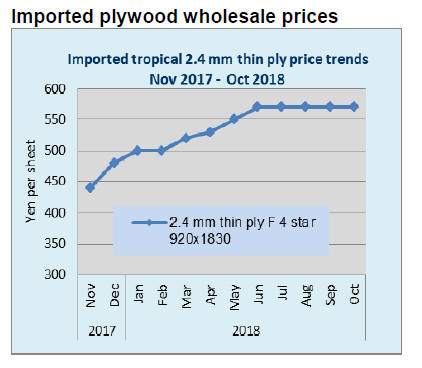

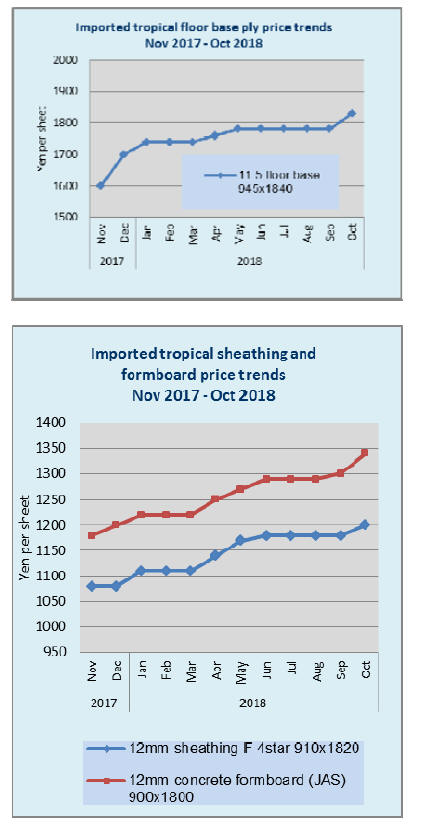

Plywood

Plywood market is stagnating. September sales were slow

and there is no fall demand surge. Imported plywood

market is firm as the importers try to increase the sales

prices by increasing suppliers¡¯ prices.

Market prices of softwood plywood are holding steady

despite spotty low prices in distribution channel.

Domestic manufacturers hold the sales prices firmly,

which stops slide of the market prices.

Softwood plywood production in August was 252,000

cbms, 1.1% less than August last year and 5.9% less than

in July because working days in August were shorter due

to vacation season. In this structural plywood production

was 232,800 cbms, 3.4% less and 6.3% less. Nonstructural

plywood production was 19,200 cbms, 39.2%

more and 0.9% less.

The shipment of softwood plywood in August was

240,800 cbms, 3.7% less and 7.2% less. That of structural

plywood was 221,800 cbms, 6.5% less and 7.6%v less.

That of non-structural plywood was 18,900 cbms, 49.3%

more and 1.5% less.

The inventory of structural plywood was 157,000 cbms,

increase of 10,900 cbms. With increasing inventory, some

dealers asked price reduction but the manufacturers say

that the inventory is still less than one month shipment and

with increasing demand for non-structural plywood, the

manufacturers do not listen to price reduction request

.Users are now getting cautious in buying with rumors of

lower prices in the market.

On imported plywood, the suppliers intend to increase the

sales prices before rainy season with prospect of lower log

supply and higher log prices and offer volume is less than

before.

Dealers in Japan need to increase the market prices as

higher cost cargoes will keep arriving so the market prices

of imported plywood are climbing. However, there were

some low price offers in September as the dealers made

aggressive sales in September before midterm book

closing at the end of September so price hike was limited.

The prices of imported plywood will be firm in October

and be climbing in coming months.

Sing Yang of Malaysia acquired forest

management

certificate

Sing Yang group, the largest plywood manufacturer in

Sarawak, Malaysia has acquired forest management

certificate on natural forest. This is the second forest

district Sing Yang received the certificate.

The forest is about 72,685 hectares, where acacia is main

species, which is used for manufacturing plywood. It

acquired three years certificate of MTCS (Malaysian

Timber Certificate System), which means the area is

admitted as sustained yield forest. MTCS is tied with

PEFC.

|