|

Report from

North America

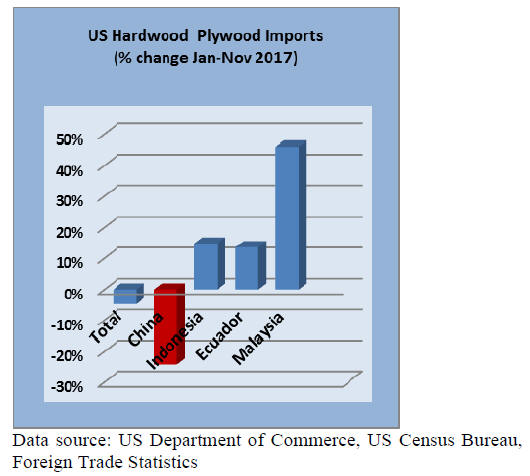

Duties on Chinese plywood benefit other suppliers

Hardwood plywood imports grew strongly in October

before declining again in November.

Not surprisingly imports from China were significantly

down because of the US antidumping and countervailing

duties on plywood from China. Year-to-date plywood

imports from China were 24% lower than in November

2016.

All other major plywood suppliers shipped more to the US

year-to-date compared to the same time last year. Despite

the increase in imports from Indonesia, Malaysia, Ecuador

and others, the total volume of US hardwood plywood

imports was 5% lower year-to-date than in November last

year.

Higher flooring imports from Indonesia and Thailand

Imports of most processed wood products from tropical

countries declined in November. Only tropical hardwood

veneer imports recovered in November with Italy

accounting for almost half of all US imports of tropical

veneer.

Hardwood moulding imports from Brazil were also down

significantly in November, both month-on-month and

year-to-date.

On the other hand, hardwood flooring imports from China

were up in November, despite an overall decline in US

flooring imports. Assembled flooring imports from both

Indonesia and Thailand gained significantly in the US

market compared to 2016.

US furniture market outlook positive

Imports of wooden furniture were up 4% in November.

Except for Canada and India, most countries increased

furniture exports to the US. Malaysia was the strongest

performer in November.

Wooden kitchen furniture imports grew the most in

November, followed by upholstered and non-upholstered

seating and bedroom furniture. Wooden office furniture

imports declined.

The US furniture industry reported growth in December,

according the Institute for Supply Management, while

wood product manufacturing declined. Retail sales by

furniture stores increased 8% from October to November

according to US Census data. When home furnishings are

included, retail sales grew 5% during the previous twelve

months compared to the year earlier.

The latest Smith Leonard survey of US residential

furniture manufacturers and distributors reports the

following growth figures for October 2017: New furniture

orders increased 8% compared to October 2016. Furniture

shipments were up 5% year-to-date from October last

year.

Strong economic indicators

Employment in US manufacturing and construction

increased in December. The overall unemployment rate

was unchanged in December 2017 at 4.1%. US GDP

increased at an annual rate of 2.6% in the fourth quarter of

2017 according to the preliminary estimate by the Bureau

of Economic Analysis. In the third quarter GDP growth

was 3.2%.

US tax reform enacted

The US recently enacted the most comprehensive tax

reform since 1986. The tax plan cuts corporate tax rates

permanently from 35% to 20%. Individual tax rates for

certain income brackets are lowered temporarily until

2025, unless the cuts are extended at a later date.

Despite the tax cuts consumer confidence was largely

unchanged in January according to the University of

Michigan Surveys of Consumers report. More consumers

thought the tax reform would be positive than the number

of respondents who said it would be negative.

2017 US housing starts highest since 2007

Housing starts were up 2.4% in 2017 compared to 2016

according to newly released data from the US Department

of Housing and Urban Development and the Commerce

Department. Total housing starts were 1.2 million in 2017.

Residential construction was strongest in the West in

2017.

Over 70% of total starts were single-family homes, which

is a positive signal for the economy and for wood product

demand. Single-family starts grew by 8.5% from 2016,

while multi-family construction fell by over 10%.

The National Association of Home Builders predicts

continued growth in housing production in 2018. The

association forecasts a 2.7% growth in starts to 1.25

million units in 2018.

Canadian housing starts up 12% in 2017

Housing starts in Canada were higher in 2017 than

predicted by the Canadian Housing and Mortgage

Corporation (CMHC) at the start of last year. Housing

starts increased 12% compared to 2016, based on

preliminary starts data for December 2017.

Multi-family construction grew 16% in 2017, while

single-family starts increased 5%. CMHC remains

concerned about overvalued housing in several areas of

Canada relative to population and income.

ITTITTO/EC IMM ReportO/EC IMM Report

ITTO/EC IMM Report

ITTO-IMM reviews Indonesian furniture presence in

Cologne

IMM Cologne 2018 was attended by Robin Fisher,

consultant to the ITTO¡¯s Independent Market Monitor

(ITTO-IMM) initiative. On behalf of ITTO-IMM, Mr

Fisher identified and interviewed a large number of

furniture retailers, wholesalers and manufacturers,

focusing particularly on those engaged in supply of

Indonesian products to the European market.

The interviews undertaken by Mr Fisher are the first stage

of a larger study commissioned by ITTO-IMM with the

objective of better understanding the structure of the trade

in FLEGT licensed furniture products with the EU, with

respect to products, competitiveness, and distribution

networks. The results of the larger study will be made

available during 2018 at the ITTO-IMM website

(www.flegtimm.eu).

There was a wide variety of furniture sourced from

Indonesia on display at the show, and the range of

exhibitors also highlighted the different market niches and

distribution channels involved in supply of Indonesian

wood furniture to the EU, for example: Lower-end mass

produced outdoor furniture, mainly in plantation grown

teak, as exemplified by Indoexim, selling to larger

department chain stores, furniture retailers, and garden

centres throughout Europe.

Higher-end outdoor furniture ¨C high quality products

usually designed by European designers and distributed

under European brands such as Gloster, Fischer-Möbel,

Ethimo, Life Outdoor Living, and Kettal which market

themselves as ¡°outdoor space designers¡± particularly

towards contract customers in the hotel and hospitality

sector.

The products combine teak, both from plantations and

often recycled, occasionally acacia and mango wood, with

other high-quality materials such as stainless steel,

lacquered aluminium, powder coated steel, glass. In some

cases, the product is entirely manufactured in Indonesia in

others certain components are made in Indonesia and

assembled in Europe. Products are distributed via

specialist retailers of top end outdoor furniture.

Locally-designed Indonesian indoor furniture, which tends

to be hand-crafted in solid wood, often quite heavy and

with a rustic and rough finish and targeting the low to

middle end of the market.

The most commonly used species are teak, mahogany

(Toona Sureni), mango wood, munggur (Indonesian

redwood) and acacia. The use of black forged iron

combined with the solid wood is a dominant trend in this

style of furniture.

Large industrial Indonesian manufacturers of both interior

and exterior furniture. The Vivere Group which was

exhibiting in Cologne is an example of an Indonesian

company making a very wide variety of furniture

including mass-produced panel-based furniture with

modern design concepts, often for large scale contracts,

and which also has a subsidiary that specializes in high

end furniture for the export market.

The competitive market position of each of these types of

Indonesian furniture varies widely and needs to be better

understood to fully appreciate the impact of policy

measures like FLEGT licensing.

For example, the more traditional locally-designed

Indonesian furniture is competing directly with, and was

often exhibited alongside, furniture from India of a similar

type and in similar species (although furniture in sheesham

wood was specific to the Indian continent).

Some EU-based furniture importers and wholesalers are

working with some of these smaller craft-based Indonesian

manufacturers and are helping them to ¡°westernize¡±

furniture product lines to meet customer trends in Europe.

These companies are now selling Indonesian interior

furniture to a wide range of customers from big to small

retailers as well as online.

In contrast a large Indonesian group like Vivere is

competing more directly with large manufacturers

elsewhere in Asia. However, part of their strategy is also

to differentiate in the international market by bringing

Indonesia¡¯s traditional strong craft skills into more modern

designs.

Vivere have called on Indonesian designers to come up

with furniture designs that highlight Indonesian hand

weaving skills with natural rattan while embracing

contemporary design with clean lines and a light touch.

Rattan is combined with coated metal frames and

occasionally some elements in teak. In Cologne they were

launching Sadha an indoor furniture range which includes

teak hand rests for their sofas and armchairs.

Trade consultations on the EU FLEGT VPA initiative

In March, The Building Centre in London, UK will host

the first in a series of trade consultations on the EU

FLEGT VPA initiative and FLEGT licensing system.

This event is being organised by the EU FLEGT

Independent Market Monitoring (ITTO EC/IMM) project

in cooperation with the Global Timber Forum (GTF).

For more see:

http://www.ttf.co.uk/article/imm-to-hold-flegtradeconsultation-

in-london-on-8-march-672.aspx

|