|

Report from

North America

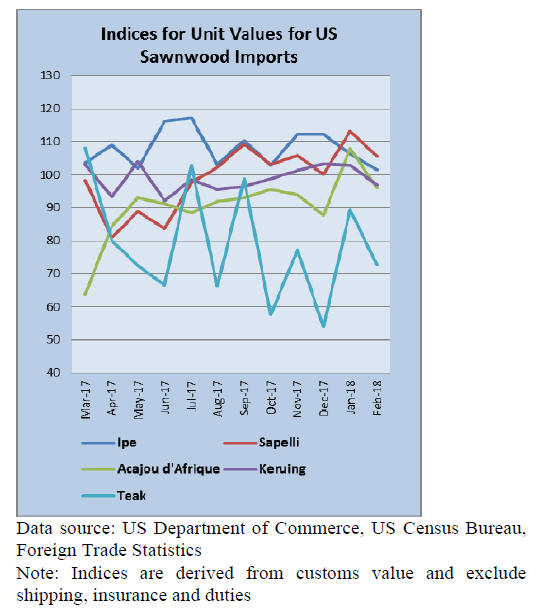

Keruing sawnwood imports rise twofold in February

The U.S. imported 80,012 cu.m. of temperate and tropical

sawn hardwood in February, up 18% from January, but the

value of imports was down. The volume increase was in

several temperate species, while tropical sawn hardwood

imports declined to 17,820 cu.m. Year-to-date tropical

hardwood imports were down 7% compared to February

2017.

The largest month-over-month decline was in imports

from Brazil. Imports of almost all species from Brazil fell,

with ipe sawnwood imports decreasing 15% from January

to 2,627 cu.m. Fewer than 200 cu.m. of Brazilian

mahogany were imported, down from 1,345 cu.m. in

January.

Sawnwood imports from Malaysia on the other hand

doubled from January due to higher keruing imports.

Canadian tropical sawnwood imports recover

Following three months of lower imports, Canadian

imports of tropical sawnwood increased to US$1.5 million

in February. Still year-to-date imports were down by

almost one third from February last year.

Imports from most major supplier countries declined

month-over-month except for imports from Congo

(formerly Zaire), Malaysia and the U.S. Imports from the

U.S. accounted for one third of total tropical sawnwood

imports.Over 40% of February imports were ¡°other

tropical¡± i.e. not captured in the HS codes that specify

species.

Formaldehyde emission limits, testing and labelling

As the June 1, 2018 deadline approaches for the main

requirements of the EPA¡¯s Formaldehyde Emissions

Standards rule, trade associations are offering guidance for

manufacturers and importers of composite wood products,

component parts, and finished goods containing composite

wood products, such as furniture.

The Composite Panel Association offers a comprehensive

overview including all compliance dates on their website

at https://www.compositepanel.org/publicpolicy/

formaldehyde-standards-tsca-title-vi.html

The American Home Furnishings Alliance is offering two

webinars in April. The first webinar reviews the

responsibilities of third-party certifiers and composite

board manufacturers relating to the new June 1 deadline,

while the second webinar is addressed at the downstream

users in the supply chain including fabricators and

importers.

The EPA offers information and resources for industry on

its website in the section ¡°Resources for Rule

Compliance¡± at

https://www.epa.gov/formaldehyde

Furniture industry escapes Trump tariffs

In early April the Trump administration announced $50

billion of new tariffs largely targeted at China. The tariffs

appear not to directly affect imports of furniture,

components or textiles used in furniture manufacturing in

the U.S. Machinery and tools for wood processing and

furniture production may be affected by the tariffs. A date

has not been set for when the tariffs will go into effect.

China responded by announcing tariffs on U.S. exports to

China.

Canadian wood product industry applauds CP-TTP

Canada¡¯s wood product industry predicts better access to

key global export markets, especially in Asia. The

remaining members of the Comprehensive and

Progressive Agreement for Trans-Pacific Partnership

(CPTPP) - Australia, Brunei, Canada, Chile, Japan,

Malaysia, Mexico, New Zealand, Peru, Singapore, and

Vietnam ¨C agreed to a revised trade deal after the U.S.

under the Trump administration abandoned the agreement.

The Forest Products Association of Canada expects the

following reductions in tariffs on Canadian wood exports:

31% tariff to Vietnam for certain kinds of wood, going

down to 0% starting Year 1 of the agreement.

40% tariff to Malaysia for plywood, down to 0% by Year

6. 10% tariff to Japan for wood products, going down as

low as 5% in Year 1 and 0% as early as Year 11.

|