US Dollar Exchange Rates of 10th May

2018

China Yuan 6.3269

Report from China

Declining wood products trade between China and the

USA

According to the data from China¡¯s Customs the value of

wood products trade between China and the USA fell 16%

to US$1,90 million in March 2018. China¡¯s imports

dropped 5% to US$840 million while exports declined

23% to US$1,050 million.

However, the value of wood products trade between China

and the USA in the first three months of 2018 rose about

9% to US$6.26 billion, China¡¯s imports increased about

6% to US$2.28 billion while exports value grew 10% to

US$3.98 billion.

Log and sawnwood imports

China¡¯s log imports from the USA in the first three

months of 2018 totalled 1.41 million cubic metres, a year

on year increase of 7% over the same period of 2017.

China¡¯s sawnwood imports from the USA in the first three

months of 2018 rose 5% to 709,600 cubic metres.

Exports fibreboard and plywood

China¡¯s fibreboard exports to the USA fell 11% to 71,200

cubic metres and plywood exports to the USA dropped

31% to 360,000 cubic metres in the first three months of

2018.

As exports to the USA decline there has been a rise in

exports of panel products to Nigeria, Kenya and the UK.

In the first quarter of 2018 export volumes to these three

markets were Nigeria; 78,900 cubic metres, Kenya; 9,800

cubic metres and UK; 6,000 cubic metres..

The direction of trade of China¡¯s plywood exports has also

altered with the UK, Thailand and Nigeria becoming more

prominent. China¡¯s plywood exports to the UK, Thailand

and Nigeria rose 28%, 74% and 270% respectively.

Rise in tropical hardwood log imports

China¡¯s log imports were 14.38 million cubic metres in the

first three months of 2018, up 14% over the same period

of 2017, hardwood log imports rose 25% to 4.93 million

cubic metres.

Of total hardwood imports in the first quarter 2018,

tropical hardwood log imports totalled 2.65 million cubic

metres, up 23% over the same period of 2017 and

accounted for 18% of the national total. The value of

tropical log imports in the first three months of 2018 was

US$837 million reflecting a 28% rise.

The average price for imported tropical logs in the first

three months of 2018 rose 5% to US$316 per cubic metre.

Before its log export ban Myanmar was a major source of

tropical logs for China. Data from China¡¯s Customs shows

log imports from Myanmar in the first three months of

2018 were just 2,500 cubic metres valued at US$3.43

million. At an average price of US$1,372 it seems unlikely

that these were plantation logs.

China imported tropical logs mainly from Papua New

Guinea (32%), Solomon Islands (28%), Equatorial Guinea

(11%), Nigeria (5%), Cameroon (5%), Congo Brazzaville

(4%). The top 10 suppliers accounted for over 90% of

China¡¯s tropical log imports in the first three months of

2018.

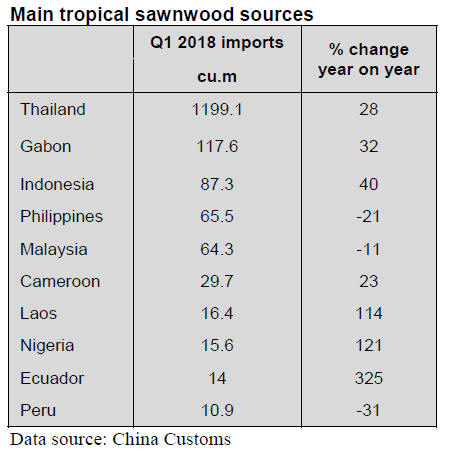

Rise in tropical sawnwood imports

China¡¯s sawnwood imports were 8.29 million cubic metres

in the first three months of 2018, up 5% over the same

period of 2017. Sawn hardwood imports rose 15% to 2.91

million cubic metres.

Of total sawn hardwood imports, sawnwood imports from

tropical coumtries were 1.67 million cubic metres valued

at US$662 million, up 25% in volume and 32% in value

and accounted for 20% of the national total.

The average price for sawnwood imported from tropical

countries was US$395 per cubic metre, down 7% from the

the same period of 2017. Six tropical countries supplied

just over 90% of China¡¯s ¡®tropical¡¯ sawnwood

requirements in the first three months of 2018 namely,

Thailand (72%), Gabon (7%), Indonesia (5%), Philippines

(4%), Malaysia (4%) and Cameroon (2%).

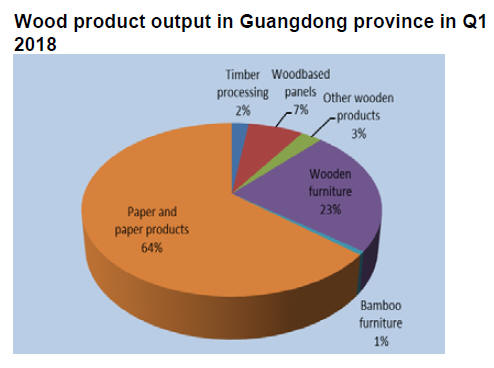

Slow growth in timber processing industry of

Guangdong province

It has been reported that the growth of timber processing

industry in Guangdong province slowed in the first three

months of 2018 and the value of output was RMB100.39

billion. Paper products and wooden furniture are the main

outputs from the industry in Guangdong province.

Analysts write that the main reason for the decline in the

value of wooden furniture and flooring output is that

enterprises, especially the Taiwanse companies, have

relocated to Vietnam being attracted by lower taxes and

the educated and abundant labour force.

The products manufactured by companies in Vietnam are

very competitively priced in the international market

which has created a marketing challenge for those

remaining in Guangdong. An additional factor weakening

output from Guangdong mills is that Guangdong Real

Estate Regulations and control policies in the province

have resulted in an almost 10% drop in housing starts.

A further factor behind the decline in output has been the

closure of plants that were technically deficient or could

not afford to comply with stricter environmental

regulations.

|