Japan

Wood Products Prices

Dollar Exchange Rates of 10th

May

2018

Japan Yen 1097.43

Reports From Japan

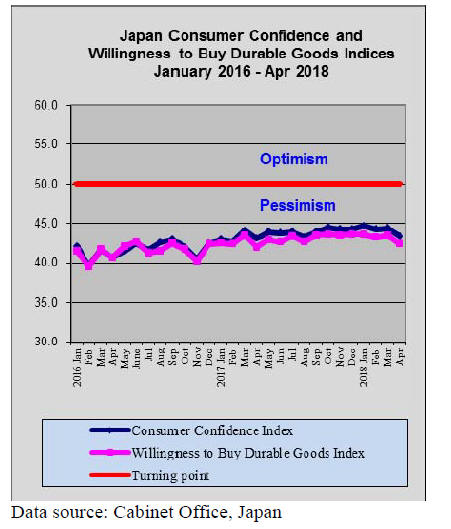

Consumer confidence drops to

eight month low

The Cabinet Office April survey suggested Japanese

consumers felt negative on economic prospects, the first

drop in two months. The consumer confidence index for

April dropped to an eight-month low of 43.6 from 44.3 in

March.

Japan's six-year economic recovery slowed in the first

quarter of this year as the pace of growth in exports

slipped while at home rising prices for everyday goods

began to worry consumers.

Analysts attribute the decline in the consumer confidence

to rising utility costs, higher fuel costs (which are

impacting home delivery and other service charges) and

the perception that food prices are rising while incomes

are stagnant.

The confidence sub-index for ¡®livelihood¡¯ also fell in April

and the index for income growth also dropped. In addition

there were noticeable declines in the indices for

willingness to buy durable goods and the employment

prospects.

Changes in consumer behavior

An article from McKinsey & Company, an

American consulting firm with offices in Japan, says

Japanese consumers are now behaving more like their

counterparts in Europe and the United States.

Once noted for their willingness to pay for quality and

avoiding cheaper products, Japanese consumers are now

showing keen interest in discount and online bargains.

This shift in the attitudes and behavior of Japanese

consumers seems likely to persist, says the McKinsey

report, even if the economy recovers because of the rise

internet shopping across all age groups and the emergence

of a less materialistic younger generation.

This conclusion is borne out by trends in the furniture

market where off-shore manufactured low cost items are

capturing market share from the traditional ¡®last a life

time¡¯ furniture styles.

For the full article see;

https://www.mckinsey.com/industries/consumer-packagedgoods/

our-insights/the-new-japanese-consumer

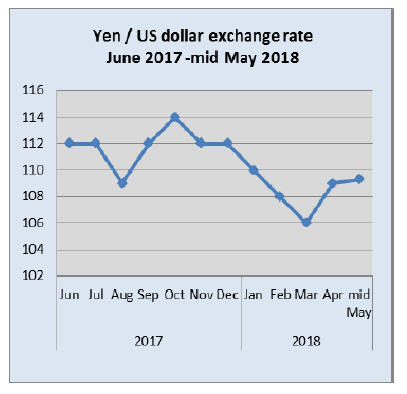

Yen set to weaken further

The US dollar rallied against the yen in early May and

steadied at just over 109 yen per US dollar. This marked

the sixth consecutive week of yen depreciation due to the

rise in the dollar because of the hawkishness sentiment in

the US Federal Reserve.

Analysts say the outlook for the yen remains weak as the

US dollar¡¯s strength is likely to continue. All eyes are on

the upcoming meeting between Trump and Kim. If there

are signs that progress on denuclearisation on the Korean

Peninsula is possible then further dollar strength is

forecast.

Overall, say commentators, the yen looks set to extend its

depreciation to 110.0 against the US dollar. But this

depends on prospects for further interest rate hikes in the

US and the Bank of Japan maintaining its loose monetary

policy.

5-fold growth in smart home demand forecast

Interest in ¡®smart homes¡¯ is growing in Japan and a recent

report from Orbisresearch entitled ¡®Japan Smart Home

Industry Production, Sales and Consumption Status and

Prospects¡¯ says the smart home market in Japan could

grow almost fivefold by the year 2024.

The smart home system allows home owner to remotely

control and monitor different devices in the home such as

cooling, lighting, security and more. In Japan, there is a

demand for a safe and secure living environment,

especially concerning safety functionalities and discrete

monitoring for elderly people.

For more see: http://orbisresearch.com/contacts/requestsample/

2035854

Home builder grabs Global Environment Award

The Japanese house builder, Sekisui House, one of Japan's

largest homebuilders in the country was awarded the

Grand Prize during the April Annual Global Environment

Awards for its eco-friendly, anti-disaster ¡°Smart-

Community¡¯ Projects. Four other companies were

recognised for their environmental initiatives during the

award ceremony.

The Global Environment Award and Fujisankei

Communications Group FCG-sponsored Grand Prize has

been presented annually with the goal of recognising

businesses and other organizations for their innovations

and activities conducive to curbing global warming and

environmental conservation.

Sekisui House was rewarded for a range of work,

including its role in constructing energy self-sufficient,

disaster resilient ¡®smart communities¡¯ in 16 locations

across Japan.

See: https://japan-forward.com/sekisui-house-leads-globalenvironment-

awardees-2018/

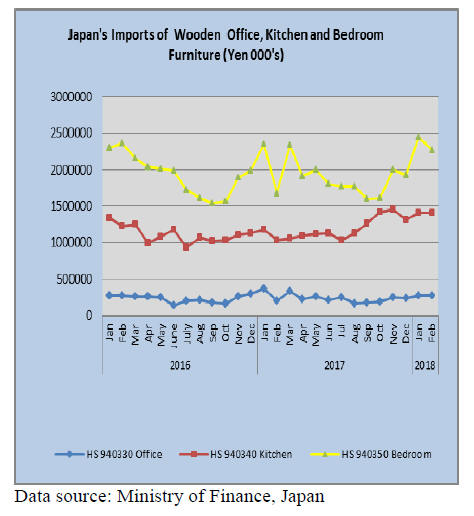

Furniture imports

The value of Japan¡¯s February 2018 imports of wooden

office, kitchen and bedroom furniture was largely

unchanged from the previous month but significantly

higher than in February 2017.

Compared to the value of imports in February 2017,

February 2018 import values for all three categories of

wooden furniture being tracked jumped over 30%. From

mid-2017 there has been a steady rise in the value of

furniture imports.

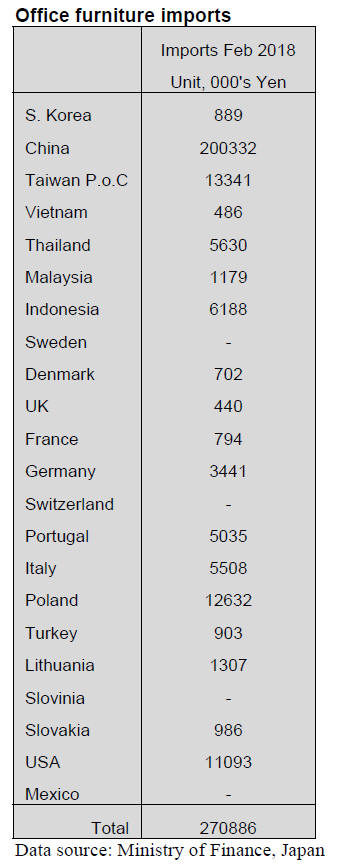

Office furniture imports (HS 940330)

August 2017 marked the low point in Japan¡¯s imports of

wooden office furniture (HS 940330). Since then imports

have risen steadily and only in February 2018 was there

the first signs of a slowdown as imports dropped about 1%

compared to January.

Year on year wooden office furniture imports in February

2018 were some 32% above the value of February 2017

imports. The top four shippers of wooden office furniture

(HS 940330) to Japan in February 2018 accounted for

almost 90% of all imports of this category of furniture.

China was the largest supplier at 74% of the total in

February followed by Taiwan P.o.C (5%), Poland (5%)

and the US (4%).

Kitchen furniture imports (HS 940340)

February imports of wooden kitchen furniture (HS

940340) were flat month on month but compared to a year

earlier February imports jumped 30%.

In February 2018 there was a sharp rise in Japan¡¯s imports

of wooden kitchen furniture from China (+55%) and a

25% rise in the value of imports from Italy. The other

main shippers, the Philippines and Vietnam say export

values drop.

The Philippines is emerging as the major supplier of

wooden bedroom furniture to Japan and in February 2018

topped the rank of suppliers being followed closely by

Vietnam.

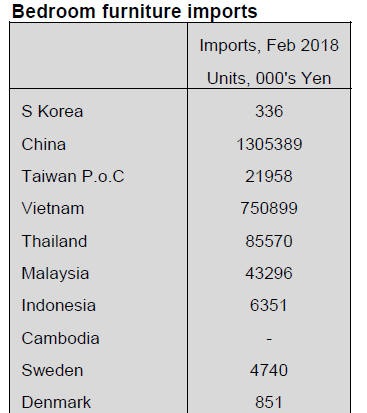

Bedroom furniture imports (HS 940350)

February marked a correction in the value of wooden

bedroom furniture imports with month on month imports

dropping 7.5%. However, year on year, February 2018

imports were 35% higher.

Two shippers account for over 90% of Japan¡¯s wooden

bedroom furniture imports, China (58%) and Vietnam

(33%) with the third ranked shipper, Thailand, only

managing around 4%.

In February this year shipments from China were flat and

shipments from Vietnam dropped 13% with most other

minor suppliers recording slightly lower shipments.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Wood demand projections

The forestry Agency held wood demand projection

meeting for the second and third quarter of this year.

Generally demand for imported wood products would

decline for both logs and lumber while domestic logs for

lumber and plywood would increase. This would improve

self-sufficiency rate but may result in oversupply of

domestic logs.

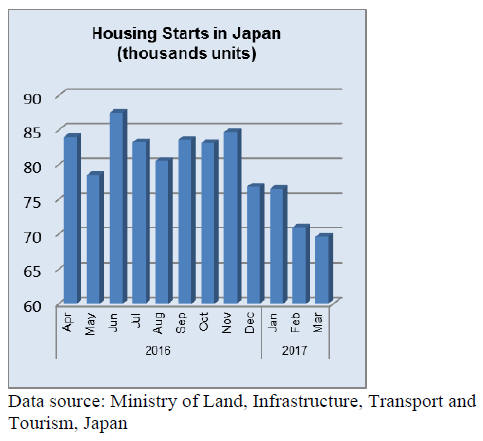

Reflecting continuous decline of new housing starts

compared to the same month a year earlier, forecast of

new housing starts by 12 private think tanks is average of

953,000 units, 8,000 units lower than previous forecast.

Due to high export prices, import of North American logs

and lumber would decrease. Log supply for the second

quarter would improve so the import would increase by

2.4% but the third quarter import would decline by 4.5%

due to forest fires during summer months.

The demand for these quarters would stay unchanged from

2017. Actually the demand is more than the supply.

Supply of North American lumber would decline by 4.7%

for the second quarter and the third quarter supply volume

would stay the same as last year but the demand for the

second quarter would decline by 8.3% and for the third

quarter by 5.1% because of high export prices due to

overheated U.S. lumber market.

The supply is more than the demand so that the inventories

at the end of the third quarter would increase. European

lumber, which has increased for two straight years, would

keep decreasing all through 2018 as the supply side is

more interested in other markets and the prices in Japan

have climbed high enough.

Supply of both domestic and imported structural

laminated lumber for the second quarter would decline by

4.3 % and for the third quarter by 3.8%. Reasons are

continuous stagnation of whitewood products and

dropping orders for redwood beam as the demand has

peaked on imported products while domestic production

would stay almost the same as last year.

Radiata pine log supply declined while lumber supply

increased in 2017. In 2018, log supply would stay the

same as 2017 and lumber would increase slightly in 2018.

By higher prices of radiate pine lumber, the demand would

shift to lower cost domestic cedar lumber.

Russian log import would continue low through the third

quarter due to higher log export duty. Russian lumber

import increased by 10.4% in the first quarter but the

second quarter supply would be the same as 2017 then

drop by 9.1% for the third quarter. Reason is that other

markets are more attractive for the Russian suppliers.

Demand for domestic logs would keep increasing through

the third quarter. For lumber, the Forestry Agency made

policy to give subsidy for use of solid wood then new

plywood mill started in April.Also log export would

increase to all the market, particularly for China.

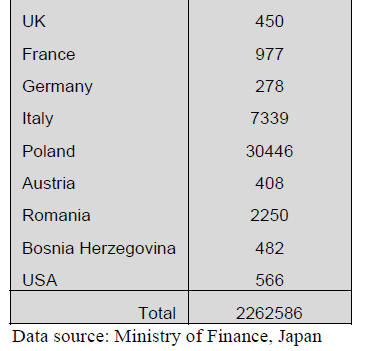

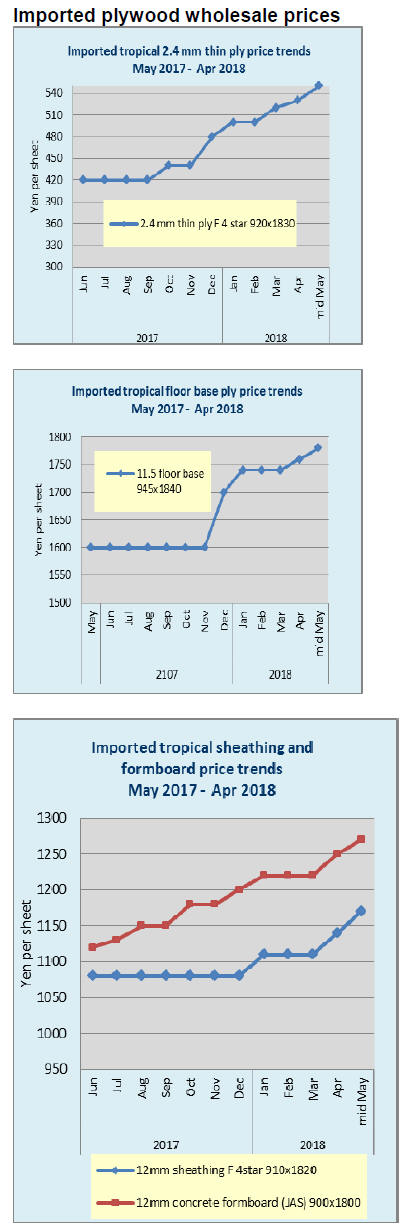

South Sea (tropical) logs and lumber

Rainy season in the South East Asian countries seems to

be over now and log production is recovering but it will

take quite some time to solve log shortage for local

plywood mills. With aggressive log purchase by India and

China, log prices would continue high.

Plywood mills in Japan are not able to pay any more high

prices for logs despite low log inventories while orders

rush in with declining supply of imported plywood. Log

prices of meranti regular are unchanged at 12,000 yen per

koku CIF.

Movement of South Sea lumber like free board has not

recovered yet in April but the market prices are high due

to high export prices and the suppliers are declining

supply.

Indonesian mercusii pine and Chinese red pine free board

prices are holding between 115,000-120,000 yen FOB

truck per cbm. There are plenty of inquiries on crating

lumber.

New plywood plant in Miye

Nisshin Group Ltd. (Tottori prefecture) completed

building a new plywood manufacturing plant in Miye

prefecture. It has started the production in April. This is

the first plywood plant in Kii peninsula, where has rich

forest resources.

Total investment is seven billion yen. Total employees are

about 50. The plant is fully automated to save man power.

Annual log consumption is 103,000 cbms at the beginning

and it will be expanded to 120,000 cbms in future.

Main producing item is non-structural panels like floor

base and coated concrete forming panel. Monthly plywood

production will be 6,000 cbms.

To secure logs stably, it has concluded an log purchase

agreement with local forest unions, log auction market and

timber owners. It will have three routes to collect cedar

and cypress logs from Miye prefecture log suppliers,

Nisshin will subsidize cost of replantation for timber

owners, who supply plywood logs by clear cutting.

Nisshin aims to make this plant as the most high

production plant in Japan.

2017 review of laminated lumber

Total supply of both domestic and imported structural

laminated lumber in 2017 was 2,434,799 cbms, 11.1%

more than 2016. Domestic production was 1,567,000

cbms, 10.3% more and imports were 868,00 cbms, 12.5%

more. Both are the highest record.

New housing starts in 2017 were 0.2% less than 2016 but

the demand of laminated lumber grew higher than housing

starts.

Laminated beam lumber prices climbed steadily

supported by strong demand but laminated post prices

stagnated due to over -supply and competition with

domestic low priced cedar laminated post.

By size, small size was 745,300 cbms, 13.4% more,

medium size was 786,700 cbms , 8.7% more and large size

was 32,700 cbms, 10.2% less. Overlaid post was 2,300

cbms, 17.9% less.

While structural laminated lumber supply increased,

supply of laminated lumber for interior has decreased for

four consecutive years with 120,000 cbms, 7.0% less.

Domestic production for both structural and interior was

1,687,000 cbms, 8.9% more, which was 0.6% more than

2006¡¯ record high volume.

Source of raw materials of domestic production was 67%

of European, 26% of domestic and 6% of North American.

Compared to 2016, European increased by 1 point and

North American decreased by 3 point then domestic

increase by 2 points.Rough estimate in volume is,

European was 1,130,290 cbms, 10.5% more than 2016 or

108,000 cbms.

Domestic was 439,000 cbms, 18.0% more or 67,000 cbms.

North American was 101,000 cbms, 27.4% less or 38,000

cbms. North American declined because of higher export

prices and domestic increase was result of higher

production of cedar laminated post.

In total supply of structural laminated lumber, small size

was 1,242,531 cbms, 12.4% more, medium size was

1,155,961 cbms, 10.5% more and large size was 37,400

cbms, 9.2% less.

Domestic share was 64.4%, 0.4 pointless. By size, small

was 60.0%, 0.5 points more. Medium was 68.1%, 1.0

pointless. Large was 96.2%, 1.0 pointless.

Domestic production of small size has increased for two

straight years with 745,300 cbms, 13.4% more. Compared

to 2015, it was 24.2% more. With imported small size,

total supply was 1,242,531 cbms, 12.4% more, which was

more than past record of 1,137,501 cbms in 2013.

The most notable change of small size is rapid expansion

of laminated cedar post production.

Total production of domestic laminated lumber increased

by 18.0% or 66,788 cbms in volume. Two companies of

Chugoku Lumber and Kyowa Lumber increased

production of cedar laminated post by about 70,000 cbms,

which is almost the same as increase volume in total

supply.

Since small size production includes sill, purlin and girder

besides post, it is hard to estimate percentage of post but in

laminated post, 40% may be domestic cedar laminated

post.

In any rate, more than 20% of total supply of small size is

domestic species of cedar, cypress and larch. Cost of

domestic cedar laminated post would be 50,000-53,000

yen per cbm delivered, which is equivalent to 1,650-1,750

yen per piece. Cost of whitewood laminated post has been

1,850-1,900 yen all through 2017.

While prices of other members like sill and beam have

kept climbing, house builders shifted to lower cost cedar

post to reduce overall cost. However, it is doubtful if cedar

laminated post manufacturers make money when the

prices are lower than solid wood KD cedar post. Cedar

laminates post prices used to be higher than whitewood

laminated post.

Price drop to present level is result of competition among

the manufacturers, not by competition with whitewood

laminated post. Meantime, whitewood lamina cost in the

fourth quarter of 2016 was Euro 243-248 per cbm C&F

then it climbed to Euro 255-260 in the fourth quarter 2017.

Euro 12 increase in one year.

With weaker yen, the yen cost rose from 33,000 yen per

cbm FOB truck port yard to 39,000 yen, 6,000 yen

increase. Therefore, there is no winner in terms of

profitability for cedar laminated post and whitewood

laminated post.

European made whitewood laminated post prices also

climbed so the importers were not able to pass higher cost

onto sales prices in stagnant market so they lost money.

Import of small size in 2017 was 497,231 cbms, 11.1%

more than 2016. This is two consecutive years¡¯ increase.

Imported value was 25,863 million yen, 24.2% more than

2016 so average cost rose from 46,534 yen per cbm in

2016 to 52,014 yen in 2017,11.8% or 5,480 yen but

market prices in Japan has not changed much due to

oversupply and competition with cedar post.

Fluctuation of exchange rate of Euro changed the cost

month after month from low of 1,850 yen per piece in

spring to high of 1,950 yen in summer.

European lamina cost seems to keep climbing this year as

demand is strong in Europe and other markets particularly

U.S.A. while demand in Japan seems to be lower than last

year so if high level supply continues like last year, price

hike would be much harder than last year.

On medium size, domestic production was 786,700 cbms,

8.7% more than 2016. Imported medium size increased by

14.3% so total supply of medium size was 1,155,961

cbms, 10.5% more. Since imports increased more than

domestic, share of domestic is down by 1.0 point at

68.1%.

Volume of beam and girder in one unit of house is

estimated about 1.7 times more than post but supply of

medium is lower than small size so share of medium size

laminated lumber is still low.

Beam competition is between redwood laminated beam

and solid wood KD Douglas fir lumber as compared to

post competition is between laminated whitewood and

laminated cedar.Shifting from solid wood to laminated

beam is going faster.

Inquiries on laminated beam was much stronger than solid

wood beam last year so that the prices of redwood

laminated beam climbed smoothly last year. Redwood

lamina export prices in the fourth quarter 2016 were Euro

240-245 per cbm C&F then it rose to Euro 270 for the

fourth quarter 2017 so redwood lamina prices climbed

higher than whitewood lamina.

Imported yen cost climbed from 32,000 yen per cbm to

40,500 yen, 8,500 yen up in one year. Cost of imported

redwood beam rose from 55,000-56,000 yen in the fourth

quarter 2016 to 64,000 yen in fourth quarter 2017, 8,000-

9,000 yen increase in one year.

Domestic manufacturers increased the sales prices since

last July. The prices of domestic made laminated beam

were 56,000 yen per cbm delivered until June. They rose

to 58,000 yen in July then 60,000 yen in September. In

January this year the prices are 63,000 yen.

Competing Douglas fir solid wood KD beam prices were

raised twice late last year by total of 4,000 yen because of

higher log prices, which help pushing laminated beam

prices up higher. Price increase of laminated beam is

smaller than Douglas fir KD beam.

Despite rapid price increase, there is no negative reaction

so laminated beam should have solid demand. Higher

prices of finished product support purchasing power of

redwood lamina.

Medium size laminated lumber import in 2017 was

369,261 cbms, 14.3% more. Share of imports was 31.9%,

1.0 point up. Total value of imports was 19,438 million

yen so the average unit price was 52,641 yen per cbm, up

by 5,875 yen or 12.6%.

Export prices of redwood laminated lumber were Euro 430

at the fourth quarter 2016, which rose to Euro 450 at the

fourth quarter 2017.

Supply capacity of medium size from Europe has been

expanding. Finland has been leading supply country. It

shipped 123,000 cbms in 2013 then increased to 217,000

cbms in 2017. Share of Finland is 59%. Estonia, Rumania

and Germany follow Finland. Plan to increase the

production continues in Europe so the supply will increase

in 2018 as long as Japan pays competitive prices.

|