|

Report from

North America

Tropical sawnwood imports down but values up in

April

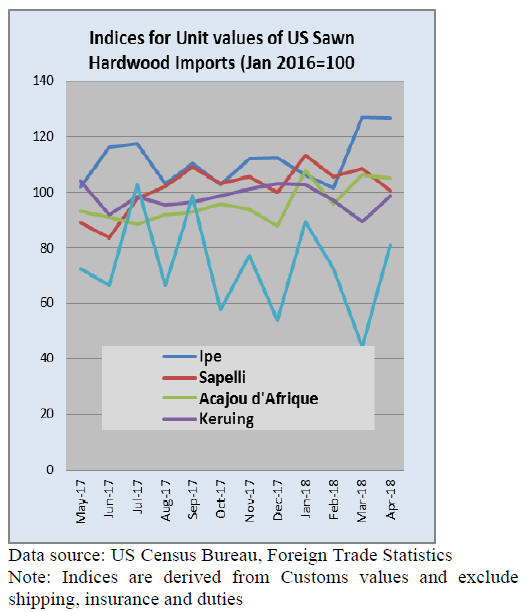

U.S. imports of sawn hardwood (temperate and tropical)

declined in April for the third consecutive month to 66,749

cu.m. The volume of tropical sawn hardwood imports was

unchanged from the previous month at 17,484 cu.m.,

while the value of imports grew by 2%.

Year-to-date, tropical hardwood imports were down 12%

compared to 2017. The overall decline in tropical

sawnwood year-to-date is mainly due to lower balsa and

sapelli imports. Changes in year-to-date imports varied

greatly by species. Jatoba imports were up significantly

from 2017 along with keruing, while sapelli, acajou and

virola declined.

In April, balsa imports increased but imports of most other

tropical hardwood species declined month-on-month. Only

cedro and acajou sawnwood imports increased from

March, while meranti was unchanged.

In a recent survey by the Import/Export Wood Purchasing

News (June/July 2018) most imported wood suppliers

agreed that U.S. demand was strong, especially for African

species.

The rising euro to U.S. dollar exchange rate has increased

prices for US buyers. Several respondents reported higher

domestic transportation (trucking) costs and delays at

export ports in Africa.

For US hardwoods,the consulting firm Forecon reports

consistent and good demand from US manufacturers. US

hardwood prices have increased in 2018, but this is in part

due to strong demand in exports markets (Asia and

Canada).

Canada imports more tropical sawnwood from Brazil

Canadian tropical sawnwood imports increased 10% in

April, while year-on-year imports were a quarter lower

than at the same time last year.

The month-on-month increase was largely in imports of

mahogany. Sawnwood imports from Brazil increased in

April, making Brazil Canada¡¯s third-largest source of

imports after the US and Cameroon.

Canadian retaliatory tariffs on US imports include

plywood

In late May the US administration announced tariffs on

Canadian, Mexican and EU aluminium and steel imports.

Canada retaliated with a plan to impose trade restrictions

for various products from the US including plywood and

upholstered seating:

Plywood, consisting solely of sheets of

wood Plywood, consisting solely of sheets of

wood

(other than bamboo), each ply not exceeding 6

mm thickness: Other, with both outer plies of

coniferous wood

Other plywood, veneered panels and similar Other plywood, veneered panels and similar

laminated wood

Other seats, with wooden frames:

Upholstered Other seats, with wooden frames:

Upholstered

These countermeasures are set to take effect on 1 July and

remain in place until the US lifts its tariffs on Canadian

steel and aluminium. Mexico has also announced

retaliatory tariffs on US exports targeting mainly

agricultural and steel products.

Timber Innovation Act supported by group of Senators

The recently proposed Timber Innovation Act received

support from a bipartisan group of Senators. The bill had

been introduced to the US Senate in 2017 and would direct

the Department of Agriculture (USDA) to conduct

research and development, education, and technical

assistance to facilitate the use of innovative wood products

in wood building construction in the US.

US building codes currently do not recognise ¡®novel¡¯

wood products such as mass-timber as official

constructional materials leaving the product without a

standard rating system for fire and earthquake resistance,

quality and other safety standards.

The Senators in support of the bill say that when approved

it will create jobs in rural areas, encourage sustainable

building construction, and encourage more forest

management in areas at risk of large wildfires.

Most mass-timber is made from softwoods but in Europe

beech hardwood cross-laminated timber (CLT) has been

manufactured and used. In the U.S. research and

development is underway to utilise tulipwood and other

low-value hardwood species for mass-timber in

construction.

American Hardwood Environmental Profile updated

The American Hardwood Export Council (AHEC) has

updated the sustainability information provided with

shipments of sawn hardwood to export markets. Last year

the Association developed a system for US exporters to

create a comprehensive report that aligns with the EU

Timber Regulation (EUTR) and this has been accepted in

other countries with due diligence requirements such as

Australia and Japan.

AHEC has updated the system to cover multiple shipments

within one document and provide forest regeneration

calculations. With one document US exporters can provide

their customers with information on the legality and

sustainability of the hardwood species and quantitative

data on the environmental impacts of delivering it

anywhere in the world.

|