US Dollar Exchange Rates of 25th August 2018

China Yuan 6.81

Report from China

Rise in home sales

In the first seven months of this year investment in real

estate in China expanded at a fast pace. According the

latest press release from the National Bureau of Statistics

(NBS) investment increased 10.2% year on year in the

first seven months, compared to the 9.7% expansion in the

January to June period

Investment in residential real estate increased 14.2% in the

first seven months, compared to 13.6 percent in the first

half of the year.

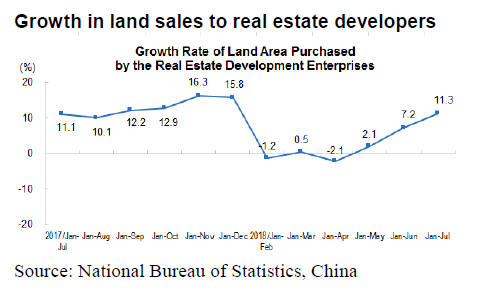

In the same press release the NBS says the area of land

purchased by real estate developers, was up by 11.3%

year-on-year.

See:

http://www.stats.gov.cn/english/PressRelease/201808/t20180820

_1617997.html

In response to what was deemed an overheated market the

government and city authorities have acted to cool market

growth. Administrators in major cities across China have

introduced a raft of regulations, in some case over 200 up

to July, an all-time record according to Centaline Property

Agency one of the largest property agencies in Hong

Kong.

In an effort to hold down house prices there are now limits

on the number of properties which can be owned, the

minimum down-payment has been raised and there are

limits on how quickly a recently purchased property can

be put back on the market.

Working against efforts to cool house buying as an

investment has been the recent sharp decline in interest

rates making loans that much cheaper.

Southwest China to see investment in timber ports and

processing zone

A cooperation and investment agreement was recently

signed between China Forestry Group Corporation and the

administration in Ba¡¯nan district of Chongqing

municipality. An investment of RMB23 billion will be

used to build timber trade ports, a timber processing zone

and a wood products demonstration and trading centre in

Western China.

Currently in China the timber ports and industrial zones

are mainly distributed in coastal areas and along the border

areas and there is a gap in the southwestern regions of

China.

The new infrastructure will result in large volumes of

imported timber entering the southwestern regions and this

will cut transportation costs for enterprises in the region

and will also expand employment opportunities.

It is forecast that demand for timber would expand to 100

million cubic metres in the southwestern region including

Yunnan, Sichuan, Guizhou, Guangxi provinces, Xizang

Autonomous Region and Chongqing municipality.

Chongqing municipality is the distribution centre in

southwestern China and the technology for timber

processing mills is well established and production costs

are very competitive, say analysts.

http://www.cfgc.cn/g2757/s6318/t11281.aspx

Surge in landed cost of North America logs

Traders in China are complaining that the landed cost of

imported North American logs has jumped by around 30%

as a result of the depreciation of RMB and the trade frition

between China and the United States.

Although shippers in the US have been lowering log prices

to maintain market share in China the higher costs

continue to be a major challenge to Chinese importers.

The reason behind this is that, even with price reductions,

landed costs are still higher than previously which means

competitiveness in the domestic market is weakened and

traders are losing out to alternative timbers.

At present, the price for grade A processing general

materials (2-4m) North America hemlock and fir in the

Guangdong market is between RMB1680-1760 per cubic

metre. The price for grade A processing general material

(2-4m) southern pine is between RMB1580-1660 yuan per

cubic metre.

Decline in plywood imports

In the first half of 2018 China¡¯s imports of plywood fell

9% to 79,400 cubic metres. Of the total, imports from

Malaysia were the highest at - 22%, from Indonesia and

Russia imports fell 11% and 10% respectively.

The proportion of China¡¯s plywood imports from Russia

was the highest in the first half of 2018 at 27% (21,100

cubic metres) followed by Malaysia to 25% (19,850 cubic

metres) and Indonesia to 19% (15,000 cubic metres).

Surge in timber imports from Japan

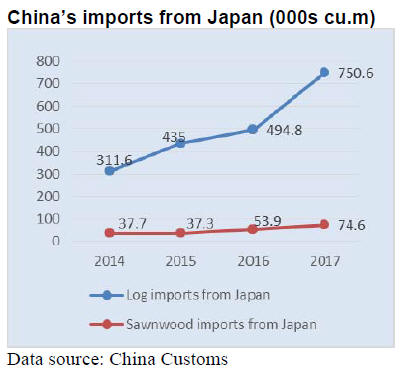

According to the data from China Customs, China¡¯s log

imports from Japan have increased from 311,600 cubic

metres in 2014 to 750,600 cubic metres in 2017. 2017 log

imports from Japan were worth US$102.44 million and the

average price for logs from Japan rose 8% to US$136 per

cubic metre.

In 2017 China¡¯s sawnwood imports from Japan were 74,

600 cubic metres valued at US$18.44 million, up 39% in

volume and 32% in value. The average price for

sawnwood from Japan fell 5% to US$247 per cubic metre.

Wooden pallets demand for huge timber

Pallets are the essential in logistic operations and it has

been estimated that at the end of 2017 the stock of pallets

in China exceeded 1.263 billion pieces of which wooden

pallet accounted for 73% with plastic pallets taking up

most of the balance.

Wooden pallets are said to have a cost advantage. In China

the price for a wooden pallet is around RMB150 but for

plastic pallet the price is over RMB250. The demand for

wood for pallet manufacture is huge and manufacturers

warn that pallet prices will rise as the landed cost of timber

imports rise.

Logistics enterprises plan to address this by switching to

pallets from alternative materials.

Analysis shows that the annual cost of plastics pallets is

lower than wooden pallets because of improved service

life. Moreover, plastic pallets can be cleaned and used for

transport of fresh food, medicines and other perishable

goods.

|