Japan

Wood Products Prices

Dollar Exchange Rates of 25th

September

2018

Japan Yen 112.78

Reports From Japan

¡¡

An alternative view on

prospects for growth in Japan

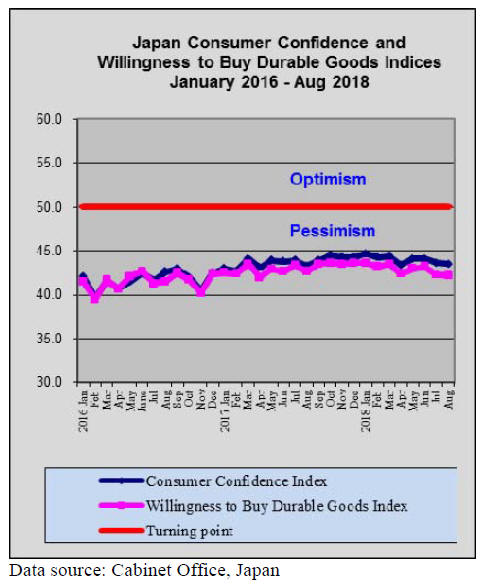

The almost universal negative view of prospects for the

Japanese economy has been challenged in a recent article

written by Adair Turner and published by Project-

Syndicate.

Adair Turner, a former chairman of the United Kingdom's

Financial Services Authority and former member of the

UK's Financial Policy Committee, is Chairman of the

Institute for New Economic Thinking.

The article points out that years of zero interest rates and

massive quantitative easing have failed to achieve the 2%

inflation target the Bank of Japan set itself. On top of this

a rapidly aging and declining population and an aversion

to immigration means that Japan¡¯s workforce could drop

by almost a third by 2070.

The signs are not good says the author, pointing out that

since 1991 economic growth has been below 1% which,

when combined with other factors, has driven government

debt to over 200% of GDP.

Conventional thinking is that tax increases and reduced

public spending must be introduced to drive down the

deficit and avoid a debt crisis. But is there another view?

Turner writes¡± While Japan¡¯s demographic decline poses

challenges, it may also imply some advantages: and

Japan¡¯s debts are far more sustainable than they appear.

True, Japan¡¯s GDP growth lags most other developed

economies, and will likely continue to do so as the

population slowly declines.

But what matters for human welfare is GDP per capita,

and on this front Japan¡¯s 0.65% annual growth in the

decade since 2007 equals the US and is better than the

UK¡¯s 0.39% and France¡¯s 0.34% ¨C not bad for a country

starting with one of the world¡¯s highest living standards¡±.

For more see: https://www.projectsyndicate.

org/commentary/japan-successful-economic-model-byadair-

turner-2018-09

BoJ signals determination to stay the course

to

achieve inflation target

At its mid-September policy meeting the Bank of

Japan (BoJ) did not change its stance on monetary policy

and maintained its optimistic view on the economy despite

the risks to the global economy from trade frictions.

Short term interest rates were kept at minus 0.1% and the

BoJ pledged to keep interest rates extremely low for an

extended period.

Because inflation has not taken hold the BoJ introduced

new measures signaling its determination to stay the

course and active its 2% inflation target.

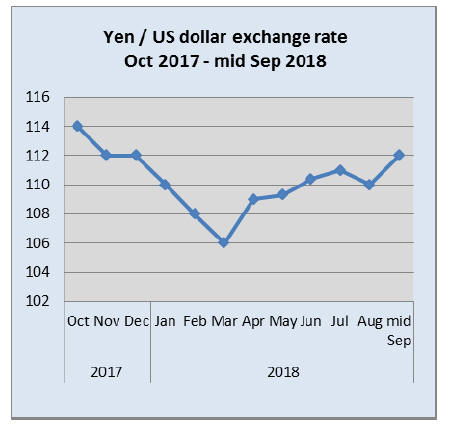

Yen moves close to low seen in January

In a recent speech the Bank of Japan Governor reaffirmed

that the Bank is confident the Japanese economy will

continue to expanding with expectations of annualised

growth of 3.0% likely in the third quarter. But, the Bank is

still struggling to achieve its 2% inflation target as

consumer prices remain subdued.

External issues exerted pressure on the yen in late

September and the yen touched 113 to the dollar, a low not

seen since January this year.

The strong dollar, together with a rally in US equities, is

setting the tone of the market at present. Also holding the

US dollar at its high is the message from China that, while

pressure from the US will not undermine the Chinese

economy, it is open to negotiations to resolve the trade

dispute.

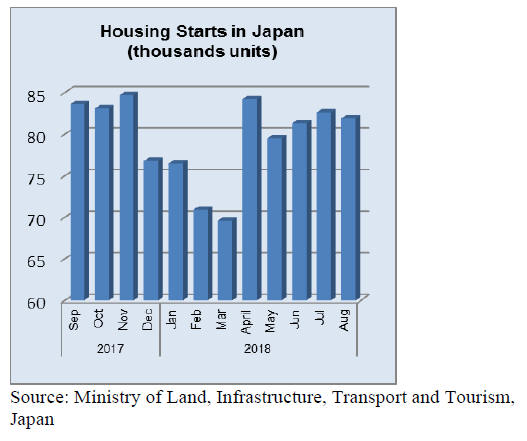

August orders for new homes reverse fall in

July

Data from Ministry of Land, Infrastructure, Transport and

Tourism on August housing starts show a year on year

increase for the first time in two months Housing starts

increased a modest 1.5%percent in August compared to

levels in August last year.

Data from the ministry also show that orders received by

the top 50 builders rose 0.5 slightly in August contrasting

with the sharp fall in July. Orders for new homes increased

for the first time in four months.

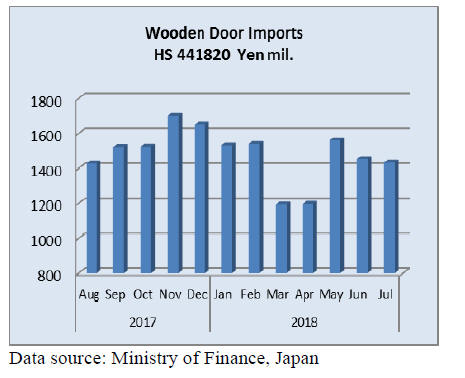

Import round up

Doors

July door imports

After the peak in May imports, the value June and July

imports of wooden doors (HS441820) declined. Year on

year, July wooden door imports were down slightly but

month on month there was little change.

Most wooden door imports are from China (63%)

followed by the Philippines (19%) and Malaysia (8%).

These three suppliers accounted for around 90% of

Japan¡¯s July wooden door imports

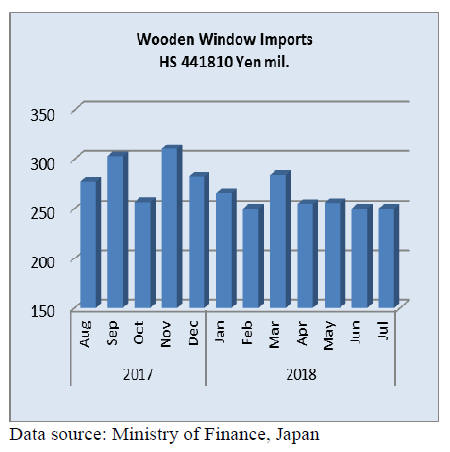

Window imports

July window imports

Japan¡¯s monthly imports of wooden windows (HS

441810) have remained at around the same level since a

peak in March. Year on year, July imports fell sharply,

dropping 26% but month on month the value of imports

remained unchanged.

Two suppliers, China and the US account for over 60% of

Japan¡¯s imports of wooden windows with another 20%

coming from the Philippines. In July the US topped the

list of suppliers.

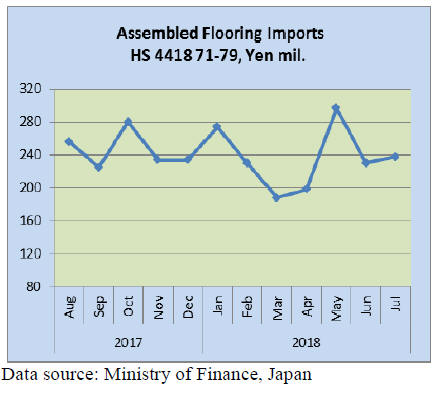

Assembled flooring

July flooring imports

Japan¡¯s imports of wooden flooring continue to be

dominated by HS441875 followed by HS441879. In July,

as in the previous month these two categories of

assembled flooring accounted for around 90% of the value

of all assembled wooden flooring imports.

The main shippers of HS441875 in July were China

(66%), Vietnam (8.5%) and Thailand (8.5%). In contrast

for HS441879 the main shippers in July were Thailand

(43%) and Indonesia also (43%).

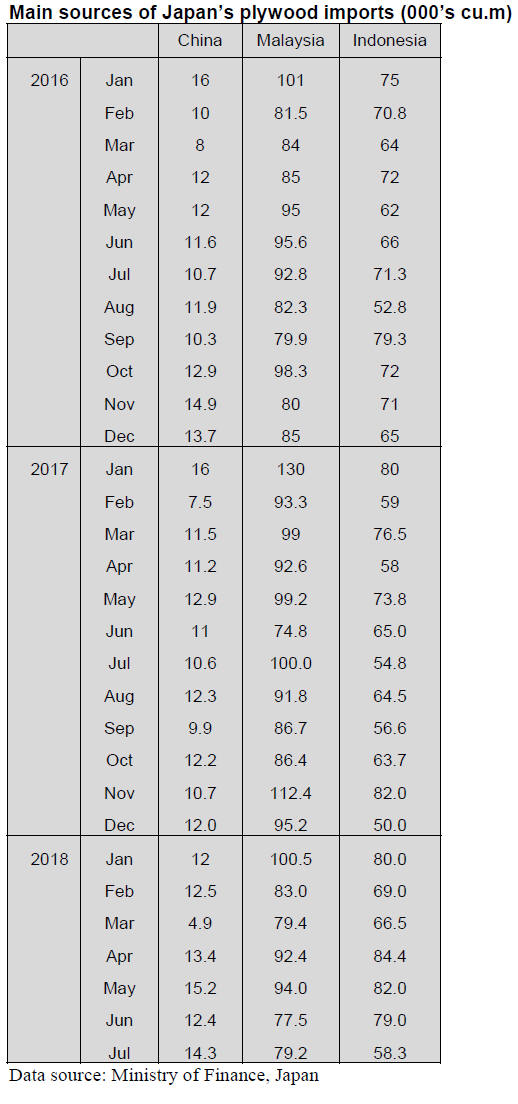

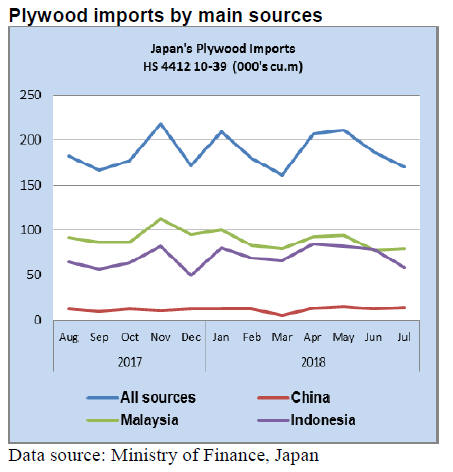

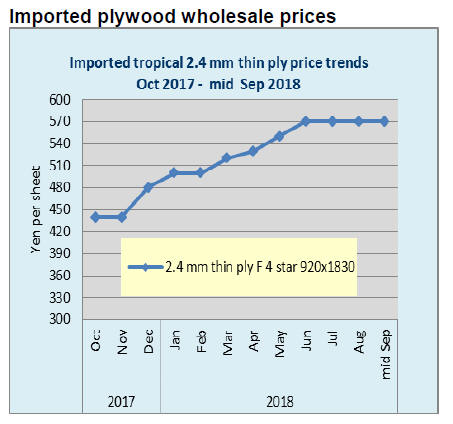

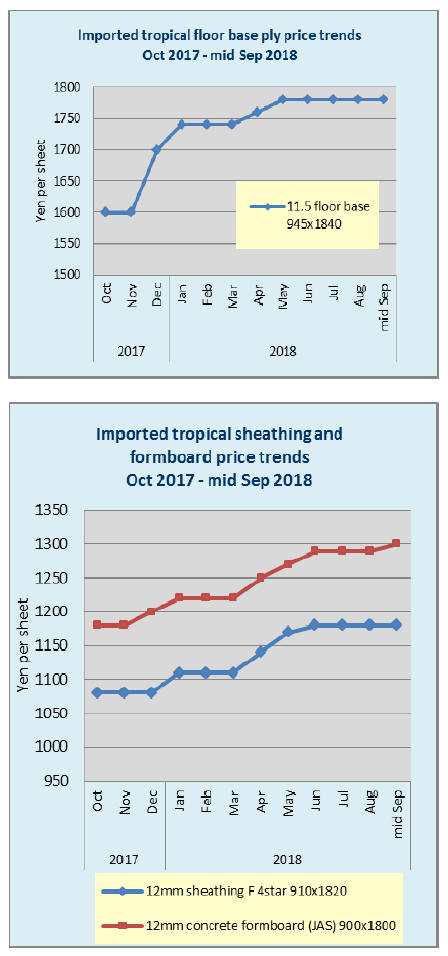

Plywood

July plywood imports

For two consecutive months there has been a sharp decline

in Japan¡¯s imports of plywood (HS441210-39). Year on

year the volume of imports has fallen 5% and in July there

was a 9% month on month fall.

The biggest decline was in imports from Malaysia which

dropped over 20% year on year. In contrast, the volume of

imports from both Indonesia and China rose (5% and 40%

respectively).

Imports of HS441231 dominte Japan¡¯s plywood imports

accounting for over 85% of imports with Malaysia and

Indonesia being the main shippers. In July a small volume

of HS441231 arrived from Vietnam.

For both HS441233 and HS441234 Malaysia is the main

shipper with China and Vietnam contributing small

volumes to July imports.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Plywood supply

Total plywood supply in June was 514,100 cbms, 3.7%

more than June last year and 4.6% less than May. While

domestic softwood plywood production was over 250,000

cbms, imported plywood supply did not increase much.

Total domestic plywood supply was 281,800 cbms, 1.4%

more and 7.3% more. In this, softwood plywood was

271,900 cbms, 2.4% more and 8.0% more out of which

non-structural plywood production was 18,700 cbms,

56.0% more and 8.3% more. The shipment of domestic

plywood was 262,300 cbms, 5.3% less and 3.8% more.

This is three consecutive months¡¯ high level shipment over

250,000 cbms.

In this, softwood plywood was 249,700 cbms, 5.1% less

and 3.8% more. The inventories at the end of June were

148,900 cbms. The inventories have been increasing for

five straight months but they are less than one month

consumption.

Volume of imported plywood in June was 232,200 cbms,

6.7% more and 15.8% less. The volume varies by the

month but an average monthly volume of imported

plywood for the first six months was 247,800 cbms, 0.1%

more than the same period of last year. By source, 79,700

cbms from Malaysia, 3.7% more and 17.7% less, 85,600

cbms from Indonesia, 15.9% more and 5.8% less, 46,600

cbms from China, 11.5% less and 29.4% less.

Malaysian volume dropped less than 80,000 cbms after

one year while Indonesian supply exceeded 80,000 cbms

for two straight months. The volume for the first six

months of this year shows the same trend of declining

Malaysian and increasing Indonesian. By thickness, thin

hardwood plywood of 3 mm or less increased by 29.5%

with 78,600 cbms.

Plywood

Movement of plywood of both domestic and imports in

August was stagnating. The prices are on weak side and

there some low priced offers in the market but domestic

manufacturers and importers are rigidly holding the prices

so there are no extreme low prices in the market. The

manufacturers are in no hurry to ship out with low prices

as they need to hold certain amount of inventories with

shortage of trucks.

Imported plywood movement is fairly well but there is no

robustness. Softwood plywood production in July was

267,700 cbms, 2.3% more than July last year and 1.5%

less than June.

The shipment of softwood plywood was 259,400 cbms,

1.0% less and 3.9% more. The manufacturers¡¯ shipment

continues same as last year despite dullness in the market.

The inventories of softwood plywood were 173,300 cbms,

9,800 cbms more than June end. The inventories have

been increasing month after month but they are only 0.6

month.

On imported plywood, arrivals of high cost cargoes have

started and the importers try to push the sales prices little

by little. It is hard to increase the sales prices but bottom

level is firm now. Dealers are watching softening of the

prices as the importers and large wholesalers may dispose

of the inventories since September is interim book closing

month.

Vietnamese plywood prices rising

Export prices for Vietnamese eucalyptus plywood for

crating have been gradually climbing. Reason is heavy

rain damaged some veneer plants so that supply of veneer

is decreasing and the prices of veneer are escalating. This

results in higher cost of plywood so the export prices are

now more than US$320 per cbm C&F.

Some manufacturers shift to more profitable US market so

the supply for Japan is getting tight. By shortage of

veneer, shipments of contracted volume are delaying.

While export prices are climbing, the yen is getting

weaker so arrived yen cost is higher.

The market prices in Japan need to be revised higher to

cover the cost but the market in July was inactive and

August is vacation month so recovery would be in

September.

Demand is firm and there are some orders of non-JAS

plywood used for engineering works for restoration of

flood damaged Hiroshima and Okayama area.

First JIS MDF plant in Vietnam

MDF plant was built jointly by Korea¡¯s Dongwha

Enterprise and Vietnam Rubber Group in 2008. This is

VRG Dongwha Joint Stock Company with annual

production capacity of 558,000 cbms. This is the largest

MDF plant in Asia and it has acquired JIS certificate in

last July and will ship out first cargo for Japan in August.

The plant has one press for thick MDF of monthly

production of 31,500 cbms and one press for thin MDF of

monthly production of 15,000 cbms. For Japan market,

trial product is 2.5 mm thick 4x6.

Raw materials are rubber wood, acacia, Vietnamese pine

and cashew nut. For Japan market, the raw materials is

pine for thin MDF and acacia or pine for thick MDF.

In Vietnam, demand for furniture for U.S. market is active

so the plant is manufacturing furniture materials with U.S.

standard, which takes about 70% of market. It also exports

the products to the South Eastern Asian countries, India

and Middle East.

|