|

Report from

Europe

Slow growth in EU wooden furniture and joinery

sectors in 2017

There was only very slow growth in both the EU wood

furniture and joinery sectors during 2017. While

production and consumption gained momentum in parts of

continental Europe, particularly in Eastern Europe, this

was offset by a significant slowdown in the UK and stasis

in Germany.

Growth in the EU door sector was considerably more

buoyant than in the window and furniture sectors in 2017.

While wood made up some lost ground against plastics in

these sectors, market share was being lost to metal

products.

These are the main conclusions to be drawn from analysis

of newly released Eurostat PRODCOM data which

provides a snapshot of the production and consumption

value of wood furniture and joinery products in the EU in

2017.

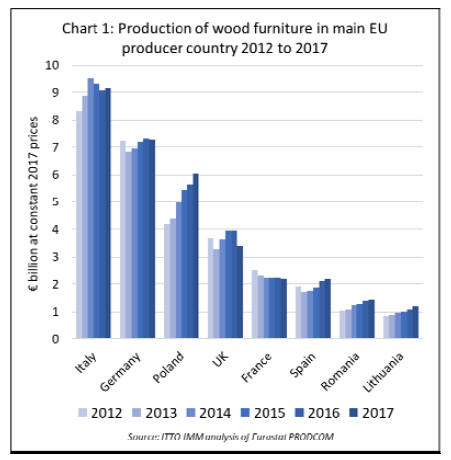

No growth in wood furniture production in 2017

The value of EU wood furniture production was 40.3

billion in 2017, no change from the previous year and still

20% down on the level prevailing before the financial

crises in 2008.

A slowdown in production in the UK offset gains in

Poland, Spain, and Lithuania. Production in Italy and

Germany, the two largest manufacturing countries, and in

France and Romania was broadly flat in 2017 (Chart 1).

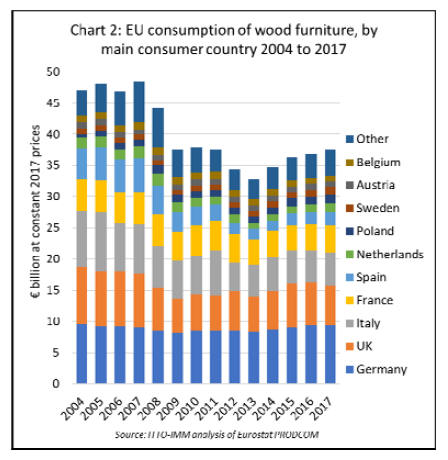

EU consumption of wood furniture was 37.6 billion in

2017, a gain of 2% compared to 2016. During 2017,

consumption was stable (at 9.4 billion) in Germany, the

largest market, and rising in Italy (+3% to 5.2 billion),

France (+1.5% to 4.3 billion), Spain (+7% to 2.2

billion), Netherlands (+30% to 1.5 billion), Poland

(+15% to 1.4 billion) and Sweden (+2.5% to 1.1

billion).

However, wood furniture consumption fell 6% to 6.5

billion in the UK and 5% to 870 million in Belgium

(Chart 2).

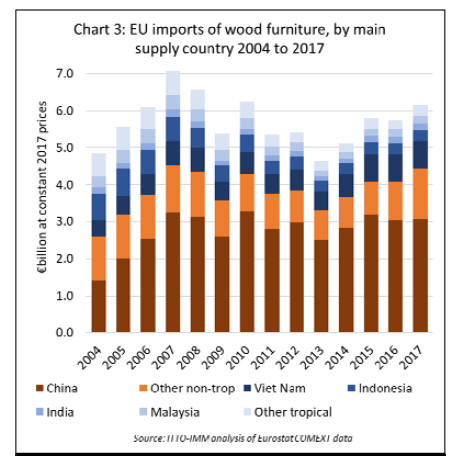

After flat lining in 2016, the value of EU imports of wood

furniture from non-EU countries increased 7% to 6.16

billion in 2017. Imports from China, by far the largest

external supplier fell 4% in 2016 but recovered 0.7% to

3.08 billion in 2017 (Chart 3).

In recent years China‘―s competitiveness in the EU wood

furniture market has been impeded as prices have risen on

the back of growing domestic demand and new laws for

pollution control pollution in China.

EU furniture importers also continue to question the

variable quality of product imported from China and some

have struggled to obtain the legality assurances required

for EUTR conformance when dealing with complex wood

supply chains in China.

The main beneficiaries of rising EU wood furniture

imports in 2017 were other European countries including

Ukraine, up 67.7% to 133 million, Bosnia, up 14.9% to

218 million, and Serbia, up 13.7% to 127 million.

EU imports of wood furniture from tropical countries

increased 3.5% to 1.72 billion in 2017, reversing a 2.5%

decline the previous year.

Vietnam is the dominant supplier of furniture to the EU,

although imports were flat in 2016 and 2017 after rising

40% in the previous two years. Imports from Vietnam

declined 0.7% in 2016 and then increased just 0.5% to

724 million in 2017.

EU imports of wood furniture from Indonesia increased

2% to 309 million in 2017, following a 6% decline the

previous year. Imports from Malaysia increased 11% to

180 million, EU imports from Malaysia recovered by

10.7% to reach 203 million last year. Imports from

Thailand fell 3.4% to 61 million.

Recent survey work undertaken by the ITT0-IMM in

highlights that, to some extent, direct competition between

furniture suppliers in the various South East Asian

countries is limited by market differentiation.

With the rapid decline of availability of natural forest teak

from Myanmar, Indonesia is now best placed to supply a

wide range of outdoor furniture products, particularly due

to relatively abundant plantation teak supplies.

Indonesia's long woodworking tradition has also meant it

has gained a reputation for supply of good quality

specialist hand-made furniture, a niche market in the EU

where it competes most directly with India.

By contrast, the Vietnamese furniture sector has gained a

reputation for supply of large volume mid-range products,

both for exteriors and, increasingly, for interior use, and is

importing a wide range of wood from around the world to

feed this production.

The Vietnamese furniture industry is regarded by EU

importers as technically more evolved than most other

Asian producer countries and increasingly able to supply

products to high European quality standards.

Malaysia also supplies high quality products but offers a

much smaller range than Vietnam with a heavy focus on

rubberwood and other plantation species.

While these various external suppliers now play an

important role in specific sections of the EU furniture

market, the domestic industry remains very dominant. The

share of domestic manufacturers in total EU furniture

supply declined only slightly between 2013 and 2017.

In 2017, domestic manufacturers accounted for 86.7% of

the total value of wood furniture supplied into the EU

market, down from 87.5% in 2016 and 88.6% five years

before.

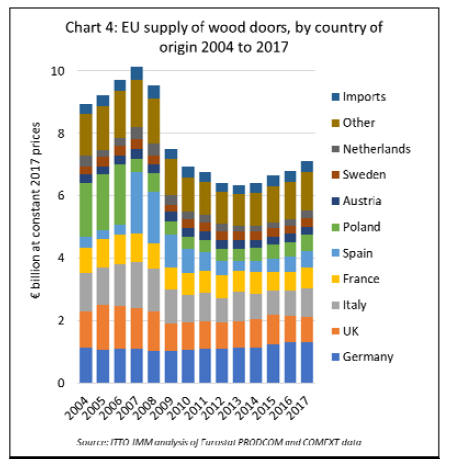

5% growth in wood door supply to the EU in 2017

Eurostat PRODCOM data reveals that the total value of

wood doors supplied to the EU increased by 5% to 7.12

billion in 2017. Despite the increase, the value of wood

doors supplied to the EU in 2017 was still more than 25%

down on the level prevailing before the global financial

crises (Chart 4).

Most new wood door installations in the EU comprise

domestically manufactured products. The EU‘―s domestic

production increased 4.9% to 6.78 billion in 2017. There

was significant variation in the performance of the wood

door sector in EU countries in 2017.

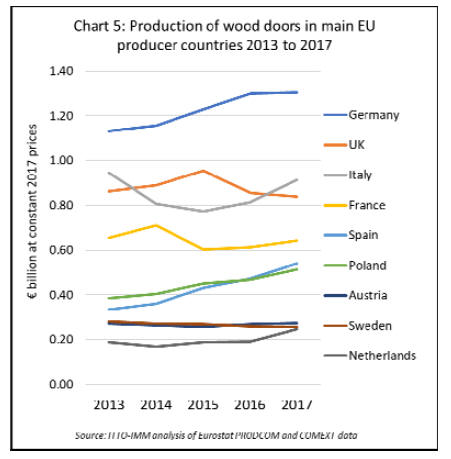

Production in Germany, the largest wood door

manufacturing country, was stable at 1.30 billion during

the year while production in the UK continued to slide, by

2% to 840 million.

However, production increased sharply in Italy (rising

12% to 910 million), France (rising 5% to 640 million),

Spain (rising 14% to 540 million), Poland (rising 10% to

510 million) and the Netherlands (rising 30% to 250

million) (Chart 5).

Wood door imports into the EU increased by just 0.3% to

341 million in 2017. Imports accounted for 4.8% of the

total euro value of wood door supply to the EU in 2017,

down from 5.0% the previous year.

Most of the gains in EU door imports in 2017 were from

other temperate countries including Norway (+7% to 16

million), South Africa (+16% to 12 million), Bosnia

(+29% to 7 million) and Ukraine (+50% to 7 million).

Imports from UAE, becoming more important as a wood

processing hub, increased from negligible levels to 5.4

million.

However, imports from China, the largest external

supplier, fell 2% to 111 million in 2017.

The total value of EU imports of wood doors from the

tropics fell 6% to 159 million in 2017. This was mainly

due to a decline in imports from Malaysia (-9% to 38

million) and Brazil (-19% to 13 million). The value EU

wood door imports from Indonesia also fell, but by only

3.8% to 102 million in 2017.

The European wood door industry is now dominated by

products manufactured using engineered timber driven by

requirements to comply with higher energy efficiency

standards and efforts to provide customers with more

stable products and long-life time guarantees.

Another key trend is towards composite doors with a steelreinforced

uPVC outer frame with an inner frame

combining hardwood and other insulation material.

These new products are designed to combine strength,

security, durability, high energy efficiency, with a strong

aesthetic.

There may be a place for tropical hardwoods in the design

of these products with manufacturers looking to combine

high quality, consistent performance, regular availability,

and good environmental credentials with a competitive

price.

EU market for wood windows flat in 2017

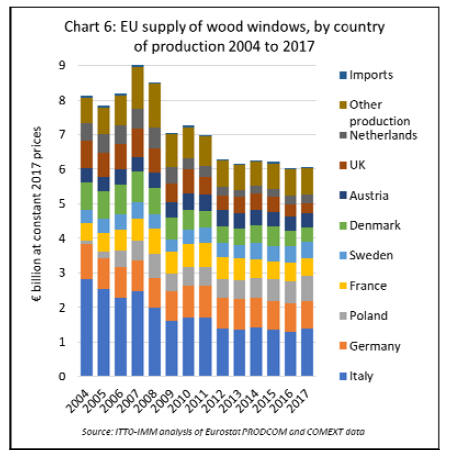

There was little growth in the market for wood windows in

the EU in 2017. The total value of wood windows supplied

to the EU increased only 0.7% to 6.07 billion in 2017

following a 2.8% decline the previous year (Chart 6).

The supply of wood windows to the EU is

overwhelmingly dominated by domestic production which

increased 0.7% to 6.07 billion in 2017. Imports from

outside the EU accounted for only 0.5% of total EU wood

window supply in 2017.

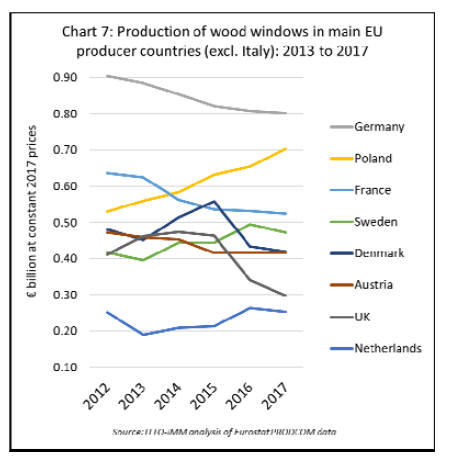

Italy has maintained its position as the largest window

manufacturer in the EU, with production rising around

7.2% to 1.39 billion in 2017. Production in Poland

continued to rise during the year, by 7% to 704 billion.

In contrast, wood window production in most large

western European markets declined in 2017, including

Germany (-1% to 802 million), France (-1% to 525

million), Sweden (-5% to 420 million), UK (-12% to

299 million) and the Netherlands (-4% to 254 million)

(Chart 7).

Imports of wood windows from outside the EU fell by

5.3% in 2017 to 31.4 million, continuing the downward

trend of the previous year. EU imports of wood windows

derive mainly from neighbouring European countries,

including Norway, Bosnia and Switzerland.

Only a very limited, and highly variable, quantity of wood

windows is imported into the EU from tropical countries.

The value of EU imports of wood windows from tropical

countries fell 32% to 3.17 million in 2017. Typically,

50% to 70% of wood windows imported in the EU from

the tropics each year derive from the Philippines and are

destined for France and Belgium.

While tropical countries are not significantly engaged in

the EU market for finished windows, this sector is of

interest as a source of demand for tropical wood material.

From this perspective, a notable trend in the EU window

sector ¨C as in the door sector - is towards use of

engineered wood in place of solid timber. This is

particularly true of larger manufacturers producing fullyfactory

finished units that buy engineered timber by the

container load.

Increased use of engineered wood is closely associated

with efforts by window manufacturers to meet rising

technical and environmental standards, provide customers

with long lifetime performance guarantees and recover

market share from other materials.

Increased focus on energy efficiency means that tripleglazed

insulating window units with very low U-factors

are now more common than double-glazed units in

Europe. These units demand thicker, more stable and

durable profiles that in practice can only be delivered at

scale using engineered wood products.

The quality and engineering of wood windows has

undergone a revolution in the EU in recent years so that

manufacturers are now able to deliver products with many

of the benefits previously reserved only for the best quality

tropical hardwood frames using softwoods and temperate

hardwoods.

Factory-finished timber windows are given a specialist

spray-coated paint finish for even and durable coverage

which might only need redoing once a decade. The

lifespan of factory-finished engineered softwood frames is

now claimed to be about 60 years, while thermally or

chemically modified temperate woods can achieve around

80 years.

Nevertheless, smaller independent joiners producing

bespoke products in low volumes still tend to rely on solid

timber purchased from importers and merchants to

manufacture window frames.

Tropical woods such as meranti, sapele and iroko continue

to supply a high-end niche in this market sector,

competing directly and often successfully with oak,

Siberian larch, and western red cedar.

The apparent stasis in EU production of wood windows

during 2017, a year when overall construction activity in

the region is estimated by Euroconstruct to have risen by

3.5%, implies some loss of market share.

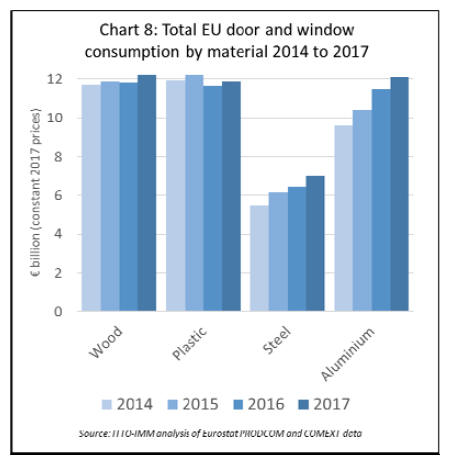

The Eurostat PRODCOM data provides evidence for this

showing that between 2014 and 2017 total EU

consumption value for doors and windows increased 26%

in aluminium and 28% in steel. The consumption value for

wood increased only 4% during this period, while

consumption of plastic stagnated (Chart 8).

Overall the share of wood in the total value of EU door

and window consumption fell from 30% to 28% between

2014 and 2017, while the share of aluminium increased

from 25% to 28%, steel increased from 14% to 16%, and

plastic decreased from 31% to 27%.

This highlights that while wood may be making gains in

relation to plastic products in the EU market for windows

and doors, it is losing share to metal products.

Aluminium is becoming a particularly prominent

competitor. Aluminium has always remained the default

windows product in the commercial market but over the

last 5 years the material has enjoyed considerable

resurgence within the residential window and door market.

An important driver behind this has been aluminium bifold

and sliding doors as consumers demand greater space

and light within living areas. Another factor is the demand

for lower maintenance and greater strength in light weight

frames for high energy efficiency double and triple glazed

units.

|