2.

MALAYSIA

Researchers challenged to find

native trees for

industrial plantations

Malaysian Primary Industries Minister, Teresa Kok, has

said the government is committed to maintain a 50% forest

cover as pledged at the 1992 UN Rio Earth Summit and

she emphasised that Malaysia’s oil palm plantations are on

land reserved for agriculture and no land has been released

from permanent forest reserves.

Maintaining forest reserves is an important objective of

the new government which was sworn in after the May

general elections. There is a renewed interest in

alternatives to natural forest production such as rubber

trees and oil palm stems.

The Malaysian Prime Minister has challenged the research

community to search for plants, particularly native plants

and trees, that can be used as raw materials for industry in

the same way as exotic rubberwood.

Better utilisation of bamboo resources falls into this

category and the government is urging the country's

bamboo industry to take proactive steps to ensure that the

bamboo processing sector embraces up-to-date

technologies to increase exports more than the

RM300,000 recorded last year. Currently, there are more

than 100 bamboo processors in Malaysia and most of these

are small and medium sized enterprises.

Malaysia has more than 70 species of bamboo. In

Peninsular Malaysia bamboo forests extend over 329,000

hectares with much more being found in Sabah and

Sarawak.

See:

https://www.inbar.int/%EF%BB%BFmalaysian-bamboodevelopment-

challenges-and-opportunities/

Sabah certified forest

The Sabah based Sapulut Forest Development Company

(SFD) has achieved certification under the Malaysian

Timber Certification Scheme (MTCS) for its natural forest

management within Forest Management Unit 14.

With the additional of these 54,643 hectares of forest

certified under the MTCS, a total of 850,519 hectares are

now under some form of certification in the state such as

Ramsar, MSISO Standard 9001:2008, Forest Stewardship

Council (FSC) for Natural Forest and Forest Plantations

and the MTCS. The MTCS certificate will be valid until

June 2021 and means the SFD will also be recognised

within the PEFC system.

For more see:

http://sapulutfmu14.blogspot.com/

Calls for plantation logs to be excluded from Sabah log

export ban

A company with extensive plantations in Sabah has

appealed to the State Government to exclude logs derived

from plantations from its recent export ban. Benn Osman,

Director of Boon Rich, said plantation logs can readily be

verified as legal and so should not be included in the log

export ban.

Osman pointed out that both the State and Federal

governments encouraged investment in plantations and the

current ban undermines that initiative. To emphasis this

Osman pointed out that between 2014 and 2018 the

Federal Government provided loans of around RM1

billion for tree planation development and that loans have

to be repaid.

Osman said his company has planted teak which is now 20

years old and the company is negotiating with buyers in

Dubai and India but that the log export ban is undermining

business development.

3.

INDONESIA

Post-Brexit – UK will

continue to recognize FLEGT

licenses

The UK Ambassador to Indonesia, Moazzam Malik, has

said in the post-Brexit period Indonesia's timber and wood

product exports to the UK will not be disrupted and that

the FLEGT licensing system will be upheld.

He also suggested to the Minister of Environment and

Forestry, Siti Nurbaya Bakar, that post Brexit there could

be a bilateral agreement that covers the timber trade. As a

follow-up the UK Ambassador proposed beginning

bilateral discussions as early as March next year when

Britain officially leaves the European Union.

In related news, a workshop/dialogue themed "Interactive

Dialogue on the FLEGT Scheme: Boosting Indonesian

Wood and Timber Products Exports to the EU" was

recently held in Belgium. This event was hosted by the

Indonesian Embassy in Brussels jointly with Fedustria, a

Belgian non-profit federation of representing the textile,

wood and furniture industry.

The purpose of the dialogue was to review implementation

of the FLEGT and discuss strategies to increase

Indonesia's wood and timber products exports to the EU.

According to the Deputy General Manager of Fedustria,

Filip De Jaeger, businesses in Belgium report that the

FLEGT licensing system has helped promote trade in the

timber sector between Indonesia and the EU because

importers no-longer have to contend with due diligence

requirements. However, some importers of Indonesian

products said more needs to be done to inform end-users

and consumers on the security the FLEGT system offers.

Indonesia committed to fair trade policies

Indonesia’s International Trade Negotiation Director

General, Imam Pambagyo in the Ministry of Trade, has

said that Indonesia will continue to uphold trade policies

committed to fair trade in order to avoid conflicts which

could hurt the economy.

He said competition in international markets is rising but

that there is a need for Indonesia to take a positive

approach and engage in bilateral consultations and avoid

punitive policies. He said the best approach is for

Indonesian manufacturers to strengthen their

competitiveness.

Import restrictions not yet reducing deficit

Sri Mulyani Indrawati, the Indonesian Finance Minister,

has reported that the current account deficit has not been

significantly reduced despite government measures to

limit imports. The current account deficit in the second

quarter was just over 3% of GDP or US$8 billion,

compared to US$6 billion in the first quarter.

In its efforts to reduce the deficit the government

introduced measures to limit imports, including higher

tariffs and a mandatory use of 20% blended biodiesel (

B20 ) for heavy vehicles. The government also postponed

several large infrastructure projects.

4.

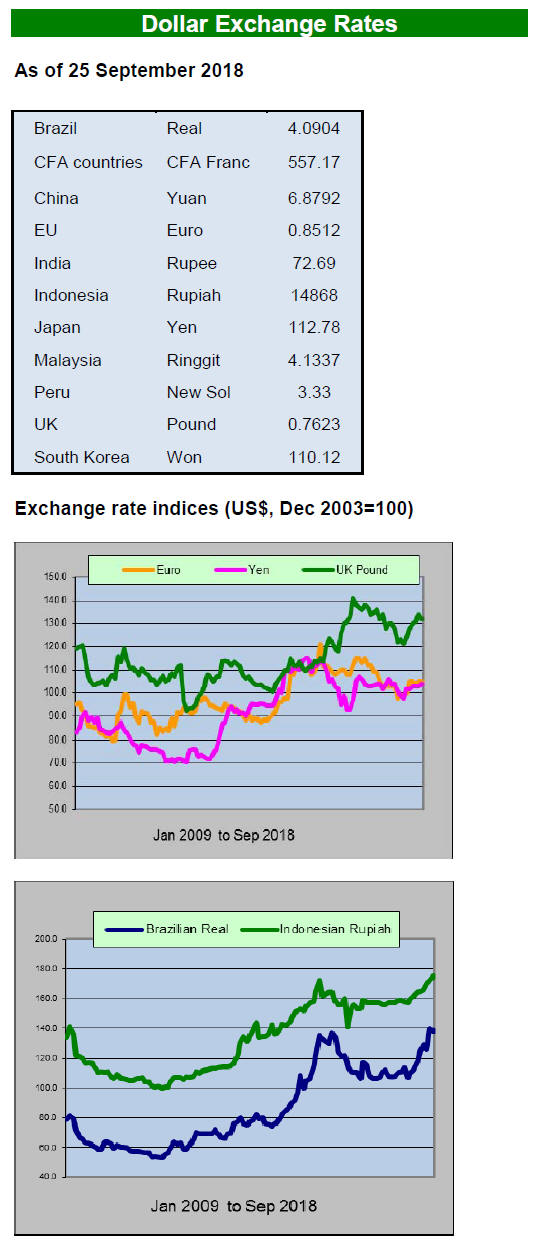

MYANMAR

More on clearing Karenni teak log stocks

Concern has been raised by environmental commentators

over the decision by the government to allow the Karenni

National People’s Liberation Front to sell log stocks.

The Myanmar Government Spokesperson, Zaw Htay,

clarified this decision when meeting the press in late

September saying some Non-State Armed Groups which

signed a National Ceasefire Agreement with the

Government had approached the National Reconciliation

and Peace Centre (NRPC) seeking approval for trading

previously harvested logs from the areas that they

controlled.

These groups are slowly coming under the umbrella of the

State but are still largely self-sufficient and need to

generate income.

In respect of the request from the Karenni National

People’s Liberation Front for permission to sell log stocks,

Zaw Htay said that it this the most recent case in which the

Ministry of Natural Resources and Environmental

Conservation (MONREC) accepted the recommendation

of the NRPC that consideration should be given to

allowing the sale of a specific volume of logs.

Analysts write - MTE had a mechanism to allow this

known as the Modified Procedure (MP).MTE stopped

using this mechanism for harvesting in areas it controlled

but from time to time the MP procedure has been used to

allow Non-State Armed Groups to harvest and sell logs.

According to one retired Myanmar Timber Enterprise

(MTE) official, such cases of MP approvals in the past

were not initiated by the MTE as part of its commercial

operations but were politically motivated.

According to Khu Daniel, a member of Karenni National

Progressive Party (KNPP) Central Committee, KNPP

received permission to harvest the logs now being offered

for sale in 2013 and 2014 after signing a ceasefire

agreement with the government of the time. He points out

it is only now that the current government is considering

allowing the sale of these logs.

Corporate transparency improving steadily says EITI

Myanmar’s efforts to raise transparency within its

extractive industries are slowly bearing fruit. While Stateowned

enterprises have yet to meet international standards

of governance, transparency is nevertheless improving,

according to two reports issued by the Extractive

Industries Transparency Initiative (EITI).

If there is continued progress Myanmar could meet the

strict EITI assessment procedures soon which would

enable the country to be considered as a member of the

initiative. EITI is a global standard for the good

governance of oil, gas and mineral resources and seeks to

address key governance issues in the extractive sectors.

EITI has said that in the past corporate governance in

Myanmar’s extractive industries has been lax and

corruption was an issue common. Indeed, findings from

the two EITI reports reveal shortcomings in SOE

procedures for the granting of licenses, signing of

agreements with the State and payment of taxes.

Efforts to lift Myanmar’s rank on Global Index on Illicit

Trade

Myanmar urgently needs to combat illicit trade,

particularly in the areas of logging, mining, human

trafficking and consumer goods, the Transnational

Alliance to Combat Illicit Trade (TRACIT) said after the

country placed near the bottom of a global index on illicit

trade.

EuroCham in partnership with Transnational Alliance to

Combat Illicit Trade (TRACIT) and the Economist

Intelligence Unit hosted an Anti-Illicit Trade Forum 2018

in Myanamar, The objective was to improve the

knowledge and understanding of the regulatory

environment and economic circumstances that enable

illicit trade and provide recommendations on priority

areas.

Attending the Forum were, anti-corruption experts,

Myanmar government officials and industry stakeholders

and discussions focused on to strengthening Myanmar’s

efforts to fight illicit trade especially through legal reforms

and the tightening border controls.

The local media quoted TRACIT Director-General, Jeffrey

Hardy, as saying Myanmar’s poor showing on the Global

Index on Illicit Trade pointed to inadequate structural

defenses against illicit trade. He urged the government to

work more closely with neighboring countries to address

immediate cross-border illicit trade issues. The illegal

timber trade across Myanmar’s border with China is worth

hundreds of millions of dollars each year.

See:

https://www.eccp.com/events/?id=474

Bamboo plantations planned for Nay Pyi Taw

U Kyaw Thu, Chairman of Myanmar Bamboo Growers

Association has told the local media (Myanmar Times)

that around 1000 acres of bamboo plantations will be

created in Nay Pyi Taw and the Association and

government will assist enterprises better commercialise

bamboo products.

Myanmar joined the International Network on Bamboo

and Rattan (INBAR) in 1997. Currently, it is carrying out

promotion on sustainable management and use of bamboo

resources in cooperation with Thailand International

Cooperation Agency (TICA).

5. INDIA

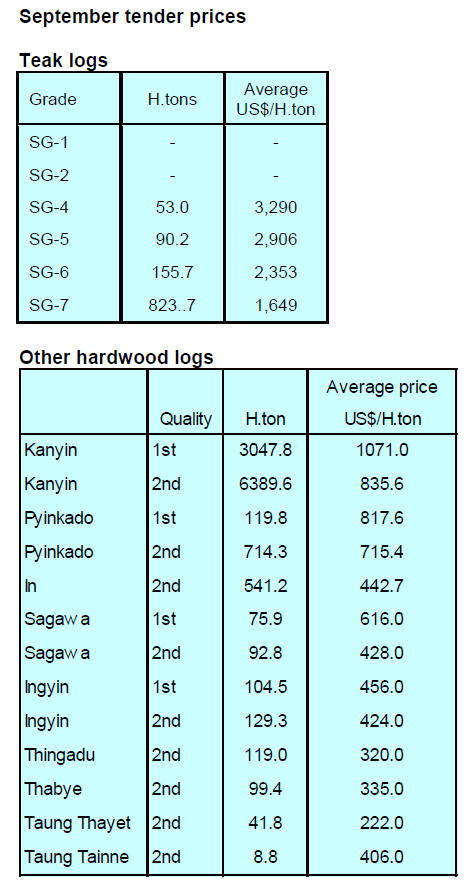

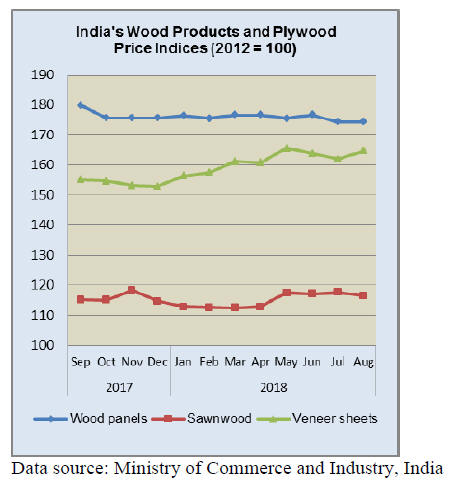

Timber commodity prices move higher

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for August 2018 released by the

Office of the Economic Adviser to the government rose to

120.00 in August from 119.7 in July. The annual rate of

inflation, based on monthly WPI in August 2018 was

4.53% compared to 5.09% for the previous month.

The price index for ‘Manufactured Wood and Products of

Wood and Cork’ Group rose almost 0.6% in August due to

higher prices for veneer sheets and plywood. However,

prices for sawnwood fell slightly in August.

The press release from the Ministry of Commerce and

Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

GDP at 8.2 % in first quarter 2018-19

India's economy grew at a healthy 8.2% in the first quarter

of 2018-19 financial year ending in June. This is the

highest growth in two years and strongest since the first

quarter of 2016.

The manufacturing and construction sectors performed

well achieving over 7% growth while the agriculture,

forestry, fisheries and mining sectors did slightly less well.

For more see:

//economictimes.indiatimes.com/articleshow/65623967.cms?utm

_source=contentofinterest&utm_medium=text&utm_campaign=

cppst

Kerala floods - plywood mills damaged

Heavy rain and floods have affected the plywood industry

in Perumbavoor as many roads have been washed out

making it impossible to transport logs to the mills. This

has meant a steep drop in production at the 65-plus mills

in the area affected.

Plywood mills in Perumbavoor use mainly rubberwood

from local sources around Idukki, Kottayam and

Pathanamthitta but analysts report roads, especially in

Idukki and Pathanamthitta, are badly damaged and many

of the rubberwood plantations were also damaged by flood

water.

Several mills were flooded and production machinery has

been damaged and several containers of imported veneers

were also so damaged as to be unusable for anything

except boiler fuel.

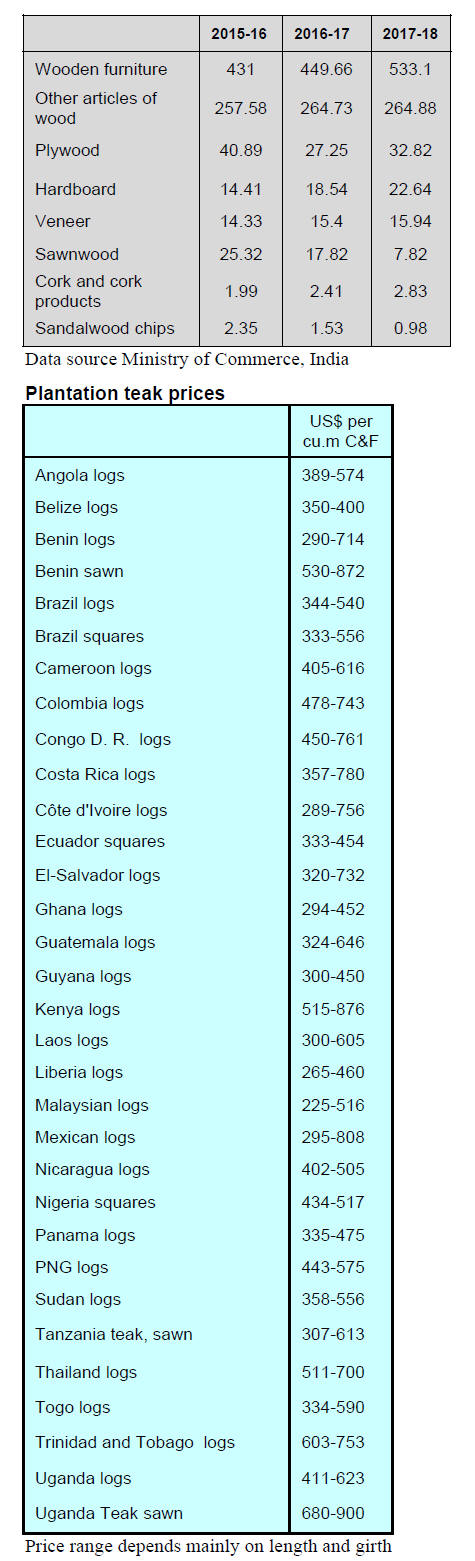

Growth in exports

Exports of plywood and other wood products during the

2017-18 financial year reached US$881.04 million, up

over 10% year on year. This year exports should get a

boost from the weaker rupee.

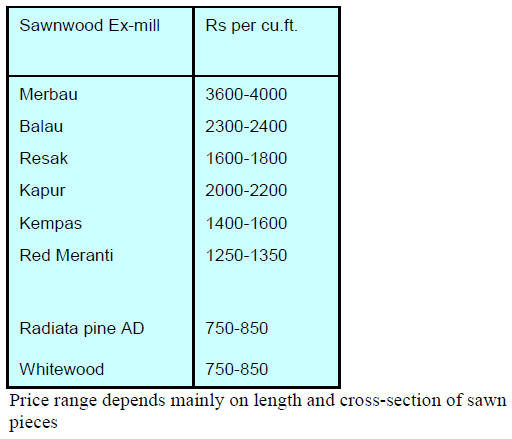

Plantation teak

On the back of firm demand for imported plantation teak

log traders have been able sustain the rise in domestic

wholesale prices to off-set the higher landed costs due to

the weaker rupee. The unresolved issue of lack of credit

facilities for traders continues to be a major problem.

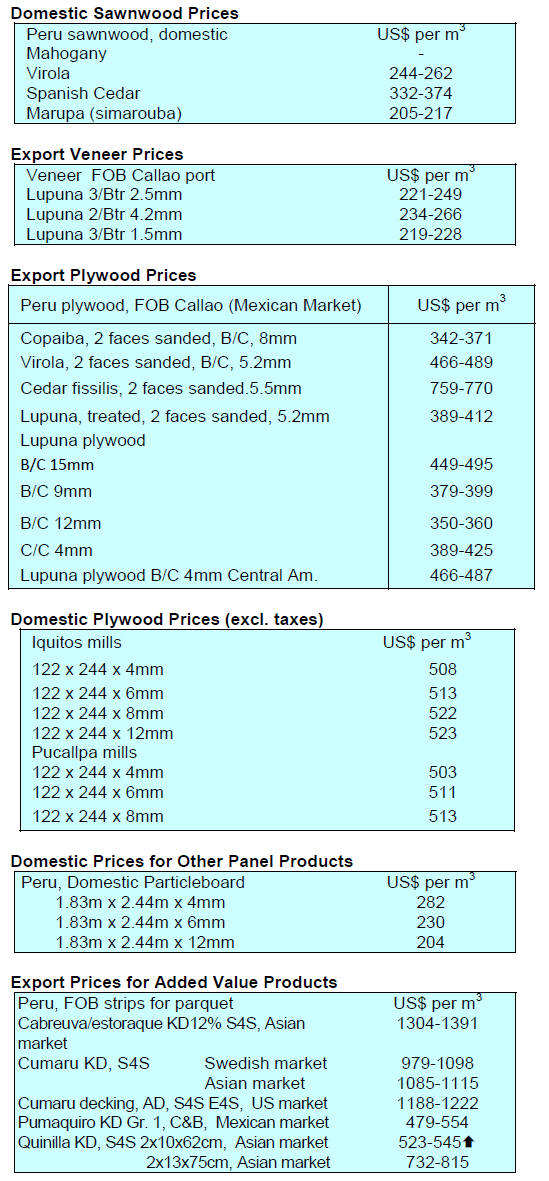

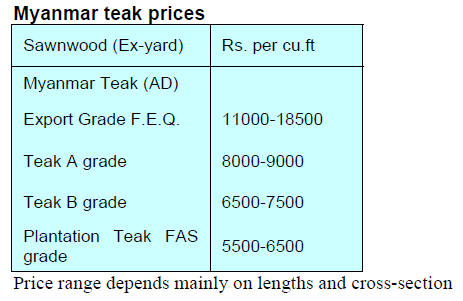

Locally sawn hardwood prices

The higher ex-mill prices introduced at the beginning of

September are holding and millers are thankful to be

getting some relief from the rising costs of imported raw

materials as the rupee continues to fall against the US

dollar.

A spokesperson from the Reserve Bank of India said the

bank is closely monitoring the situation but has yet to

intervene to support the rupee.

Myanmar teak

Improved demand for teak products for the housing

market gave the opportunity for a price increase at the

beginning of the month and the higher prices have been

accepted in the market.

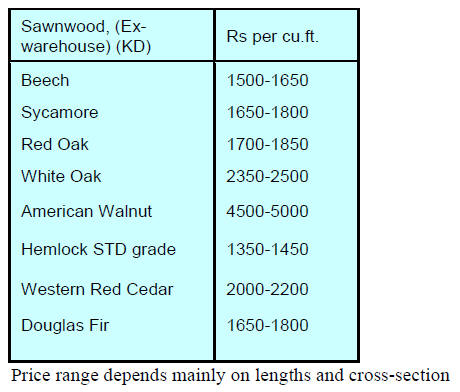

Sawn hardwood prices

Because of the limited demand for imported sawnwood

ex-wharehouse prices for N. American and European

hardwoods remain unchanged from a month earlier.

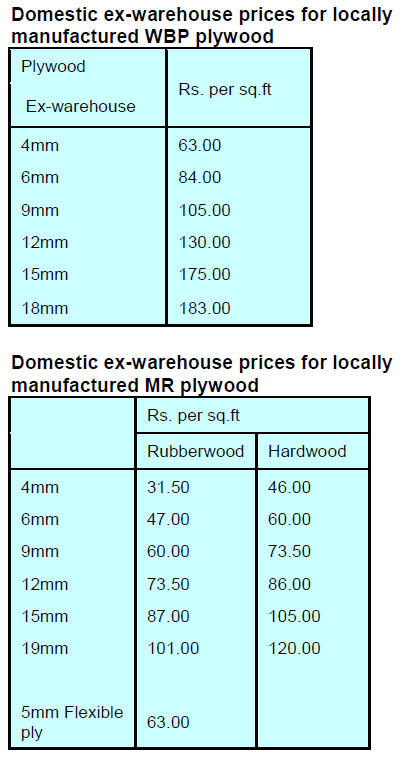

Plywood market

On the back of firm demand in the housing and

construction sectors plywood manufacturers have been

able to raise margins through the recent price increase.

Now the major concern is the weakness of the rupee and

the impact this has on production costs.

Decorative veneers prices have also been raised by around

3% and the makers of paper overlays have also lifted

prices due to higher import costs.

6. BRAZIL

Deforestation rate falling,

but still a challenge

Monitoring by the National Institute of Space Research

(INPE) has revealed that between 2004 and 2017 the

annual rate of forest clearing in the Legal Amazon fell

75%, from 27,700 km˛ to 6,900 km˛.

According to INPE, between 2001 and 2017 deforestation

in the Cerrado biome also declined from 29,400 km˛ to

7,400 km˛ per year. As in the Amazon biome, the

downtrend was only up to 2012 after which the

deforestation rate rose and moved up and down until 2017.

One conservation strategy adopted by the government has

been the creation of protected areas called Conservation

Units (CUs). Currently, there are 335 federal CUs

according to the Chico Mendes Institute for Biodiversity

Conservation.

In April this year five new CUs were created. CUs are key

to preserving native habitats but problems of falling

budget allocations, insufficient staffing and poor

infrastructure are putting the strategy at risk.

Analysts write - it is not enough to control deforestation;

the challenge is to recover the native vegetation and

maintain biodiversity.

Differentiating deforestation from authorised land-use

change

The Federal Government has created a mechanism that

will allow transparent differentiation between

deforestation and legal land clearing.

An Administrative Ordinance No. 373 from the Ministry

of Environment published in September establishes a

simplified procedure to calculate areas of authorized land

clearing. The data will be compiled by the Brazilian

Institute of Environment and Renewable Natural

Resources (IBAMA).

The measure aims to provide transparency and to unify,

through systems managed by IBAMA, information on

vegetation changes throughout the country. At present data

are scattered in various environmental agencies at three

levels of government which creates problems in

differentiating illegal deforestation from authorised land

use change.

This initiative will contribute to achieving Brazil’s

commitments in the context of the Paris Agreement on

climate change. With the unification of data, the country

will be able to adequately measure and report progress on

the commitment to achieve zero illegal deforestation in the

Brazilian Amazon by 2030.

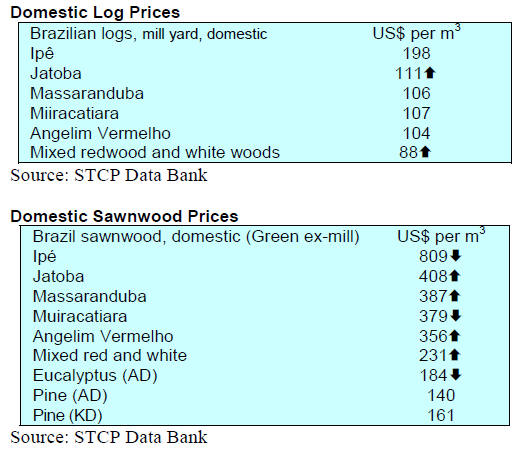

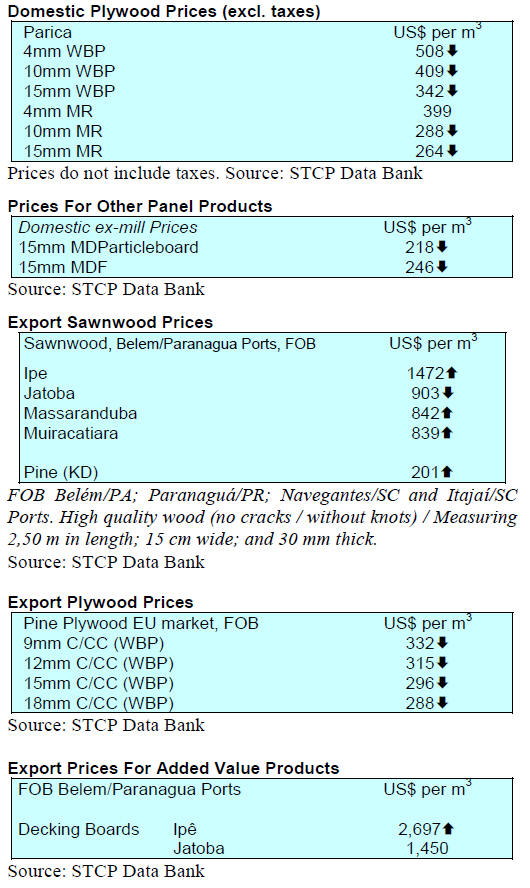

Export update

In August 2018, Brazilian exports of wood-based products

(except pulp and paper) increased 34.4% in value

compared to August 2017, from US$238.6 million to

US$320.6 million.

Pine sawnwood exports increased 11.6% between August

2017 (US$42.3 million) and August 2018 (US$47.2

million). In terms of volume, exports remained almost

constant over the same period, from 205,100 cu.m to

205,000 cu.m.

In August tropical sawnwood exports increased 30% in

volume, from 35,200 cu.m last August to 45,800 cu.m in

August this year. In value terms, exports increased 22.4%

from US$16.5 million to US$20.2 million, over the same

period.

Year on year the value of pine plywood exports increased

27% in August 2018, from US$50.6 million to US$64.2

million and in terms of volume exports increased 3% over

the same period, from 177,600 cu.m to182,800 cu.m.

As for tropical plywood, exports declined 23% in volume,

from 16,800 cu.m (US$ 6.5 million) in August 2017 to

12,900 cu.m (US$6.1 million) in August 2018.

Pace of furniture exports rises

The Brazilian Association of Furniture Industries has

published data on production in June and July this year. In

June 34.7 million pieces were produced, 15% higher than

in May. Between January and June 2018, there was a 5.5%

increase in the number of pieces produced according to

Brazilian Institute of Geography and Statistics (IBGE).

Over a 12 month period to June 2018 there was a 9%

growth.

The value of Brazil’s furniture exports totalled US$64.5

million in June 2018, a significant increase compared to

May (+43%). In July, exports reached US$70.1 million, a

further 9% increase compared to June.

Three states in the Southern region are the largest

exporters of furniture in Brazil; Santa Catarina State, Rio

Grande do Sul and Paraná accounted for over 80% of

Brazil’s furniture exports in the first seven months of

2018.

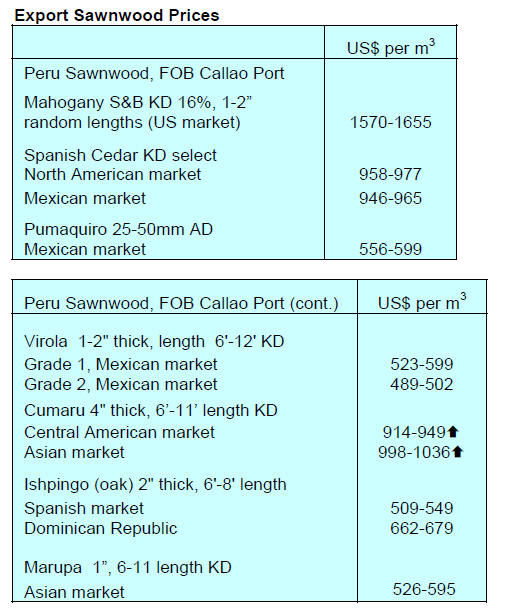

7. PERU

ADEX and government working

to promote exports

Peru’s exports of wood products between January and July

were worth US$68.7 million, a slight improvement on the

value of exports in the same period in 2017.

Erik Fischer, the Second Vice President of the Association

of Exporters (ADEX) said that renewed cooperation

between the Executive Board for Forestry Development

and the private sector will advance public policies that

promote the development of the forest industry.

Regarding the possibility that the Law on Agrarian

Promotion could also cover the forestry sector, Fischer

said that if this can speed the development of the forestry

and wood processing sectors that would be good. He

recalled that in 2017 wood processing for export supported

around 33,000 jobs.

Data from ADEX shows that most wood product exports

in terms of value were semi manufactures and that

between January to July they were worth US$42 million

representing over 60% of the total.

The main items exported were slats and friezes for

parquet, moldings and other profiled wood.

Sawnwood exports were valued at US$13 million,

construction products US$5 million, veneers and plywood

US$4 million, furniture and parts US$3 million. The main

destination for wood product exports s was China, US$29

million or around 40% of the total exports. The other main

markets are the US (US$7.6 million), Mexico (US$7

million), France (US$6 million) and Dominican Republic

(US$4 million).

Landmark agreement on foreign trade with US

Peru will further facilitate trade with the United States as a

result of the signing of the Mutual Recognition Agreement

between the National Superintendency of Tax

Administration (Sunat) and the US Customs and Border

Protection Office (CBP).

This agreement recognises the American Alianza Aduana -

Private Sector Against Terrorism (C-TPAT) programme

and the Peruvian Authorised Economic Operator

programme (OEA).

See:

https://www.cbp.gov/frontline/frontline-peru-advisers

The US government website says “This mutual

recognition, which is the first signed by the United States

with a South American country, will help facilitate

bilateral foreign trade and ensure the logistics chain,

providing mutual benefits for operators certified under

such programs, allowing them to reduce costs and time in

their activities, which will give a greater level of

competitiveness to Peruvian products.”