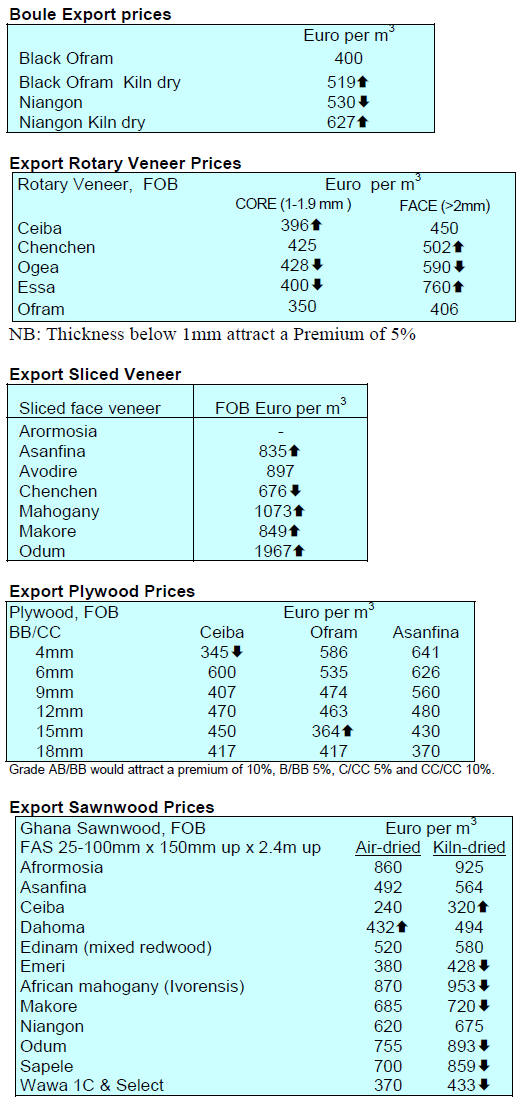

2. GHANA

Investors promised litigation-free land for plantations

The Chief Executive Officer of the Ghana Forestry

Commission, Kwadwo Owusu Afriyie, has said the

Commission will release land for private plantation

developments across the country.

This initiative will contribute to efforts to restore Ghana’s

depleted forest cover and generate jobs and revenue for

government.

The plan is to expand public/private partnerships

which

deliver benefits for both government and the private

sector. The Forestry Commission promises potential

investors litigation-free land for medium and large scale

tree plantations.

The Commission’s CEO said the government wants to

attract investment from local corporations and businesses

but that he appreciates investing in forestry requires a long

term vision but still urges Ghanaians to take up the

challenge.

Sea port tariffs to go up in 2018

There are signs that the Ghana Ports and Harbours

Authority (GPHA) intends to revise tariffs in January 2018

which means exporters and importers will have to pay

more. The domestic press is reporting that charges could

go up anywhere between 5 – 20%. The current charges

were set 4 years ago.

To win understanding of the business community the

GPHA has engaged the Ghana Shippers Authority (GSA),

the Ship Owners, Agents Association, freight forwarders,

importers and exporters.

A rise in tariffs will increase the cost of doing business

and could significantly affect the costs of importing

machinery and spare parts as well as terminal handling

charges on exports.

The GPHA is a statutory corporation established to

provide efficient port facilities with the vision to make

Ghana a leading logistics hub for West Africa.

Government to improve conditions for expanded

industrialisation

The National Investment Bank (NIB) and the Ghana

Agriculture Development Bank (GADB) could be merged

into a new National Development Bank.

The rationale behind creating a new bank is to provide

competitive credit to the agricultural and manufacturing

sectors of the economy, thus aligning the banking

operations to the needs of the domestic industries rather

than, as is the case now, being focused on international

investments.

During the presentation of the 2018 budget the Finance

Minister, Mr. Ken Ofori-Atta, announced that the new

National Development Bank would have some US$500

million specifically for the agriculture and manufacturing

sectors.

Prof. Godfred Bokpin, Head of Finance at the University

of Ghana Business School, has applauded the proposal

while the Governor of the Bank of Ghana said it makes

sense for the NIB and the GADB to be merged. The

government of Ghana is determined to improve the

conditions for expanded industrialisation. The National

Development Bank could be launched before the end of

this year.

3. SOUTH AFRICA

Domestic mills face prospect of starting New Year

with

high stocks

Analysts report that there is little activity in the building

sector and that most of the current work is on finishing

existing contracts before the builders holidays which starts

on the 16 December.

On the domestic front the pine market is said to be steady

but the usual year end activity has not made much of an

impact on the high stocks being carried by the mills. The

prospects of starting the New Year with such high stocks

will make almost impossible to push ahead with any price

increases which are required to off-set rising log prices

and the anticipated increases electricity charges.

The property market remains weak. Many building plans

have been approved but most people are waiting to see the

outcome of the ANC elective conference which is

scheduled for mid-December as this could change the

political and economic climate in the country.

Importers face uphill battle to lift wholesale prices

The weak Rand has affected imports and traders are

ordering only what is needed and they have to work hard

to secure the price increases for meranti, US hardwoods

and African hardwoods needed to off-set the weaker Rand.

Analysts report demand for panels is also weak as most of

the shopfitting work in the malls has now been completed

there is little new work in the pipeline.

The furniture market remains very subdued despite a slight

improvement in disposable income levels which translated

into an expansion of retail sales in the beginning of the

third quarter of the year. However, consumers are still

very cautious on spending on household items such as

furniture, the purchase of which can be delayed.

Tough year for sawmillers

In the November issue of Sawmilling South Africa Roy

Southey writes “The past year has been a very tough one

for our sector with not much to celebrate, but we do feel

that there is potential and light at the end of the tunnel for

2018.

One thing that seems certain is that we will see some

significant change of ownership in our sector and with that

will come renewed energy and enthusiasm.

For the past two or three years many sawmills have been

preoccupied with the idea and feasibility of converting

biomass into electricity with not much emerging from this

direction, this may have something to do with the fact that

the national power grid seems to have stabilised and so

many sawmillers are now starting to cast their eyes back

towards mill modernisation, productivity improvement

and mechanisation.

With the government intent on introducing a National

Minimum Wage (NMW) in 2018 this could make good

sense.”

For more see http://www.timber.co.za/newsletter

4.

MALAYSIA

LEAN manufacturing for the timber

industry

The Malaysian Timber Industry Board (MTIB) in

cooperation with the Malaysia Productivity Corporation

(MPC) will be organising a ‘Lean Study Mission’ to

Japan in December.

The purpose is to experience the application of best Lean

Management Practices and Techniques demonstrated in

the Toyota Production System for the manufacturing and

service industry. Participants will also have the

opportunity to visit major furniture manufacturers.

Lean manufacturing or lean production, often simply

called "lean", is a systematic method for waste

minimisation within a manufacturing system without

sacrificing productivity.

See:

http://www.mtib.gov.my/index.php?option=com_content&view=

article&id=2455%3Alean-study-mission-japan-

2017&catid=1%3Ahighlights&lang=en

Bio-mass energy plans in Sabah and Sarawak

In Sabah, POIC Trading, BELL Corporation and My

Clean Energy have agreed to set up a satellite biomass

collection centre. This partnership could eliminate the

fragmentation of the sector in the State and so attract

investment in the bio-energy sector.

In related news, Sarawak has now established a group to

work on a feasibility study aimed at attracting investments

in the bio-energy sector.

The Chief Minister of Sarawak said the biomass industry

could generate around RM5 billion annual income and

create 30,000 jobs and thus become one pillar of the

State’s objective to diversify the economy.

Sarawak legality verification system up and running

The Second Minister of Urban Development and Natural

Resources, Awang Tengah Ali Hasan, has said the state

government is planning to gazette 6 million hectares as

Permanent Forest Estates (PFEs). So far some 4.3 million

hectares have been gazetted as of October this year.

The state government is also implementing the ‘Sarawak

Timber Legality Verification System’ which is based on

the Inter-Agency Standard Operation Procedures for the

forestry and timber industry. This ensures that timber and

timber products from the state are verifiable legal. The

Sarawak legality verification system provides for thirdparty

audit verification.

Community forest management model for Sabah

A partnership to develop community forest management

has been established bringing together Forever Sabah, the

Hutan – Kinabatangan Orang Utan Conservation

Programme and the World Wildlife Fund Malaysia.

The focus of forest governance activities will be in a

89,000 hectare forest area in Trus Madi Forest Reserve

with support from the Sabah Forestry Department and

licensee Anika Desiran.

Training of and technical assistance for state government

officers overseeing biodiversity protection and

management will be offered.

Observing innovations in China’s plantation sector

Members of the Sarawak Timber Association (STA)

Forest Plantation Committee benefitted from a week-long

study tour in Southern China to observe forest plantation

establishment, plantation management practices and

processing in China.

The delegation visited the Hainan Forest Department

they

also visited APP Ling Gao-Cheng Ling Forest Farm where

they were introduced to innovative approaches in land

utilisation and plantation techniques.

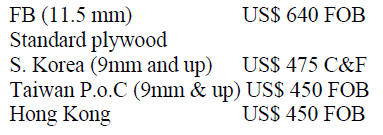

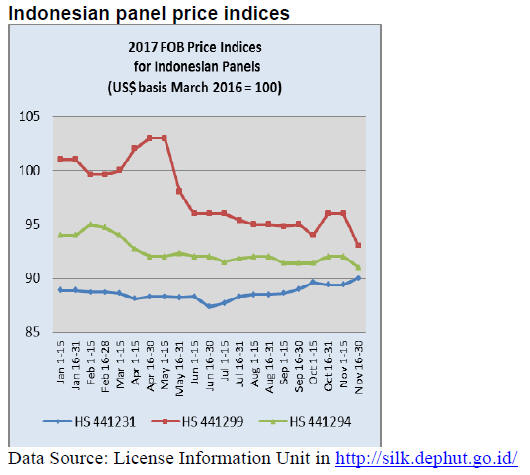

Plywood price update

Plywood traders based in Sarawak reported the following

export prices:

5.

INDONESIA

Furniture industry weighed

down by regulations and

inadequate raw materials supply

The Vice Chairman of the Raw Materials Sector in the

Indonesian Furniture and Handicraft Industry Association,

Andang Wahyu Triyanto, has said the recent poor export

performance of the furniture sector is the result of over

burdening regulations and problems with raw material

supplies.

She said the introduction of the SVLK and FLEGT license

systems are holding back the industry and while the

FLEGT license was promoted as a means to secure more

exports to the EU this has just not happened. She said “so

far, FLEGT implementation has not significantly raised

sales’.

Not only is FLEGT an issue but also the Indonesian

Timber Legality Verification System (SVLK) is a

problem, both of which are considered as hampering the

furniture and handicraft industries.

In related news, Gati Wibawaningsih, Director General of

Small and Medium Industry in the Ministry of Industry,

revealed that inadequate raw material supplies,

overlapping regulations and the decline in the number of

craftsmen in the furniture and handicraft sectors are major

problems.

In addition, inadequate attention to market promotion has

allowed competitors to capture international market share

from Indonesia. He said Indonesian manufacturers have

become less competitive than those in Malaysia,

Singapore and Vietnam.

Indonesian Furniture exports in 2015 totalled US$1.21

billion but fell to US$1.04 billion in 2016. Despite the

problems in the furniture sector the government is aiming

for furniture and handicraft export in 2018 to top US$2

billion.

Gati said that while the government plans to increase its

support for export promotion manufacturers should

improve their productivity and be more innovative in

designs.

Online timber exchange planned

The Indonesian Forest Entrepreneurs Association (APHI)

plans to launch an online timber exchange. The aim is to

prioritise transparency and effectively link buyers and

sellers of Indonesian wood products. The online system

could reduce transaction costs according to APHI and will

lead to greater sales.

Forestry ministry to allow log exports

Bambang Hendroyono, the Secretary General of the

Ministry of Environment and Forestry (KLHK), has said

the decision to allow plantation log exports was made

because the volume being produced was more than the

domestic industry can absorb and that the quality was

suitable for the export market.

Also, allowing log exports will create competition and

thus yield better prices for the local planation log

producers which will allow plantations owners to invest in

more advanced management and harvesting systems to

raise productivity.

However, the move to allow log exports has drawn

criticism from the Chairman of the Association of Sawn

Timber and Processed Timber Manufacturers Softwood

Producers (ISWA), Soewarni, who said why, when more

than 30 countries have banned log exports, would

Indonesia think to open the door for this trade? Soewarni

expressed concern that poor supervision of the log export

trade could provide a loophole for trade in illegal timber.

US company to expand manufacturing in

Surabaya

Furniture Today, the US based trade magazine, has

reported that case goods manufacturer Sunny Designs will

expanding its manufacturing in Asia with a second plant in

Indonesia.

6.

MYANMAR

Calls for review of recent changes to

foreign

investment rules

The Myanmar Investment Commission (MIC) has

introduced new rules seen by many as making the

investment climate more complex for foreign investors. At

the same time it has granted ministries more discretion to

make decisions on a case-by-case basis.

The new rules apparently place restrictions on economic

activities in or around watershed forests, religious sites,

traditional worship sites, farms and grazing lands and

water resources.

This, say analyst, could be used to exclude foreign

investment in almost any sector by any investor. Calls

have been made for a careful review of the changes. Also,

the MIC has declared a suspension of investment permits

relate to utilisation of the timber from the natural forest.

The Director General of the MIC said this decision will

stop potential investors from being misled that the

resources from the natural resources are abundant.

However, businesses utilising raw materials forest

plantations or imported timber will be allowed to continue.

Currently, some of the domestic timber-related businesses

operate by importing raw timber from Africa and Latin

America.

In Myanmar, the almost entire forest belongs to the state

and the Forestry department has already announced that

15,000 hoppus tons of teak logs and 300,000 hoppus tons

of non-teak logs are to be harvested in the 2017-18

financial year. At the planned harvest levels it has been

estimated that there will be a shortfall of around 5,000

hoppus tons for domestic industry.

Farm forest best practices discussed

Forest and Farm Producer Organizations (FFPOs) from

more than 10 countries in the Asia-Pacific region recently

met in Myanmar for the second regional conference to

accelerate and scale up implementation of the Sustainable

Development Goals in climate-resilient landscapes for the

benefit of local farm and forest communities.

The conference: “From users to producers: Scaling up

FFPO businesses to implement the SDGs in climateresilient

landscapes” was a three-day meeting providing an

opportunity for representatives of local, regional and

global forest and farm-related organizations to share best

practices that will help improve livelihoods through

collaboration and networking.

See: http://www.fao.org/asiapacific/news/detailevents/

en/c/1068453/

7. INDIA

Positive growth in the third quarter

India's economy is showing signs of recovering from the

impact, first, of the removal from circulation of the 500

rupee ($7.50) and 1,000 rupee ($15) notes which

accounted for over 80% of notes in circulation and

secondly the introduction of a standard Goods and

Services Tax (GST) replacing complicated state systems

with a single national rates. Analysts say that the latest

growth data may indicate that the negative impact of these

two changes is diminishing.

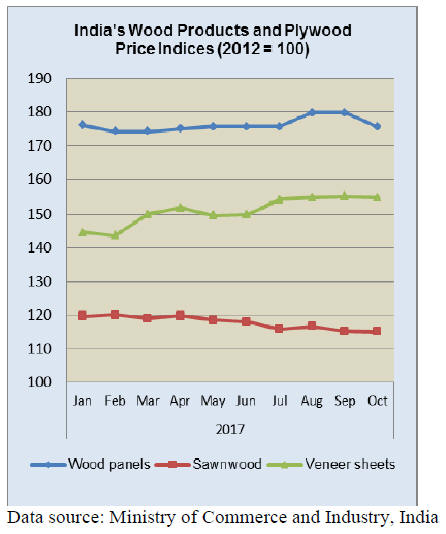

Main timber price indices trend down

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for October 2017 released by the

Office of the Economic Adviser to the government (OEA)

rose to 115.5 from 114.3 for the previous month.

The annual rate of inflation, based on monthly WPI,

stood

at 3.59% (provisional) for October 2017 compared to

2.6% for the previous month.

Inflation for this financial year so far was 2.03% compared

to a buildup rate of 3.53% in the corresponding period of

the previous year.

The October wholesale price indices for wood panels,

sawnwood and veneers all declined in October.

The press release from the Ministry of Commerce and Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

European plywood gaining a foothold in India

Plywood manufactured in Europe is steadily gaining a

foothold in the Indian market according to the November

issue of Ply Reporter, the Indian panel sector journal.

Birch plywood has caught the attention of architects and

designers because of the high standard of the product.

Ply Reporter says a dealer in Delhi commented that

European plywood is as good as top quality India made

plywood because of its dimensional stability, clean look

and strength. As demand in India ramps up creating a

supply demand gap traders are looking for alternative

plywood suppliers.

No change in prices for plantation teak logs

The demand for imported teak logs remains steady and the

recent reduction of the GST on some wood products is

encouraging importers to believe there is hope that GST

rates for other wood products will be eventually achieved.

At the time of this report prices continue within the range

a previously stated.

Locally sawn hardwood prices

Prices for imported hardwoods remain unchanged.

Domestic demand for imported sawnwood continues to be

firm and the there is growing substitution of hardwoods

for imported plantation teak as the quality and size of

plantation teak logs has deteriorated recently.

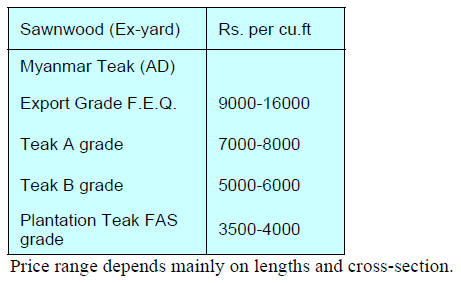

Myanmar teak prices

Importers have indicated that while the availability of

sawn teak from Myanmar is satisfactory ex-yard sales are

flat because of the high price of imported sawn teak

compared with some other good quality sawn hardwoods.

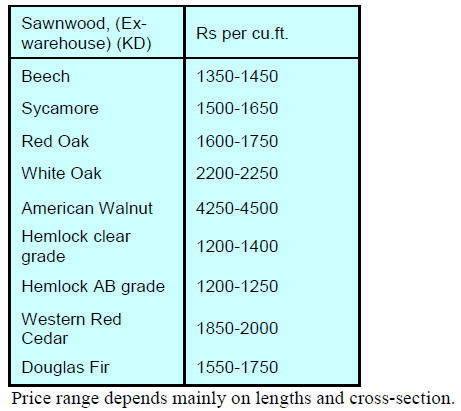

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

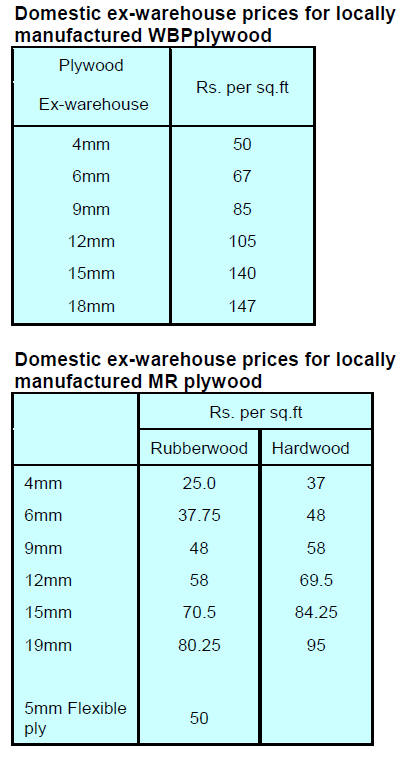

Prices for WBP and MR plywood manufactured

by

domestic mills

Plywood manufacturers in India are still celebrating the

reduction in GST on panels which helps them face the

challenge from imported plywood.

8. BRAZIL

Commitment to sustainable

forest management gets a

boost

Preference for timber from sustainably managed forests

and reforestation areas is now part of the government’s

procurement programme. The federal government has

included wood in the list of materials for which

sustainable practices are a prerequisite for procurement.

This development is seen as contributing to the

implementation of the Action Plan for Prevention and

Control of Deforestation in the Amazon (PPCDAm) and

Cerrado (PPCerrado) 2016-2020. These aim to reduce

deforestation but an added benefit is that this measure will

expand the market for wood products.

The measure also changed the thinking of the Interministerial

Commission on Sustainability in the Public

Administration (CISAP) linked to the Ministry of

Planning, Development and Management.

The Commission defines how the new standard will be

applied to public procurement and Decree Nº 9.178, of

October 24, 2017, confirms that sustainable criteria and

practices are acknowledged in the bidding documents as a

technical qualification.

The Brazilian Forest Service will define the technical

criteria for the implementation of the new rule and

promote the dissemination of this measure and conduct

training courses in procurement for public agencies.

Forest concessions system a tool to combat illegal

harvesting

One of the greatest challenges in the Amazon is to

reconcile job and income generation with forest

conservation. Forest concessions are one of the

instruments to achieve this goal.

According to a November report from Huffington Post

Brazil, the forest concession system of management can

contribute to combating predatory extraction in the

Amazon by delivering verified legal timber to the market

and efforts are underway to make the Documents of Forest

Origin (Documentos de Origem Florestal - DOF) system

more transparent .

The DOF is an instrument for oversight and control of

forest product transportation throughout the country from

the forest to its final destination. Greater transparency will

allow for effective social control and the creation of robust

public and private instruments to combat illegal activities

in the sector.

The Ministry of the Environment says that much of the

wood products from the Amazon are derived from illegal

activities and that a large part of this occurs in protected

areas such as conservation units (UCs) and indigenous

reserves.

There are 29 forest concession areas in Brazil and

almost 1

million cubic metres of wood have been sustainably

produced in these areas. The potential of the forest

concession approach in the fight against illegal harvesting

and the promotion of fair trade in Amazonian timber is yet

to be fully exploited.

Transparency in the issuance of DOFs will impart

legitimacy on forest products among traders and

consumers. The joint expansion of these two measures is

fundamental to ensure legitimate trade in timber from the

Amazon.

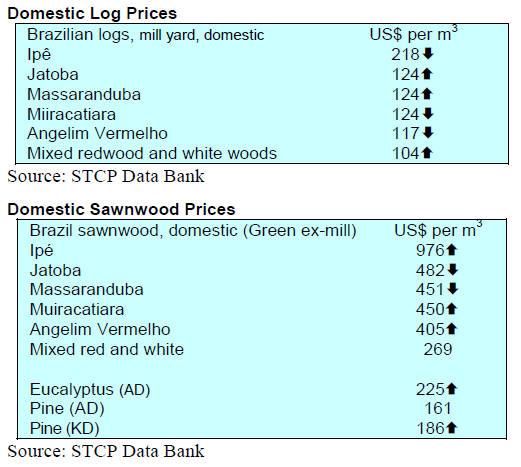

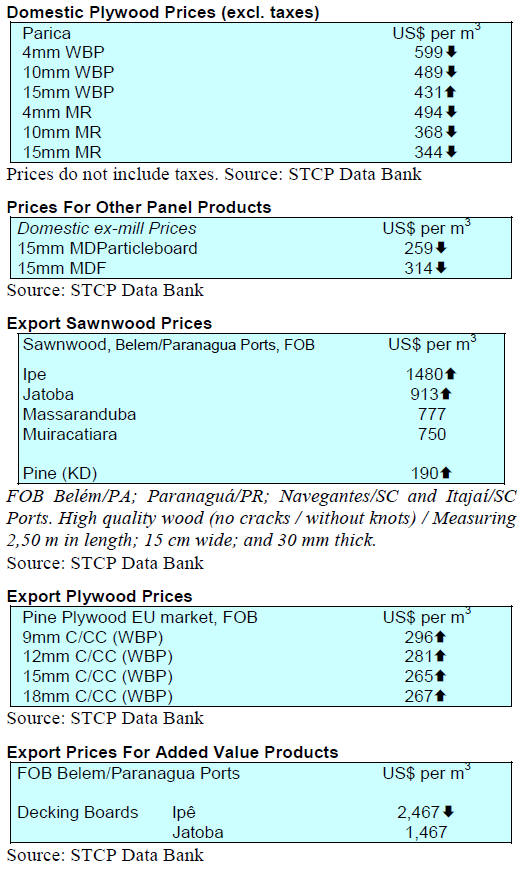

Export up-date

In October 2017, the value of Brazilian exports of woodbased

products (except pulp and paper) increased 44%

compared to October 2016, from US$ 86.8 million to US$

69.0 million.

Pine sawnwood exports increased in value by almost 50%

between October 2016 (US$28.5 million) and October

2017 (US$42.6 million) while the volume of exports rose

41% over the same period, from 146,700 cu.m to 207,100

cu.m.

In the sam 10 month period tropical sawnwood exports

increased 67% in volume, from 26,100 cu.m in October

2016 to 43,600 cu.m in October 2017 an the value of

exports rose 63%from US$12.1 million to US$19.7

million, compared to October 2016.

The positive trend continued with pine plywood where

exports jumped 50% in from US$34.5 million to US$51.8

million. Over the same 10 month period export volumes

increased 33% from 129,800 cu.m to 172,900 cu.m.

As for tropical plywood, Brazilian exports were 7.0%

higher in volume and value rising from 14,200 cu.m (US$

5.6 million) in October 2016 to 15,200 cu.m (US$ 6.0

million) in October 2017.

Finally, exports of wooden furniture from Brazil increased

from US$35.6 million in October 2016 to US$44.8 million

in October this year, 26% rise.

Wood-based panel export growth

According to the Brazilian Tree Industry Association

(IBÁ) in the first nine months of this year woodbased

panel exports were worth US$212 million, a 20% increase

year on year. On the other hand imports of woodbased

panels remained stable at around US$3 million.

Latin American countries remained the main markets for

Brazil’s woodbased panels in the first nine months of this

year with export revenues of over US$ 110 million, a 17%

increase compared to last year.

Asia and Oceania markets grew 70% over the same period

and the value of exports jumped from US$20 million in

the first nine months of 2016 to US$34 million over the

same period this year. In contrast, exports to Europe fell

by around 50% to US$3 million.

In the period from January to September 2017 the

domestic market absorbed 4.8 million cubic metres.

PNQM updated to meet CN Mark requirements

The National Programme for Wood Quality (PNQM)

developed by the Brazilian Association of Mechanically-

Processed Timber Industry (ABIMCI) recently included

new procedures such as preventive maintenance of

equipment, competency training, customer complaints

policy and supplier qualification. The objective is to

improve the programme and enable improvements in

control and traceability of production.

The PNQM provides a standardised structure for

manufacturing process control from the receipt of raw

material and inputs to final products packaging and

shipping.

Companies that implement PNQM's management system

have seen gains in productivity and competitiveness,

reduced losses and costs and guaranteed access to the main

consumer markets as their products meet national and

international technical standards.

The other advantages for companies that implement the

PNQM are improvements in internal culture and enhanced

product image that leads to greater customer satisfaction.

The process also stimulates continuous improvement and

control of the manufacturing process.

The updated PNQM meets the requirements of BM Trada,

a certification body in the UK with which ABIMCI has an

agreement to facilitate CE Marking certification for

structural panels from Brazil.

The CE system requires the manufacturer to meet the

requirements of EN (European Standard) through the

construction products regulation - CPR (305/2011),

governed by standard EN 13986 + A1 2015 for woodbased

panels, valid for 28 countries of the European

Economic Area and three of the four member states of the

EFTA.

9. PERU

President of Peru addresses

ITTC

Peru hosted the 53rd Session of the International Tropical

Timber Council (ITTC) in late November. The meeting

brought together ITTO member countries who account for

around 90% of the global trade in tropical timber.

Peru, together with other producer and consumer

countries, is part of the International Tropical Timber

Organization (ITTO), an intergovernmental institution that

promotes the conservation, management, utilisation and

sustainable trade of tropical forest resources among its

members.

The President of the Republic, Pedro Pablo Kuczynski,

attended the opening ceremony where he said conserving

and sustainably managing Peru’s vast forest resources is

fundamentally important for ensuring the country’s future.

“The position of Peru is clear,” said Mr Kuczynski. “It is

to promote, along with other countries, the conservation of

tropical forests, because they provide oxygen and

freshwater supply and mitigate climate change.

If we don’t protect our tropical forests, it will have a huge

impact on future generations.”

Mr Kuczynski also spoke about a new Peruvian initiative,

Sierra Azul, one of the aims of which is to restore

degraded lands in the Peruvian Andes by establishing tree

plantations to protect water catchments and generate jobs

in rural communities.

Peru is a founder member of ITTO and has benefitted

from projects worth nearly US$20 million addressing the

sustainable management and use of tropical timber.

High level dialogue on development of the forestry

sector

The Association of Exporters (ADEX) recently organised

a high level dialogue seeking to identify and promote

actions for an efficient and sustainable forest management

system that will lead to the development of the sector and

that involves the entire productive chain.

Representatives from the National Forestry and Wildlife

Service (Serfor), the Forestry and Wildlife Resources

Oversight Agency (Osinfor), the regional governments,

the Ministry of Production, the National Forestry

Confederation (CONAFOR), participated in this meeting

along with the National Forestry Chamber and ADEX

executives.

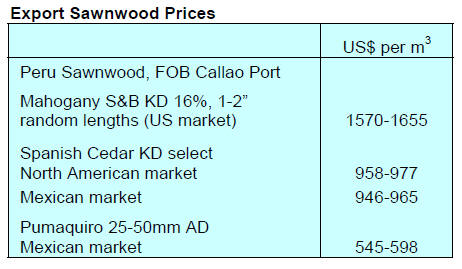

Peruvian exports of wood to August 2017

According to ADEX, as of August 2017, the FOB value of

exports of Peruvian wood products amounted to US$77.1

million down on the US$88.3 million recorded in the same

period in 2016.

China continues as the main export market for the wood

products sector (50%) while Mexico is in second place

with a 14% share. Exports to the US are around 10% of

total exports but export volumes have been falling.

Exports of sawnwood go mainly to the Dominican

Republic (31%) and China (26%) but exports to China

have been falling as they have to US and South Korea.