|

Report from

North America

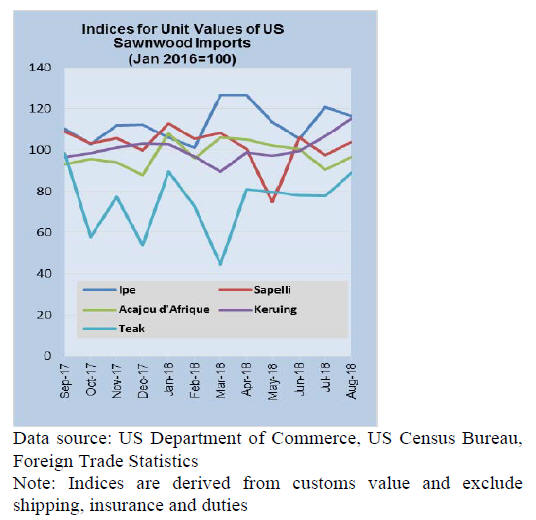

Tropical sawnwood import volumes drop

After a healthy rise in July, US imports of tropical sawn

hardwood returned in August to the lower numbers seen

throughout 2018. The August volume of tropical sawn

hardwood imports was down 17% from the previous

month at 16,598 cu.m., while the value of imports grew by

5%.

Year-to-date, tropical hardwood imports were down 14%

compared to 2017. The overall decline in tropical

sawnwood year-to-date is mainly due to lower balsa and

Sapelli imports. Sapelli imports dropped sharply in August

and are now 30% down from 2017 year-to-date.

Changes in year-to-date imports vary greatly by species.

Jatoba imports were up significantly from 2017 along with

Keruing and Padauk, while Acajou and Virola declined.

In August, Balsa and Padauk imports increased but

imports of most other tropical hardwood species declined

month-on-month. Cedro and Meranti sawnwood imports

decreased in August but continue to surpass 2017

numbers.

ITC 2018 Harmonised Tariff Schedule revisions affect

wood products

The US International Trade Commission issued Revision

12 to the Harmonized Tariff Schedule. The relatively

comprehensive update implements, as of October 1, new

provisions for wood products agreed to by the World

Customs Organization.

Changes also include new provisions for the third, US$200

billion list of 10% Section 301 tariffs, including those on

wood products from China that took effect beginning

September 24.

Among the numerous changes for imports to the US the

former subheading 4412.32 for plywood ¡°with at least one

outer ply of non-coniferous wood¡± is eliminated and

replaced by new subheading 4412.33 for plywood with at

least one outer ply of one of the following species: Alder,

Ash, Beech, Birch, Cherry, Chestnut, Elm, Eucalyptus,

Hickory, Horse Chestnut, Lime, Maple, Oak, Plane Tree,

Poplar and Aspen, Robinia, Tulipwood or Walnut.

A new subheading 4412.34 is created for plywood with at

least one outer ply of a species of non-coniferous wood

not listed in subheading 4412.33 (other than bamboo).

See:

https://hts.usitc.gov/view/release?release=2018HTSARevision12

Deal struck to update NAFTA

The US and Canada struck a deal on trade and announced

the framework for a new, revised North American Free

Trade Agreement (NAFTA) ¡ª now known as the United

States-Mexico-Canada Agreement, or USMCA. The three

countries reached a consensus after more than a year of

talks.

This revision of the nearly 25-year-old NAFTA agreement

contains major changes on cars and new policies on labor

and environmental standards, intellectual property

protections, and some digital trade provisions. All three

countries involved must still ratify the deal.

The agreement includes strong support for sustainable

forest management and notes that forest products, when

sourced from sustainably managed forest contribute to

global environmental solutions, including sustainable

development, conservation and sustainable use of

resources and green growth. The agreement also includes

provisions to enhance the effectiveness of inspection of

shipments containing wild fauna and flora and to support

the trade in legally harvested wood products.

See: https://www.whitehouse.gov/briefings-statements/presidentdonald-

j-trump-secures-modern-rebalanced-trade-agreementcanada-

mexico/

The Forest Products Association of Canada (FPAC)

applauded the Canadian government¡¯s efforts on reaching

an agreement. ¡°The USMCA will ensure certainty and

improved trade stability among all three countries,¡± says

FPAC CEO Derek Nighbor. ¡°FPAC is specifically pleased

with the outcome of maintaining the existing Dispute

Settlement Mechanism as this allows all industries in the

three countries to challenge discriminatory trade actions.¡±

https://www.woodbusiness.ca/industry-news/news/fpacwelcomes-

the-conclusion-of-the-usmca-5206

Federal Reserve raises interest rates

The Federal Reserve (Fed) raised interest rates in

September and signaled that an additional increase is

expected by the end of this year. It was the third rate

increase this year and the benchmark rate is now at 2 to

2.25%.

The Fed described economic conditions as ¡°strong.¡± It

predicted that growth this year could top 3%, before

slowing in coming years. Unemployment remains low,

inflation remains around the 2% pace the Fed regards as

optima, and the pace of investment has increased it said.

According to the US Department of Labour the US

unemployment rate dropped in September and the number

of unemployed persons fell by 200,000 to 6.0 million.

Employment in construction continued to trend up in

September (+23,000) and has increased by 315,000 over

the past 12 months.

Despite tariff concerns US consumer sentiment reached

very favorable levels in September as the University of

Michigan¡¯s survey index¡¯s measure topped 100.0 for only

the third time since January 2004.

Consumers anticipated continued growth in the economy

and expected the unemployment rate to continue to slowly

decline during the year ahead. The single issue that was

cited as having a potential negative impact on the

economy was tariffs. Concerns about the negative impact

of tariffs were cited by nearly one-third of all consumers

in September.

See:

http://www.sca.isr.umich.edu/

New housing sales and starts rebound

Sales of newly built, single-family homes rose 3.5% in

August to a seasonally adjusted annual rate of 629,000

units after being revised down June and July reports,

according to the US Department of Housing and Urban

Development and the US. Census Bureau.

These downward revisions suggest softness in new home

sales activity this summer. However, on a year-to-date

basis, sales are up 6.9% from this time in 2017. The

National Association of Home Builders credits the rise to

the overall strength of the economy but is cautious about

future sales.

The NAHB says ¡°Housing affordability has taken a toll on

new home sales over the summer, and there could be

market volatility in the months ahead as communities

grapple with the after effects of Hurricane Florence,¡±

Moody Analytics estimates the hurricane caused between

US$17 billion and US$22 billion in flood damage in the

Atlantic coast states of North and South Carolina.

Privately-owned housing starts in August were at a

seasonally adjusted annual rate of 1,282,000. This is 9.2%

above the revised July estimate of 1,174,000 and is 9.4%

above the August 2017 rate of 1,172,000. Single-family

housing starts in August were at a rate of 876,000 -- up

1.9% from the revised July figure.

See:

http://www.sca.isr.umich.edu/

|