Japan

Wood Products Prices

Dollar Exchange Rates of 10th

June 2018

Japan Yen 110.38

Reports From Japan

¡¡

Risk of recession could be avoided

if private

consumption picks up

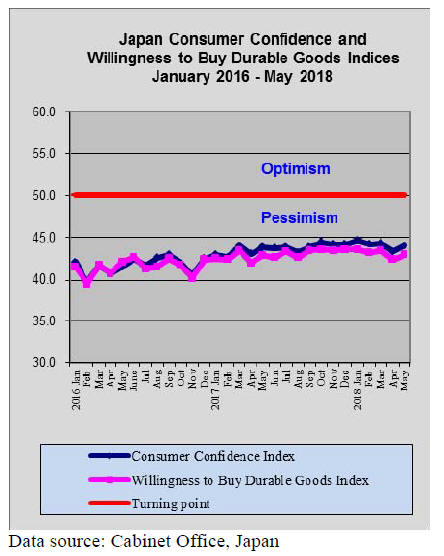

The economic contraction in the first quarter of this year

brought to an end the eight consecutive quarters of growth,

the longest sequence of growth since 1986.

Japan¡¯s GDP shrank 0.6% on an annualised basis in the

first quarter, driven down by weak private consumption. If

the second quarter data is also negative then Japan will be

in a technical recession which will put more pressure on

the already embattled prime minister. However, most

analysts think recession can be avoided as the latest

monthly data suggest consumption is picking up again as

demand in the US and EU is firm.

On the downside, Japanese workers¡¯ inflation-adjusted

real wages were unchanged in April from a year earlier

putting arise consumer spending at risk. The April

weakness follows a modest increase in real wages in

March. This latest data will disappoint the Bank of Japan

as it struggles to meet its 2% inflation target.

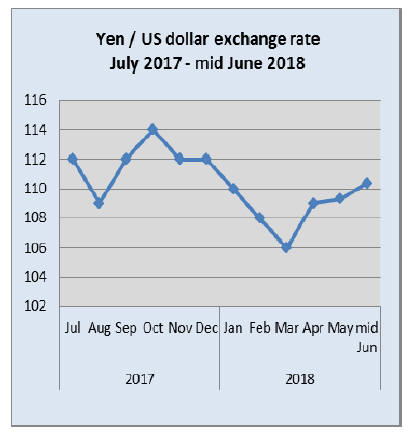

Domestic politics unsettling yen exchange

rate

In mid-month and after the Trump/Kim summit the dollar

strengthened against the yen rising from 109.70 to 110.30

as it became apparent the summit was a success. The US

Federal Reserve raised interest rates for the second time

this year in June and this gave the dollar a boost.

Analysts point out that the main risk to the yen is domestic

politics as there appears to be a leadership battle looming

because of recent scandals involving the prime minister. A

change at the top of the ruling party may spell the end of

¡®Abenomics¡¯ the 'loose monetary policies that have kept

held the yen down and boosted exports.

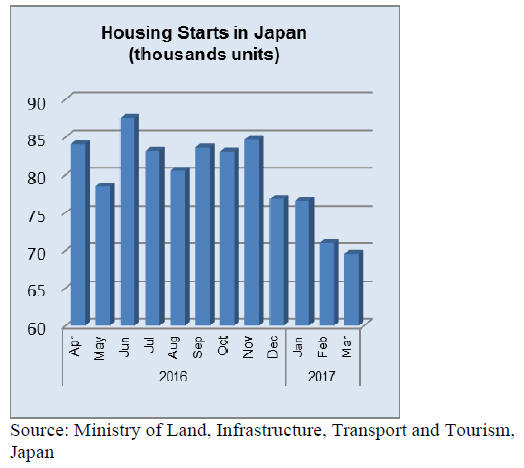

Boost to pre-owned home market

As new home prices in the main cities in Japan continue to

rise more first time buyers are beginning to look at the less

expensive pre-owned home market. For the last several

years, the market for pre-existing homes in Tokyo has

been expanding while growth in sales of new homes has

been more subdued.

Buying a pre-owned home and arranging for renovations

can be a difficult and risky. Until recently it was difficult

to find specialists able to assess the structural integrity of

old homes. This has now changed and could breathe new

life into the pre-owned home market.

A consortium of the ten biggest Japanese housing

developers in Japan have come together to form a ¡®Quality

Housing Stock Association¡¯ and this offers a service to

inspect and certify the quality of a pre-existing home. This

service will give buyers more confidence in distinguishing

good old properties from bad.

The Association announced last year that it would provide

free defect insurance to consumers buying a pre-owned

home built by one of its ten members. For five years after

purchase, new owners will be eligible for up to 10 million

yen in compensation to repair any major defect.

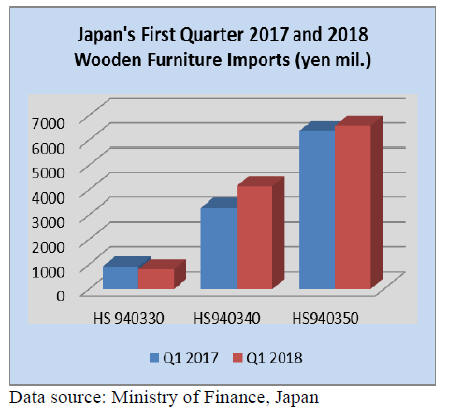

Furniture imports

In the first quarter of 2018 the value of imports of wooden

kitchen and bedroom furniture was higher than in the first

quarter of 2017. However, the value of wooden office

furniture imports over the same period declined.

As was the case in the first quarter of 2017, wooden

office

furniture imports accounted for around 8% of all wooden

furniture imports followed by wooden kitchen furniture at

around 30%. The main wooden furniture item imported

into Japan is bedroom furniture which regularly accounts

for around 60% of all wooden furniture imports.

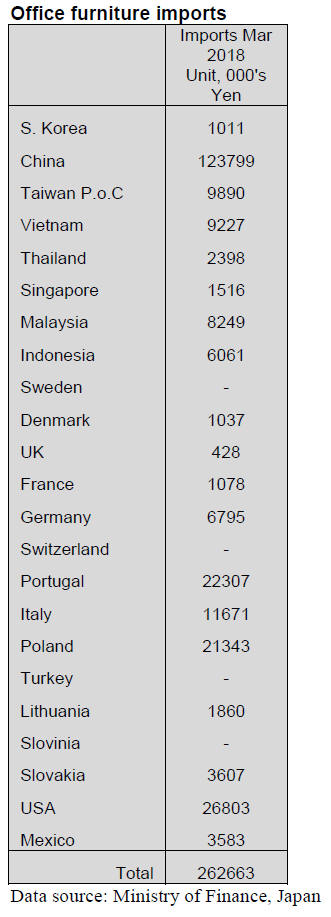

Office furniture imports (HS 940330)

Since August 2017 the value of Japan¡¯s wooden office

furniture imports (HS940330) have been slowly rising

reflecting improving business confidence and corporate

spending.

The value of March 2018 imports were some 35% above

the low in August 2017. March saw a sharp decline in

shipments of wooden office furniture from China. In

previous months shipments from China regularly

accounted for around 70% of all wooden office furniture

imports but in March this year shipments accounted for

less than 50%.

Month on month, imports of wooden office furniture

dipped just 3% despite the big decline in shipments from

China and were supported by significant increases in

imports from Portugal and Poland.

Year on year, Japan¡¯s imports of wooden office furniture

in March were at around the same level as in March 2017.

Kitchen furniture imports (HS 940340)

Year on year, the value of Japan¡¯s March 2018 imports of

wooden kitchen furniture were 25% higher but compared

to levels in February 2018 March imports were down 6%.

Manufacturers in the Philippines have steadily gained

market share and in March this year were the number one

shipper of wooden kitchen furniture to Japan accounting

for around 50% of all wooden kitchen furniture imports by

value.

Vietnam is the second ranked supplier of wooden kitchen

furniture to Japan and in March accounted for over 30% of

Japan¡¯s imports of this category of wooden furniture.

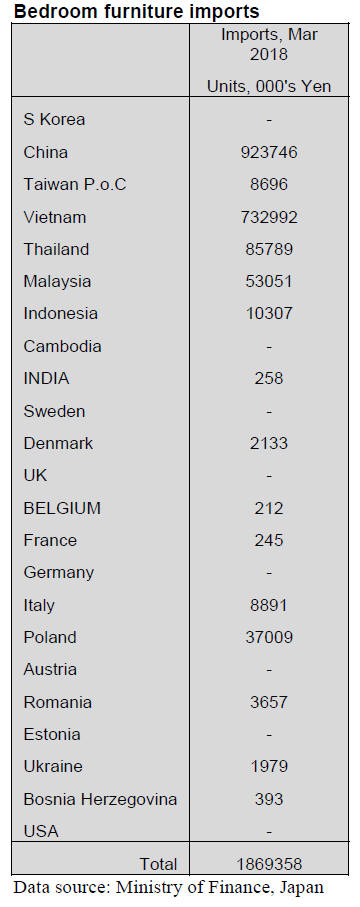

Bedroom furniture imports (HS 940350)

The sharp downward correction in February in the value of

Japan¡¯s imports of wooden bedroom furniture extended

into March. Year on year, wooden bedroom furniture

imports in March were down 20% and compared to levels

in February there was a 17% decline.

This downward trend has been a familiar pattern with

wooden bedroom furniture imports in Japan. Every year

the value of bedroom furniture dips around in the first and

second quarters and then picks out later in the year.

In March this year there was a steep fall in the value of

imports of wooden bedroom furniture from China (-29%)

but still manufacturers in China account for almost half of

the value of all Japan¡¯s wooden bedroom furniture

imports.

Vietnam was the second largest shipper of wooden

bedroom furniture in March this year and the combined

shipments from China and Vietnam account for over 90%

of Japan¡¯s imports of bedroom furniture.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Demand shifting to domestic wood

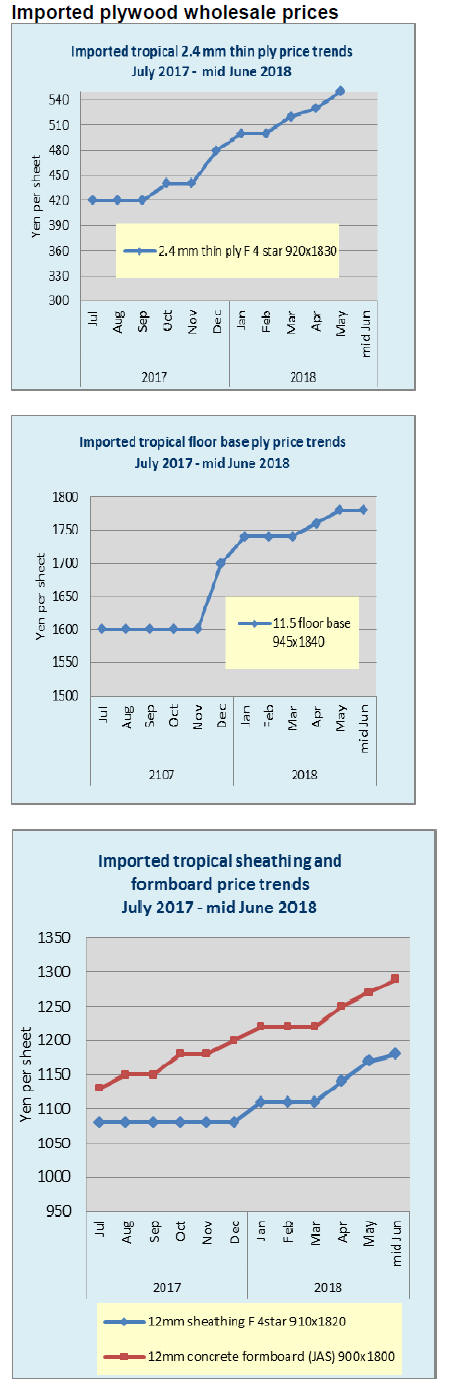

It becomes apparent that worldwide demand for wood

products has kept growing year after year so the export

prices by the suppliers continue to climb.

Besides wood products¡¯ prices, other cost like oil price

rose to US$70 per barrel, the highest in three and half

years, which pushes cost of ocean freight, various

chemical products prices like adhesive for plywood and

laminated lumber.

Looking at sources of wood products supplying countries,

North American logs and lumber prices jumped up by

active lumber market with high housing starts in the

U.S.A. so the export prices soared and the supplying

volume declines.

European lumber is the same as the demand is expanding

worldwide, particularly by China and North America.

Hardwood plywood prices from Malaysia and Indonesia

soar to US$560 per cbm C&F, US$30 jump at one time.

Japan used to be the largest importing country of radiata

pine logs from New Zealand but now China is dominant

player by far so Japan has to follow China prices. Chilean

radiate pine lumber has steady demand in Japan but Japan

is not able to buy enough volume in competition with

other markets.

In short, Japan is no longer dictating the desired purchase

prices or importing volume.

In this situation, domestic wood is reviewed again.

Domestic products are nothing to do with exchange rate of

foreign currencies so the cost is closely forecasted.

In recent years, subject of large investment for

manufacturing domestic wood has been mainly plywood

plants but now large size sawmills have been built one

after another after sawmills receive steady lumber orders

when supply of imported wood products is unstable and

the prices of foreign products continue climbing.

Good example is Cypress Sunadaya, which used to be

major North American yellow cedar lumber manufacturer

but after supply of yellow cedar becomes desperately low,

it changed to domestic cypress as there is mounting

demand for domestic cypress sill. It consumes over 10,000

cbms of cypress a month.

According to the survey made by the Japan Forest

Products Journal, there are about 40 sawmills in Japan,

which consume more than 60,000 cbms of logs a year and

total log consumption by these is about 5,000,000 cbms.

Since total log consumption by all the sawmills in Japan is

about 16,000,000 cbms, these large ones takes about one

third of total sawmills. Number of sawmills, which

consume logs over 100,000 cbms a year is about 20 in

Japan. By species, cedar is by far the largest.

Chugoku Lumber¡¯s Hyuga mill consumes about 440,000

cbms of logs a year then it is preparing the second mill,

which will consume about 300,000 cbms so total log

consumption would be close to one million cbms

including other plants like laminated lumber and biomass

power plant.

National forest business plan for 2018

For fiscal year of 2018 (April 2018 through March 2019),

total sales of logs are 2,596,000 cbms, 0.6% more than

2017 and total sales of standing timber are 3,199,000

cbms, 10.5% more. System combined sales of national

forest logs and private logs will be 37 cases from 21 cases

in 2017.

To back up settlement of new forest management system,

which will start next year, large lot with long term of

harvest and sales of National Forest resources is newly

considered.

Plan to build new logging road system is 152 kilometers,

41 kilometers less than 2017 because of reduced

supplementary budget and acreage of thinning is 110,000

hectares, 10,000 hectares less.

Plantation area is 5,100 hectares, 13.3% more than 2017.

National Forest has been trying to reduce the cost of

replantation by introducing containerized nursery trees. In

2016, two million containerized nursery trees were planted

then in 2018, plan is to plant six million trees.

New forest management system, which will be introduced

in 2019, is for private forest. To support such system,

national forest will introduce timber harvest in large scale

and much longer period it has never done before. Concrete

schedule has not been disclosed yet but so far, timber

system sale can be extended for five years so this new

system should be much longer than this.

Climbing radiata pine log prices

Radiata pine log export prices from New Zealand have

been rising. The prices for China finally passed over

US$150 per cbm C&F. Log prices for Japan are also

climbing with higher ocean freight.

Present prices for China are US$151-152, about US$4

higher than last month. Log arrivals in China for March

and April marked record high level with steady shipments.

Port log inventories maintain at about five million cbms.

New Zealand log suppliers had held the export prices for

some time but seeing strong demand in China, they

decided to increase the prices.

Log prices for Japan are about US$160 per cbm C&F,

US$5-6 higher than April. Ocean freight is one of major

reasons of price increase. There are a limited number of

ships for Japan and higher crude oil price pushes freight

up. Exchange rate has been weakening, which pushes yen

log cost up higher so sawmills are in tougher spot. Crating

lumber demand is slowing after April.

Future is hard to predict but normally China market slows

down in June and July by seasonal reason so steep price

hike may ease.

South Sea (tropical) logs and lumber

Log market prices in Japan are holding unchanged. There

is no chance that log prices soften as export

prices continue climbing. Supply of keruing for lumber is

very tight so that the market is looking for

semi-finished products.

Products like window frame are made by South Sea

hardwood lumber but after availability of such lumber is

hard to come by, the demand is shifting to laminated free

board made by mercusii pine, acacia and radiate pine.

Demand of free board is expanding for DIY stores and

falcate product is getting popular because the prices are

lower than mercusii pine.

New move is that Japanese cedar logs are exported to

China, which is processed into laminated free board and is

shipped back to Japan, which competes with falcate

lumber

Tight supply of Vietnamese plywood

Supply of Vietnamese eucalyptus plywood for crating is

getting tight so the distribution volume in Japan is

dropping considerably.

In Vietnam, construction of large plywood mills by the

Chinese capital has started one after another. In April,

plywood plant with monthly production of 25,000 cbms

has started operation near Hanoi and another one with

monthly production of 12,000 cbms will start up in

coming summer also near Hanoi.

These plants purchase eucalyptus veneer in large volume

as raw material so smaller plants manufacturing for Japan

market are not able to have enough veneer.

The large plants use both eucalyptus and acacia veneer but

a majority is eucalyptus. Manufactured products are

interior materials for trailer and base materials for floor

heating for the U.S.A. and Korea. These items are much

higher priced so the large plants are unlikely to

manufacture low priced crating plywood for Japan market.

Purchase competition of raw material veneer pushes

plywood prices up as high as US$310 per cbm C&F and

further increase is expected. This level of price is way too

much for the market in Japan. The importers in Japan

think that this is not temporarily price increase but by

structural change so future supply is very uneasy.

|