Japan

Wood Products Prices

Dollar Exchange Rates of 25th

June 2018

Japan Yen 110.04

Reports From Japan

2% Inflation eludes Bank of Japan

Recent data from Japan¡¯s Ministry of Internal Affairs and

Communications shows that the May consumer price

index rose 0.7% year-on-year, unchanged from April. This

index includes oil products but excludes fresh food.

Analysts were quick to point out that this underlines how

difficult it has been for the Bank of Japan to achieve its

2% inflation target despite over five years of massive

fiscal stimulus.

Against this background it is unlikely that the Bank of

Japan will halt its ultra-easy monetary policy while the

ruling majority government is in power.

The economy is expected to recover in the second quarter

from the contraction recorded in the first quarter but there

are many risks ahead especially the looming trade war

between the US and China.

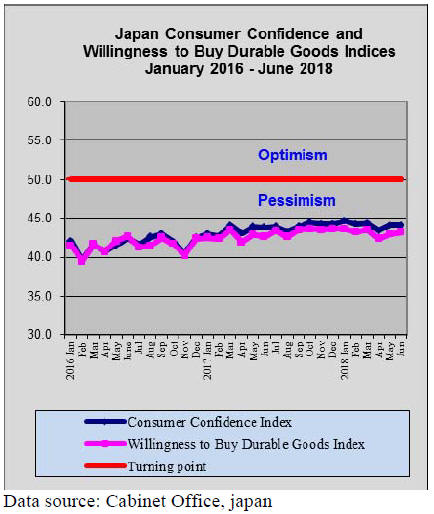

Japan's consumer confidence weakened marginally in June

according to data released by the Cabinet Office.

The consumer confidence index dropped to 43.7 in June

from 43.8 in May. The index for livelihood fell to 41.9 in

June from 42.1 in the previous month. Similarly, the index

for income growth declined. But the gauge of willingness

to buy durable goods rose from the previous month.

¡¡

Concerns on impact of looming trade war

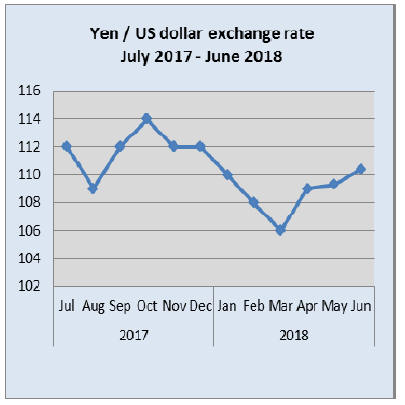

The US dollar rate weakened against most other major

currencies in the second half of June driven down by fears

of escalating trade tensions between the United States and

its major trading partners. Currency traders are

increasingly concerned that the global economy may be

negatively affected.

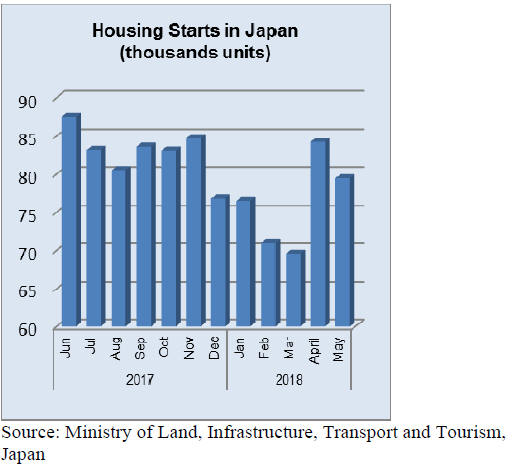

Unexpected June rise in housing starts

The May housing data from Japan¡¯s Ministry of Land,

Infrastructure, Transport and Tourism showed an

unexpected downturn from a month earlier despite being

slightly higher year on year. Housing starts were forecast

to drop 6% in May.

Factoring in the May data then annualised starts at

the

current rate would be 996,000.

The survey of construction companies revealed that orders

received by the major companies dropped almost 19%

year on year in May in contrast to April's rise.

Import round up

Doors

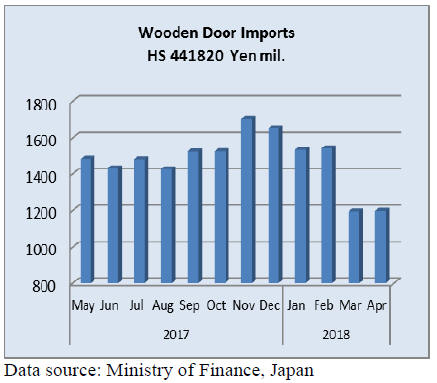

March door imports

The sharp drop in the value of imports of wooden doors

(HS441820) in March was sustained into April. But Year

on year, April imports were some 4% up.

March imports were driven down by much lower

shipments from China and a modest decline in shipments

from the other main suppliers, the Philippines and

Malaysia.

As in previous months China was the major supplier

of

wooden doors to the Japanese market. Imports from China

accounted from 56% of total wooden door imports with a

further 18% from the Philippines, 10% from Indonesia and

7% from Malaysia. These four shippers accounted for over

90% of Japan¡¯s April wooden door imports

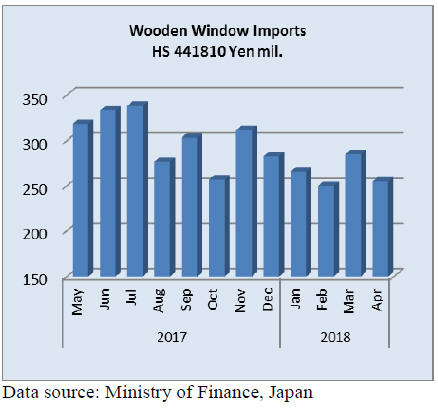

Window imports

April window imports

After the slight recovery in the value of wooden window

imports in March which reversed the downward trend

recorded in the previous two months, April imports

declined.

Year on year, April 2018 imports of wooden windows

were down just over 25% and compared to levels in March

there was a 10% decline.

The top three shippers of wooden windows to Japan in

April were the same as in March but shippers in China

displaced the US as the top supplier by a small margin.

In April China accounted for 32% of Japan¡¯s wooden

window imports followed by the US (28%) and the

Philippines (23%). There was a substantial import of

wooden windows from Sweden in April which acounted

for a further 9% of total wooden window imports.

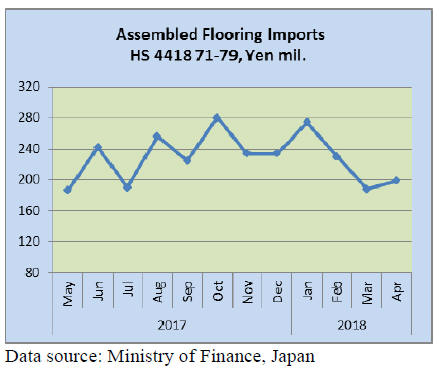

Assembled flooring

April imports

As in previous months wooden flooring imports were

dominated by HS 441875 followed by HS441879.

Together these two categories of assembled flooring

accounted for over 80% of the value of all assembled

wooden flooring imports.

In order of rank by value, China, Malaysia and Indonesia

were the main shippers of HS441875 in April while for

HS441879 the main shipper was Indonesia at 47% of all

shipments of this category of flooring followed by

Thailand at 15%.

From the beginning of 2018 the value of wooden flooring

imports into Japan has been falling. The upturn in April

imports marked the first sign of recovery in the year to

date. The reversal of the downturn in imports recorded in

February and March which was largely due to increased

imports of HS441875 from Indonesia and Thailand.

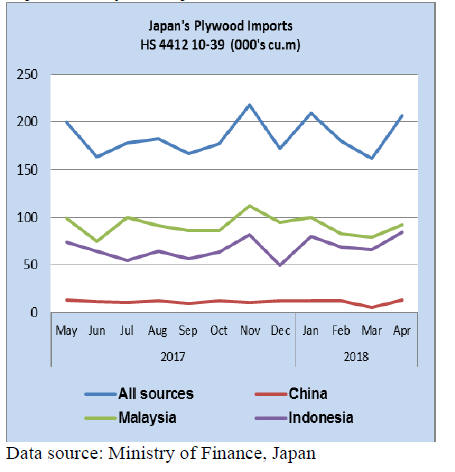

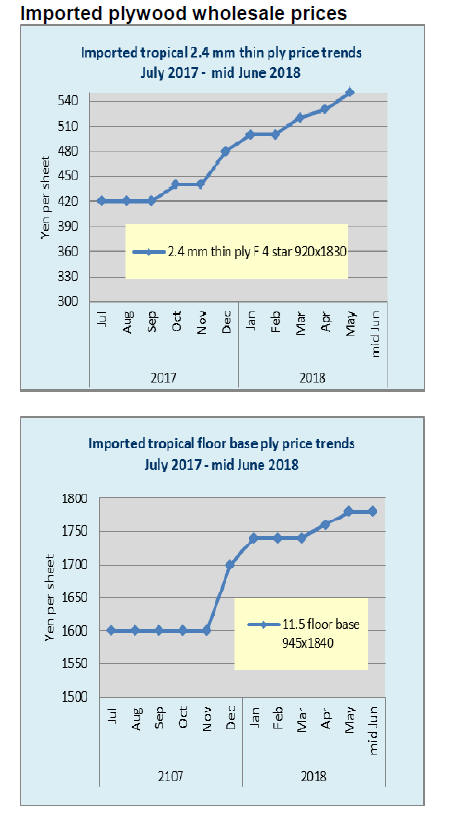

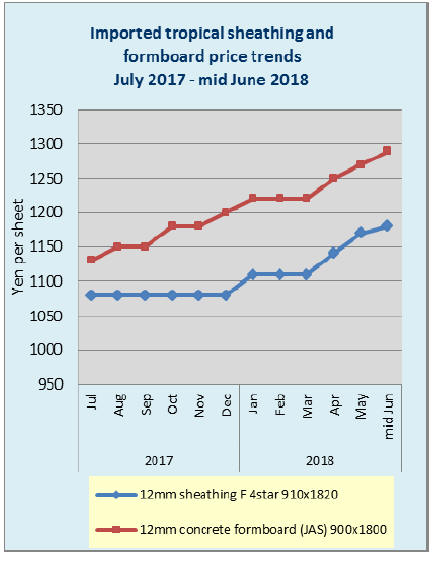

Plywood

April plywood imports

As in previuos months plywood in HS 441231 accounted

for most of Japan¡¯s imports of plywood.

In April HS441231 accounted for over 89% of all plywood

imports. HS441234 accounted for just 6% of April

plywood imports, HS441233, 4% and HS441239 less than

1% of imports.

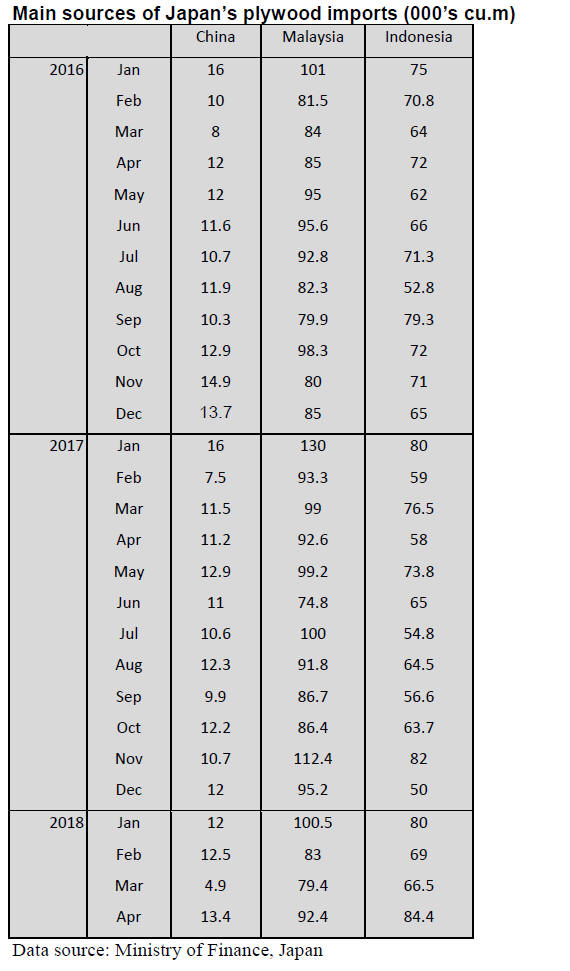

Year on year April plywood imports from all sources rose

18% with both China and Indonesia recording sharp gains

in shippments to Japan.

In contrast exports of plywood from Malaysia to Japan fell

7% month on month in April but compared to a year

earlier there was little change. Restrictions on harvest

volumes and the lingering rain season had an effect on

April plywood shipments to Japan.

Plywood imports by main sources

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

Roof of the national stadium

Construction of large roof of the national stadium has

started since January this year. Three companies,

Sumitomo Forestry, Emachu group and Japan Kenzai are

engaged in assembling wooden parts and installation for

the large roof of the new national stadium.

The roof is truss structure with combination of steel and

laminated lumber of cedar and larch. All the wood is

forestry certified and preservative treated. Wood is visible

from all the seats of the stadium.

Main part is steel with sufficient strength then wood is

combined to prevent deformation by strong wind and

earthquake. Wood is used inside of the roof where rain

does not reach but to give durability, wood is preservative

treated to prevent rotting.

The roof is designed to last 100 years without any major

repair but for regular maintenance, movable gondola under

the truss, corridor for inspection inside truss and access

route to roof top are installed. The new stadium will be

used for the 2020¡¯s Olympic Games.

Wood statistics of 2017

The Ministry of Agriculture, Forestry and Fisheries

publicized wood statistics of 2017. Housing starts in 2017

were less than 2016 but supply of domestic logs was

21,279,000 cbms, which is the highest since 1997. Driving

factor is increase for lumber use with 12,632,000 cbms,

3.7% more than 2016.

Imported wood was 5,059,000 cbms. Logs from New

Zealand increased but logs from Russia, South Sea and

North America decreased. In particular, logs from North

America were 3,882,000 cbms, 5.5% less than 2016.

Total log supply in 2017 was 26,337,000 cbms. Logs for

lumber were 16,802,000 cbms, 1.3% more than 2016.

Logs for plywood were 4,875,000 cbms, which include

logs for CLT. Logs for wood chip were 4,66,000 cbms,

2.0% less. Domestic logs for lumber and plywood

increased but imported logs decreased.

Meantime, lumber import in 2017 was 0.1% more than

2016 and plywood import decreased by 8.2%. Wood chip

import increased by 2.2%.

Generally, domestic log use for lumber and plywood

increased while domestic production of wood chip

decrease and import increased.

Lumber shipments in 2017 were 9,457,000 cbms, 1.8%

more than 2016 out of which percentage of kiln dried

lumber was 41.4%. This is the first time that a percentage

passed over 40%.

In shipments, lumber for construction increased by 1.9%.

In these, a percentage of board increased by 14.1% while

square increased only by 1.7%. Lumber for crating and

furniture recovered from decline in 2016. Limber for

engineering works construction decreased.

Domestic logs for plywood increased by 311,000 cbms.

By species, cypress and fir increased while larch declined.

In imported logs, logs from South Sea countries and

Russia decreased while logs from North America and New

Zealand increased. Increase of New Zealand logs is mainly

for LVL manufacturing.

In domestic log producing regions, prefectures producing

over one million cbms are Hokkaido, Miyazaki, Iwate and

Akita. Ranking has not changed from 2016 but the

production of Akita and Miyagi decreased from 2016.

Others like Fukushima, Tochigi and Fukuoka increased

the production over 100,000 cbms from 2016.

Plywood

Movement of softwood plywood is getting stagnant and

some low priced offers are around but orders from large

precutting plants are steady so basically the market is firm.

April domestic softwood plywood production was 260,200

cbms, 3.2% more than April last year and 2.4% less than

March, out of which structural panel production was

239,300 cbms, 0.8% less and 3.7% less. Shipment of

softwood plywood was 250,700 cbms, 0.5% less and 0.4%

less.

The demand for March and April was slow but the

manufacturers continued full production to catch up

delayed orders and build up the inventory. Users try to

have extra volume to prepare fall demand pickup. The

market is optimistic for the demand through the year,

Softwood plywood inventory in April was 127,700 cbms.

Imported plywood movement remains slow despite low

arrivals. The suppliers continue passing higher log cost

onto future plywood offers.

Domestic logs and lumber

Log production is slowing toward rainy season. This is the

most slow season until fall. Sawmills reduce log purchase

since log quality is easy to deteriorate so log prices tend to

weaken. Lumber movement continues slow even after the

holiday season was over in early May

Changing crating lumber materials

New Zealand radiata pine logs used to be major material

for crating lumber but after China becomes major buyer,

log prices continue climbing and sawmills are not able to

pass higher cost onto lumber.

Substituting Chilean radiata pine lumber supply becomes

seller¡¯s market as worldwide wood demand keeps

expanding and Japan cannot buy enough volume and

specifications are not as free as before. In short, Japan has

to swallow what suppliers give.

Crating lumber is not high priced item in lumber market.

Lumber from other sources like North America and South

Sea countries is also used for crating but lumber prices

from these sources are also inflating by competition of

other markets.

What is needed depends on type of cargoes. For heavy

cargoes, sturdy lumber is needed like keruing and kapur

from South Sea countries but they are now hard to come

by so others like agathist and melapi from Malaysia and

planted species of taun and callophylum from PNG

replace and particleboard is one of replacing item.

Crating lumber assembly plants select suitable

species by

type of cargoes or buyers¡¯ order. Domestic cedar is the

most likely substituting material now. Hokkaido larch has

been main crating material for years. Larch is strong and

water resistant but appearance is not so good as

construction material so it has been used for crating and

sill.

Cedar has abundant resource but lacks strength so it is not

considered as good crating material but it is usable as

crating board. Assembly plants select various materials

and combined package like domestic cedar and North

American hemlock is now popular. Assembly plants make

wooden box, wire drum and pallet.

Pallet is another major wooden product but due to high

cost of wood, plastic and metal pallet are gradually

increasing.

According to the Japan Pallet Association, annual

production of pallet is about 60 million pieces out of

which wood pallet is about 40 million. Plastic pallet is

about 10 million and metal pallet is two million. Average

cost of wood pallet is less than 30,000 yen and of plastic is

about 35,000 yen. Metal is over 100,000 yen. Recycled

wood pallet prices are less costly at 10,000-13,000 yen.

|