2. GHANA

Export show positive growth

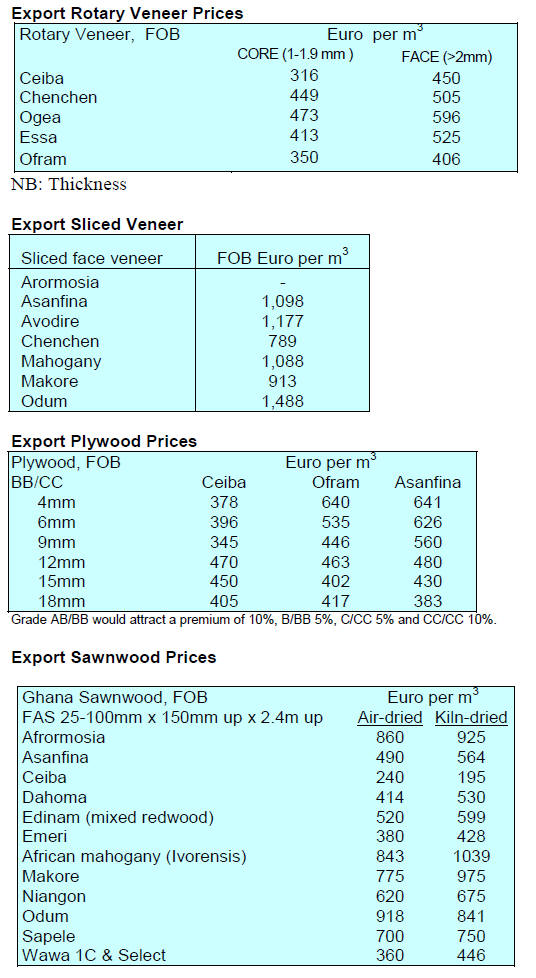

Ghana’s exports of wood products in the first 2-months of

this year totalled 57,539 cu.m compared to 56,501 cu.m

for the same period in 2017. The products that contributed

significantly to the year-on-year increase in trade were as

follows: rotary veneer +19%, dowels +16%, billets +12%,

kiln dry sawnwood +6%, air dry sawnwood +6% and

sliced veneer, +3%.

Of the products exported, sawnwood and billets accounted

for most of the export volumes (+80%). Teak, rosewood,

wawa, ceiba and papao were the dominant species traded

and these were shipped to the India, China, Germany

Vietnam and Belgian markets.

AGI calls for stimulus package for industries

The Association of Ghana Industries (AGI) has appealed

to government for a stimulus package that will allow local

industries to improve export competiveness. The AGI sees

good opportunities for local industries with the signing of

the Economic Partnership Agreement (EPA) on trade with

the EU as well as the African Continental Free Trade

Agreement which will boost trade between African

countries.

In a recent statement signed by its newly elected president

Dr. Yaw Adu Gyamfi, the AGI said “considering the

impact of these agreements on Ghana's revenue prospects

it is expedient for government to give local industries the

needed stimulus package support such as in order to give

meaning to these trade agreements that usher Ghana into

these regimes”.

According to Dr. Adu Gyamfi, manufacturing is a

cornerstone of the economy and urged government to

move quickly to implement the ‘One District One Factory’

policy since this will benefit manufacturers.

Sourcing raw materials from Liberia

In late April the domestic press reported that Anthony

Partey Asare, Director of Communications for the

Domestic Lumber Traders Association of Ghana, said his

Association is looking at the possibility of importing raw

materials from Liberia to address the problem of domestic

timber supplies.

The Association had approached the government

appealing for a waiver import duties. Analysts write, “my

understanding is that this proposal has been discussed at

government levels but the big issue is consideration of

duty waivers on import duties and this has become a

stumbling block”.

Ghana delegation attends UN Forum on Forests

A six-man Ghanaian delegation led by the Minister of

Lands and Natural Resources, Mr. John Peter Amewu,

attended the 13th Session of the United Nations (UN)

Forum on Forests, in New York.

The Minister delivered a keynote address on the Voluntary

Partnership Agreement (VPA) processes in Ghana. The

delegation also be discussed the country’s contribution to

the UN Strategic Plan for Forests (2017-2030).

3.

MALAYSIA

Ministries being reorganised

On 9 May Malaysian elected a new government replacing

the party that had ruled Malaysia for around 60 years. The

government is now in the hands of Pakatan Harapan

(Alliance of Hope).

The head of the now ruling coalition, Dr. Mahathir

Mohamad, has said the government will be serviced by a

small Cabinet initially comprising 10 key ministerial

positions: finance, home affairs, defense, education, rural

development, economy and international trade, public

works, multimedia, science and technology and foreign

affairs.

There is no news yet on under what ministries forestry and

the timber industries will fall.

State takes control of Sabah Forest Industries

The Sabah State government has announced it will take

control of the failed India-owned pulp and paper mill,

Sabah Forest Industries (SFI), in Sipitang. This will secure

the jobs for the approx. 1,500 workers at the plant. The

State Government had been searching for a suitable buyer

for SFI but to no avail.

SFI is one of Malaysia’s largest plantation owners and

processors. The forest estate extends over 25,000 hectares

and processing capacity includes pulp and paper

manufacturing facilities, a sawmill, veneer mill and

plywood factory.

Valuing forest concession in Sabah

Valuation of forests in tropical countries always generates

considerable interest and the recent valuation of a forest

concession in Sabah is no exception. A Forest

Management Unit 5 (FMU5) timber concession in Sabah

extending over 88,920 hectares, for which Priceworth

International is proposing to pay RM260 million, has been

independently valued at RM433.8 million, significantly

higher the earlier valued.

The company is seeking shareholder approval for the

purchase of the concession rights for FMU5 which has 79

years remaining on the 100-year licence to manage, extract

and sell timber from the area.

Priceworth said the proposed acquisition of FMU5 would

cement its position as the leading integrated timber player

in Sabah with both upstream and downstream assets.

Malaysian young designers in India

The Sarawak Timber Industry Development Corporation’s

(STIDC) ‘Pool of Young Designers’ was recently in

Mumbai participating in the 30th INDEX India, an

international interiors, architecture and design event.

The aim of the visit was to explore opportunities in the

Indian market. The young team brought with them their

exclusive designs and innovative products for display.

STIDC’s participation in INDEX Mumbai is part of its

promotional programme to commercialise new designs

developed under the designers programme.

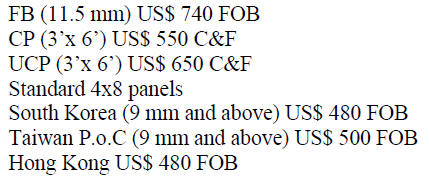

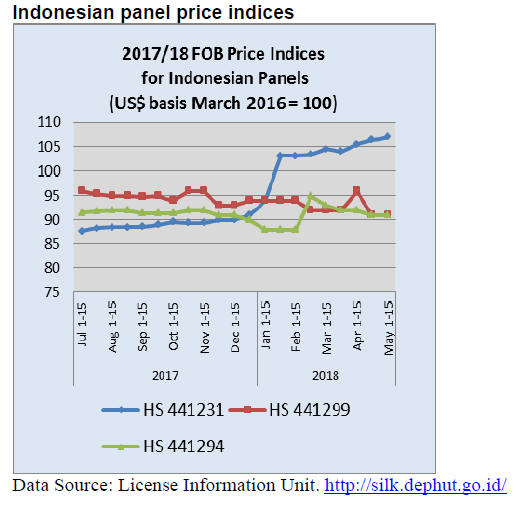

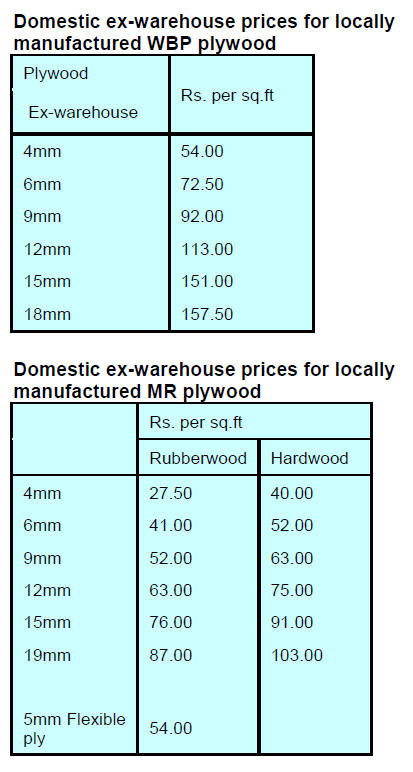

April plywood prices

Plywood traders based in Sarawak reported the following

export prices:

4.

INDONESIA

Indonesian enterprises

invited to Laos

Wishnu Krisnamurthi, Head of Economic Division of the

Indonesian embassy in Laos has said that Laos offers

many opportunities for Indonesian businessmen, including

those in the wood processing sector. He said there are even

opportunities to import roundwood from Laos.

According to the domestic press in Indonesia the Secretary

General of the Indonesian Furniture and Handicraft

Industry Association (HIMKI) will visit Laos to gain a

firsthand appreciation of opportunities. The government in

Laos is trying to attract inward investment and offers

generous support to investors.

Recently a representative of the Laos Furniture

Association was in Indonesia to court Indonesian firms.

During the visit the head of the Lao delegation signed a

MOU with the HIMKI under which Indonesian companies

will help with the development of timber processing.

In August 2015 and May 2016 regulations the Lao

government prohibited the export of logs and “lightly

processed sawnwood”. This had an immediate impact on

timber exports particularly those to China.

For more see:

https://www.forest-trends.org/publications/impacts-of-thelaos-

log-and-sawnwood-export-bans/

Plantation log production set to rise

The debate on the availability of plantation logs continues.

Indroyono Soesilo, Chairman of the Association of

Indonesian Forest Concessionaires (APHI) has said that

despite the recent decline in log production, 2018

production should improve.

He said that while national plantation round wood

production in the first quarter of this year was some

330,000 cu.m below that of last year due to adverse

weather conditions, prospects for the rest of the year look

promising as the dry season should result in an increase in

harvesting.

Restoration of peatlands helps in reducing incidence

of fire damage

The Ministry of Environment and Forestry has reported a

significant decline in the number and extent of forest fires

over the past three years. One reason behind the decline is

the efforts on restoration of peatlands.

Bambang Hendroyono, Secretary General in the Ministry

said that in 2015 some 2.6 million hectares of forest

suffered damage, the worst ever recorded. With the

establishment of the Peatland Restoration Agency (BRG)

things improved.

The BRG has accelerated the pace of peatland recovery

and restored the hydrological function of damaged

peatlands.

In 2016 the extent of fire damage covered 400,000 ha. and

this dropped to 160,000 ha. in 2017. Bambang said close

cooperation between central and regional agencies and

local stakeholders was important in achieving success.

Singapore companies biggest investors

Total direct investment (foreign plus domestic investment)

in Indonesia rose 11.8 percent year-on-year (y/y) to IDR

185.3 trillion in the first quarter of 2018 raising

expectations that the 2018 direct investment target of

Rupiah 765 trillion can be achieved.

The biggest foreign investor was Singapore with around

US$ $2.6 billion originating from this single source. Many

Singaporean companies that invest in Indonesia have

Chinese or Indian parent companies. The second ranked

investor was Japan at US$1.4 billion, followed by South

Korea, China and Hong Kong.

See:

https://www.indonesia-investments.com/news/todaysheadlines/

foreign-direct-investment-in-indonesia-rose-12.4-inq1-

2018/item8769

5.

MYANMAR

Investment in plantations required before

approvals

for processing

It has been reported that the Myanmar Investment

Commission is requiring foreign investors in wood

processing to first establish plantations to ensure raw

material supply.

This has been strongly criticised because it will deter

potential investors because of the time it takes for

plantations to yield industrial sized logs and because the

nature of the plantation business and wood processing

require very different skills and level of investment.

In related news, the Forest Department has announced that

it has repossessed title over 135,000 acres of plantations

because contractual terms have not been met.

Media reports say some 63,000 acres of teak plantations

and 72,000 acres of other hardwood plantations have been

repossessed. In another instance around 140,000 acres has

been repossessed by the Tanintharyi Regional Government

because of contract non-compliance by investors who

intended to establish palm plantations.

Analysts write that under the previous administration in

Myanmar many influential people acquired land for forest

plantation and other uses.

The timber industries in Myanmar have to deal with

uncertainty of raw material supplies, especially teak. The

Forest Department has announced the conditions under

which harvests of teak logs from government owned

plantations will be allowed.

There are two conditions, say analysts, minimum age 30

years and minimum girth 3 feet.

MTE dollar and Kyat log sale system could create

problems for CoC

One exporter, who prefers to remain anonymous recently

said that the Myanma Timber Enterprise (MTE) should

consider simplifying the system for the sale of teak logs.

The MTE is currently selling through two systems, one is

sales in US dollars which allows buyers to process for

export, the other system is timber sales in local currency

but in this case the products cannot be exported.

Barber Cho of the Myanmar Forest Certification

Committee has said that, in terms of chain of custody,

having two systems one of which allows exports could

create problems of verifying legality as it would require

the separation of logs and products (US$ purchase or local

currency purchase) throughout the supply chain.

As the independent certification bodies in Myanmar will

soon start inspections for the issuance of Legality

Compliance Certificates this matter should be addressed.

State owned enterprises have heavy financial

obligation to governmemt

According to an interview given to the Myanmar Times,

MTE Deputy General Manager, U Khin Maung Kyi, said

the MTE is targeting sales of 5,000 tonnes of teak and

100,000 tonnes of other hardwoods in the first half of

fiscal 2018. This could generate Kyat 63 billion.

The MTE, as a state owned enterprise, is apparently

required to contribute some of its revenue to the central

government as well as pay corporate taxes. According to a

statement by Daw Nwe Nwe Win, Director General from

Budget Department, state-owned enterprises must

contribute 20% of their revenues to the State as well as

pay a 25% tax on net income.

6. INDIA

Trade in some dalbergia species

resumes

As a result of active intervention by the Indian Ministry of

Commerce and the Forest Department a resumption of

trade in of some dalbergia species has become possible.

CITES notification No. 2018/031 dated 26 March 2018

details the extent of the changes agreed. The following is

the text of the CITES notification which can be found at:

https://www.cites.org/sites/default/files/notif/E-Notif-2018-

031.pdf

1. The Management Authority of India has informed the

Secretariat that the Government of India has banned the

export for commercial purposes of all wild-taken

specimens of species included in Appendices I, II and III,

subject to paragraph 2 below.

2. India permits the export of cultivated varieties of plant

species included in Appendices I and II and has indicated

that all products, other than the wood and wood products

in the form of logs, timber, stumps, roots, bark, chips,

powder, flakes, dust and charcoal, produced from wild

sourced (W) Dalbergia sissoo and Dalbergia latifolia and

authorized for export by a CITES Comparable Certificate

issued by the competent authorities of India are exempted

from the general ban.

Such Dalbergia sissoo and Dalbergia latifolia specimens

are harvested legally as per the regional and national laws

of India and as per the prescribed management (working)

plans, which are based on silvicultural principles and all

are covered under Legal Procurement Certificate; all the

material are sold from the Government timber depots

through auction or are legally procured and can be

exported legally.

3. Starting on the date of this Notification, all the CITES

Comparable Certificates will be issued with a footnote,

stating that the wild (W) source specimens are covered

under Legal Procurement Certificate as per regional and

national laws in India.

4. Parties are urged to inform the Indian Management

Authority and the Secretariat of any attempted violations.

5. This Notification replaces Notification to the Parties

No. 1999/39 of 31 May 1999.

Analysts say that exporters are buying the logs legally

from various Forest Departments and that they are

delighted to see a resumption of trade.

One positive result of the dalbergia ban has been growing

market acceptance of Terminalia tomentosa (Indian laurel)

for musical instrument manufacture.

As a follow-up to the easing of restrictions on domestic

dalbergia, the local industry has requested government

inventory all dalbergia standing trees across the country to

make show that India has an abundance of this species and

there is no risk of extinction. It seems that a survey will be

conducted through the Botanical Survey of India.

Seized Sandalwood to be auctioned

The Maharashtra Thane forest authority will be auctioning

80.46 tonnes red sanders in a 24-hour auction between 16-

17 May, 2018. Prospective buyers have until 15 May to

inspect the logs.

More details can be found at:

www.mstcecommerce.com.

This is the first time Maharashtra will be auctioning wood

from the protected species. Over the past 10 years some

600 tonnes of illegaly harvest red sanders has been seized.

This highly valued timber has a ready international market

in China, Japan, the Middle East, Sri Lanka, Bhutan and

Nepal.

Builders ‘think small’ to target buyers on a budget

For Indian home buyers affordability is key and at last

builders are adjusing the size of homes to make them more

acceptable. Real estate companies are desperate to attract

buyers the inventory of unsold homes is enourmous

because of the long period of slow sales.

‘Space efficiency’ (read smaller) 2 and 1.5 bedroom,

affordable, homes are in demand and one major company

nows offers a one bedroom-hall-kitchen property for first

time buyers.

Because of demonetisation and other regulatory changes

property prices have begun to drop and adjusting home

sizes will bring in more buyers according to local

commentators.

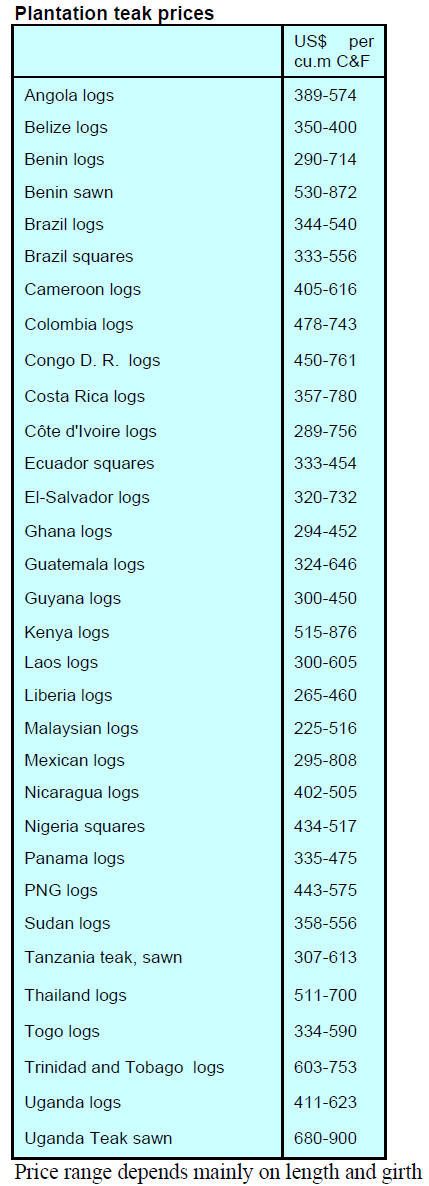

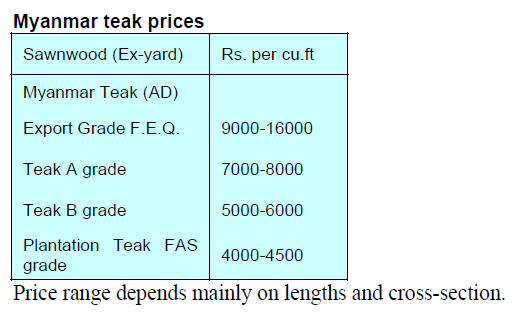

Plantation teak prices

Demand for imported logs continues unchanged but the

volumes imported are still well below levels prior to the

date when banks cut the credit limits for importers, a

response by the banks to the banking scandal in the

country. Without adequate working importers are

struggling to finance imports.

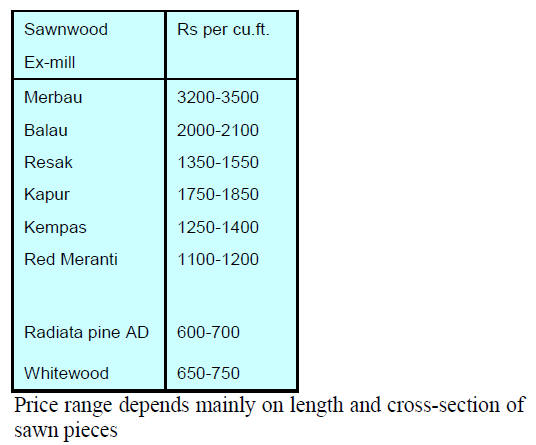

Locally sawn hardwood prices

Prices for domestically milled imported hardwoods

continue unchanged.

Imported sawn Myanmar teak

The consensus in trade circles is that more and more

endusers are moving away from using Myanmar teak as

they find cheaper alternate species good enough.

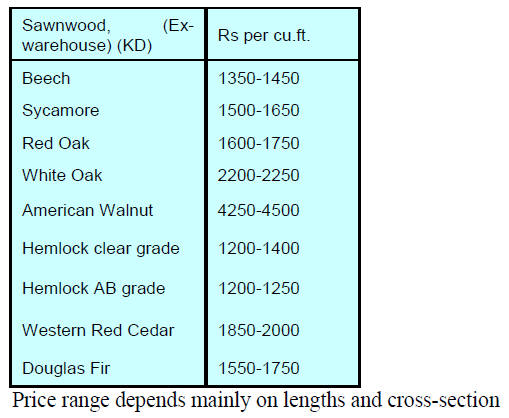

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) ex-warehouse

remain unchanged.

Greenply rebrands as Greenpanel

Greenply Industries Limited (GIL) has rebranded its MDF,

wood floors, plywood, veneers and doors as Greenpanel.

This was announced to coincide with coming on-line of its

board production facility at Chittoor, Andhra Pradesh

which, the company says, is set to be the largest MDF

plant in Asia.

Greenply has a substantial share of the Indian ‘organised’

plywood market and a 30% share of the domestic MDF

market.

7. BRAZIL

Deadline for SINAFLOR implementation

pushed

forward

The Brazilian Institute for the Environment and

Renewable Natural Resources (IBAMA) has extended, to

December 31, 2018, the deadline for the implementation

of the National Forest Products Control System. This was

slated to come into force 2 May 2018.

The IBAMA regulation 14/2018 establishes transition

rules for authorisation of forestry activities submitted

under the National Environmental System (SISNAMA).

Requests for authorisation of forestry activities filed with

SISNAMA agencies before 2 May can be registered

through the Forest Logging Authorisation (Autorização de

Exploração Florestal - AUTEX) which is part of the

Document of Forest Origin (DOF) system and will stay in

place until the 31 December deadline.

The December deadline also applies to applications for

revalidation, extension of validity or other procedures

related to logging permits previously registered in the

DOF system provided that they are submitted to the

environmental agency before May.

SINAFLOR is designed to integrate the various IBAMA

control mechanisms such as the Forest Origin Document

(DOF) and the Annual Operational Plan (POA) as well as

the Rural Environmental Registry National System

(SICAR).

One of its objectives is to improve the control of the origin

of wood products tracking the steps from authorisation of

harvesting exploration through transport, storage,

processing and sale. The system aims to increase the

degree of security and reliability of the systems as a

whole.

Furniture production recovering

In the first three months of this year the furniture industry

recorded an increase of 8.9% in production and in the 12

months up to March 2018 there was an almost 9% rise.

According to the Brazilian Institute of Geography and

Statistics (IBGE), compared to a month earlier domestic

furniture sales in March fell slightly although year on year

March sales were up. Analysis by IBGE suggests that

domestic sales in 2018 will be better than 2017 but that

month on month volatility can be expected.

The private sector confirmed the slight drop saying March

output declined 2.5% compared to February but increased

7% when compared to production in March last year. The

weak retail furniture sales reflect consumer uncertainties

with the economy and politics in the country.

Woodbased panel exports increase

The value of woodbased panel exports in the first quarter

of 2018 totalled US$73 million a 14% rise compared to

the same period last year.

Between January and March of this year the main markets

for woodbased panels were Latin America (up 11% to

US$39 million) and North America (up 21% to US$17

million). In terms of volume, woodbased panel exports

totalled 308,000 cubic metres in the first quarter of this

year an increase of 8.5% compared to the same period in

2017. In the domestic market, 1.6 million cubic metres

were sold, an increase of 3%.

Cooperation agreement with Chinese association

The Brazilian Association of Mechanically Processed

Wood Industry (ABIMCI), comprising manufacturers of

wood products such as plywood, sawnwood, frames,

doors, among others has signed a cooperation agreement

with the China Timber and Wood Products Association

(CTWPDA) which has over 3,000 members in China.

The goal is to foster closer business ties between the two

associations, facilitate access to information between the

two Associations and identify trade opportunities between

China and Brazil.

According to ABIMCI, Brazil has a real potential for

growth in exports and can verify the legal origin of its

wood products. Currently, almost 70% of planted forests

in Brazil are certified. In 2017, Brazil exported more than

63,000 cubic metres of tropical timber and 328,000 cubic

metres of pine sawnwood to China.

The spokesperson for the CTWPDA highlighted the

quality of Brazilian wood products and stressed that it is

necessary for the Association members to understand the

opportunities in Brazil as they work to satisfy Chinese

domestic demand.

8. PERU

Local enterprises

disadvantaged when it comes to

financing plantations

A former minister has commented that private forestry

sector operatives face two major challenges; a complicated

legal framework for forest plantations and securing

financing for plantation development.

Domestic financing sources for plantations are limited,

difficult to access and attract high interest rates. Plantation

forestry depends on long-term financing and a lender that

understands that returns on investment can only be made

when the trees are ready for harvest which could be as

long as 20-30 years depending on the species.

Executive Committee for Forestry Development should

be strengthened - ADEX

Erik Fischer, Vice President of the Peruvian Association

of Exporters (Adex) has noted that the full potential of the

country’s Executive Committee on Forest Development is

yet to be achieved.

The Executive Committee is charged with initiating

economic development in the sector.

"The Executive should be strengthened and logistical,

technical, administrative and budgetary support should be

provided to accelerate progress through removing the

hurdles facing the private sector as it moves to expand the

productive sectors and take the country forward", said

Fischer.

Specifically, Fischer pointed out that the trade balance for

the forestry sector in 2017 was in deficit with imports

exceeding the US$315 million while exports were only

US$121 million,.

Fischer called on the national authorities to recognise the

enormous value of the Peruvian forests but one that

contributes the least to the Peruvian economy.

In related news, Drago Bozovich, CEO of Maderera

Bozovich, one of the largest exporters of Peruvian timber,

has commented on the growing interest of foreign

companies in the purchasing local forestry sector

enterprises.