2. GHANA

Timber exports register positive gains

The Timber Industry Development Division (TIDD) of the

Forestry Commission has published the country’s timber

and wood export report for January 2018.

Ghana earned Euro19.35 million from the export of

31,289 cu.m of wood products in the first month of 2018.

This represented year on year 9% increase in export values

and an almost 2% increase in export volumes.

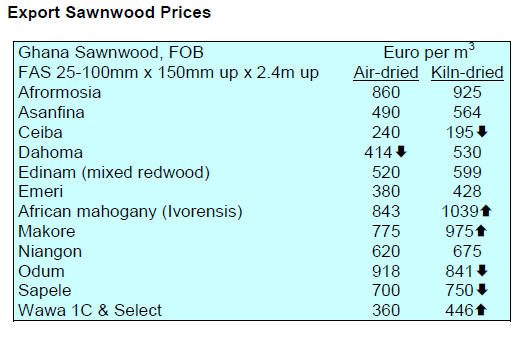

The major products shipped in January 2018 were air-dry

sawnwood (71%), kiln-dried sawnwood (12%), billets

(8%), sliced veneer (3%) and furniture parts. Most were

exported to China (41%) and Indian (34%). The report

also identified teak (34%), rosewood (34%), wawa (7%),

ceiba (5%) and papao/apa (3%) as the leading species

shipped.

Ghana/ EU test FLEGT license shipment

Late last year Ghana tested the Forest Law Enforcement,

Governance and Trade (FLEGT) licensing system for

timber export to Europe.

As exports to the EU are expected to be covered by the

FLEGT licensing scheme this should put an end to

concerns on the legality of export shipments as well as

concerns that illegal timber enters the domestic market

which has been a considerable challenge to address.

Ghana and the European Union (EU) members will

convene a meeting of the Expert Group on FLEGT/ EU

Timber Regulation (EUTR) in April 2018, in Brussels to

review progress towards Forest Law Enforcement,

Governance and Trade (FLEGT) licensing.

At the Brussels meeting the group will also review

the

outcome of a trial shipment of FLEGT licensed timber

made last year in preparation for the Final Joint

Assessment of the Ghana Legality Assurance System

(GhLAS) set to be undertaken in May this year.

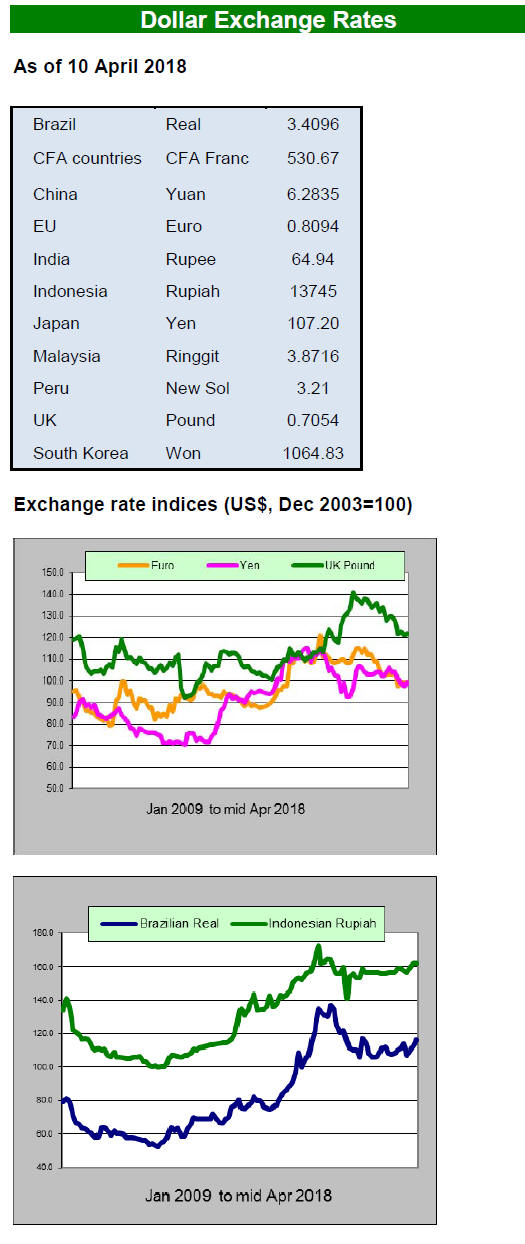

Ghanaian businesses confident in economy

The Institute of Economic Affairs (IEA) has surveyed

business confidence specifically looking at changes

between the first and second halves of 2017. In the first

2017 survey 77% of businesses expected Ghana’s

economy to grow while in the second survey 82% held the

same view.

The optimism expressed by businesses, say analysts, can

be attributed to the improved macroeconomic climate, a

more stable exchange rate, reduced inflation and lending

rates and the government initiative to lower power charges

for manufacturers. According to the Ghana Statistical

Service the economy grew by 8.5% in 2017 compared to

3.7% in 2016.

3.

MALAYSIA

Election fever dominates domestic

news

Malaysians will go to the polls on 9 May and election

fever in the media has pushed business news to one side.

However, international politics are having an impact on

business sentiment as exporters fear a looming trade war

between the United States and China.

Exporters benefit from US anti-dumping duties on

Chinese plywood

US anti-dumping duties imposed on Chinese plywood

imports have resulted in American buyers turning to

Malaysia and Indonesia which has created an opportunity

for exporters to raise plywood prices. Trade analysts feel

that, in the short term, the winners will be SE Asian

shippers while the losers will be consumers in the US.

Rise in thin plywood prices explained

The Japanese market for thin plywood is currently very

active and prices have been steadily increasing. Buyers in

Japan have offered an explanation for the increased

demand for thin plywood. First, say buyers, the

consumption tax will rise from 8% to 10% in October next

year and this has spurred the building of new homes and

an expansion of activity in home renovations. This, and

the construction work for the 2020 Summer Olympic

Games to be held in Tokyo, has increased demand for all

construction materials.

The demand side pull combined with the supply side push

from declining log production is impacting plywood

production by Malaysian and Indonesian plywood mills.

The combined effect of these issues is forcing up prices.

In contrast to rising demand for thin plywood, some

buyers say the market for thicker plywood is dull.

Plantation strategies - Sarawak can learn from China

Sarawak Timber Association (STA) chairman, Wong Kie

Yik, has suggested the state government should emulate

the planted forest strategies and policies in China to attain

State goals and ensure the sustainability of the State’s

timber industry. Wong said State strategies for plantation

forests need to be scaled up.

During a study tour to Southern China by STA

officials it

was learnt that in China there is no royalty or cess on

plantation logs and that the government provides

infrastructure and supports research and development

agencies and provides technical support and advice.

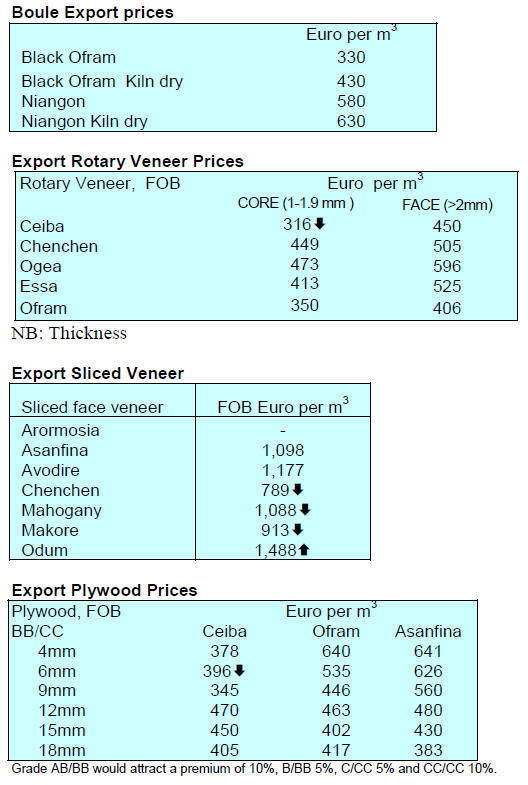

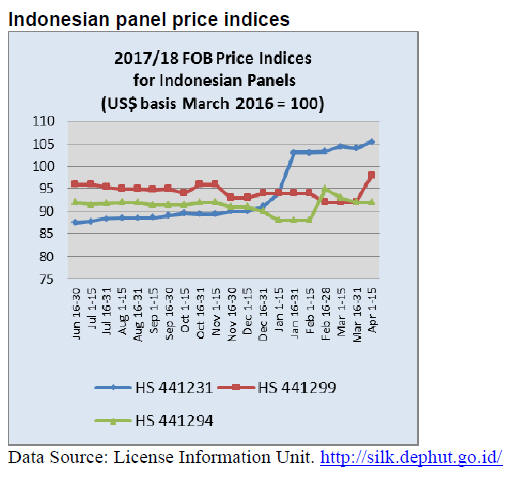

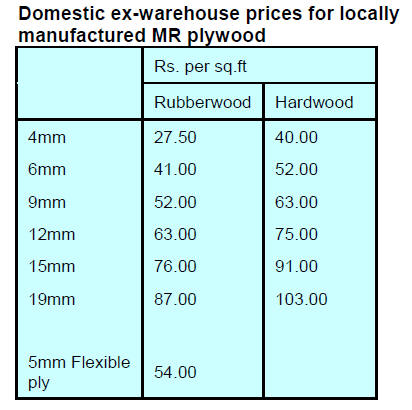

Plywood price update

Plywood traders based in Sarawak reported the following

export prices:

4.

INDONESIA

Plywood producers urged to

capture the moment

The trade dispute between China and the United States has

benefitted the Indonesian timber sector according to

Purwadi Soeprihanto, Executive Director of Association

of Indonesian Forest Concessionaires (APHI).

Soeprihanto said that, as of the end of the first quarter

2018, there was a 28% increase in processed wood

shipments to the US as buyers there sought out suppliers

to fill the gap left by China. The shift by US importers to

Indonesian suppliers, especially of plywood, is expected to

continue for the rest of this year said Soeprihanto.

Furniture Industry denies abundance of plantation

timbers

The Association of Indonesian Furniture and Handicraft

Industry (HIMKI) has denied that Indonesia has abundant

plantation resources. Media reports say HIMKI is of the

opinion that stories on the abundance of plantation

production have been generated only to encourage the

government to allow plantation log exports.

According to Abdul Sobur, Secretary General of HIMKI,

Indonesia is having to import timber from New Zealand,

the United States, Sweden and Finland to satisfy domestic

demand. He commented that imported timber is of high

quality, competitively priced and for specific enduses

while domestic plantation timbers are costly due to the

extended distribution channel.

Call for revision of Forestry Law

The Vice Chairman of Commission IV of the House of

Representatives, Viva Yoga Mauladi, is proposing

revision of Law No. 19 of 2004 on Forestry as this does

not reflect the principle of control and management of

forest he said.

Yoga said, implementation of the current Forestry Act has

allowed many changes to the forest through, for example,

providing for forest area conversion. In addition, said

Yoga, the fire management guidelines and approaches to

indigenous and tribal peoples’ rights are inadequately

addressed.

Indonesian designers to exhibit in Italy

Twenty-seven Indonesian furniture designers will exhibit

at the Milan Furniture Fair, Salone del Mobile Milano set

to run 17-22 April.

The Creative Economy Agency (Bekraf), along with the

Indonesian Furniture Designers Association (HDMI), have

gathered creative works by local designers for the fair.

Joshua Simanjuntak, a Bekraf marketing specialist says

the aim is to highlight unique Indonesian styles utilising

local techniques and materials. Salone del Mobile Milano

is one of the largest furniture trade fair in the world.

Now easier for foreigners to work in Indonesia

The government has issued a new Presidential Regulation

(No. 20/2018) on the hiring of foreign workers in order to

simplify the permit application process. The most

significant change, say analysts, is the removal of the

mandatory Expatriate Placement Plan ( Rencana

Penempatan Tenaga Kerja Asing, or RPTKA).

A report from Indonesian Investments says Hanif Dhakiri,

Indonesian Minister of Manpower, is optimistic that a

more efficient and simpler permit application process for

foreign workers will result in rising foreign direct

investment in the country. This will then also lead to more

employment opportunities for the local population.

See: https://www.indonesia-investments.com/news/todaysheadlines/

new-regulation-makes-it-easier-for-foreigners-to-workin-

indonesia/item8713

5.

MYANMAR

Independent third party certification soon

to be

operational

According to Barber Cho, Secretary of Myanmar Forest

Certification Committee (MFCC), independent third party

certification will be introduced very soon. He said that

auditor training has been given to the potential

certification bodies, three domestic and one international.

He further explained that the MFCC is strengthening the

Myanmar timber legality assurance system (MTLAS)

through which legality compliance assessment reports will

be issued independently by the certification bodies.

The MFCC has three objectives; to support due diligence

requirements in the EU for compliance with the EUTR, to

contribute to VPA negotiations and to ensure the MTLAS

is robust enough to satisfy requirements in other export

markets.

Sharp decline in timber exports

Statistics from Ministry of Commerce show that the

country exported US$11.9 billion during the period 1April

2017 to 28 February this year. Industrial products took the

top spot at US$5.468 billion followed by agricultural

products (US$2.525 billion), minerals (US$1.253 billion)

and maritime products (US$561 million). The export of

forest products stood at just US$179 million.

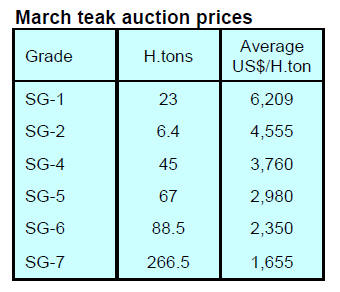

In fiscal 2016-17, the export of teak products was around

35,600 tons earning around US$110 million. In addition

190,000 tons of non-teak products were shipped earning

US$160 million. However, the export value for the same

range of products in fiscal 2017-18 at US$179 million (for

11 months) falls far short of the value in the previous year.

Analysts write that for the year as a whole there could be

an almost 40% decline recorded. The two year data

confirms that share of value of export for teak products

ranges between 40-45% while the volume is just 15 to

20% as the unit price of teak products are attracting high

prices.

Development of Thilawa Port to improve export

competiveness

A bulk terminal located at Thilawa will be developed and

operated by the International Bulk Terminal (Thilawa) Co

.(IBT). IBT has been jointly established by Lluvia, a

domestic agri-processing company and Japan-based

Kamigumi.

The International Finance Corportation has agreed to

provide a loan of US$15 million to contribute to the

construction of the international bulk terminal at Thilawa.

This bulk terminal will be one of the first in the country

and will have a capacity of more than one million metric

tonnes.

When in operation it is expected that transport and

logistics costs will be lowered which will improve the

competitiveness of Myanmar’s supply chain.

In the near future the port will be able to handle bulk

grains as well as non-agricultural commodities. The lack

of specialised and efficient bulk handling facilities forces

producers and traders to containerise bulk commodities,

which increase costs.

Asian Development Outlook report positive on

Myanmar

According to the ‘Asian Development Outlook

2018’ report Myanmar’s economy is projected to grow

steadily over the next two years as economic reforms,

strong global growth and higher foreign investment drive

growth. The Bank report says it expects the agricultural

sector to grow faster than manufacturing.

https://www.adb.org/publications/asian-developmentoutlook-

2018-how-technology-affects-jobs

6. INDIA

High housing stocks holding down

prices

The Indian housing sector has been affected by the

introduction of the new real estate law RERA,

demonetisation and the introduction of the standard Goods

and Services Tax (GST). The combined impact of these

developments has resulted in a slowdown in construction

as well as housing demand.

According to a recent survey by JLL India, thousands of

homes remained unsold across of India at the end of 2017

with Mumbai, Delhi-NCR, Chennai, Hyderabad, Pune,

Bengaluru, Kolkata the worst affected.

In 2017, just over 40% of new homes in the medium price

range were sold which helped developers reduce their

stock of units. Analysts report that in the main cities home

prices have not moved for months being held down by the

high level of unsold properties.

Draft forest policy revisions open for comment

The Indian Ministry of Environment, Forest and Climate

Change (MoEFCC) has released proposals for a new

National Forest Policy which signal a change in emphasis

from a community/environment approach to one focusing

on timber and forest-based industries. In 2016, changes

were proposed by MoEFCC but these were withdrawn as

it appeared to contradict the Forest Rights Act.

Analysts write “while there is merit in discussing new

concepts such as economic valuation of ecosystem

services, forest certification and a national forest

ecosystem management information system, for example,

there is no need for a complete shift in policy”.

For more see:

https://thewire.in/environment/national-forest-policy-draft-2018-

takes-one-step-forward-two-steps-back

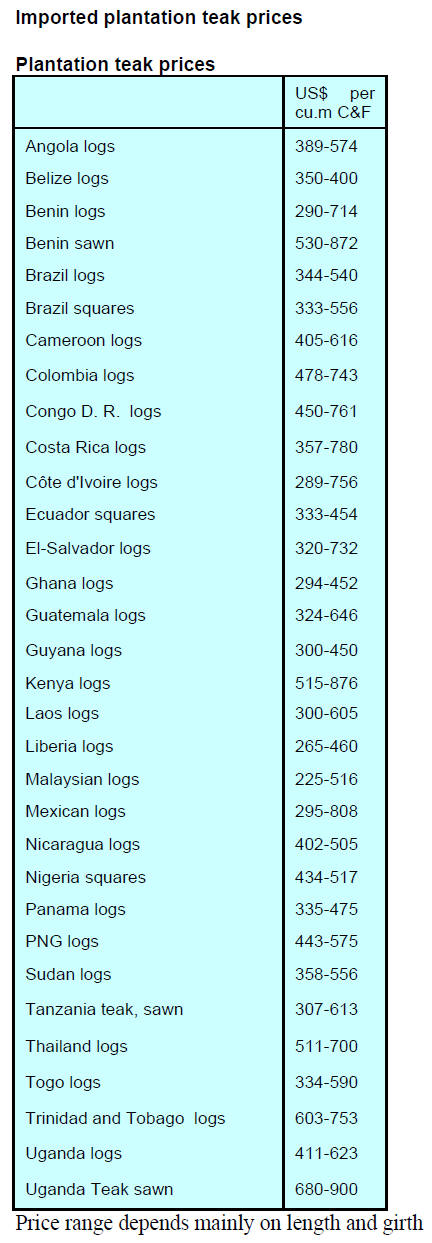

Demand for imported plantation teak logs continues

at the

same level as in the past few months but traders report

there has been a slowdown in deliveries from importers

due as credit facilities have been affected by the recent

financial scandal involving Indian Banks. Analysts say

access to working capital has been affected and this has

impacted the volume of imports.

As previously reported the quality and girths of plantation

teak logs has been declining since the end of last year.

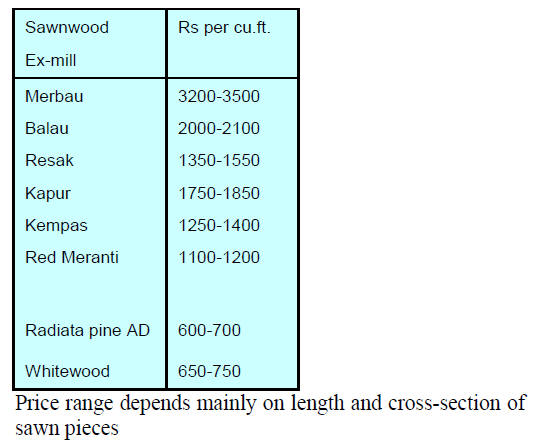

Locally sawn hardwood prices

Prices for locally sawn hardwoods remain unchanged.

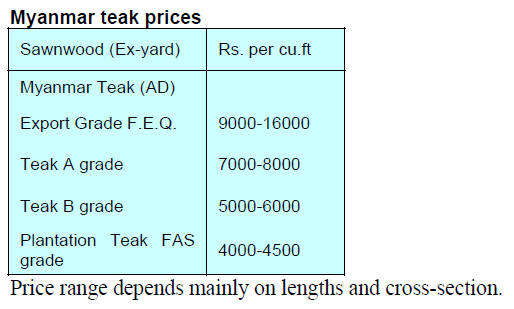

Imported sawn Myanmar teak

Prices for imported Myanmar teak remain unchanged.

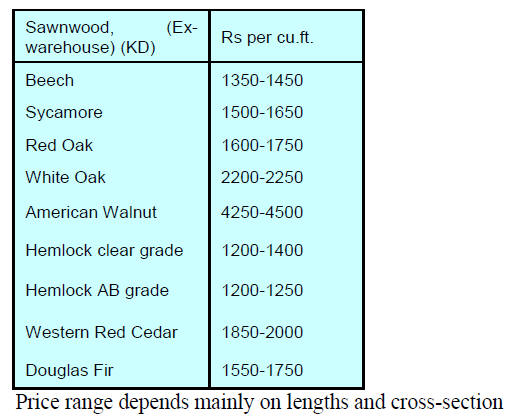

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

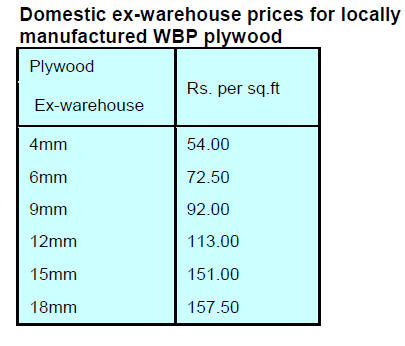

Plywood manufacturers raise prices to test

market

reaction

Plywood manufacturers are reporting that prices for peeler

logs are trending higher as are chemical prices. Adding to

the pressure to increase plywood prices are rising labour

charges. To compound the difficulties faced by

manufacturers, transport costs are also going up due to the

higher cost of fuel.

These developments have prompted plywood

manufacturers to be looking to raise prices by 10%. With

immediate effect prices have been raised by about 5% to

test market reaction.

The key to securing prices to off-set rising costs will be

improved demand in the real estate sector. Analysts say

“with the beginning of the financial year and a more

disciplined structure in the realty sector, plywood

producers are expecting an improvement in demand”.

Current prices are shown below.

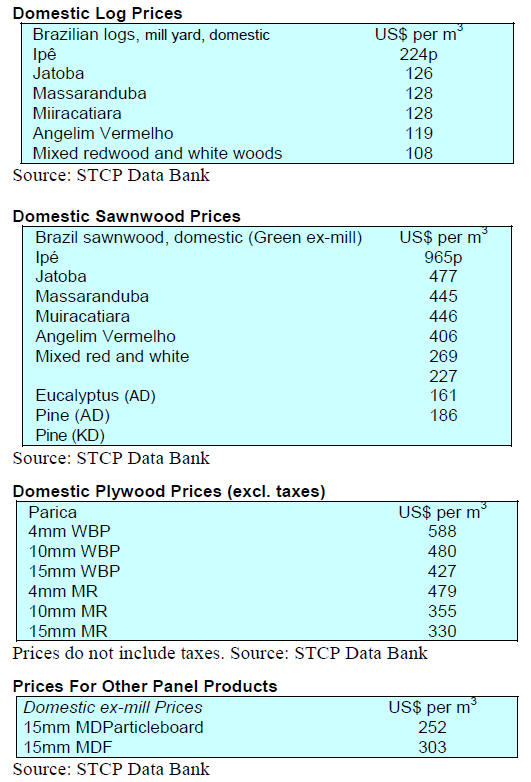

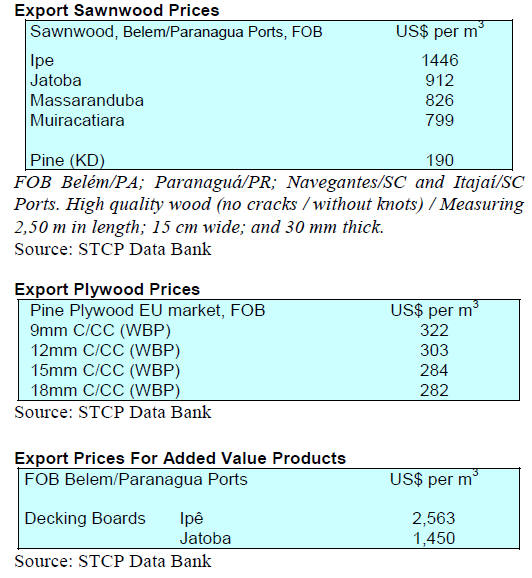

7. BRAZIL

Deforestation rate declines in

2017

According to the Ministry of Environment, deforestation

continues to fall in the Amazon. After increases in

deforestation rates in 2015 and 2016 there was a 16%

reduction in 2017.

Between August 2016 and June 2017 clear cutting, as

registered by the Project for Satellite Monitoring

Deforestation in the Legal Amazon (PRODES) in the

National Institute for Space Research (INPE,) forest

clearing amounted to 6,624 sq.km.

The decline in deforestation, said the Minister, was the

result of the monitoring agencies having adequate funds to

conduct the work in the field. He explained that

deforestation can only be controlled through active

inspection and monitoring.

The ideal is that the standing forest is worth more than an

alternative land use and until that is assured there is a need

to continuously safeguard the forest through monitoring

and inspection and legal action against those breaking the

law.

Cash boost for Amazon Fund

An agreement has been signed by the Brazilian Institute

for Environment and Renewable Natural Resources

(IBAMA) and the Brazilian Development Bank (BNDES)

for the funding of environmental inspection activities.

Through the agreement the Amazon Fund will receive

around R$140 million to prevent, monitor and combat

deforestation and to promote conservation and sustainable

use of forests in the Amazon. It has been reported that

implementation will begin in 2020 with the provision of

logistics in the form of vehicles and aircraft.

The Amazon Fund is coordinated by the Ministry of the

Environment (MMA) and is charged with environmental

monitoring and control, land management and promotion

of sustainable management of production activities in the

Amazon.

Portugal - a growing market for Brazilian wood

products

Importers in Portugal are expected to increase timber

imports in the coming years due a shortage of domestic

resources the result of recent devastating forest fires. This

was stated by the Association of Wood and Furniture

Industry of Portugal (AIMMP) and is seen as an

opportunity for the Brazilian exporters.

According to AIMMP, Brazil’s trade with Portugal could

be made more efficient if the many small sized importers

in Portugal could come together as a consortium and place

few but large sized contracts which would be cost

effective in terms of transport and payments.

February a good month for furniture exporters

February was a very good month for exporters in Rio

Grande do Sul, one of the major furniture producing states.

February furniture exports expanded almost 30%

compared to a month earlier to US$14.2 million according

to the Market Intelligence Institute (IEMI). This increase

mirrors the trend nationwide as total February exports

jumped to US$53 million.

Rio Grande do Sul is the second largest furniture exporter

behind Santa Catarina State which accounted for 27% of

all furniture exports in February. The main export markets

for shippers in Rio Grande do Sul State were the United

Kingdom, 16% of export values for January and February

followed by Uruguay with 15% and Peru with 15%.

8. PERU

Ex SERFOR head now

Environment Minister

Peru’s new President, Martin Vizcarra, has said his cabinet

will continue the pro-business policies of his predecessor.

The President’s choice for Environmental Minister,

Fabiola Munoz the former head of Peru’s SERFOR, has

been greeted cautiously by environmental activists

because she spearheaded the effort to have sawnwood

shipments to the US released after suspicions some of the

timber was illegal.

Sawnwood shipments in 2017 subject to investigation

The Government has recently received a request from the

US Office of the Trade Representative of the United States

for details of some shipments of sawnwood to the US and

Puerto Rico in 2017.

Analysts write that the companies that shipped the timber

in question have a good track record so an investigation

should provide an opportunity to show the performance of

the companies that export to the North American market.

In 2017 around 75% of exports to the US were made by

three companies, two of which have FSC forest

certification.

Adding value to wood residues

The Pucallpa CITEforestal in the Technological Institute

for Production (ITP) is a specialised technical body within

the Ministry of Production. This agency has recently

provided training on log residue utilization to small and

medium enterprises in the timber sector in Ucayali.

Participants learned how to add value to forest and mill

residues that are usually discarded or sold as firewood.

The use of waste wood represents an opportunity to added

value since it aims to transform waste into saleable items.

Residues offer an opportunity for entrepreneurs and

carpenters in the region to improve incomes through

innovative use of residues.