Japan

Wood Products Prices

Dollar Exchange Rates of 10th

September

2018

Japan Yen 111.14

Reports From Japan

¡¡

Double disaster rocks Japan

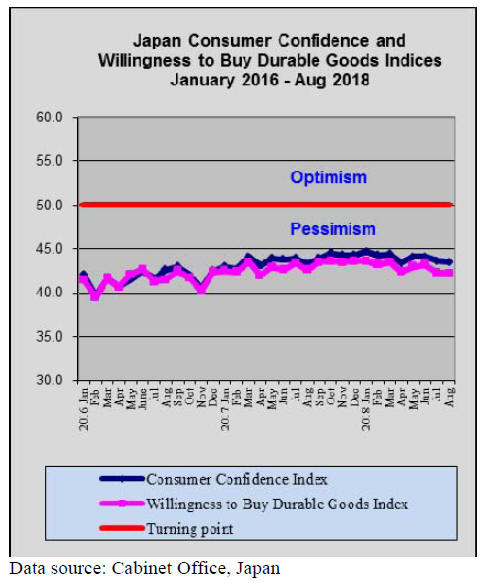

After weakening in the first quarter of 2018 the Japanese

economy returned to growth in the second quarter growing

by almost 2% on the back of better than expected

consumer spending and private sector capital spending.

However, the pace of growth is sure to be dented due to

two major natural disasters in early September.

Typhoon number 20 (Jebi) made landfall in western Japan

and was the strongest tropical storm in 25 years. The storm

caused widespread power failures and flooding. The

region¡¯s main airport was flooded and the storm almost

brought Japan¡¯s second city, Osaka, to a standstill.

Within a few days of the typhoon the northern island

of Hokkaido suffered a major earthquake which triggered

landslides across a wide area. 41 people died.

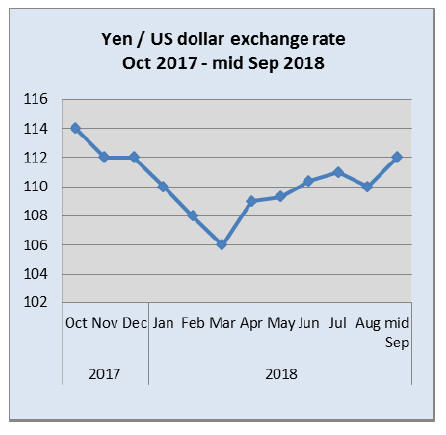

Yen tips to 112 against the US dollar

The yen strengthened briefly following the release of

revised GDP for the April-June which, on projections,

would lead to an annualised growth of 3%, much faster

than the estimate of around 2% growth made last month.

But, towards mid-month the yen weakened once more

falling to below 112.00 to the US dollar. The dollar

returned to the yen 112 mark as it gained strength after

Turkey lifted interest rates but any further yen weakness

was slowed when the Japanese Prime Minister made

reference in a speech to the Bank of Japan unwinding its

ultra-easy monetary policy.

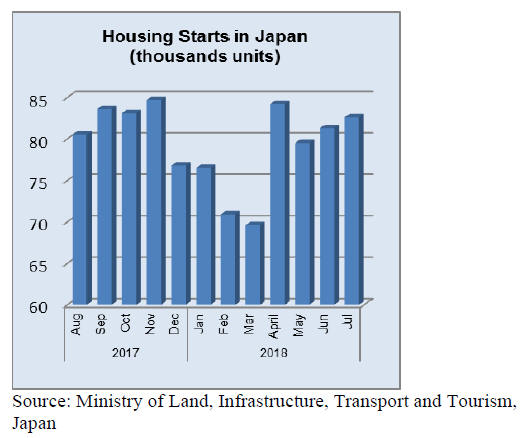

Home prices in Tokyo appear to have peaked

Over the past 12 months there has been a steady rise in

prices for existing apartments in the major cities across

Japan. Apartment prices in Tokyo rose almost 4% in the

second quarter of 2018 building upon the 4.5% rise in the

first quarter and the 3% jump in the final quarter of 2017.

Recent surveys seem to suggest that prices in Tokyo have

topped out as there was a slight fall in the third quarter of

2018.

In the case of new apartments in Tokyo prices have risen

even faster with a 9% rise recorded in the second quarter

of 2018. The Land Institute of Japan has reported that

existing apartment sales in Tokyo fell in the second

quarter while sales of existing detached houses in Tokyo

also fell. This comes on top of declining housing starts in

the second quarter.

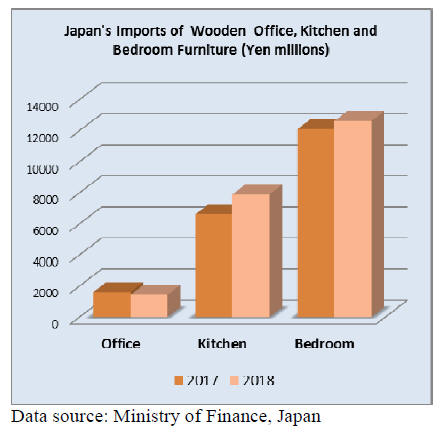

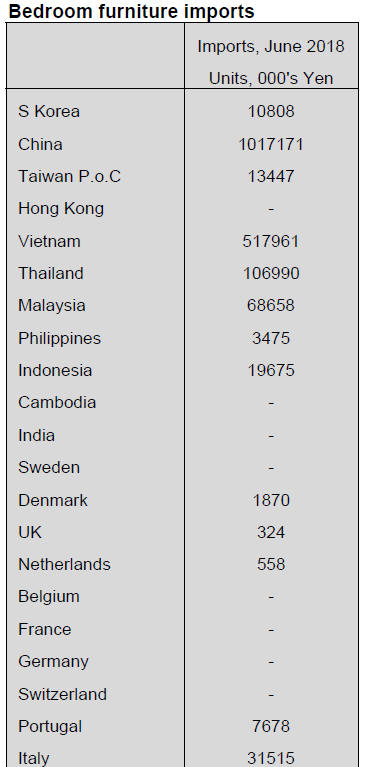

Furniture imports

The combined value of Japan¡¯s wooden office kitchen and

bedroom furniture imports in the first half of 2018 was

higher than in the same period in 2017. Kitchen and

bedroom furniture imports were up 12% and 5%

respectively. It was only wooden office furniture imports

which declined, dropping 11% in the first half of 2018

compared to the first half of 2017.

There is a vast difference in the value of Japan¡¯s

imports

of wooden office, kitchen and bedroom furniture. The

value of bedroom furniture imports are the highest and are

almost double that of kitchen furniture imports and 4-5

times the value of wooden office furniture imports.

After the slight rise in kitchen and bedroom furniture at

the beginning of the year any upward momentum lost

steam and for the three months to June saw the value of

both kitchen and bedroom furniture trending flat. Year on

year the value of first six month 2018 kitchen furniture

have risen.

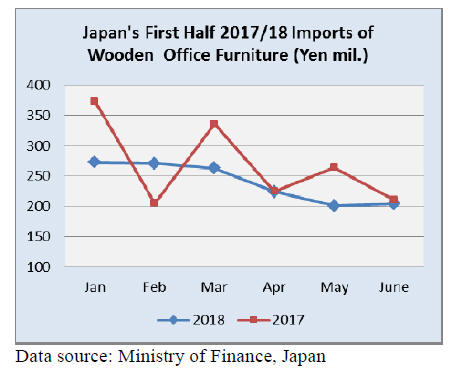

First half 2017/18 office furniture imports (HS 940330)

The pattern of 2018 imports of wooden office furniture is

markedly different from that observed in 2017 and the

steady fall in the value of wooden office furniture during

2018 is clear from the chart below. This decline

corresponds well with the decline in business sentiment

which started to be reported in the second quarter of 2018.

The Bank of Japan¡¯s Tankan survey showed that sentiment

amongst big manufacturers weakened for a second straight

quarter up to June. Analysts say the main reasons are the

rising costs of raw materials and labour and US

protectionism which could hurt Japan¡¯s export-dependent

economy.

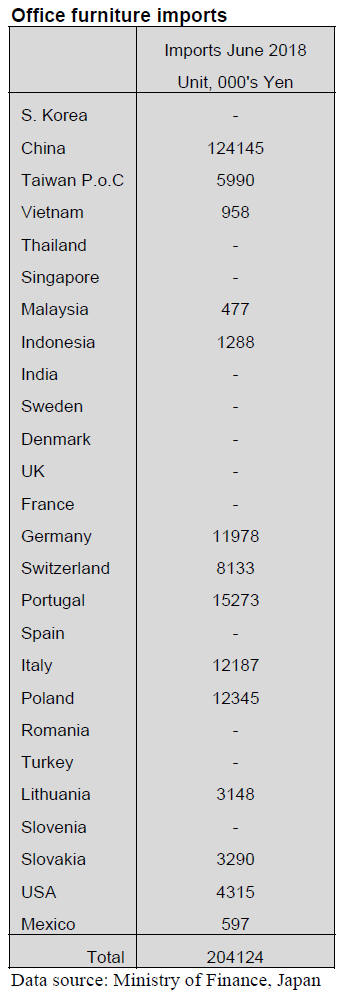

June imports

Year on year Japan¡¯s June 2018 imports of wooden office

furniture were down 3%. The decline in June imports

marked the third monthly fall driving down total second

quarter imports sharply.

The top three shippers of wooden office furniture to Japan

in June, China, Portugal and Poland accounted for over

60% of all wooden office furniture imports. Imports from

Italy in June were almost double the value of May imports.

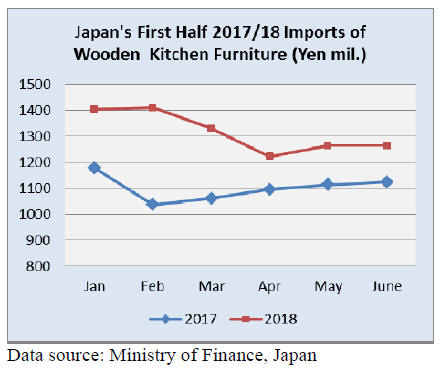

First half 2017/18 kitchen furniture imports

The value of Japan¡¯s wooden kitchen furniture imports in

the first half of 2018 was some 12% higher than in the

same period in 2017. After a good start to the early part of

the first quarter exports fell but picked up towards the end

of the second quarter.

Kitchen furniture imports (HS 940340)

As has been the case since the beginning of 2018, three

suppliers accounted for most of Japan¡¯s wooden kitchen

furniture imports; the Philippines (48%), Vietnam (36%)

and China (9%). In June, imports of wooden kitchen

furniture from Chinese shippers fell 27% driving down

their June market share by about half.

Year on year, June imports of wooden kitchen furniture

were up 12% but were flat compared to the value of June

imports.

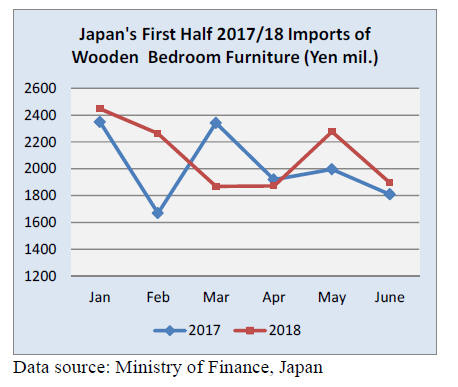

First half 2017/18 bedroom furniture imports

Despite the sharp decline in the value of first quarter 2018

imports of wooden bedroom furniture, overall first quarter

imports were 5% higher than in the first quarter of 2017

having been given a boost by the startling value of imports

in May 2018.

June bedroom furniture imports (HS 940350)

The rise in May imports of wooden bedroom furniture did

not carry over into June when there was a reversal in the

trend. Month on month June 2018 imports were 17%

down from levels in May however, year on year June 2018

imports were up 5%.

The top three shippers of wooden bedroom furniture to

Japan in June were, in order of value, China, Vietnam and

Thailand. In previous months the top three shippers

accounted for almost 90% of all wooden bedroom

furniture imports to Japan but in June the market share of

the top three slipped slightly, driven down by a rise in

imports of bedroom furniture from Poland.

|