|

Report from

North America

China announces retaliatory tariffs on US wood

products

China announced US$60 billion in tariffs on U.S. goods in

retaliation to the Trump administration¡¯s latest

announcement of tariffs on Chinese imports. Many wood

products are on China¡¯s list, including hardwood logs,

veneer, wood composite panels, various finished wood

products and furniture.

Hardwood trade associations in the US such as the

National Hardwood Lumber Association are very

concerned about Trump administration¡¯s tariffs and

China¡¯s retaliation. Last year the US exported US$1.6

billion in hardwood lumber, US$800 million in hardwood

logs and US$260 million in veneer to China according to

the American Hardwood Export Council.

Keruing sawnwood imports continue to expand

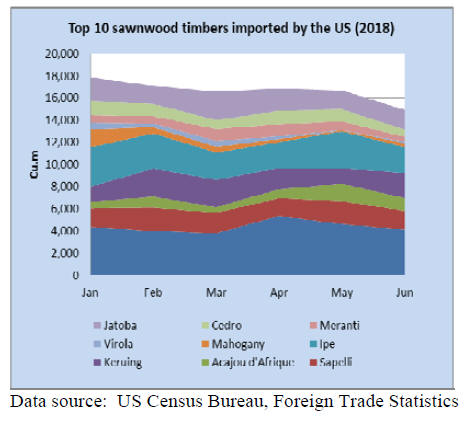

US imports of sawn hardwood (temperate and tropical)

fell 37% in June, but the drop was mainly in imports of

temperate species. Tropical imports declined 12% from

May to 15,506 cu.m.

The largest decline was in ipe sawnwood imports, which

fell 30% month-over-month to 2,332 cu.m. in June.

Imports of balsa, sapelli, acajou and meranti were also

down.

However, Keruing sawnwood imports increased

significantly in 2018. Year-to-date imports were up 90%

in June compared to the same time in 2017. More than

90% of the keruing sawnwood imported in June came

from Malaysia.

Canadian tropical sawnwood imports lower in first half

of 2018

Canadian tropical sawnwood imports grew in June but

year-to-date imports remained lower than at the same time

last year. Temperate sawn hardwood imports were down,

despite strong demand for flooring and other finished

products in the U.S. markets. Tropical imports were worth

US$2.1 million in June. The strongest month-on-month

growth was in sapelli sawnwood imports, but year-to-date

imports were down by one third compared to June 2017.

Cost of construction steady in July

Construction cost was unchanged in July according to the

Bureau of Labor Statistics, despite US tariffs on key

construction materials ¨C on steel from several countries

and sawn softwood from Canada. Several trade

associations warn that costs are likely to rise again and

possibly depress the housing market by making homes less

affordable.

However, the July survey by the National Home Builders

Association showed that builders were largely optimistic

about the market for new single-family homes. The

outlook for renovation and remodeling was also positive,

compared to the first quarter of 2018.

Despite low unemployment and economic growth, both

housing starts and sales of existing homes declined in

June. Several economists warned of a slowdown in the

housing market due to lower affordability/higher home

prices and rising mortgage rates.

|