Japan

Wood Products Prices

Dollar Exchange Rates of 25th

August 2018

Japan Yen 111.23

¡¡

Extreme heat drives down

consumer confidence

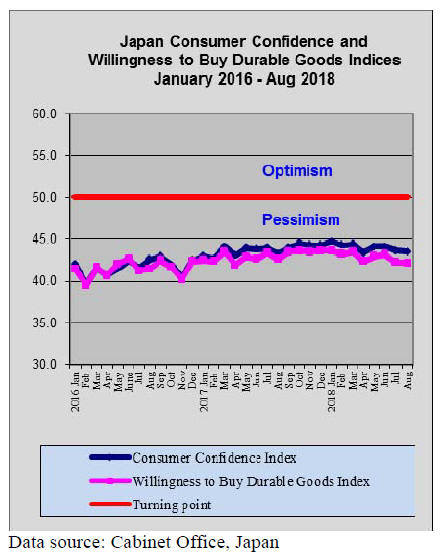

The latest Cabinet Office consumer confidence survey

showed that sentiment weakened again in August, marking

the lowest level over the past 12 months. The overall

confidence index dropped to exactly the same low as 12

months earlier.

The index for income growth also declined as did the

index for employment prospects which is unusual at a time

when unemployment is at a very low level. Of concern to

retailers and sellers of furniture and household goods was

the decline in the index which measures the willingness of

consumers to buy durable goods.

On reviewing the latest data, the Cabinet Office

downgraded its assessment of prospects for consumer

spending for the first time in four months. Analysts

explain that behind the weakness was rising food prices

due to the extremely hot weather which has affected farm

output and to consumer concerns over the high energy

bills they are facing due to the heatwave which has now

extended over more than two months.

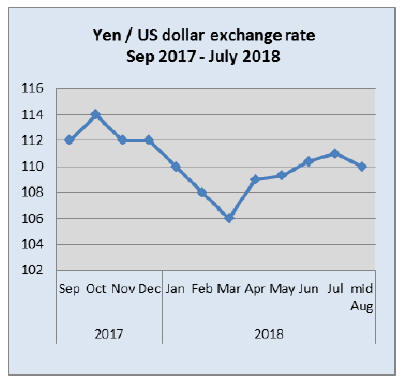

Risk to export growth holds down yen

exchange rate

What a difference a year makes. Last year was one of the

worst for the US dollar exchange rate with the dollar

falling around 10% against most major currencies. Against

this background analysts forecast the weakness would

continue into 2018.

But from the beginning of 2018 the dollar reversed

direction and is currently at its highest in a year. Analysts

point to the benefits from the tax cuts, increased

government spending and improved private sector

sentiment as support the firmer dollar.

The US dollar was trading at 111.3 to the yen at the end of

August having risen slightly because Japan downgraded its

assessment of export prospects as concerns grow that a

trade war between the US and China will disrupt global

trade.

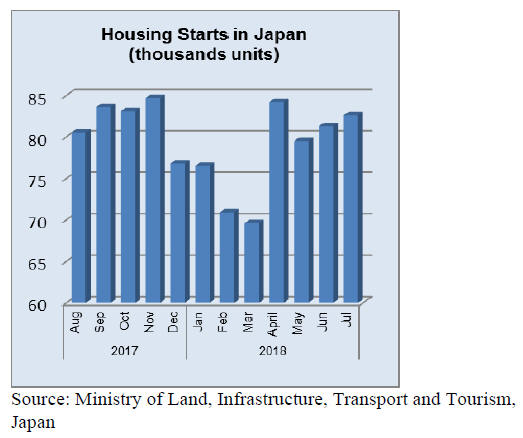

July rise in housing starts disguises

overall trend

July marked the third straight increase in housing starts but

this disguises the fact that, year on year, July starts were

down almost 1%. The decline in year on year July starts

was slower than forecast, analysts had expected a 4%

drop.

In addition to the housing starts numbers the Ministry of

Land, Infrastructure, Transport and Tourism also provides

data in its survey on orders received by construction

companies. The 50 biggest contractors reported a 9%

decline in orders during July.

Much of the discussion recently on the housing

market has

focused on zero-energy apartments as housing developers

begin to introduce advanced building concepts, common

in detached homes, into this new area.

The concept of a zero-energy home is one where the home

is energy neutral through the use of solar panels and other

renewable sources.

The government is promoting this concept and aims to

have 50% of new homes to be zero-energy by 2020.

According to recent research, households accounted for

16% of Japan's carbon emissions in fiscal 2016 so cutting

back on emissions from homes could play a big part in

Japan¡¯s target under the 2015 Paris Agreement on climate

change.

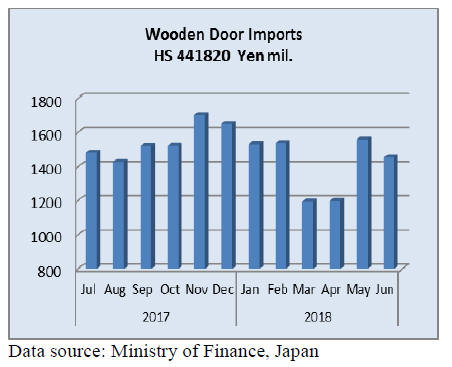

Import round up

Doors

June door imports

The value of Japan¡¯s first half 2018 imports of wooden

doors HS441820 was unchanged compared to the same

period in 2017 despite the March and April 2018 dip in

imports, a characteristic trend at the end of each financial

year in Japan.

After the peak in May imports, the value of wooden door

imports was down 7% in June with some 63% being

supplied from China and another 20% being shipped from

suppliers in the Philippines.

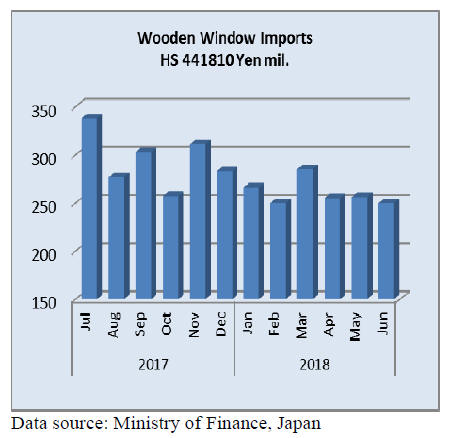

Window imports

June window imports

The value of Japan¡¯s imports of wooden windows

(HS441810) has remained fairly constant in the first six

months of 2018. The only month where there was a

change was in March when a slight rise was recorded.

However, compared to the value of imports in the first half

of 2017 there was an 8% decline seen in the first half of

2018.

The value of Japan¡¯s June wooden window imports were

unchanged year on year as well as compared to levels in

May.Wooden windows coming into Japan originate in

China (38%), the Philippines (31%) and the US (19%).

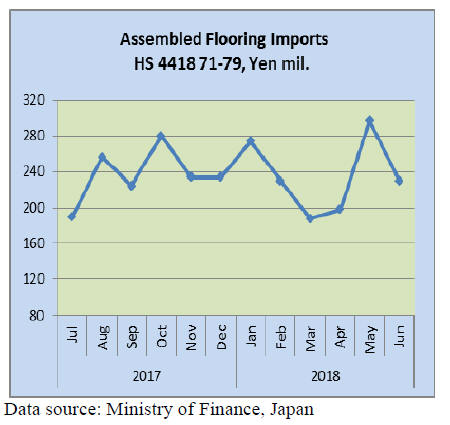

Assembled flooring

June imports

Japan¡¯s imports of wooden flooring continue to be

dominated by HS441875 followed by HS441879.

Together these two categories of assembled flooring

accounted for around 90% of the value of all assembled

wooden flooring imports.

Despite the rollercoaster trend in the value of imports, the

value of first half 2018 imports was almost unchanged

from the same period in 2017. However, the value of June

2018 imports was down 17% year on year and compared

to a month earlier June imports dropped 23%.

June shipments of HS441875 were dominated by China

(50%) and Indonesia (21%) with most of the balance made

up of shipments from Thailand and Malaysia.

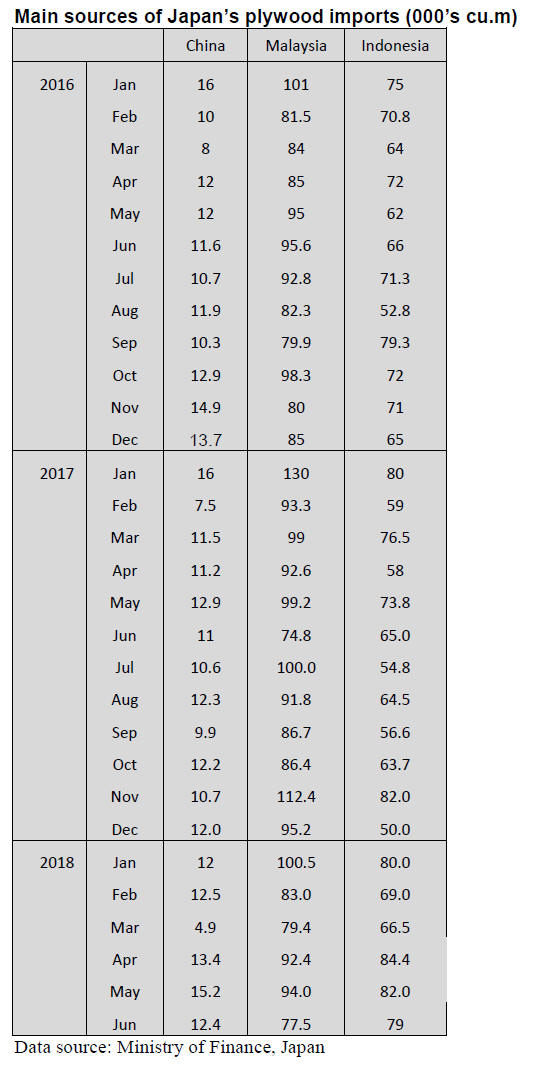

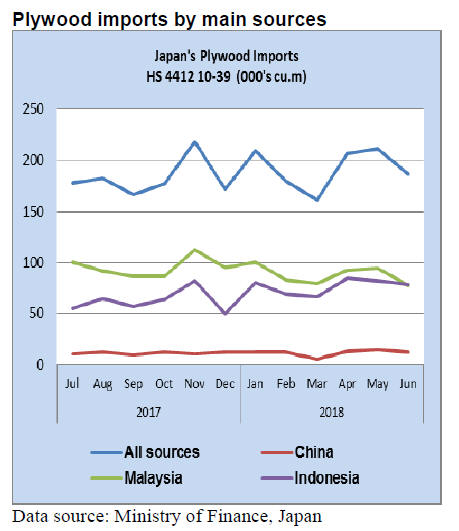

Plywood

June plywood imports

There was a sharp decline in Japan¡¯s imports of Malaysian

plywood in June 2018. The average volume of imports

from Malaysia between January and May 2018 was

around 90,000 cu.m but June imports dipped to just over

77,000.

Production in Malaysia has been falling as the State

government is strictly enforcing felling limits. June 2018

marked the first month in recent years when the volume of

plywood imports from Indonesia exceeded those from

Malaysia.

Year on year the volume of June 2018 imports of plywood

(HS 441210-39) were up 14% but month on month,

largely due to lower shipments from Malaysia, imports fell

12%.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Climbing demand of wood pellets

Demand of wood pellet is sharply increasing. Import of

wood pellet is about six times of 2013 and domestic

demand is 9% more than 2013. Reason is starts-up of large

biomass power generation facilities, which use wood

pellet solely to combines with other fuel like coal.

Import of wood pellet in 2017 is about 510,000 ton, 46%

more than 2016 while domestic production was about

120,000 ton, 0.5% more.

In 2013, total supply of wood pellet was about 190,000 ton

in which share of import was 43% then since 2015 supply

by import surpassed domestic supply then in 2017, share

of import rose to about 80%.

Meantime, the domestic supply will increase considerably

as the largest manufacturer, Meiken Lamwood (Okayama

prefecture) plans to produce about 30,000 ton a year and

Toono Kousan (Fukushima prefecture) is testing a new

plant, which will produce about 30,000 ton a year. Then

Sumitomo Forestry plans to build a new wood pellet plant

jointly with electric power company.

Increase of import of wood pellet will skyrocket after 2020

since demand of biomass fuel will expand sharply. There

are many projects of biomass power generation plant on

the coast lined-up. There are two plants with power output

of 75,000 kw in Fukuoka prefecture. Both will start up in

2021.

One in Ibaraki prefecture with output of 51,500 kw and

another in Chiba with output of 75,000 kw are planned,

which will start operating in 2021 and 2022. They are all

counting imported wood pellet as fuel. Also large electric

power companies are counting to use wood pellet in large

volume after 2022.

With expansion of imported wood pellet, trading firms are

actively engaged in securing overseas sources. Sumitomo

Forestry, which handled about a half of all the imported

wood pellet in 2017, will increase the volume to350,000

ton in 2018 after test run of tie-up power generation plant

starts this year.

Itochu Corporation will handle about 200,000 ton with

sales contract with a large power generation company.

Trading companies are busy looking for overseas source

of wood pellet and try to make long term supply contract

with the suppliers.

In related news, the domestic Asahi newspaper of 31

August has a story on illegal logging of cedar in Japan.

Prices for cedar logs have risen sharply over the past year

on the back of demand in export markets such as China,

the Philippines and South Korea. Prices have also been

given a boost from demand in the domestic consumption

in bio-fuel sector. According to the Asahi newspaper there

are growing reports of theft of trees in Kyushu and in

Okinawa.

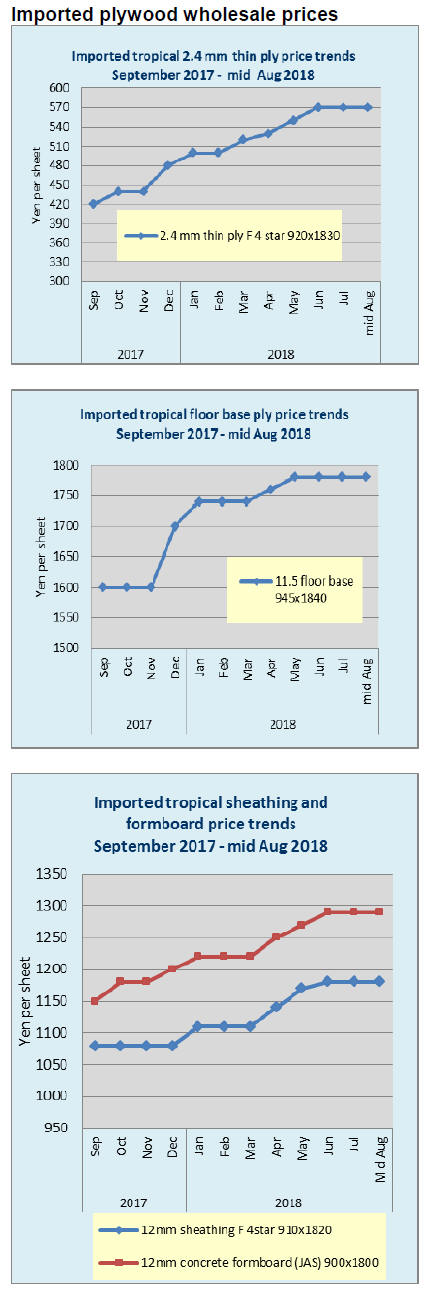

Plywood

The softwood plywood market is weakening but there is

no price collapse. In distribution channels, there are some

low price offers with various rumors so the market is

confusing. June softwood plywood production in June was

271,900 cbms, 2.4% more than June last year and 8.0%

more than May.

This is the highest monthly production. The shipment in

June was 249,700 cbms, 5.1% less and 3.8% more. The

inventory is 163,400 cbms, which is far less than one

month consumption.

The manufacturers think this is no excessive level

inventory and if the consumption picks up, it would drop

in no time. Imported plywood market does not show any

improvement. Some indicate recovery of movement but

once tight supplied coated concrete forming panel is

readily available now and over supply is now feared so the

price increase is not progressing.

Malaysian and Indonesian suppliers are preparing higher

prices before rainy season with limited offers for Japan.

The importers feel future purchase is difficult with

remaining order balances so they buy minimum necessary

volume only.

Domestic softwood plywood market

Market of softwood plywood is weak. There are some low

price offers in the market but they do not help move more

volume. Actually there are various prices in the market

and it is hard to pin point median prices. In confusing

market, wholesalers are taking cautious approach and

wait-and-see attitude is prevailing.

Softwood plywood manufacturers are holding the prices

without any price reduction. Softwood plywood

inventories at the end of June were 163,400 cbms, 22,300

cbms more than end of May. The inventories have been

increasing for five straight months but based on monthly

shipment volume, they are only 0.6 month so they are not

excessive inventories.

Orders for precutting plants are improving some from June

but there are differences among companies and areas so

upward momentum is not there yet. Also there is prospect

that demand for restoration of floor damaged areas in the

Western Japan should show up but so far there is none yet.

After all, there is very little factor to push the market up

but as long as the manufacturers maintain the prices, it is

hard for wholesalers to continue price reduction.

Therefore, the key is if the manufacturers can hang on

present sales prices.

South Sea (tropical) logs

South Sea log import for the first half of this year was over

80,000 cbms, 30% higher than 2017. Log FOB prices

temporarily softened in last fall and procured logs at this

time arrived all at once early this year. Logs from Sabah

were30% more and logs from PNG doubled.

With log export ban by Sabah, future log arrivals would

drop sharply. There is no logs in distribution channels in

Japan so market prices are unchanged.

|