2. GHANA

Readying for FLEGT licenses this year

Ghana is ready to run trials on its FLEGT licensing system

this year despite delays in the process to conclude the

work. This news was announced during a workshop

organized for timber exporters.

Alexander Dadzie, the Vice President of the Ghana

Timber Association (GTA), told attendees the delay in

implementation was due to the care required in developing

the necessary regulations and legislation.

At the same meeting with exporters, Eric Abbeyquaye, the

Permit Manager in the Timber Industry Development

Division of the Forestry Commission, said that Ghana

signed the VPA with the EU demonstrated Ghana’s

commitment towards ensuring only verified legal timber

was exported.

Illegal harvested rosewood auctioned

The Ghana Minister for Lands and Natural Resources

reported to parliament that 4,986 cubic metres of seized

illegally harvested rosewood was recently auctioned. This

auction, in addition to the sales price, netted government

around GHc296,000 in auction fees.

The logs in question, said the Minister, had been seized

from operators whose felling licences had been withdrawn

but who continued to harvest rosewood logs.

The government has now banned the harvesting and sale

of rosewood. Future trade in this valueable timber, said the

Minister, will be governed by CITES regulations.

Minister’s efforts to stop illegal mining recognised

A Christian group in Ghana has named the Minister of

Lands and Natural Resources, John Peter Amewu, as the

‘Best Minister for 2017’. This, say local media reports,

was because the Minister fought hard in 2017 to protect

Ghana’s water bodies and forests and bring a halt to illegal

mining which was destroying the environment and the

country’s forest cover.

The Ministry of Science and Environment has suggested

that the country will need external help in reclaiming

forests destroyed by illegal miners.

Ghana’s economy rebounding

Ghana’s President has said economy is improving such

that soon it would be able to forego the financial support

provided by the World Bank. This, he said, will be

possible because of the government’s fiscal responsibility

and the crackdown on corruption. Ghana’s GDP growth

for Q3 2017 shot up to 9.3% from 3.5% in the same period

2016.

For more see: https://www.reuters.com/article/us-ghanapolitics/

president-says-ghanas-economy-back-on-trackidUSKBN1F62FH

3.

MALAYSIA

Industry to face challenges on several

fronts

The Borneo Post has reported on prospects for the woodbased

industries in Malaysia as assessed by the research

arm of Hong Leong Investment Bank.

Hong Leong says in 2018 the timber sector will face a

challenge because of the strengthening of the ringgit

which will undermine competiveness and profits. A

particular challenge will derive from the fact that most

export pricing is in US dollars and if the dollar edges up

competiveness will be undermined.

Another issue raised in the Bank assessment was

that as

oil prices climb this will push up resin and other chemical

costs leading to higher production costs.

In related news, Malaysia’s Minister for Plantation

Industries and Commodities, Mah Siew Keong, has laid

raised the prospects for a National Oil Palm Trunk

Development Plan that will focus on the use of oil palm

trunks as an alternative raw material supply.

See: http://www.theborneopost.com/2018/01/17/wood-basedmanufacturers-

earnings-prospects-to-face-challenges-in-2018/

Professional Designers Programme (PDP)

The third round of the Professional Designers Programme

has been launched through collaboration between the

Malaysian Timber Industries Board, the Malaysian

Furniture Council and the Australian Furniture

Association.

This latest programme will focus on lifting Malaysian

furniture designs to a higher level through involvement of

professional designers. The aim, says the MTIB, is to

achieve 70% ‘Own Design Manufacturing’ in the

Malaysian furniture sector by 2020.

This PDP programme will combine domestic culture and

styles with production capabilities of local furniture

manufacturer to produce attractive designs for the local

and international markets.

Sarawak to collaborate with Finnish Institute on

sustainable forestry

A spokesperson for the Sarawak State government has

said an agreement has been reached with the Natural

Resources Institute Finland (LUKE) for collaborative

work on sustainable forestry in Sarawak. Plans are being

developed for securing funding for efforts on sustainable

forestry, integrated land management, forest carbon

management and climate change issues.

See: https://www.theborneopost.com/2018/01/25/sarawak-tocollaborate-

with-luke-on-sustainable-forestry/

Panel furniture a feature of upcoming furniture fair

In the lead up to the March Malaysian International

Furniture Fair set for 8-11 March this year the organisers

have a feature article on wood based panel furniture. The

MIFF article explains the panel-based furniture market

especially in the US is firm on the back of the trend for the

younger generation to opt for more affordable furniture.

In the coming MIFF 2018, says the article, an extensive

collection of both panel-based furniture and Malaysia’s

renowned solid wood furniture collection from top

domestic and international furniture manufacturers will be

on display.

For more see: http://2018.miff.com.my/media/news-andfeatured-

articles/92/the-popular-demand-wood-panel-basedfurniture/

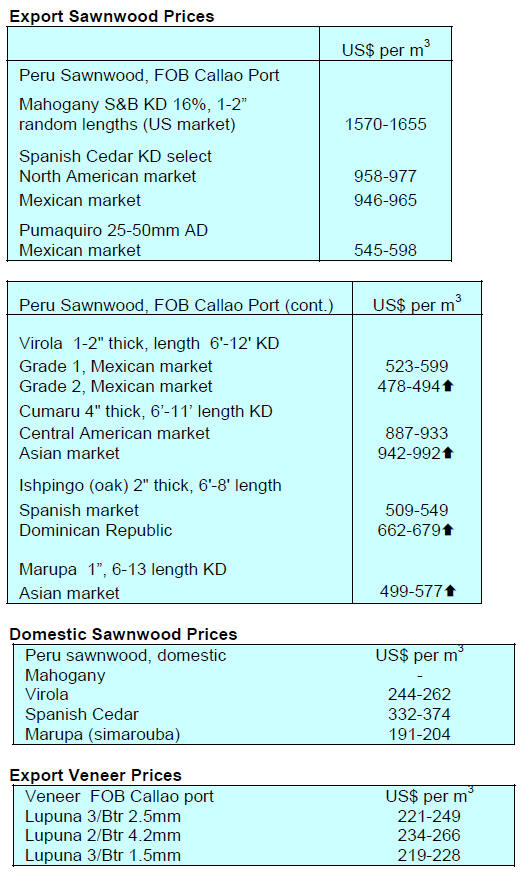

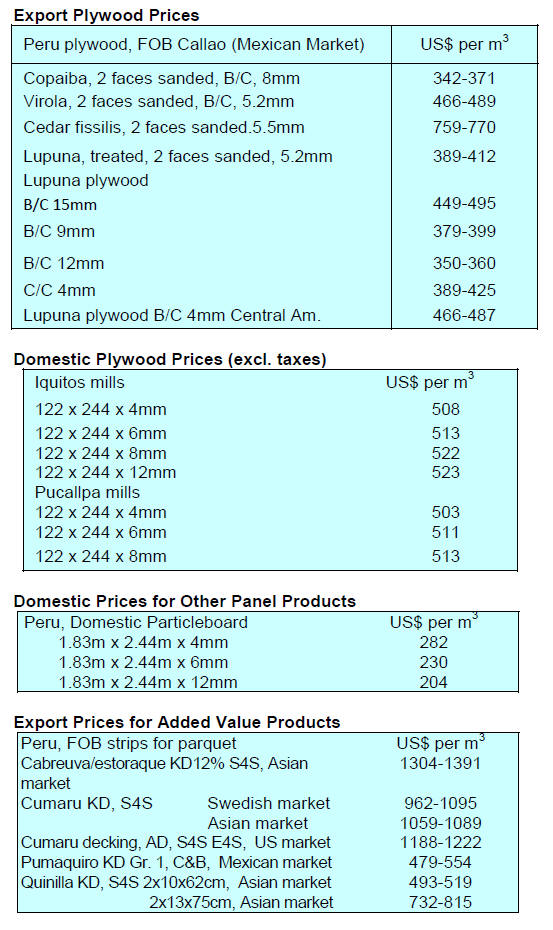

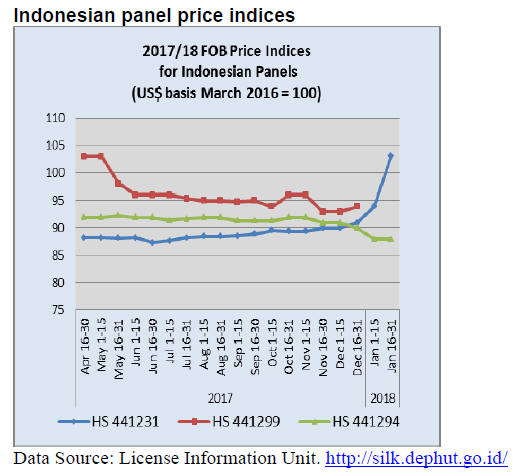

Plywood price update

Plywood traders based in Sarawak reported the following

export prices:

4.

INDONESIA

US$3 billion furniture and

handicraft export target

Secretary General of the Indonesian Furniture and

Handicraft Association (HIMKI), Abdul Sobur, has said

furniture and handicraft craft exports in 2018 could top

US$3 billion, up over 15% on 2017.

Sobur commented that 2017 exports were not much higher

than a year earlier because of problems with productivity

and competition from low cost producers in the region.

The fact that some foreign companies with factories in

Java decided to relocate operations to Vietnam made

matters worse for the sector.

Nevertheless, Sobur is still optimistic that the export target

of US$5 billion in 2019 can be achieved if regulations that

hamper and reduce industrial competitiveness are

addressed. To achieve US$3 billion in exports Sobur

pointed to the need to address raw material supply issues,

improve productivity and designs.

HIMKI companies plan to participate in exhibitions of

furniture and craft industries abroad. This year, some

exhibitions in countries such Germany, the United States

and China will be encouraged and supported by

government.

In related news, Bank Indonesia has revealed banks

provided loans to furniture manufacturers worth Rp860.01

billion, up almost 15% on 2017.

Indonesia ready to return to Salone del Mobile

At a recent press conference Joshua Simanjutak, of the

Creative Economy Agency said Indonesia companies will

be assisted in participating in Italy’s main furniture show

Salone del Mobile set for 17-22 April.

Social forestry programmes to be more closely

coordinated

Indonesia’s Peat Restoration Agency (BRG) along with

some NGOs, has called on the government to develop

programmes to support communities living in degraded

peatland areas. Myrna Safitri, Deputy Head of BRG, said

BRG will coordinate its peatland restoration programmes

with the social forestry programmes being undertaken by

the Ministry of Environment and Forestry.

5.

MYANMAR

Frequent changes to tax laws a problem for

enterprises

At a recent workshop, representatives of the American

ASEAN Traders Association, along with others, raised the

issue of the regular changes that are made to tax laws in

the country which make it very difficult for manufacturers

to calculate their tax liabilities and production costs.

It was mentioned that it is only in Myanmar that such

regular changes are made to tax laws and this can

negatively impact potential investors wishing to begin

manufacturing operations in the country.

In related news, the American ASEAN Traders

Association has called for a review of the current tax

regimes which include a commercial tax, a special

commodity tax, municipal taxes in addition to corporate

tax. They argue that an overall reduction in the tax burden

on companies would stimulate further domestic and

foreign investment .

The Myanmar Investment Commission has said it hopes

that the new Companies Law, set to come into force in

August, will create a more investor-friendly environment.

Volume of seized teak logs exceeds planned harvest

During the first three quarters of fiscal 2017-18 around

36,000 hoppus tons of timber was confiscated. This

include over 7,000 hoppus tons of teak and 29,000 hoppus

tons other hardwoods.

In the current fiscal year the Myanma Timber enterprise

(MTE) planned to harvest 15,000 hoppus tons of teak.

Against this background the authorities and civil society

groups are seriously worried about the huge quantity

which has been seized since it represents such a high

proportion of the planned legal harvest.

In a related development, since 29 Dec 2017 the Forestry

Department has suspended the auction of those logs

rejected by MTE because of their poor quality. Such

auctions, which are typically held across the country, have

been temporarily suspended in an attempt to control illegal

trading of Myanmar timber.

Currently, timber purchased by sawmillers during these

Forestry Department auctions are not allowed to be

transferred between regions and states and products

manufactured from these logs shall not be exported.

However, despite the best efforts of the authorities, illegal

timber traders and brokers continue to conduct log trading

in Myanmar’s border towns. Demand for teak in border

towns is driving up prices and this illegal trade is

distorting prices for verified legal teak used by domestic

industry making it difficult for them to operate profitably.

MTE commitment to transparency in harvesting

contracts applauded

MTE has made available details of the service contracts

with the private sector for this years’ harvesting,

specifically for felling/cutting, skidding,

loading/unloading, road construction and transportation.

The information available shows the name of the service

providers, the type of service and the region/area of forest

where harvesting will be conducted.

Last year there was confusion over the interpretation of

private sector involvement in harvesting.

MTE has confirmed that the past system, whereby private

sector contractors were granted permission to buy the logs,

will not be continued.

MTE has said clearly they will pay for the service of

contractors and that contractors will only be used if MTE

finds itself unable to undertake the respective operations.

Local analysts are very much encouraged by the serious

commitment to transparency by MTE.

6. INDIA

Factory output at 17-month high

Data from the Central Statistics Office (CSO) has shown

that November 2017 factory output increased at its

quickest pace in two years spurred by expansion in the

manufacturing sector. Analysts read the data as signalling

stronger growth in 2018.

CSO data shows that 15 out of the 23 industry groups in

the manufacturing sector had positive output growth in

November, the latest for which data is available. This is

very goodness for employment.

India/ASEAN collaboration on forestry

According to a press statement from the ASEAN

Secretariat, ASEAN Ministers of Agriculture and Forestry

and the Indian Minister of Agriculture and Farmers’

Welfare welcomed progress made in the implementation

of the ASEAN-India Plan of Action 2011-2015 to

implement the ASEAN-India Partnership for Peace,

Progress and Shared Prosperity.

Under an action plan ‘Promoting Capacity Building,

Technology Transfer and R&D for Global Competence in

Agriculture’, four capacity building activities have been

undertaken on IT Application for Agricultural Extension,

National seed quality control systems, Organic

certification for fruit and vegetables and conventional and

molecular techniques for diagnosis of trans-boundary

animal diseases.

The ministers also supported joint collaborative projects in

the areas of (i) Agroforestry interventions for livelihood

opportunities, (ii) Demonstration and exchange of farm

implement and machinery, and (iii) Genetic improvement

of parental lines and development of heterotic rice hybrids.

They noted the endorsement of the Medium Term Plan of

Action for Asean India Cooperation in Agriculture and

Forestry for 2016–2020 by the SOM AMAF and India.

http://asean.org/storage/2018/01/Joint-Press-Statement-4th-

AIMMAF.pdf

Dubai property show delivers good results

CREDAI’s Indian Property Show was held in Dubai in

early December and attracted over 13,500 visitors. The

Exhibition, in collaboration with Dubai based Sumansa

Exhibitions, was the first international exhibition of Indian

Properties in Dubai after the introduction of India’s Real

Estate Regulation and Development Act (RERA).

This act has led to a highly positive sentiment amongst

homebuyers and this was reflected in the sales of over

1,000 properties on offer at the exhibition.

The event also included state pavilions representing

Gujarat, Maharashtra, Delhi – NCR, Rajasthan, Karnataka,

Tamil Nadu, Kerala, Andhra Pradesh, West Bengal, Goa,

amongst others. Properties in Southern India were in

demand.

CREDAI President, Mr. Jaxay Shah said “CREDAI, along

with Sumansa Exhibitions, have been able to display the

most prime properties from the most credible developers

of India in Dubai.

The combination of CREDAI’s goodwill and the new era

of RERA in the Indian real estate gave the event an

extremely strong foundation to flourish amongst a base of

keen NRI buyers who also displayed an extremely strong

interest in buying Indian properties.”

See

https://credai.org/press-releases/credais-indian-property-showwitnesses-

strong-participation-from-210-developers-and-13500-

visitors

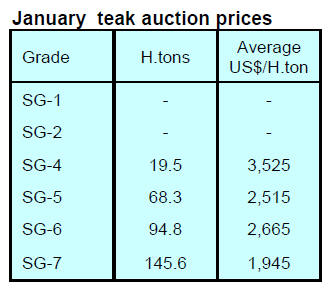

Teak auction prices

Auctions at forest depots in North and South Dangs

Divisions ended on 22 January. Of the approximately

5,000 cubic metres sold most were teak logs the rest being

tropical hardwoods such as Adina cordifolia, Gmelina

arborea, Pterocarpus marsupium, Acacia catechu and

Mitragyna parviflora.

Domestic millers are keen to purchase larger girth

domestic teak logs as imported teak logs are mainly of

small girth material. One significant advantage of

purchasing domestically grown teak logs is that the logs

are sold with the bark and sap removed. Prices at the

recent sale are shown below.

Prices at the recent sales are shown below.

First quality non-teak hardwood logs 3-4m long

having

girths 91cms & up of haldu (Adina cordifolia), laurel

(Terminalia tomentosa), kalam (Mitragyna parviflora) and

Pterocarpus marsupium attracted prices in the range of

Rs.800-1000per cu.ft. Second quality hardwood logs were

sold at between Rs.600-700 and low grade logs sold for

Rs.250-400 per cu.ft.

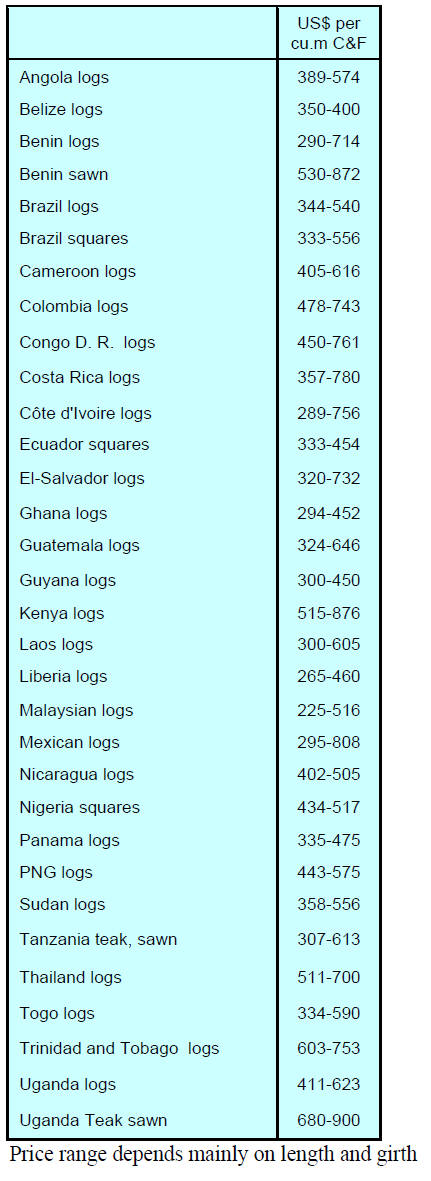

Imported plantation teak

Demand for imported logs and the pace of supply has been

steady. The combined impact of freight rates and a slightly

weaker dollar/rupiah exchange rate, along with increased

availability has meant that prices offered to exporters

remain unchanged.

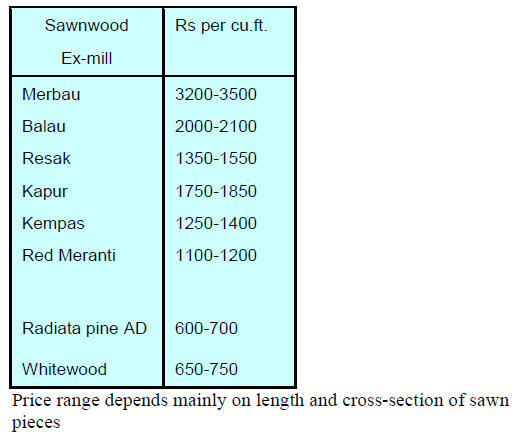

Locally sawn hardwood prices

Prices for locally milled hardwoods continue unchanged

from the beginning of the year. Millers report demand is

firming on the back of increased investment in housing

projects especially the affordable housing sector. Analysts

note that the acceptance by endusers of red meranti is

improving.

Despite the brighter demand, importers are resisting

demands from suppliers for price increases citing tough

market competition.

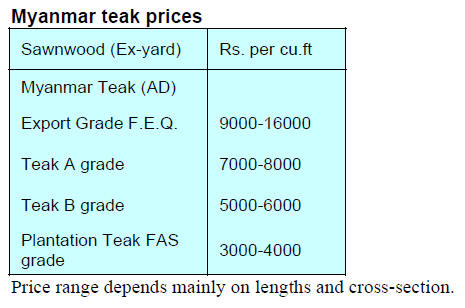

Imported sawn Myanmar teak

Analysts say that, while there is a steady demand from

dedicated Myanmar teak users, others are opting for other

hardwoods which are available at more competitive prices.

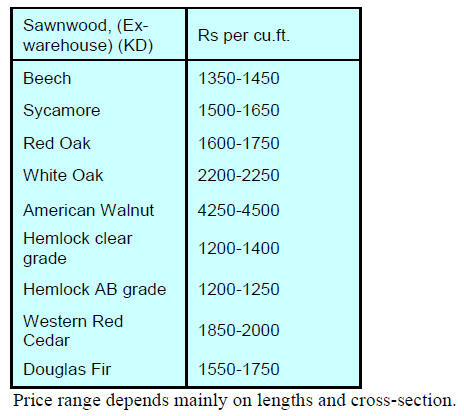

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

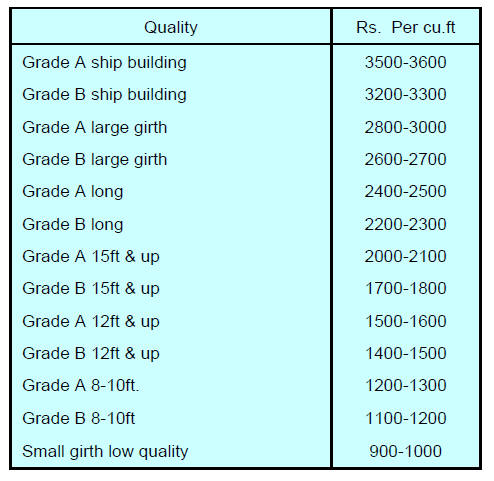

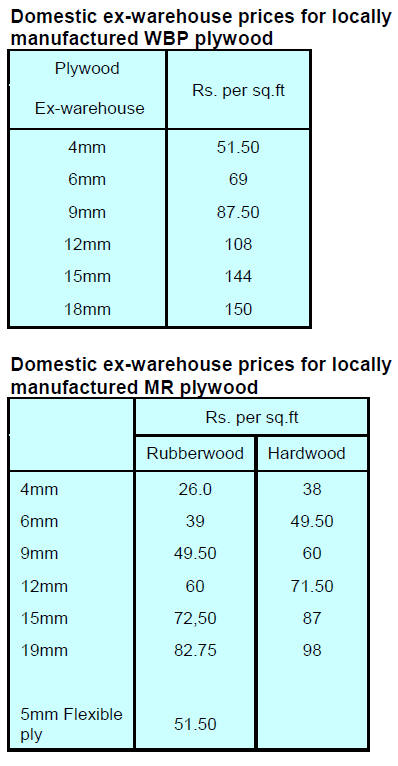

Domestic plywood prices

Plywood manufacturers are happy that the Goods and

Services Tax (GST) on plywood has been reduced from

28% to 18%. However, now they face another issue in

rising resin and other chemical costs which has forced

them to raise prices.

The current prices, after adjusting for GST and raw

material costs are shown below.

7. BRAZIL

Recover in furniture sector

some way off say analysts

According to the Brazilian Institute of Geography and

Statistics (IBGE) furniture production increased 4.4% in

the first eleven months of 2017, the fastest pace of growth

since 2011.

The IBGE conducted state surveys in Paraná and Rio

Grande do Sul. In Paraná production rose just over 3% in

the first eleven month period but in Rio Grande do Sul

there was a decline in production. In comparison to

November of 2016, furniture industries in Paraná

registered strong growth (+13.5%) while those in Rio

Grande do Sul saw a decline of 8%.

Despite the rise in production analysts point out there is

little to celebrate as the 4.4% increase is small compared

to the overall decline of almost 30% over the previous

three years.

Looking at furniture retail prices in 2017 where there was

a 0.5% decline and the 5.5% drop in sales volume up to

October, analysts estimate furniture consumption in 2018

could be lower than forecast. This suggests that it will be a

few years before the furniture sector recovers anywhere

close to the boom year of 2010.

IBAMA investigates timber companies – several face

charges

In January this year the Brazilian Institute for

Environment and Renewable Natural Resources (IBAMA)

conducted spot checks on logging companies in the

Amazon to investigate potential fraud in payment of the

Environmental Control and Inspection Fee (Taxa de

Controle e Fiscalização Ambiental - TCFA).

IBAMA has reported 2,255 infractions and fines

amounting to around R$7 million. In Mato Grosso State

alone irregularities were identified in 616 companies. In

Pará 355 cases were identified, in São Paulo 308 case and

in Rondônia 235 cases.

IBAMA says the main issue was that companies traded

forest products with a higher volume than declared in the

Federal Technical Register System (CTF).

November export update

In November 2017 Brazilian exports of wood-based

products (except pulp and paper) increased 14.9% in value

compared to November 2016, from US$211.7 million to

US$243.2 million.

Compared to the same month a year earlier the value of

pine sawnwood exports increased 35% in November 2017

(US$ 32.5 million). In terms of volume, exports increased

29% over the same period, from 165,400 cu.m to 213,700

cu.m.

Tropical sawnwood exports also increased rising 33% in

volume, from 31,800 cu.m in November 2016 to 42,400

cu.m in November 2017. The corresponding rise in value

was 25%, from US$15.4 million to US$19.2 million.

Exports of pine plywood exports surged 57% in value in

November 2017 comparison with figure of November

2016, from US$ 5.0 million to US$55.0 million. In terms

of volume, exports increased 36% over the same period,

from 132,400 cu.m to 180,100 cu.m.

In November 2017, tropical plywood exports increased

23% in volume, from 12,500 cu.m in November 2016 to

15,400 cu.m and from US$ 5.2 million in November 2016

to US$ 6.2 million in November 2017, a 19% increase.

Brazil’s wooden furniture exports rose from US$38.2

million in November 2016 to US$ 41.2 million in

November 2017, a 7.9% rise.

December export update

In December 2017 the total value of Brazil’s exports of

wood-based products (except pulp and paper) increased

26% in value compared to December 2016, from

US$220.8 million to US$277.4 million.

Pine sawnwood exports increased 21% from US$ 35.1

million in December 2016 to US$ 42.4 million in 2017

December. In volume, exports increased 15.5% over the

same period, from 174,000 cu.m to 201,000 cu.m.

Tropical sawnwood exports rose 16.3% in volume, from

36,700 cu.m in December 2016 to 42,700 cu.m in

December 2017. In value, exports increased 14.0% from

US$ 17.9 million to US$ 20.4 million, over the same

period.

December 2017 pine plywood exports increased 41% in

value year on year from US$40.0 million to US$56.3

million. The volume of exports increased by just 15.5%

from 154,000 cu.m to 177,800 cu.m.

December 2017 tropical plywood exports increased in

both volume and in value, from 17,900 cu.m (US$7.3

million) in December 2016 to 18,400 cu.m (US$ .6

million) in December 2017.

There was also a continuation of the rise in furniture

exports which jumped from US$ 39.3 million in December

2016 to US$ 43.9 million in December 2017, an almost

12% rise.

2017 furniture trade – a call to diversify markets

A look at residential furniture export shows that there was

an almost 7% rise in 2017 compared to 2016. But analysts

consider this a poor performance as half of the exports

were dependent on just three countries, the United States,

the United Kingdom and Argentina.

Exports to Argentina fell 9% and exports to the UK

dropped 13%. The three markets accounted for about 47%

the total, just 1% higher than in 2016. The total value of

furniture exports was U$633.5 million, some US$50

million below that in 2014.

By State, Santa Catarina continues to lead exports with

36% of the total followed by Rio Grande do Sul, with

29%.

Brazil’s imports of furniture continue to rise. 2017 imports

totaled US$538.5 million, an almost 16% increase on

2016. China accounted for 33% of this total, a 34%

increase over the previous year.

8. PERU

Exports fall for the third

consecutive year

Peru’s wood product exports to the US dropped by over

50% in the first eleven months of 2017 to US$110.5

million. It is likely that 2017 exports will be the third

consecutive year of decline says ADEX, the exporters

association in Peru.

The chairman of the Wood and Wood Industries

Committee of ADEX, Erik Fischer, has blamed the

persistent attacks on the reputation of timber companies in

Peru and the detention for months of shipments by US

Customs because of spurious claims that shipments were

of illegally harvested timber.

Wood product exports to the US were down around 50%

in the first eleven months of 2017 compared to the same

period in 2016. Because of the problems of shipping to the

US this market is becoming less important to Peruvian

exporters according to Fischer.

Last year the main markets were China, (US$55 million)

followed by Mexico (US$16 million). Other significant

export markets included some EU member states

countries, the Dominican Republic and New Zealand.

In terms of product, of significance were exports of semi

manufactured products (US$68.8 million) such as

mouldings and flooring. In addition, there were exports of

sawnwood (US$22 million), veneers and plywood (US$9

million), joinery products (US$5 million), furniture and

parts (US$3 million).

Promote businesses and forest conservation in

Atalaya

When speaking to regional representatives of indigenous

organizations, the Ucayali Regional Government, the

Municipality of Atalaya, Sernanp and representatives of

SERFOR, the Head of the Incentives Unit for the

Conservation of Forests (part of the Forests Programme)

said investment projects for the Mitigation of Climate

Change will support the generation of sustainable

businesses in native communities.

The aim of the Forests Programme is to promote the

sustainable use of the forest in the region, reduce

deforestation and improve the quality of life of the

population that live in or depend on the forest.

The president of the Confederation of Amazonian

Nationalities of Peru (Conap), reminded the meeting that it

is important to generate economic initiatives for

indigenous and native communities to raise living

standards. This, he said, can be achieved through support

for small businesses in the cultivation of coffee, cocoa,

fish farming and community forestry.

25% of Madre de Dios forest under sustainable

management

According to the records of the National Forestry and

Wildlife Service (SERFOR), Madre de Dios has over 25%

of its forests under sustainable management.

Around half of this is forest area is for timber harvesting,

the other half being for production of chestnuts, shiringa

(rubberwood) and aguaje (the so-called miracle fruit for

women), important crops which generate significant

employment.

In Madre de Dios there are also 190,000 hectares of

concessions for conservation there are also areas for

afforestation and reforestation.

Madre de Dios is the third largest department in the

country and has the largest forest area after Loreto and

Ucayali. However, analysts complain the potential of the

natural resources is still at risk from deforestation.

Between 2001 to 2016 an area of around deforestation of

163,000 hectares, was lost to small-scale migratory

agriculture and illegal mining.