2.

MALAYSIA

Export earnings dip due to bad

weather

Between January and August this year Malaysia’s wood

product exports declined almost 6% to RM14.6 bil.

compared to the same period last year. Analysts write that

this was mainly due to bad weather which hampered

harvesting and production.

Despite this decline, Malaysian Timber Council (MTC)

chairman, Low Kian Chuan, said the Council was

confident of achieving the 2018 export target.

Low said the main export earners were wooden furniture,

plywood, sawnwood, fibreboard and joinery products.

Marketing mission to Philippines

The Malaysian Timber Industry Board (MTIB) recently

arranged mission to the Philippines under the MTIB

‘Technical Mission and Timber Entrepreneurs

Development Programme’. The aim was to expand trade

in Malaysian wood products, particularly of high valueadded

value wood products.

In 2017, Malaysia’s wood product exports to the

Philippines were worth RM734 million. Sawnwood was

the main item exported and there has been a steady

increase in sawnwood exports to the Philippines since

2013. Other major products exported to the Philippines

include wooden furniture and plywood which in 2017

were worth RM183 and RM49.6 million respectively.

While furniture exports increased last year plywood

exports fell compared to levels in previous years.

Malaysian imports of wood products from the Philippines

were valued at RM7.4 mil. last year and comprised mainly

rattan and wooden furniture.

Landmark effort between Forestry Department and oil

palm plantation owners in Sabah

The Sabah Forestry Department recently held a landmark

meeting with key oil palm plantation owners to discuss the

Department’s EU-funded REDD-plus project "Tackling

Climate Change through Sustainable Forest Management

and Community Development."

This was the first ever meeting with a group of plantation

owners and also for the EU-REDD+ project. The aim was

to find common ground for forest conservation efforts in

the Upper Kinabatangan River corridor.

Plantation owner, Sawit Kinabalu Berhad manages the

Sungai Pin Conservation area. Here forest restoration

work is undertaken by the RiLeaf Project, the Pongo

Alliance and Bora who are building a resilient habitat for

Orang Utangs. The objective of the EU-REDD+ project is

to contribute to the sustainable and low carbon

development of Sabah.

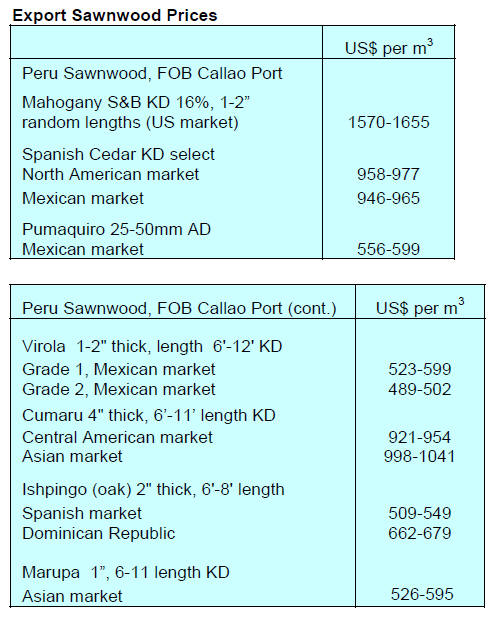

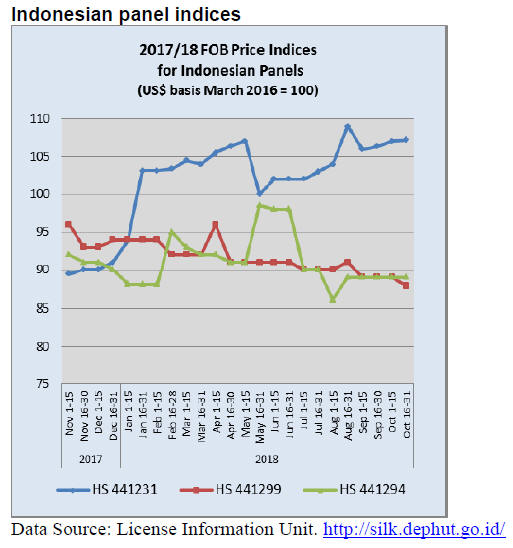

Plywood prices

Traders based in Sarawak reported the following plywood

export prices for mid-October:

3.

INDONESIA

Indonesian Timber Council

(ITC) launched

A new institution, the Indonesian Timber Council (ITC)

has been launched bringing together seven associations,

namely ILWA, ISWA, APHI, APKINDO, APKI,

ASMINDO and HIMKI.

The functions of the new Council include promoting the

timber trade and developing global markets, promoting the

development of the timber industry by expanding the

industrial manufacturing base, increasing added value

production, increasing the pool of skilled workers and

ensuring a sustainable supply of raw materials.

Interest in Indonesia’s teakwood furniture growing in

the US

The Indonesian Trade Promotion Center (ITPC) in

Chicago has reported that US demand for Indonesian teak

furniture is rising and that this is a US$1 million market

opportunity for Indonesian exporters.

During the recent ‘Casual Market 2018’ trade fair in

Chicago orders for teak products worth over US$300,000

were placed by US importers. The head of the ITPC, Billy

Anugrah, said the US market for outdoor furniture is

growing and that Indonesian manufacturers can benefit

from this.

Indonesia-Malaysia continue cooperation on wood

carving for SMEs

Officials from Indonesia and Malaysia met recently to

strengthen ties for joint development of SMEs involved in

wood carving. Meliadi Sembiring, from the Indonesian

Ministry of Cooperatives and SMEs, stated there is a

strong commitment on the part of Indonesia and the

Malaysian Ministry of Entrepreneurship and Youth to

boost SMEs growth.

A Malaysian delegation recently visited Celuk Village in

Bali one of Indonesia’s wood carving centres. The group

committed to arrange training and technology transfer

which has been the foundation of the success of the wood

carving trade for Bali and to address marketing issues.

Forestry Ministry launches online forest fire reporting

The Ministry of Environment and Forestry has established

an online mechanism for report the incidence and control

actions for forest fires. Software has been tested in Riau,

Jambi, South Sumatra, West Kalimantan and Central

Kalimantan provinces.

The Director of Forest and Land Fire Control, Raffles B.

Panjaitan, reported over 1,500 companies and institutions

are contributing inputs to the online system so that there

can be a rapid response to fires in protected forests,

production forests, conservation areas and in plantations.

Encouraging ‘lightwood’ exports

Speaking at a recent ‘International Lightwood Cooperation

Forum’ the Director General of National Export

Development in the Ministry of Trade, Arlinda, said the

Ministry is encouraging exports of ‘lightwood’ or sengon

laut, moluca, batai, albizia and jeungjing, (Paraserianthes

falcataria).

The Indonesian Lightwood Association (ILWA)

Chairperson, Sumardji Sarsono, said that Indonesian light

wood craftsmen want to export finished products but that

currently exports of ‘lightwood’ are either raw materials or

semi-finished products such as barecore for China and

Taiwan P.o.C.

The ILWA chairperson said he is optimistic Indonesia can

capture a major share of the international market for

‘lightwood’ products. To achieve growth in the lightwood

sector Sumardji said if the government’s target of 5

million hectares plantations includes Albizia (lightwood)

then there will be assured raw material availability for

export production.

ILWA has close cooperation with technologists and

traders in Germany and Singapore and in both countries

there are people with experience of utilising Albizia for a

variety of products

For more see: http://mediaindonesia.com/read/detail/191982-

indonesia-siap-rajai-ekspor-produk-kayu-ringan

4.

MYANMAR

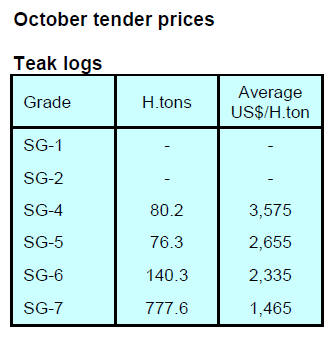

Old growth teak plantations

yield good quality logs

According to the local media, the Minister of Forestry

recently visited a sawmill where trials on old growth teak

thinnings were being conducted. The Minister was quoted

as commenting that he had noticed that the price of teak

logs from mature plantations is very attractive. This,

according to the Minister, could give a boost to investment

in teak plantations in the country.

Analysts write that it is believed the teak logs in the trial

were harvested from very old plantations which had

almost reverted to natural forest.

News awaited on options for MTE restructuring

The Myanmar government announced several years ago

that it plans to restructure the government-run Myanmar

Timber Enterprise (MTE) under private sector

management. It is understood that recently a representative

from the US Forest Service was in Myanmar to evaluate

the options for this restructuring. Analysts are yet to learn

of his recommendations.

The MTE has been responsible for managing log

extraction and for supplying teak and non-teak wood to the

private sector. It is unclear what form the restructuring

will be, all that is reported is that MTE will “operate under

a commercial model.”

Manufacturers plead for revision of taxes on timber

The MTE is among top state owned enterprise revenue

earners for the country. But domestic millers and

manufacturers are unhappy with the pricing structures

used by the MTE. According to manufacturers, MTE

timber prices include the 5% special commodity tax as

well as an extra ‘Commercial’ tax which brings the total

added to the log price to around 11%.

Manufacturers have urged the government and MTE to

eliminate the special commodity tax but this was refused

according to analysts.

FDI inflows drop

The World Bank has downgraded its economic growth

projection for Myanmar in fiscal 2018/19 ending on

March 31, to 6.2% from its original forecast of 6.8%.

The Bank attributes the change in forecast to mostly

domestic factors such as floods, inflation and the “Rakhine

crisis”.

According to the World Bank prospects are bleak. Foreign

Direct Investment (FDI) applications in the April-

September period totalled US$1.7 billion, compared with

US$3 billion during the same period last year.

Additionally, inflation is currently 8.5%, compared with

5.5% last year and the kyat has depreciated 25% in recent

months.

Strengthened environmental compliance

Bangkok-headquartered ‘SLP Environmental’ has

announced the extension of its environmental, health and

safety (EHS) compliance auditing services to cover

Myanmar. This comes after the company spent a year

compiling a comprehensive in-house database of the

existing legislation and statutory rules.

This comes as Myanmar prepares to enact new

occupational health and safety legislation which will apply

to businesses operating in multiple sectors throughout

Myanmar.

The SLP website says the company has an established

presence in Myanmar having assisted the Myanmar

Ministry of Environmental Conservation and Forestry

(MOECAF) to prepare environmental impact assessment

guidelines.

See: https://www.slpenvironmental.com/slp-environmentallaunches-

environmental-health-safety-ehs-legal-registercompliance-

auditing-services-myanmar/

5. INDIA

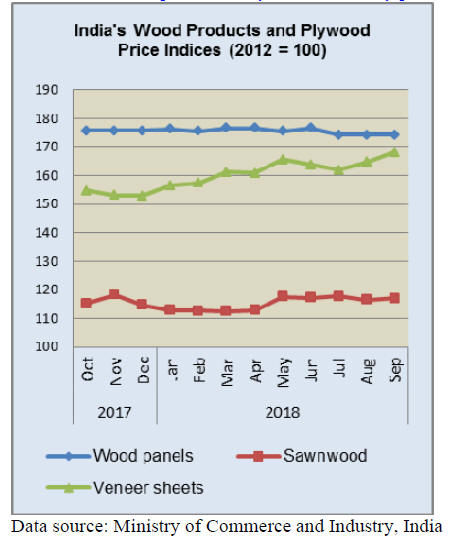

Timber commodity prices move higher

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for September 2018 released by the

Office of the Economic Adviser to the government rose to

120.8 from 120.0 for August. The annual rate of inflation

based on monthly WPI in September 2018 was 5.13%

compared to 4.53% for the previous month.

The September index for ‘Manufacture of Wood and of

Products of Wood and Cork‘ group rose to 133.7 from

132.8 for the previous month due to higher prices for

veneers and panel products, mouldings and plywood.

However, prices for wooden box/crates declined.

The press release from the Ministry of Commerce and Industry

can be found at: http://eaindustry.nic.in/cmonthly.pdf

Indian Railways abandons wooden sleepers for

composite alternative

In what analysts call a misguided statement a

representative of Indian Railways said the decision to

switch to composite sleepers was in order to “become

more eco-friendly”.

The domestic press has quoted the Indian Railways as

announcing “the Railways prefer them (composite

sleepers) over wooden sleepers because of environmental

issues that cropped up over the cutting of trees, a decision

taken in the wake of a Supreme Court order imposing

restrictions on cutting trees”

Commenting on the manufacture of composite materials a

Railways spokesperson said fibre-reinforced foamed

urethane (FFU) composite sleepers are made of rigid

polyurethane reinforced with glass fibre a lightweight,

high-strength, environment-friendly product cost-effective

alternative to timber or concrete.

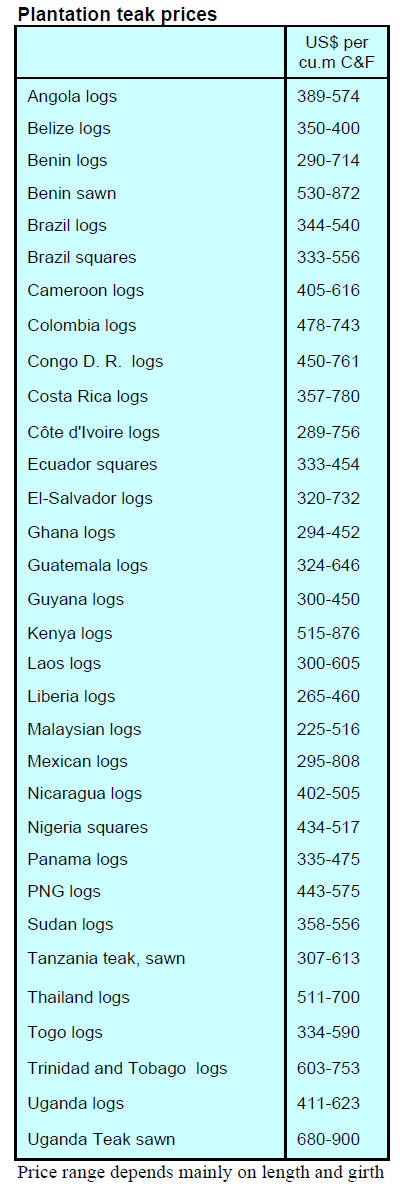

Plantation teak prices

Domestic demand for imported logs continues to improve

but exchange rate issues are of concern to importers. The

weak rupee has been pushing up landed costs but

fortunately, because of the firm market conditions,

importers have been able to pass on the higher costs to

domestic millers.

C&F prices in US dollars remain unchanged

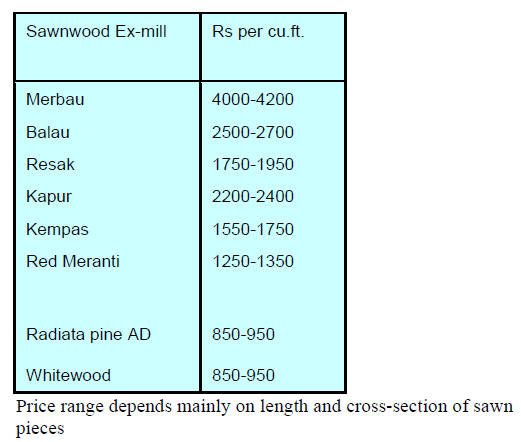

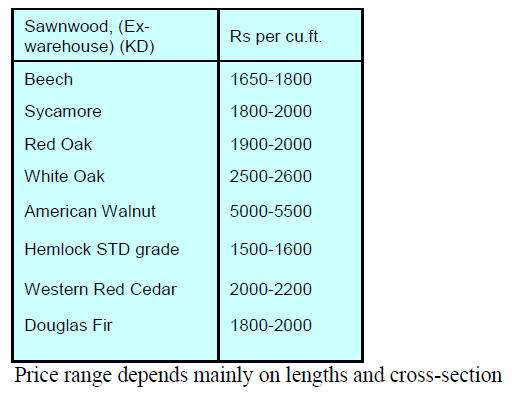

Locally sawn hardwood prices

Traders report demand is steady. The rupee landed cost for

imported hardwoods continues to rise because of the

weakening rupee so on-selling prices were raised some

weeks ago.

The industry is looking to the Reserve Bank to steady the

dollar/rupee exchange rate to avoid disruption to business.

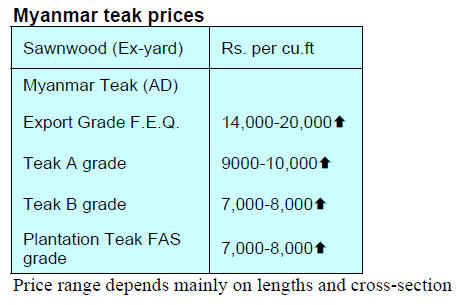

Teak stockists increase prices to take

advantage of

rising demand

Improved demand for but diminishing supply of Myanmar

teak has given Indian stockists the opportunity to raise

prices. However, the downside to this is that endusers are

now diverting attention to alternatives.

Sawn hardwood prices

Analysts report the recent price increases have been

accepted in the market.

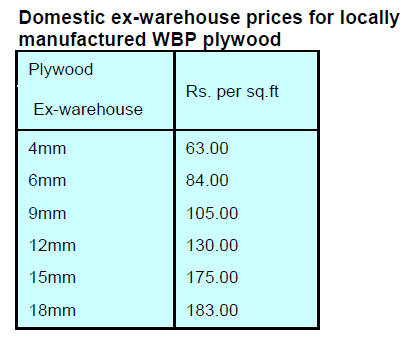

No respite from rising production costs

Indian plywood manufacturers report that their recent

prices increases have been absorbed by the market and

while this brought them some relief they are now facing

another problem.

Rising prices for petroleum products such as melamine,

phenol and formalin are pushing up production costs such

that the gains from recent plywood price increases are

being wiped out.

Adding to the woes of manufacturers in India are the

indications that the quantity of veneers being exported

from Gabon may be affected as the government in Gabon

is considering limiting the issue of veneer manufacturing

licenses. Indian analysts say it appears that veneer mills in

Gabon may have to invest to manufacture plywood.

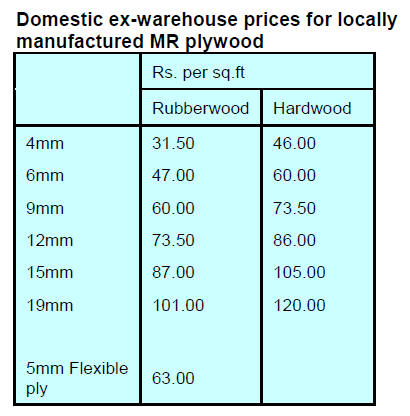

Current India ex-mill prices for plywood are shown below.

6. BRAZIL

Timber and construction

companies promoting

domestic timber use

In October this year the Wood Technology Reference

Center in the Institute for Technological Research (IPT)

brought together professionals and representatives from

the timber and construction industries to discuss

promoting greater use of wood in domestic construction.

Participants from different regions of the country (São

Paulo, Paraná, Mato Grosso, Rio Grande do Sul and Minas

Gerais) contributed to identifying what must be done to

expand the consumption of wood products in the domestic

construction sector.

During the event, five working groups were formed,

namely: Forests, Components, Education, Projects and

Construction. Among the topics that emerged were the

need to discuss fire regulations, the production of

documents and technical publications that can be used as

support materials in capacity building of professionals and

verifying the legality of raw materials.

Other aspects discussed were production of components;

capacity building for professionals in wooden structures;

aspects that should be considered in building design and

wood construction projects and prospects for construction

sector markets.

Fines levied but forest burning continues

There is an ongoing operation led by the Amazon

Environmental Protection Institute (IPAAM) and the State

Secretariat of the Environment (SEMA) to combat illegal

logging and forest clearing, particularly in the southern of

Amazonas.

Using SEMA satellite imagery the operation successfully

identified the sites of fires in the municipalities of Apuí

and Novo Aripuanã. These areas are considered a priority

for preventing deforestation and burning. The fires that

were detected resulted in the loss of around 1,500 ha. of

forest.

IPAAM has issued 40 environmental infractions totalling

more than R$9 million in fines and has also seized

illegally harvested logs in Novo Aripuanã and fined the

owner of the property R$1 million.

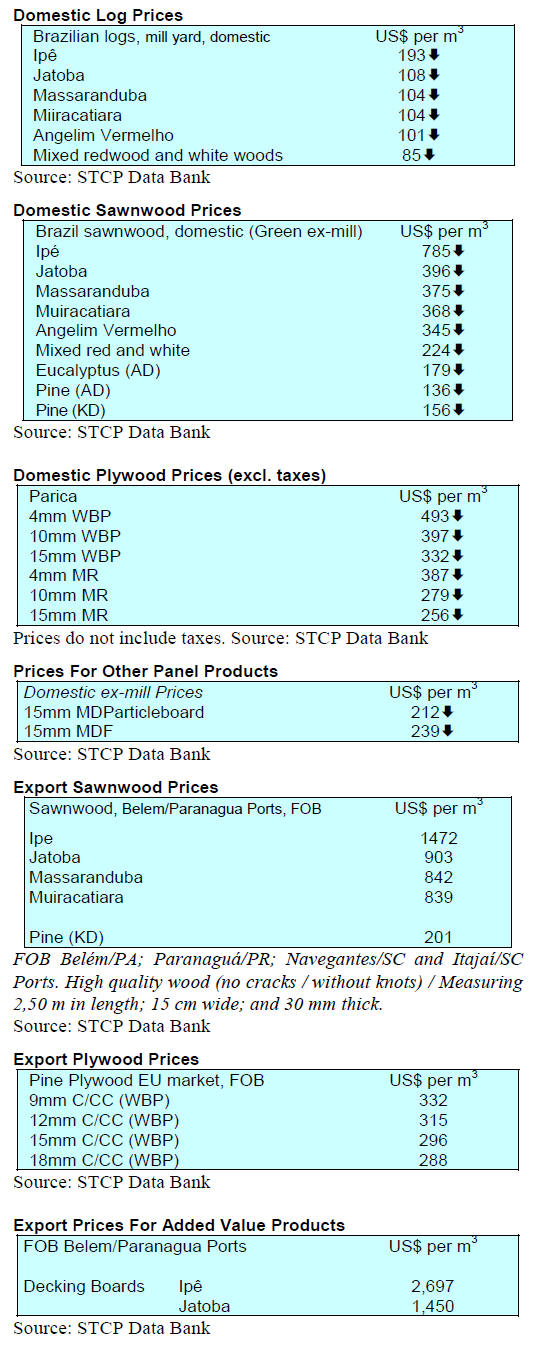

Export round-up

In September 2018 Brazilian exports of wood-based

products (except pulp and paper) increased 8.4% in value

compared to September 2017, from US$248.3 million to

US$269.1 million.

The value of pine sawnwood exports increased 20%

between September 2017 (US$41.9 million) and

September 2018 (US$50.4 million) and the volume of

exports increased 17% over the same period (202,500

cu.m to 237,700 cu.m).

Tropical sawnwood exports also increased rising 31% year

on year from 42,500 cu.m in September 2017 to 55,700

cu.m in September 2018. In terms of value, exports

increased 21% from US$19.5 million to US$23.5 million

over the same period.

September pine plywood exports increased 31% in value

year on year from US$48.7 million to US$63.6 million.

Export volumes also increased, rising 13% over the same

period, from 165,900 cu.m to 188,200 cu.m.

In contrast, tropical plywood exports declined 28% in

volume, from 16,300 cu.m (US$6.3 million) in September

2017 to 11,700 cu.m (US$5.5 million) in September 2018.

Brazil’s wooden furniture exports continue to do well and

in September 2018 totalled US$44 million compared to

US$40 million in September 2017 a 10% rise.

USA the top market for furniture from Rio Grande do

Sul

Manufacturers in Rio Grande do Sul account for most of

the wooden furniture production in Brazil. Between

January to August 2018 furniture manufacturers in the

State of Rio Grande do Sul exported mainly to the United

States and Uruguay (15% each) and the United Kingdom

(14%).

In August there was a 26% increase in furniture exports

from Rio Grande do Sul State compared to the previous

month. The value of these exports was US$17.8 million

according to IEMI - Market Intelligence Institute. The

president of the Furniture Industry Association of Rio

Grande do Sul (MOVERGS) has said his association is

pleased to see the increase in foreign currency earnings

which is a result of manufacturers beating the competition

in international markets.

But, there are challenges. As the currency weakens

manufacturing inputs such as imported components used

in the manufacture of furniture become more expensive

and planning production and pricing becomes a nightmare

if exchange rates are volatile.

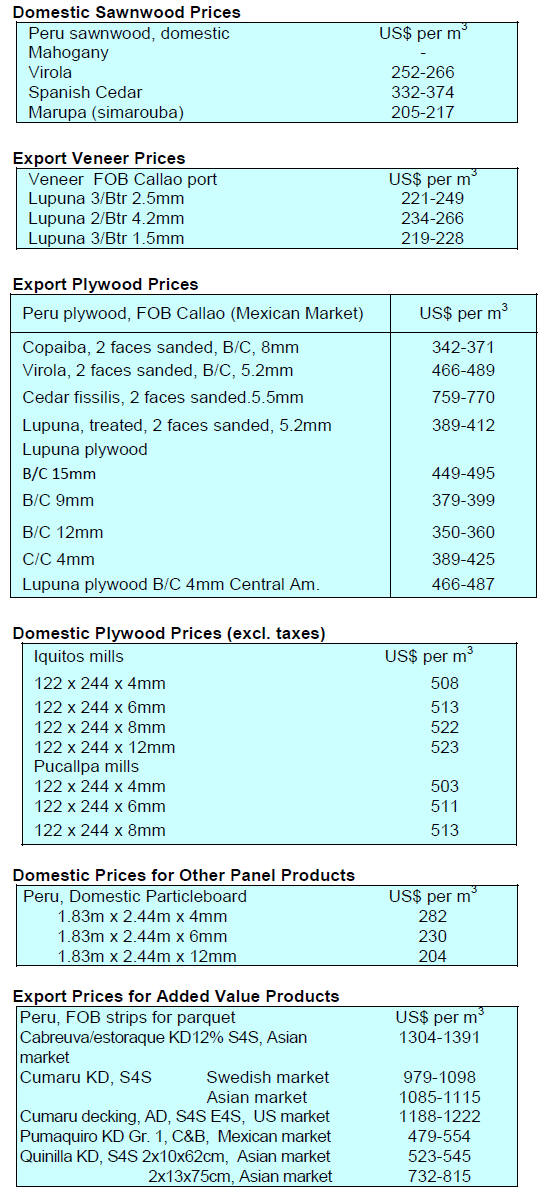

7. PERU

Timber exports set to rise after 5 years

After five consecutive years of decline Peruvian exports of

wood products seem set to rise this year. The Center for

Foreign Trade (CCEX) of the Chamber of Commerce in

Lima has forecast exports to come in at US$123 million

which would be slightly more than in 2017. Between

2013-2017 timber exports dropped around 5% annually.

The better performance is the result of higher demand for

manufactured products such as flooring, furniture and door

sets.

CCEX has reported that in the first eight months of this

year the timber sector registered a positive performance

with export shipments reaching US$79 million, a 3% rise

compared to the same period in 2017.

In 2017 Peruvian exports of wood totalled US$121

million, down 6% compared to 2016. In that year the main

products exported were semi-manufactured items (US$85

million), approximately 70% of all wood product exports;

sawn wood (US$ 24.4 million, 20%) and manufactured

products (US$ 12.1 million 10%).

The main export markets in 2017 were China at US$59

million (parquet strips, moldings and sawnwood) followed

by Mexico US$18 million (mainly virola, imbuia and

balsa sawnwood and plywood; United States US$12

million (mainly flooring and furniture).

Particleboard imports higher in July

In July 2018 Peruvian imports of particleboard amounted

to US$9.7 million, an increase of 24% compared to the

same month in 2017.

Most of the increase was accounted for by higher

shipments from Chile (US$3.8 million in July 2018 cf.

US$1.9 million in 2017) followed by Ecuador, US$3

million (2017: US$3.8 million), Spain, US$1.5 million and

Brazil, with US$1.3 million.

Regional governments informed of SERFOR

sanctioning powers

SERFOR, along with the Forest Resources Oversight

Agency (OSINFOR), the Regional Governments of

Ucayali, Loreto, Amazonas and Forest Support

Programme of the United States Agency for International

Development (USAID) and the United States Forest

Service (USFS), have established a task force whose aim

is to instruct regional forest administrations on the powers

given to SERFOR through the Administrative Sanctioning

Procedures (PAS).

A training programme was conducted with the regional

governments of Loreto, Ucayali and Amazonas to explain

the PAS. This programme for the regional forestry

authorities included delivering guidance on the scope of

the sanctioning powers of SERFOR.

SERFOR Board shares experiences with US Forest

Service

With support from the United States Forest Service and

the United States Agency for Development (USAID)

through its ‘Forest’ Programme’ the SERFOR board of

directors exchanged experiences and ideas on optimising

the performance, function and efficiency of forest

governance in Peru. This effort was undertaken as it is in

line with Peru’s Agrarian Policy which promotes the

sustainable use of forest resources and wildlife.

It is the function of the Ministry of Agriculture and

Irrigation (MINAGRI) to strengthen the country's forest

governance in order to improve the conditions for the

development of forest management and transformation of

production and trade.

This exchange provided an opportunity to consider

different management models and lessons learned in forest

management and the collaborative work by the different

entities.

One focus was on the relationship with the communities

and indigenous peoples where it was recognised there is a

need to enhance the collaborative and integrative approach

in the development of policies for the proper management

of forest resources of Peru.

During one of the dialogues a representative of USAID

informed the SERFOR Board of Directors on an ambitious

project called "Green Amazon", which could contribute to

the strengthening of forest management in the tropics.