|

Report from

North America

Hardwood plywood imports from China continue to

fall

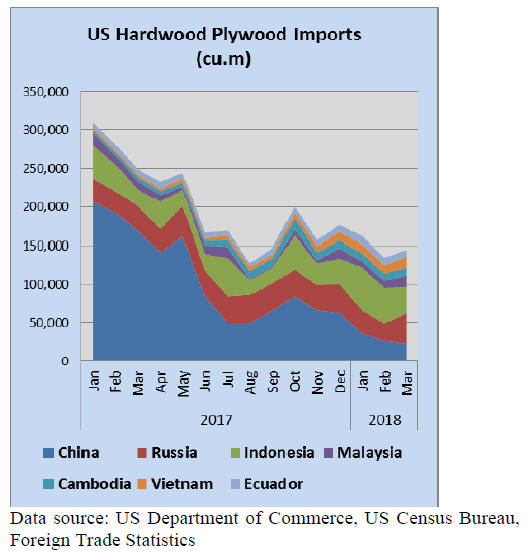

Year-to-date hardwood plywood imports were down 40%

in March compared to March 2017. Imports from

Vietnam, Cambodia, Indonesia and other suppliers

increased, but do not yet make up for the plunge in

plywood imports from China

The US imported 191,567 cu.m. of hardwood plywood in

March, up 11% from February. Imports from China

continued to decline month-over-month, while Russia,

Malaysia, Vietnam and Cambodia increased plywood

exports to the US market.

Vietnam, a major source of assembled flooring panels

Hardwood flooring imports increased for the third

consecutive month to US$5.8 million in March. The

growth was largely in Chinese shipments, while imports

from Malaysia and Indonesia declined.

Imports of assembled flooring panels (engineered and

laminate) declined for the third consecutive month.

Imports from China fell by half in March. Vietnam has

become a major source of assembled flooring panels with

over US$0.5 million worth of flooring shipped to the US

in March.

Drop in furniture imports from China and Vietnam

Wooden furniture imports declined for the second

consecutive month in March to under US$1.38 billion.

Year-to-date imports were 11% higher than in March last

year.

The decline was almost entirely in imports from China and

Vietnam. Chinese furniture shipments to the US fell 24%

month-over-month, although this drop was from very high

import levels over the last winter.

Wooden furniture imports from Mexico, Indonesia,

Malaysia and India were up in March. Imports of all types

of wooden furniture were down with the strongest

decrease in kitchen furniture/cabinets.

Furniture market indicators generally positive, but

cabinet sales slide

The wood products manufacturing sector reported the

strongest growth in April of all manufacturing industries,

according to the Institute for Supply Management¡¯s

Manufacturing ISM Report On Business. The furniture

industry also reported growth in April.

New orders in February 2018 were 5% higher than orders

in February 2017, according to the latest Smith Leonhard

survey of residential furniture manufacturers and

distributors. Year-to-date furniture shipments were up 1%

from last year.

Cabinet sales in March declined 1.7% from the same time

last year, according to the Kitchen Cabinet Manufacturers

Association (KCMA)¡¯s monthly Trend of Business

Survey.

Year-to-date cabinetry sales through March 2018 were

also down compared to the same quarter in 2017.

Retail sales of furniture and home furnishings declined

slightly in April from the previous month, but sales to date

in 2018 grew 5.3% compared to the same time in 2017.

No further decline in unemployment expected by

consumers

The unemployment rate declined from 4.1% in March to

3.9% in April, according to the US Bureau of Labor

Statistics. Similar to the previous month, employment in

manufacturing increased.

Consumer confidence in the US economy changed little

from April to May, according to the University of

Michigan survey of consumers. Most respondents expect

interest rate hikes during the year ahead. Consumers

expect the unemployment rate to not drop further, but

rather be steady at its current (low) level.

Housing affordability and supply remain key issues

Multi-family housing construction was down in April,

while single-family starts were unchanged from March,

according to the latest data release by the US Census

Bureau and the US Department of Housing and Urban

Development.

The overall decline is not unexpected since multi-family

starts were exceptionally high in March. The National

Association of Home Builders expects single-family

construction to grow in 2018, which would have a greater

knock-on effect on demand for wood products and

furniture than growth in multi-family construction.

Existing-home sales grew for the second consecutive

month in March, but lagging inventory levels and

affordability constraints kept sales activity below year ago

levels, according to the National Association of Realtors.

|