US Dollar Exchange Rates of 25th July 2018

China Yuan 6.7697

Report from China

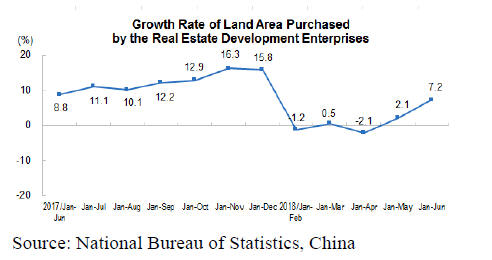

Real estate developments in the first half of 2018

China¡¯s National Bureau of Statistics has released its

assessment of national real estate development and sales in

the first six months of 2018. This shows that total

investment in real estate in the first six months of 2018

expanded slightly but was down on the pace of growth in

the first 5 months of the year.

In the first six months the area of land purchased by real

estate developers was up by 7.2% year-on-year sharply up

on the pace of growth in the first half of the year.

See:

http://www.stats.gov.cn/english/PressRelease/201807/t20180719

_1610970.html

Over the past few years the government has introduced

policies which reduced the dependence of economic

growth on the real estate sector but still the construction

sector remains a cornerstone of GDP growth. Lower

investment in the construction sector will have a knock-on

effect on imports of commodities including wood

products.

IMF ¨C China¡¯s growth prospects

In its latest annual assessment of the Chinese economy the

IMF says growth is projected at 6.6% 2018. The report

from the IMF goes on the say ¡°Four decades of reform

have transformed China from one of the poorest countries

in the world to the second largest economy. The country

now accounts for one-third of global growth. Over 800

million people have been lifted out of poverty and the

country has achieved upper middle-income status. China¡¯s

per capita GDP continues to converge to that of the United

States, albeit at a more moderate pace in the last few

years.¡±

See:

https://www.imf.org/en/News/Articles/2018/07/25/na072618-

chinas-economic-outlook-in-six-charts

Background on China¡¯s wood products trade

Data from China Customs shows that in 2017 total value

of China¡¯s wood products trade (imports and exports) rose

10% to US$156.4 billion. The growth in wood products

imports rose 21% to US$ 52.6 billion, significantly higher

than the growth in exports (1.3%).

The US is the main importer of China¡¯s wood products but

anti-dumping and anti-subsidy policies in the have resulted

in a sharp fall in exports to the US.

China¡¯s wood products enterprises are facing considerable

challenges in the US market.

The value of foreign trade in wood products between

China and the US in 2017 was US$29 billion, accounting

for 19% of China¡¯s total wood products trade.

However, tensions between the United States and China

are increasing over trade issues after tariffs on US$50

billion worth of Chinese goods were announced by the

US.

The US recently released a list of tariffs on US$200 billion

of Chinese goods and wood products are affected

including wood chips, wood charcoal, logs, other wooden

products, sleepers, sawnwood, veneer, wooden flooring,

particleboard, fibreboard, plywood, laminated wood,

wooden doors, wooden windows, bamboo and rattan,

wood pulp and waste paper, paper and board, pulp and

paper products and wooden furniture and seats.

In 2017 the value of China¡¯s exports of wood products

now included in the list attracting tariff was US$16.365

billion. The value of China¡¯s imports wood products

included in the list attracting US tariffs was $8.27 billion.

China imports mainly waste paper, sawnwood, wood pulp,

logs and paper products.

The changes to US tariffs, if implemented in full, will

create a major challenge for Chinese enterprises. The

tariffs will not immediately go into effect but will be

subject to a two-month review process beginning in

August.

|