2.

MALAYSIA

Staying in the top 10 global

furniture exporters

The Malaysian Timber Industry Board (MTIB) will host a

conference “Wood Based Furniture Design 2018:

Sustainable and Commercial” planned for 30 October in

Kuala Lumpur.

In promoting the conference the MTIB said the thrust in

the business community today is evolution and

diversification of businesses aiming for environmental and

financial sustainability.

The MTIB conference is aimed at acknowledging these

challenges so that Malaysian manufactures manage to

keep the country in the top 10 list of the furniture

exporters. More than 80% of Malaysia’s furniture exports

are wood based.

For more see:

http://www.mtib.gov.my/index.php?option=com_content&view=

article&id=2503%3Aconference-on-wood-based-furnituredesign-

2018-sustainable-acommercial&

catid=1%3Ahighlights&lang=en

The annual Malaysian International Furniture Fair (MIFF)

made history in 2018 according to the organisers. The fair,

held in March this year, was said to be the largest in

MIFF’s 24-year history. MIFF 2018 organisers say a 25%

increase in exhibition space was booked by exhibitors.

Apart from Malaysia, exhibitors came from China, Taiwan

P.o.C, Indonesia, Hong Kong, South Korea, Japan, India,

Turkey, Vietnam, Thailand, Singapore and the USA. Of

the products on show most were home furnishings (397

exhibitors), followed by office furniture (133) and fittings

and accessories (64). MIFF 2019 will run from March 8 to

11 and will be themed “Design Connects People.”

New Chief Conservator of Forests for Sabah

When meeting the press after his appointment the new

Sabah Chief Conservator of Forests for Sabah, Manshor

Mohd Jaini, said the State government’s new policies for

the forestry sector will require all stakeholders to adjust

and adapt to meet the aims of forest conservation in Sabah.

He said actions by the Forestry Department will now be

open and transparent and will focus on forest reserve

management and conservation. This will not be an easy

task according to Mashor as the Forestry Department is

responsible for management over more than 50% of

Sabah's land which has been gazetted as forest reserves,

protected areas and wildlife conservation areas.

Read more at

https://www.nst.com.my/news/nation/2018/09/409713/39-

million-hectares-sabah-land-earmarked-forest-reserve

Timber industry transformation plan for Sarawak – the

major challenge is lack of workers

The Sarawak government’s Deputy Chief Minister,

Awang Tengah Ali Hasan, has said the State government

is committed to securing a sustainable timber industry

because the sector contributes a lot to the state’s export

revenue. The minster said exports of wood products from

Sarawak last year were worth around RM47 million

compared to RM43 million in 2016.

2017 wood product exports comprised plywood (RM3.27

billion) or 53% of total wood product exports followed by

logs (RM1.21 billion) or 20% of exports, sawnwood

(RM803 million) or 13% and fibreboard (RM308 million)

or around 5%.

Despite this good performance the minister outlined the

need to move to the export of high-value wood products

and to support this transformation of the timber sector the

Sarawak Timber Industry Development Corporation has

developed a “Timber Industry Transformation Plan’ the

aim of which is to transform the industry from the current

dependence on exports of primary and secondary products

to one exporting high-value timber products by 2030.

One of the biggest challenges in seeing this plan become

reality is the lack of skilled labour. The youth in Sarawak

show no interest in working in the wood products sector

and Federal Government policies make it hard to hire

foreign workers.

This was taken up by the Malaysian Furniture Council

Secretary General, Albert Khoo, who called for consistent

policies for the hiring of foreign workers as a way to

ensure stable development in the furniture manufacturing

sector.

Read more at http://www.theborneopost.com/2018/09/04/lackof-

local-labour-skills-hamper-furniture-industry-mfc/

3.

INDONESIA

Import tariffs on downstream

products

Airlangga Hartarto, Indonesia’s Minister of Industry, has

said the government is planning to impose 7.5 to 10%

import tariffs on downstream products in an effort to curb

imports. For raw materials the import tariffs will be 2.5% .

The Indonesia media have reported that Airlangga said

tariffs on raw materials will be kept to a minimum.

He said the government planned to complete its list of

products that will attract higher tariffs during September

and that this is being done to improve the current account

deficit. The government has assessed 900 consumer goods

for which import tariffs would be increased.

See:

http://www.thejakartapost.com/news/2018/09/04/indonesia-toimpose-

up-to-10-percent-import-tariffs-on-downstreamproducts.

html

Sukuk – a possible source of funding to support

energy plantations

The development of forest-based renewable energy in

Indonesia requires financial support according to Agus

Justianto, Head of Research and Development Agency, in

the Ministry of Environment and Forestry. Some 89,860

ha. of bio-fuel plantations have been planted in Indonesia

and these are distributed over 10 industrial plantation

forests. In addition, there are 23 industrial plantation

concessions (HTI) units that are preparing to plant another

87,600 ha.

According to Agus, if the programme of blended biofuel

(B10) is successfully implemented there could be a

reduction in greenhouse gas emissions by 5 million tonnes

equivalent of C02.

The Head of the Sub-Directorate in the Ministry of

Finance Sharia State Securities Market Development, Dwi

Iriati Hadiningdyah, explained that green sukuk could be a

source of funding to support climate change control.

She explained that sukuk has become a source of ministry

of finance support. In the period 2008-2018, the total

issuance of sukuk reached Rp.925.2 trillion.

See: http://www.beritasatu.com/satu/507771-energi-terbarukanberbasis-

hutan-butuh-dukungan-pembiayaan.html

Furniture exports boosted by participation in

international fairs

The online ‘Indonesia Investments’ has quoted Abdul

Sobur, Secretary-General of the Indonesian Furniture and

Handicraft Industry Association (HIMKI) as saying in the

second quarter of 2018 Indonesia’s furniture exports

increased almost 11% year-on-year to US$$930 million.

Sobur said the increase was boosted by the participation of

Indonesian furniture manufacturers in furniture exhibitions

in Germany, France and China. As there are more

exhibitions scheduled this year Sobur encouraged

manufacturers to gear up and participate.

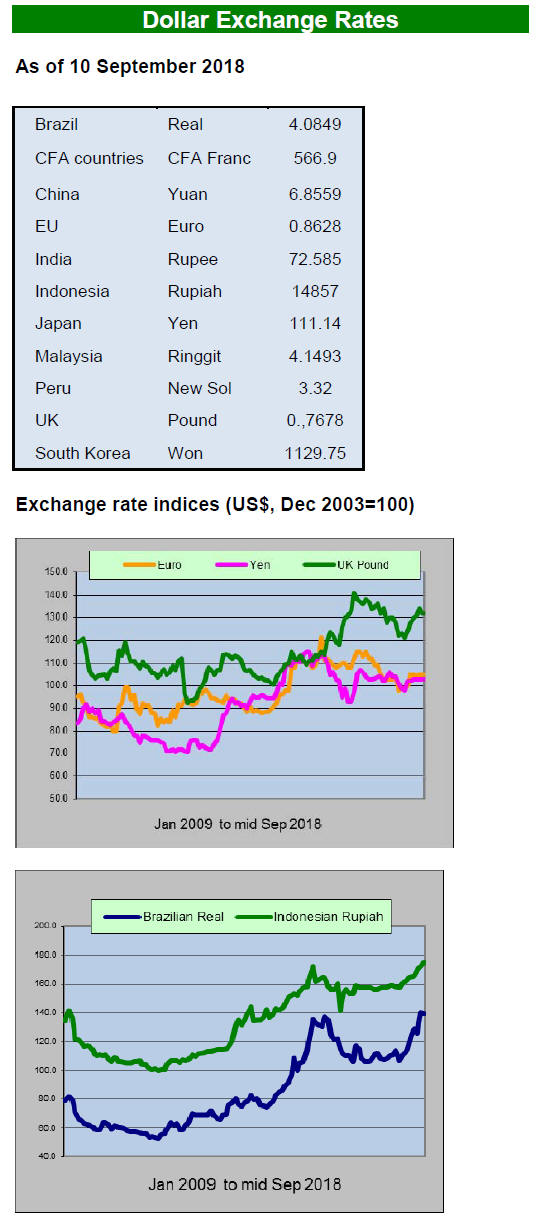

Sobur said as the rupiah gradually weakens against major

currencies Indonesian furniture exporters are getting a

boost from price competiveness especially as most raw

materials are sourced domestically.

In related news, Indonesian furniture products attracted

many visitors to the 2018 Spoga + Gafa Exhibition which

was held recently in Cologne. This event included

business-to-business meetings and promotion.

See:

https://www.indonesia-investments.com/news/newscolumns/

good-growth-indonesia-s-furniture-exports-in-2ndquarter-

2018/item8954

Duty-free to Australia

The recently signed Indonesia-Australia Comprehensive

Economic Cooperation (IA CEPA) opens the way for

some 7,000 Indonesian export products to enter Australia

tariff free according to Ni Made Ayu Marthini, Bilateral

Trade Director in the Ministry of Trade.

Products exempted include textile products, herbicides,

pesticides, wood products, coffee, chocolate, paper and

machinery according to Ni Made Ayu Marthini .

See:

https://www.cnnindonesia.com/ekonomi/20180907125755-92-

328489/ia-cepa-7000-barang-ri-bebas-bea-masuk-ke-australia

4.

MYANMAR

Multi Stakeholders Group for

VPA negotiations

The official commissioning of the Multi Stakeholders

Group (MSG) for VPA negotiation with EU was

conducted in Nay Pyi Taw on 7 September. The MSG

comprises 8 members from three key Stakeholders: the

Government, the Private Sector and civil society plus one

focal point from the Forest Department.

However, it is not clear how MSG will steer the VPA

negotiation as the UK has withdrawn support and is

reshape its assistance strategy.

Logs from Karenni National People’s Liberation Front

to processed

According to a local media source (BNI Media Group

Online Media) the Forest Department will officially

transport 3,000 tons of teak and 2,000 tons of other

hardwood logs which are stock piled in East Than Lwin.

Permission was granted by the National Reconciliation

and Peace Center (NRPC).

These logs had been extracted from the production areas

under the control of the Karenni National People’s

Liberation Front (KNPLF). Critics point out that this

exercise must be carefully monitored to ensure traceability

and the legality of the timber.

Efforts continue to boost economic development

A National Economic Coordination Committee was

formed recently to address widespread criticism of

government efforts on economic development. The aim of

the Committee is to formulate dynamic economic policies

and to assure the effective coordination among state

economic organisations.

According to Myanmar Investment Commission (MIC)

domestic investments reached around US$2 billion for the

period July 2017 to July 2018 and were mostly in the

areas of housing development and manufacturing.

According to the Myanmar Chamber of Commerce, local

investment focusses largely on import substitution.

Between April 2017 and March 2018 the MIC approved

222 new investments worth almost US$5 million. In

addition, the MIC approved 12 foreign investments worth

US$401.8 million for the Thilawa Special Economic Zone

Project. Total FDI reached US$6 million in fiscal 2018.

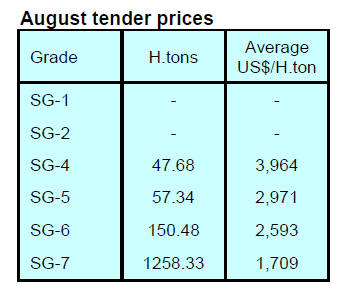

Log auctions

The Myanma Timber Enterprise (MTE) has announced the

tender schedules for the period 1 October 2018 to 30

September 2019. MTE plan to will sell 15,000 H. tons of

teak logs, 150,000 H. tons of non-teak logs and 2,200 tons

of teak sawnwood.

5. INDIA

Growth prospects good says World Bank

– but

reviving bank credit facilities a priority

The latest India Development Update from the World

Bank forecasts that the Indian economy is set to revert to

its growth rate of 7.5% in the coming years as it gets

beyond the fallout from the Goods and Services Tax

(GST) and the negative impacts of demonetisation.

The report says, while services will continue as the main

driver of growth, manufacturing is expected to accelerate

following the implementation of the GST. Despite the

recent momentum, the Bank says “attaining a growth rate

of 8 percent and higher on a sustained basis will require

addressing several structural challenges. India needs to

durably recover its two lagging engines of growth –

private investments and exports - while maintaining its

hard-won macroeconomic stability”.

One priority identified in the latest report is the need to

revive bank credit facilities to support growth. The Indian

banking sector suffers high balance sheet stress which can

be traced back to the period of exuberant bank credit

growth during 2004–08. The bank says “decisive reforms

will be needed to enable the Indian banking sector to help

finance India’s growth aspirations”.

See: https://www.worldbank.org/en/news/pressrelease/

2018/03/14/india-growth-story-since-1990s-remarkablystable-

resilient

GST - one year on

It is now one year since India introduced its standardised

Goods and Services tax (GST) system. The initial turmoil

and fears in the manufacturing sector have given way to a

general acceptance that, while not perfect, it is working

and there are signs of benefits but many issues remain to

be addressed.

One advantage for the central government is that more

business have sought registration and so come under the

tax umbrella. Business registration has expanded from 6.4

million enterprises before the GST to 11.2 million as of

July 2018.

One of the main issues raised by the private sector, apart

from the need to address tax rates, is the requirement to

register in all states where the company operates. This the

requirement for multiple registration has complicated

things for industry not made it easier. Companies fear that

multiple audits and assessments due to multiple

registrations will be an administrative burden and raise

costs.

Read more at:

http//economictimes.indiatimes.com/articleshow/64787124.cms?

utm_source=contentofinterest&utm_medium=text&utm_campai

gn=cppst

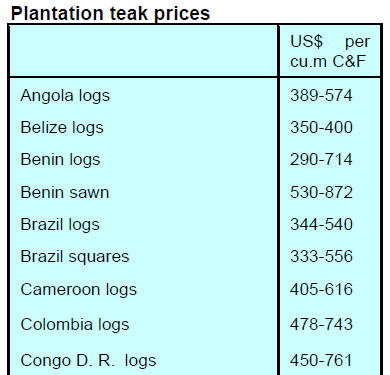

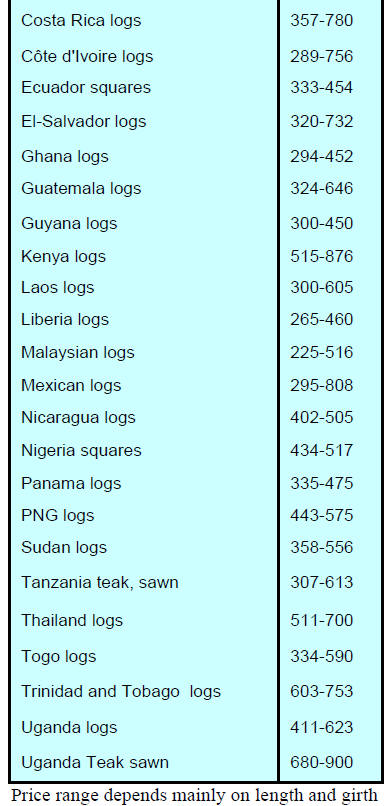

Plantation teak

Demand for imported plantation teak logs is steadily

coming back to life but importers are struggling with the

rising landed costs. To compensate for this prices to

endusers in the domestic market have been raised by

around 5%.

Credit facilities for importers still not been fully resumed

and this, the weak rupee and rising fuel costs are becoming

a burden.

The combined impact of a widening trade deficit, rupee

weakness and growing core inflation has resulted in the

reserve Bank of India (RBI) raising its key policy rate at

each of its last two bi-monthly policy review

meetings. Analysts write “as the US Federal Reserve is

showing no signs to slow interest rate hikes, further

monetary tightening by the RBI looks inevitable”.

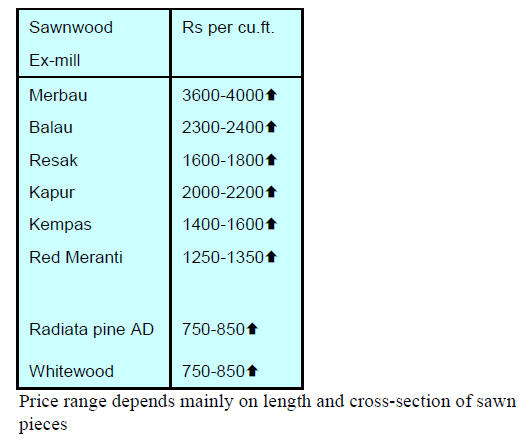

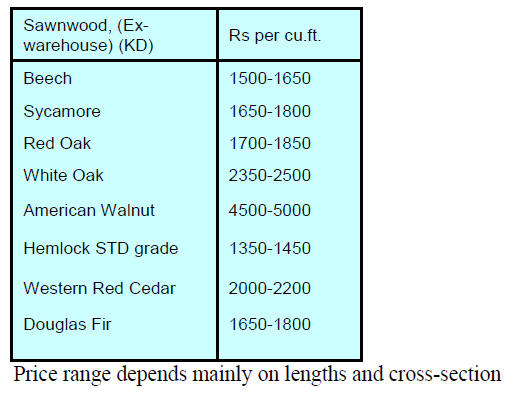

Locally sawn hardwood prices

As the realty market has started to improve the demand for

timber has also seen warming up. The imported costs are

rising due to weakening Rupee so to meet the situation the

sales prices have to be raised and the market has

responded to this need.

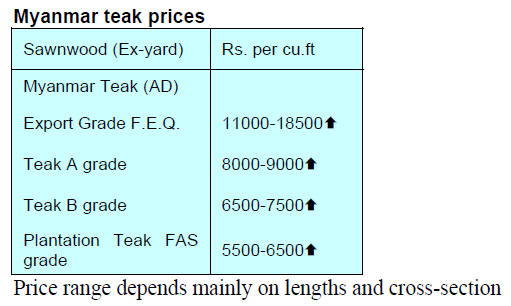

Myanmar teak

As activity in the building sector is rising demand for

Myanmar teak has finally come alive. The improved

demand has given millers the opportunity to raise prices.

Sawn hardwood prices

No further prices increases have been reported.

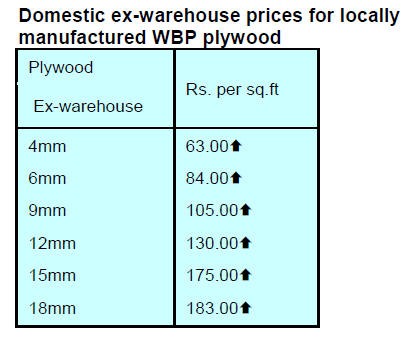

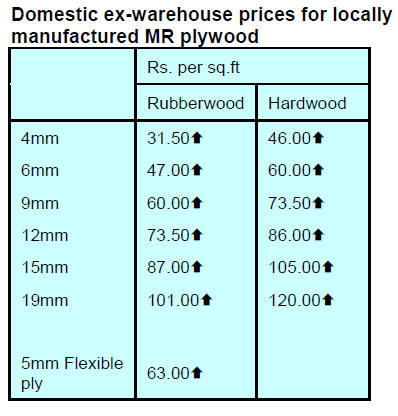

Plywood up-date

Given the firm demand in most sectors utilizing plywood

domestic producers have taken the opportunity to raise

prices in an effort to off-set rising production costs.

The earlier price increase has been accepted by consumers

and the latest increases will mean plywood manufacturers

can contain costs and profitability.

6. BRAZIL

Forest structure maintained

through controlled

harvesting

More than 32,000 trees have been logged in the past

decade in concessions in the Amazon Jamari National

Forest. The Jamari National Forest was the first in the

country where logging was controlled through government

approved management plans.

Of the entire Jamari National Forest area only around 30%

is available for harvesting and two companies won

concession rights for a 40-year period. All harvesting is

planned one year in advance and must be approved by the

Brazilian Institute for the Environment and Renewable

Natural Resources (IBAMA).

Investigations reported by the Federal University of

Rondônia illustrate that damage to the forest as a result of

harvesting quickly recovers.

Research has shown that after 3 or 4 years regeneration is

good and that the forest structure remains intact. The

Brazilian Forest Service controls extraction and has a

chain of custody mechanism through which wood sold by

the companies can be traced back to its origin.

Analysts write that around 70% of the timber harvested in

Jamari is for international markets. Since 2010, the

Brazilian government has collected R$44 million from

concessionaires harvesting public forests. Part of this

revenue is remitted to the states and municipalities in the

region where the companies operate.

Timber sector supports revival of construction sector

The Brazilian wood industries, through the representation

of the Brazilian Association of the Mechanically

Processed Wood Industry (ABIMCI), joined the ‘Coalition

for Construction’ set up by the Brazilian Chamber of Civil

Construction Industry (CBIC). This coalition brings

together 26 of the most important associations and

industry entities.

The objective behind this coalition is to unite efforts for

the development of measures to support the recovery of

Brazilian civil construction sector. One of the immediate

actions was the presentation of suggestions from the

productive sector to government.

The expectation is that the government will act to ensure

legal security, access to credit, and that there will be

planning and encouragement of private capital flows. For

ABIMCI, the participation of the wood industry in this

movement comes at an important time as it is a major

supplier to the construction industry.

ABIMCI has said that the timber sector faces low trade

competitiveness due to trade barriers, domestic

bureaucratic obstacles, port logistics that are the most

expensive in the world and low level of investment and

credit.

First half 2018 forestry sector exports rise

The Ministry of Industry and Foreign Trade (MDCI) has

reported that between January and June 2018 forestry

sector output grew significantly. Data from MDCI show

that first half 2018 exports of paper, woodbased panels

and pulp increased sharply rising to US$5.5 billion on the

back of firm demand in China as well as North America,

Europe and other Asia countries.

Market promotion with Mexico

ABIMCI recently hosted a visit by the president of the

Mexico-Brazil Chamber of Commerce (CAMEBRA). The

Chamber, located in Mexico City, is looking for business

opportunities between the two countries. The Brazilian

timber sector is one of the most attractive to Mexico

according to the president of CAMEBRA.

Mexican importers wish to identify Brazilian exporters

and this first meeting marked the beginning of

negotiations for a mutual cooperation agreement and a

memorandum of understanding between the two entities to

facilitate actions and promote more business in the timber

sector between the two countries. Plans are being made for

business to business meetings and trade missions.

7. PERU

SERFOR gets cash to combat

illegal forest activities

The Ministry of Economy and Finance has authorised the

transfer of Sol 6.4 million to the National Forestry and

Wildlife Service (SERFOR) to finance surveillance

activities to combat illegal activities in the forest.

According to SERFOR the aim is to "strengthen the

actions of supervision and supervision of the legal origin

of forest resources and their preservation over time, in a

sustainable and safe manner". This is an approximate

translation of the text in supreme decree No. 198-2018-EF,

published in the Official Gazette El Peruano.

Minister - a significant part of Peru’s Amazon can be

commercially utilised

The Minister of Production, Raúl Pérez-Reyes, has said in

eight years Peru will double forestry and aquaculture

output pointing out that the value of production in these

two sectors went from US$600 million to US$5 billion

over the past 15 years.

Pérez said that almost 60% of Peru is Amazonian forests

and a significant part of this can be commercially utilised

which would provide for sustainability of the forest

resource. He mentioned also that it is necessary to

rehabilitate a significant part of the almost 8 million

hectares of natural forest lost to deforestation.

Surge in private investment lifts growth prospects

Peru’s economy continues to see significant growth in the

private sector. Investment is set to achieve a 5% increase

this year and forecast to increase 7.5% in 2019 according

to the Ministry of Economy and Finance.

According to Andina, the state owned news agency,

private investment will be one of the major drivers of the

economy next year. Andina reported that there has been

significant expansion of private investment reversing 14

quarters of decline.