|

Report from

Europe

Firming demand for plywood in EU but sales suffer

from supply problems and price rises

The European plywood market faces a combination of

buoyant demand, mounting competition for product from

other leading consumer countries plus persistent supply

delays and constraints among key producers, notably

tropical suppliers.

In fact, tropical suppliers actually saw their exports to

Europe fall in the first quarter of 2018. The overall result

of these factors has been rising prices, increasing caution

about forward buying and, if not shortages, longer lead

times and difficulties, as one importers said, ¡®in planning

ahead and obtaining the right volumes at the right time¡¯.

Concerns have also been raised in the industry once more

about mis-marking of Chinese plywood imports in terms

of timber species mix and recommended application

labelling. This has been voiced particularly by the UK

Timber Trade Federation (TTF), which has consequently

issued new product performance and content checking

protocols for its members.

Boost from European construction

The key driver of European plywood demand has been the

continuing buoyant state of construction across most of the

EU. This is underpinned, according to market monitor and

analyst Euroconstruct, by generally robust wider economic

performance, low interest rates, migratory flows,

particularly into urban centres, and the latent demand that

has built up due to the building investment backlog since

the economic crisis.

The latest Euroconstruct report, published on June 11 and

charting building sector development in its network of 19

European countries describes their current construction

growth as ¡°exceptional¡±. It adjusts its estimate for 2017

expansion of the industry, forecast in November last year

at 3.5%, to 3.9%. This gives the industry turnover of

euro1.52 trillion, comprising 49% new build and 51%

renovation, repair and refurbishment. It also predicts, with

building levels still 20% off their 2007 market peak, that

there is more growth to come through 2018 (2.4%) into

2019 (1.9%).

¡°Never before have all Euroconstruct countries¡¯ building

industries grown for two years in a row,¡± states the report.

Fastest 2018 construction expansion is expected in

Hungary, forecast at a rate of 24.6%, Ireland 11.1% and

Poland 9.9%, with the worst performance in a ¡®barely

positive¡¯ UK market, where poorer economic performance

is expected to keep growth down to just 0.1%.

Having said that, the UK will remain the third biggest

construction market in Europe, with a value of euro210.9

billion, after Germany (euro332 billion) and France

(euro216 billion), but ahead of Italy (euro169.4 billion).

New residential construction has recently been the main

engine of European construction growth, increasing last

year by 10%. That rate, says Euroconstruct, will halve in

2018, but civil engineering will take over as the key

market driver, expanding 5%.

This, said one importer, will be positive for plywood

demand, as will growth in renovation, which,

Euroconstruct says, will ¡®continue for a long time and on

average exceed and be more stable than growth in new

construction¡¯.

Solid plywood demand, rising prices

Against this background, European plywood importers

variously describe demand ranging from ¡®stable and

sound¡¯ and ¡®at a good level¡¯, to ¡®strong and strengthening¡¯.

Most companies said sales were solid across the range,

although Malaysian generally and Indonesian marine

plywood were highlighted as being particularly sought

after.

At the same time, all importers had issues with supply in

different degrees. ¡°There have been delays from

everywhere, for various reasons,¡± said one leading

continental operator. ¡°Overall supply is short, making it

difficult to plan,¡± confirmed a UK company. ¡°Mills are

also often running very late.¡±

The problems with Indonesian and Malaysian supplies are

largely attributed by European importers to the long and

severe wet season and its impact on harvesting and log

transport, with mills consequently running short of logs.

The weather and raw material supply situation has since

improved, but a report in the European trade press early

April said that in some regions ¡®logging roads are still

muddy and log hauling is difficult¡¯, adding that it could

take a further month before the situation returned to

normal.

Plywood prices for both Malaysia and Indonesia in the EU

are reported to have increased by 30% in the last six

months.

Until recently, supply from Brazil was described by

European importers as ¡®no better or worse than usual¡¯, but

the recent nationwide truckers strike over high fuel prices

is expected to cause continuing delays in delivery of raw

material to mills and finished product to port.

President Temer ultimately made concessions to the

strikers and industrial action was called off end of May,

but the country was left with a significant backlog of

undelivered cargo and the action is now expected to dent

GDP.

Increased competition from US buyers for Malaysian and

Indonesian product is also said to be impacting availability

and price in Europe.

¡°Traditionally, US buyers have sourced Asian hardwood

plywood imports most heavily from China [worth $1.12

billion last year], but their requirements are now such that

they¡¯ve been exploring other sources, including Indonesia

and Malaysia,¡± said a European importer/distributor.

¡°Whether US anti-dumping and countervailing duties on

Chinese hardwood products, activated in December, will

heighten this trend remains to be seen.¡±

China¡¯s plywood trade disrupted by domestic

environmental controls

Meanwhile Chinese plywood supply is reported by EU

importers to be disrupted by tough new national

environmental controls, which are forcing mills to

interrupt production to upgrade or replace emission and

waste treatment technology. Here prices are reported to

have risen 10% in the last six months.

¡°Inspectors have been visiting our Chinese supplier mills

now for months, and we¡¯ve seen regular stoppages as they

improve their systems,¡± said one importer/distributor.

¡°And recently there were more in Linyi and Pizhou.¡±

¡°Stoppages also increased in Qingdao as part of the

authorities moves to improve the local environment for

June¡¯s Shanghai Cooperation Organisation meeting,¡± said

another leading EU importer.

Some European traders maintain that one reason for the

pollution crackdown is to rationalise and concentrate the

plywood industry, forcing smaller producers to close.

One European importer/distributor, however, insisted this

was not the prime objective. ¡°We visit regularly and are

convinced it¡¯s motivated by a genuine desire to reduce the

industry¡¯s environmental footprint and help meet climate

change targets,¡± he said. Importers added that they

generally back China¡¯s action as underpinning its overall

environmental credibility.

As for the situation with Russian hardwood plywood

supplies to the EU, an importer summed it up as ¡®more or

less OK¡¯. ¡°But there have been some issues with a lack of

trucking capacity,¡± he said.

EU plywood imports up 5% in first quarter

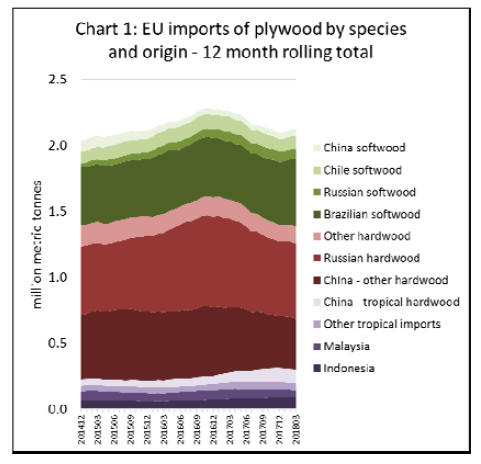

Analysis of latest trade figures for plywood supply to the

EU tally with importers¡¯ comments. Total EU plywood

imports have picked up a little this year, hitting 686,000

cu.m in the first quarter, nearly 5% more than the same

period in 2017. However, supply constraints have meant

that imports are still well below levels prevailing two

years ago in 2016. (Chart 1).

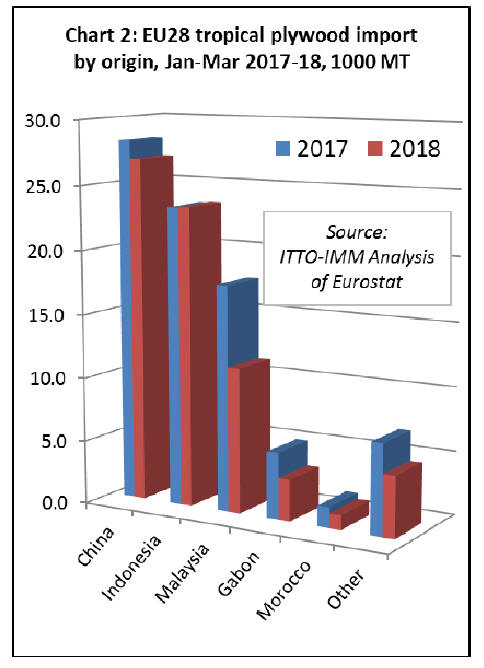

Lack of supply has been a significant drag on EU imports

of tropical hardwood plywood this year. Imports from all

the EU¡¯s leading tropical suppliers except Indonesia

declined in the first quarter of 2018 (Chart 2).

The volume of EU plywood imports from Indonesia

increased only slightly, by 0.3% to 23,000 tonnes, in the

first quarter of 2018. However, import value from

Indonesia fell 10.9% to euro23.9 million during the period.

In the first quarter of 2018, EU imports of tropical

hardwood plywood from China contracted 16.5% by value

to euro16.5 million and 5% in volume to 26,900 tonnes,

and Malaysia¡¯s were down 40% to euro8.4 million and

36% to 11,350 tonnes.

Imports from Gabon were 37% lower by value at euro4.6

million and 37.5% by volume to 3,250 tonnes, and from

Morocco down 29% by both value and volume to euro1.9

million and 1,137 tonnes.

Together with other sources, this meant total first quarter

EU tropical plywood imports were 23% lower by value at

euro61.9 million and 15% by volume to 74,029 tonnes.

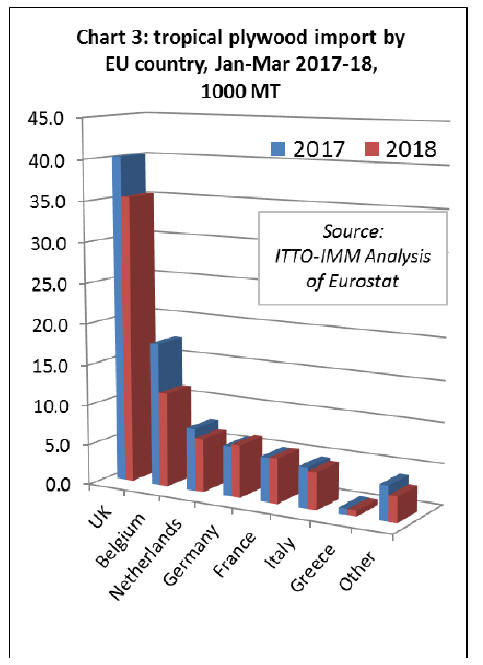

By individual EU country, in the first quarter of 2018,

imports of tropical plywood declined in the UK by 12% to

35,331 tonnes, Belgium by 34% to 11,630 tonnes,

Netherlands by 15% to 6,601 tonnes, Italy by 8% to 4,592

tonnes and Greece by 7% to 723 tonnes.

In contrast, German imports increased 5% to 6,480 tonnes

and French imports were up 32% to 5,530 tonnes in the

first quarter of 2018. (Chart 3).

EU first quarter imports of ¡®other¡¯ (i.e. non-tropical)

hardwood plywood from Russia, China, Ukraine, Belarus,

Bosnia Herzegovina, Uruguay and Brazil and other

suppliers were 276,042 tonnes, a 2% gain against 269,471

in the first quarter of 2017.

Softwood imports, primarily from Brazil, Russia, Chile,

China, South Africa, Uruguay, Canada and Norway, were

335,590 m3 in the first quarter of 2018, 13% more than the

same period in 2017.

Plywood importers comments on FLEGT licensing

Asked about FLEGT licensed Indonesian plywood,

importers interviewed for this market report said it had not

had significant impact on their purchasing or sales.

One commented that this was related to lack of supply

from Indonesia generally. Another said that they had

recently seen an upturn in demand for marine ply from

Indonesia. ¡°But that¡¯s been due primarily to the excellent

quality from our suppliers,¡± he said.

Importers also cited customer¡¯s preference for FSC and

PEFC certification, with FLEGT licensing regarded as a

¡®bonus form of legality verification¡¯. ¡°We still don¡¯t

believe that enough is known about FLEGT licensing or

the wider FLEGT Voluntary Partnership Agreement

initiative in the marketplace, particularly in terms of itson

the ground impacts in the supplier country,¡± said an

importer.

¡°We still need more communication on FLEGT generally,

with awareness greater among our customers of

Indonesia¡¯s long-established SVLK timber legality

assurance system, which became the TLAS of its FLEGT

VPA, than FLEGT itself. Certainly, little is known of the

sustainability aspects of FLEGT licensing.¡±

UK TTF Managing Director David Hopkins took up the

themes of awareness and market impact of FLEGT

licensing at the recent FLEGT Independent Market

Monitoring Trade Consultation in Nantes, France at the

end of May. He urged the EU industry to press their

national governments to accept a FLEGT licence as

evidence of full compliance with their timber purchasing

policy, which currently only those of the UK and

Luxembourg do.

¡°We actively promote the fact to the market that the UK

government accepts a FLEGT licence as ¡®Category A¡¯

proof of legality and sustainability on a level with what we

regard as branded certification businesses, FSC and

PEFC,¡± he said.

The UK TTF has also taken steps to ensure Chinese

plywood satisfies standards claimed in documentation and

labelling. After a year-long review of the market, it has

now established a new ¡®plywood framework¡¯ within its

compulsory Responsible Purchasing Policy.

This demands that UK TTF members ensure third-party

testing of glue bonds and obtain all relevant paperwork on

suppliers¡¯ factory production controls. The TTF stipulates

too that all packs should be marked with product technical

class and timber species used. It has also started a market

education programme to tackle ¡®ignorance about plywood

classes and their application¡¯.

Cautious optimism about future EU plywood demand

Looking to the future, despite recent supply issues and

price hikes, EU importers say that they remain cautiously

optimistic to upbeat about prospects for the rest of the

year.

Demand in coming months was variously predicted to be

¡®stable¡¯ to ¡®robust¡¯ and customers are reported to be

broadly accepting the reasons for price rises.

¡°When they see it¡¯s across the market and effectively out

of our hands, they pay the increase,¡± said one company.

Supply from Asia is also expected to improve as the dry

season improves raw materials flows and Chinese mills

complete implementation of the new environmental rules.

There is also some positive news from France¡¯s Rougier

Group, whose African operations entered creditor

protection earlier this year.

Speaking at the Carrefour International du Bois exhibition

at the end of May, Romain Rougier said that, while the

Group is exploring various options for its troubled

Cameroon operations, it is determined to stay in Africa in

the form of its successful and growing Gabon business,

which includes its 37,000m3 per year plywood mill.

Underscoring this commitment, Rougier used the French

show to launch Mokalam, a new range of thermally

modified cladding from Gabon based on okoum¨¦ and

frak¨¦, with plans to add further species.

|