Japan

Wood Products Prices

Dollar Exchange Rates of 10th

February

2018

Japan Yen 108.00

Reports From Japan

Disappointing wage growth in

2017

2017 data on Japanese wage growth released by the

Ministry of Labour has shown real wages adjusted for

inflation were actually lower than in 2016. This, and the

news that consumer prices barely budged in 2017, has

undermined the attempts by the government and the Bank

of Japan (BoJ) to stimulate inflation.

December data shows that wages of Japanese workers fell

in December at their fastest pace in five months. Against

this backdrop the task of convincing companies to raise

wages during the spring wage negations with employee

groups will be tough.

Consumer confidence un-moved

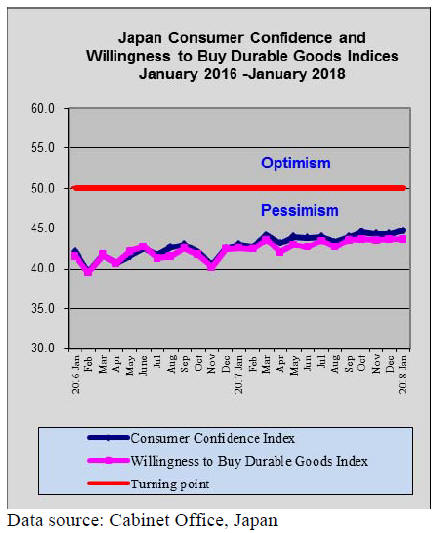

Japan¡¯s Cabinet Office released the results of its January

consumer confidence survey at the beginning of February.

This reveals a largely unchanged situation. The index for

overall livelihood expectations fell slightly in January as

did the perception for income growth. On the other hand,

consumers were more optimistic on prospects for growth

in employment opportunities.

Bank holds steady as yen strengthens

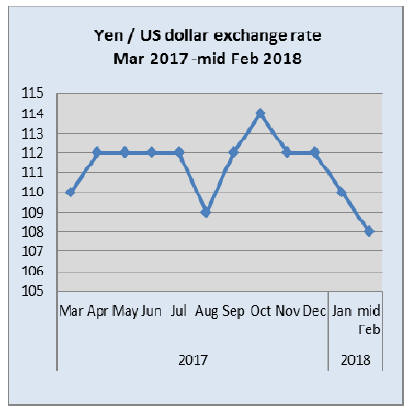

After a sharp decline early in the month stock markets

around the world recovered slightly bringing some relief

to Japan¡¯s policy makers.

The impact of falling stock prices, especially in the US,

caused investors to seek a safe haven, the Japanese yen.

From around yen 112 to the US dollar in mid-January the

rate strengthened to yen 108 to the US dollar at one point

in February. A strong yen is bad for exporters and this was

reflected in a sell-off on the Tokyo stock market.

If the yen strengthens in the short-term importers will be

pleased but a prolonged spell of a strong yen will

eventually impact prospects for growth in the economy.

In the face of the strengthening yen, BoJ governor,

Haruhiko Kuroda, said this is likely a short term response

to the prospect of higher US interest rates and that it was

certainly not the time for Japan to be thinking of raising

rates.

BoJ Governor likely to be reappointed

The Japanese media are reporting that the Prime Minister

seems to have decided to allow Bank of Japan (BoJ)

Governor, Haruhiko Kuroda, to continue leading the BoJ.

This will see Kuroda in post until 2023 allowing him

to continue trying to create conditions for sustained

inflation in Japan.

Smart home market potential

A press release from Research and Markets is promoting a

new report ¡°Japan Smart Home Market, Volume,

Household Penetration and Key Company Analysis -

Forecast to 2024¡±.

The press release says the Japanese smart home market is

likely to grow fivefold by the year 2024 from its current

level. Smart home is a system that allows home owners to

control and monitor different devices in the home

including heating, lighting, security and entertainment

remotely via the Internet. In Japan, there is a demand for a

safe and secure living environment especially for elderly

people.

Growth in the smart home market is attributed to

factors

such as a significantly expanding middle class, cost

reduction measures enabled by home automation systems,

the large number of manufacturers expanding their product

portfolios and increasing importance of home monitoring

from remote locations.

With the increasing use of smart home devices the risk of

security and privacy breach will also increasing. Issues

pertaining to privacy and security are currently holding

back the growth of the smart home market.

For details see :

https://www.researchandmarkets.com/research/x6f4vl/japan_sma

rt_home?w=4

Furniture imports

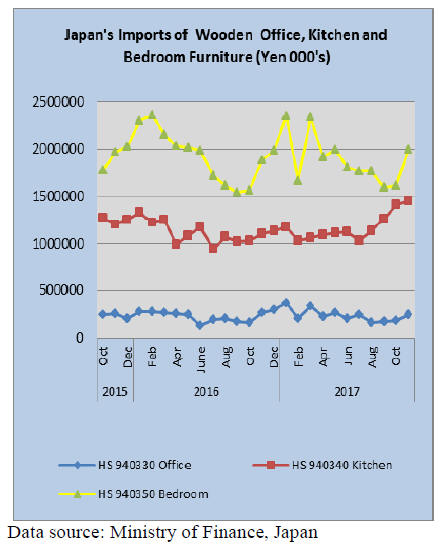

The value of Japan¡¯s November wooden furniture imports

were higher month on month and year on year except for

wooden office furniture which was down 7% year on year.

Wooden office furniture (HS 940330) imports were up

over 30% month on month in November.

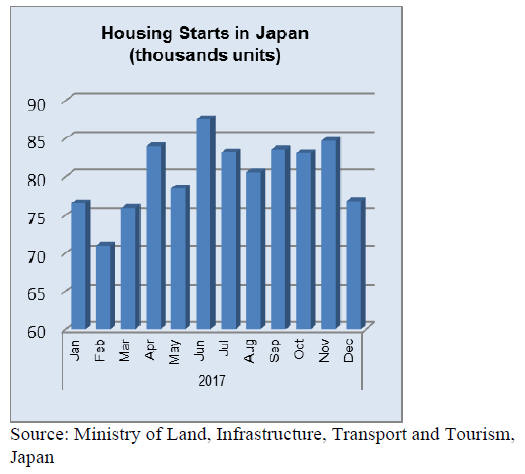

November data for both wooden kitchen and bedroom

furniture imports followed the upward trend seen in

previous years. The traditional cyclical up-tick in the final

quarter of the year is partly the result of retailers getting

ready for when consumers spend their year-end bonuses.

In Japan, most companies pay bonuses twice a year to full

time employees. The summer bonus or Kaki Shoyo is paid

in June or July and Toki Shoyo or Winter bonus is paid in

December. The bonus amount varies from company to

company and from year to year, but is generally several

months¡¯ salary.

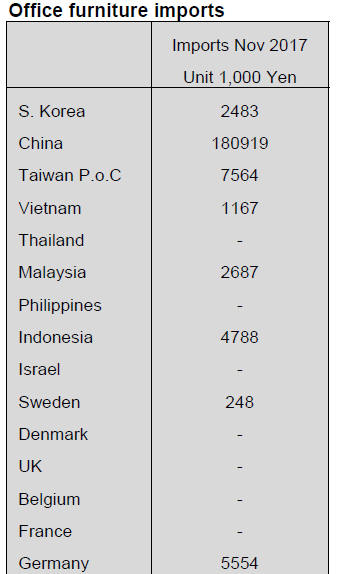

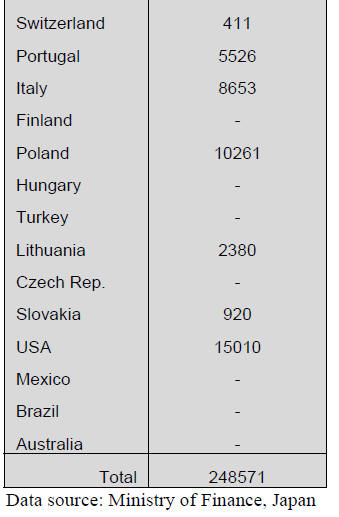

Office furniture imports (HS 940330)

Japan¡¯s imports of wooden office furniture are becoming a

smaller and smaller proportion of the value of wooden

bedroom and kitchen furniture imports.

Year on year, the value of November imports of wooden

office furniture down 7% but month on month imports

jumped over 30%. For 2017 it would appear that wooden

office furniture imports will be slightly above that for

2016.

In November shippers in China accounted for around 75%

of Japan¡¯s wooden office furniture, up from the approx.

60% a month earlier. The other main shippers were the US

(6%), Poland (4%) and Italy (3.6%).

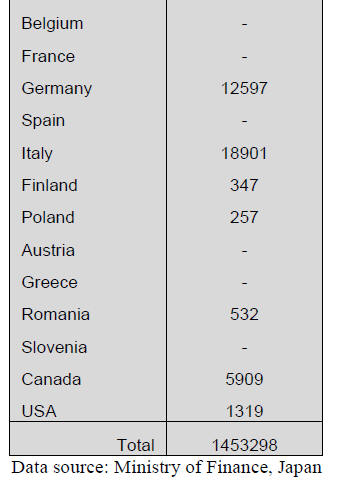

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s imports of wooden kitchen furniture

has been steadily rising since July and November marked

the fourth straight monthly rise.

This year end surge in imports has been observed in past

years and, as mentioned above is related to consumers

spending year-end bonuses. The up-tick in wooden kitchen

furniture imports between July and November 2017 was

greater than in the same period in 2016.

Year on year, November 2017 imports were up 31% but

compared to a month earlier imports were flat.

The combined shipments from the Philippines, Vietnam

and China once again account for over 90% of all

November shipments of wooden kitchen furniture.

November shipments from the Philippines and China were

at almost the same level as a month earlier but shipments

from Vietnam jumped month on month.

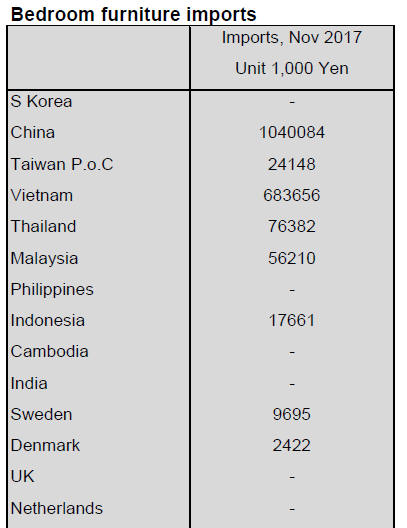

Bedroom furniture imports (HS 940350)

The 25% burst in November 2017 imports of wooden

bedroom furniture is reinforcing the traditional year-end

increase in imports of this category of wooden furniture.

Iif December imports follow this trend then it appears as if

the value of 2017 imports of wooden bedroom furniture

could be slightly above that for 2016.

Shippers in China and Vietnam continue to dominate

Japan¡¯s imports of wooden bedroom furniture accounting

for 52% and 34% respectively of bedroom furniture

imports.

If shipments from Thailand are added then around 90% of

all wooden bedroom furniture imports is accounted for. In

November shippers in Vietnam did well seeing a

significant jump in the share of imports but, not to be

outdone, shippers in China and Thailand saw November

shipments to Japan rise.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

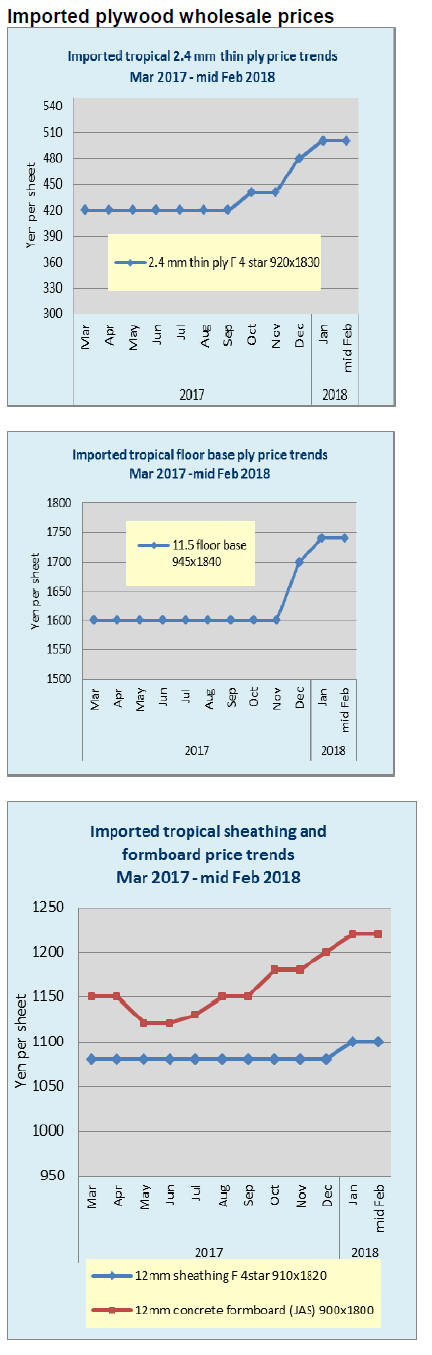

Plywood production in 2017

Total plywood supply in 2017 was 6,114,600 cbms, 4.8%

more than 2016. Domestic production was 3,210,500

cbms, 4.8% more. In this, softwood production was

3,064,700 cbms, 5.8% more. Imported plywood was

2,904,100 cbms, 4.8% more. Consequently, share of

domestic and imports is 52.5% of domestic and 47.5% of

imports and domestic share is over imports for two straight

years.

Production of softwood structural panel was 2,925,500

cbms 5.0% more and the shipment was 2,914,400 cbms,

3.3% more so produced volume was shipped immediately

by active demand for housing. Production of nonstructural

panel was 139,100 cbms, 37.2% more. Because

of considerable delay of shipment of floor base by the

suppliers from South East Asian countries, Japanese floor

manufacturers rapidly shift to use domestic softwood

plywood and other building materials manufacturers also

shift to domestic softwood plywood to avoid risk of

exchange rate fluctuation.

Production of softwood concrete forming panel was

28,800 cbms, 6.5% more. The increase is small due to

slow demand for concrete forming panels. Plywood

inventories remain low with only 93,000 cbms at the end

of last December.

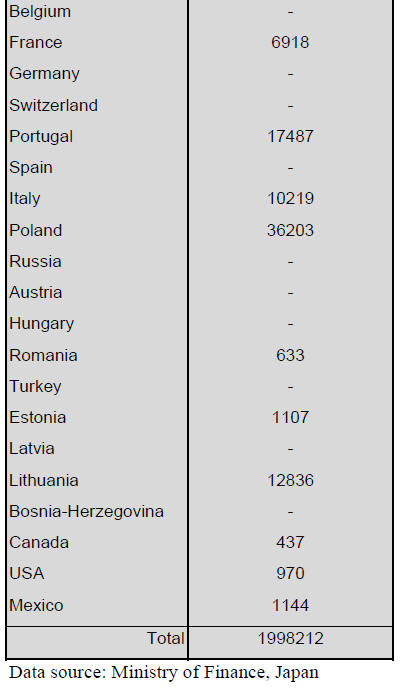

As to imported plywood, Malaysia supply was 1,190,400

cbms, 10.7% more. Malaysian supply peaked in 2013

with 1,604,400 cbms then it had been dropping

considerably for three years but this is the first time in two

years that the volume exceeded 1,100,000 cbms.

Indonesian supply had been steady for the first half of the

year then it started dropping in the second half by about

30% less every month and ended up with 877,700 cbms,

2.8% less.

Concern to the Chinese supply was mills¡¯ closures by

strict environmental restrictions but it did not have much

impact on the supply so far.

Plywood in December

Softwood plywood demand is easing but precutting plants

are asking delivery of delayed production. Normally the

movement slows down in the first quarter but because of

labour shortage, construction works are delayed so the

demand is being carried over. Domestic plywood

manufacturers are busy catching up delayed orders.

December production and shipment maintained high level

despite many holidays. December domestic plywood

production was 271,100 cbms, 4.8% more and 4.1% less.

Softwood production was 259,300 cbms, 8.6% more and

4.4% less. Softwood structural panel production was

244,800 cbms, 6.5% more and 5.0% less.

December imported plywood was 232,300 cbms, 0.5%

less than December last year and 16.7% less than

November. Malaysian supply was 97,200 cbms, 10.7%

more and 15.9% less.

Indonesian supply was 56,900 cbms, 20.8% less and

37.6% less. Major plywood mills in Indonesia stopped the

operation because of log shortage so the arrivals dropped

considerably.

The production in Malaysia and Indonesia should stay low

during rainy season so the arrivals do not seem to increase

until next spring. The inventories of imported plywood in

Japan keep declining by reduced arrivals.

|