|

Report from

Europe

UK sawn hardwood market holds up well despite

Brexit concerns

While imports of tropical sawn hardwood into the

eurozone countries have failed to live up to expectations in

2017, having declined as economic growth has revived,

imports into the UK have followed the opposite trajectory.

UK imports of tropical sawn hardwood have held up well

this year despite slowing economic growth. The UK

imported 70,475 cu.m of sawn tropical hardwood in the

first 8 months of 2017, marginally more than 70,322 cu.m

imported in the same period in 2016.

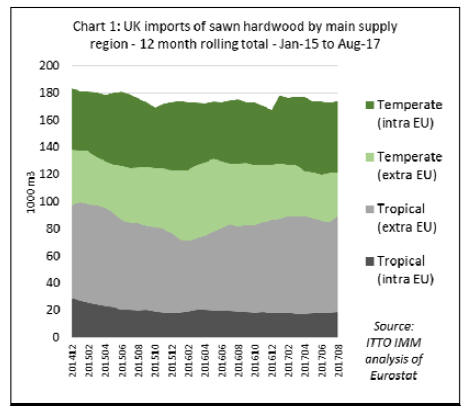

Chart 1 puts the UK¡¯s relatively strong imports of tropical

sawn hardwood in their wider market context. Total UK

imports of sawn hardwood, both tropical and temperate,

have been consistent at between 170,000 cu.m and

180,000 cu.m per year since the start of 2014.

The moderate growth in UK tropical sawn hardwood

imports this year has come partly at the expense of

temperate hardwood imports which have declined in 2017,

particularly from the USA, Estonia and Italy.

African sapele is by far the dominant tropical hardwood

imported into the UK, being strongly preferred for a wide

range of joinery applications. UK importers report that

sapele prices, which were stable in the first three quarters

of 2017, are now beginning to rise.

They also report that supply of some other popular tropical

hardwoods ¨C such as iroko and meranti ¨C has been limited

this year. However, availability of idigbo and utile has

been good, with stable prices.

This year, demand for sapele in the UK was boosted

following the catastrophic fire at Grenfell Tower which

led to at least 70 deaths in London in June this year. One

outcome of the subsequent nationwide review of fire

safety standards has been withdrawal of approval to use

beech for manufacture of 60-minute fire doors and a

partial switch to sapele in this application.

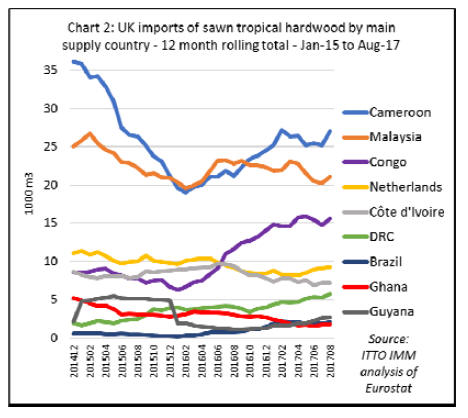

Chart 2 shows that UK imports of tropical sawn hardwood

from Cameroon have recovered this year following a

significant decline in 2015 and 2016. There has also been

a notable rise in UK imports from the Congo Republic.

Imports from Ghana and Ivory Coast have been sliding

this year.

Imports from Malaysia, mainly of meranti, recovered

ground at the end of 2016, but have been declining in

2017. Imports from Brazil, which fell to negligible levels

in 2014 and 2015, have been slowly recovering in the last

two years.

The EU Timber Regulation has had a major impact on

tropical timber procurement practices in recent years. It

has focused supply on a much more limited range of

companies in tropical countries for which UK importers

are confident of assurances that timber is legally

harvested. In practice this has meant increased demand for

FSC and PEFC certified products.

The fact that UK imports of tropical sawn hardwood have

been rising from DRC this year, and are still high from

Ivory Coast, both countries with no certified forest area,

indicates that other forms of legality assurance are still

being accepted.

Pressure mounts for imports of certified timber

However, the pressure on UK importers to purchase only

certified material is mounting. Many of the UK¡¯s largest

timber distributors are signatories to the WWF Forest

Campaign which commits them to sourcing 100% certified

material by no later than 2020.

Significant changes are already underway in UK imports

of temperate hardwoods. The recent decline in UK imports

from the US, of which around 55% comprises oak, was

initially currency driven. The slide in UK trade in

American hardwood began immediately after the Brexit

vote in June 2016 when the pound plunged in value

against the dollar.

Since then, UK importers have grown accustomed to the

greater uniformity and more appropriate moisture content

of European oak (which is slightly higher and better suits

UK ambient temperatures) compared to US oak and have

been reluctant to switch back even as prices for European

oak have risen. This is particularly true of thicker sizes of

oak, a market which is now heavily dominated by the

European variety.

The decline in UK sawn hardwood imports from the US

this year is also partly due to deteriorating supply of

American ash, now seriously impacted by the emerald ash

borer infestation.

This is devastating ash stocks in the US and has also

encouraged the EU to impose stringent phytosanitary

controls on US ash imports. US suppliers are diverting

most of the ash that is available to markets with less

stringent phytosanitary rules, particularly China where

there is strong demand for the stocks available.

On the other hand, UK imports of American tulipwood

have been consistent, with strong demand for this species

for lighter interior joinery and furniture applications.

Estonia is not traditionally known as a supplier of higher

grade hardwood, and much UK import from the Baltic

state comprises lower grade boreal species such as aspen

and alder used for pallets and other industrial applications.

However, Estonia is also now heavily engaged in thermal

modification of imported hardwoods, notably ash from

other parts of Europe and the US, to supply a product

which competes directly with tropical hardwood in

external applications like decking, cladding and window

frames.

The recent decline in UK imports from Estonia, while

tropical imports have been robust, suggests that tropical

hardwood continues to resist this market pressure from a

potential substitute, at least in certain applications in the

UK.

Slower UK imports of hardwoods from Italy are primarily

due to Croatia¡¯s ban on exports of oak logs and lumber

over 25% moisture content. Italian companies were

heavily engaged in the Croatian oak trade, purchasing logs

and lumber for further processing in Italy for shipment to

the rest of Europe.

However, in June 2017, the Croatian government

implemented the two-year ban on unprocessed oak

exports, ostensibly to stop spread of oak lace beetle ¨C

although some traders suspect a tactic to underpin greater

investment in wood processing in Croatia.

Italian mills are now setting up plants in Croatia to secure

supplies, but lack of kilning capacity is still causing

bottlenecks. European oak prices have risen accordingly,

with another 10% increase anticipated for the new cutting

season.

Stock levels in UK are high

Due to the strong buying activity in the first half of the

2017, UK traders report that hardwood stock levels of

unsold timber on the ground are now quite high. The

September to November period is traditionally very busy

for UK hardwood traders, as customers ramp up buying

between summer vacations and the year-end, but business

has slowed a bit this year.

There is no signs of crises in the UK market just yet, but

many expect demand next year to fall short of the level in

2017. Economic prospects certainly seem to have cooled.

The British Chambers of Commerce (BCC) says that the

UK economy is now on a ¡°low growth trajectory¡±. In its

latest economic review, the BCC revised its growth

forecast for 2018 UK downward, from 1.3% to 1.2%, and

for 2019 from 1.5% to 1.4%.

The BCC says that the post EU referendum slide in the

value of the pound had ¡°done more harm than good¡± as the

rising cost of imported raw materials had driven inflation,

which was now expected to hit 3% by the year end,

suppressing consumer spending.

Uncertainty over Brexit and the UK¡¯s subsequent trade

deal with the EU is cited as a key factor in the deceleration

of the UK economy, with Commerzbank commenting that

it was running at 0.5% slower growth than before the EU

referendum.

UK construction had been on an upward curve, with

housing starts in the year to June up 13% at 164,960. But

the industry contracted in the second and third quarters of

2017 and forecasts for growth in 2018 have been

downgraded to under 1%.

Various industry bodies are now urging the UK

government to push for rapid conclusion of a transition

deal with the EU on Brexit to help lift the economy.

In the meantime, the International Monetary Fund has

revised down long-term and short-term UK growth

forecasts in response to ¡®negative effects¡¯ from the Brexit

vote starting to show. It now predicts the economy will

expand 1.7% this year and 1.5% next.

Falling EU imports of mixed hardwood plywood from

China

After rising strongly in 2016, EU imports of hardwood

plywood have been slowing this year. The decline in

imports has been concentrated in mixed hardwood

products from China. Imports of tropical hardwood

plywood, both directly from tropics and from China, have

been rising this year (Chart 3).

EU imports of hardwood plywood peaked at an annualised

level of 2.80 million cu.m in November 2016, but this

figure had fallen to 2.65 million cu.m by July 2017.

During this period, imports of mixed hardwood plywood

from China fell from an annualised level of 1.03 million

cu.m to 862,000 cu.m.

This decline in imports was partly offset by a rise in

annualised imports of tropical hardwood plywood from

China from 124,000 cu.m in November 2016 to 181,000

cu.m in August 2017.

During the same period, direct imports of hardwood

plywood from tropical countries also increased, from an

annualised level of 356,000 cu.m in November 2016 to

393,000 cu.m in August 2017.

Between November 2016 and August 2017, there were

significant gains in annualised imports from Indonesia

(129,000 cu.m rising to 144,000 cu.m), and Brazil (19,970

cu.m rising to 23,000 cu.m). Imports also increased from a

range of smaller supplying countries including Vietnam,

Thailand, and Morocco.

During the same period, annualised imports were flat from

Malaysia at 123,000 cu.m and declined from Gabon from

38,000 cu.m to 35,000 cu.m.

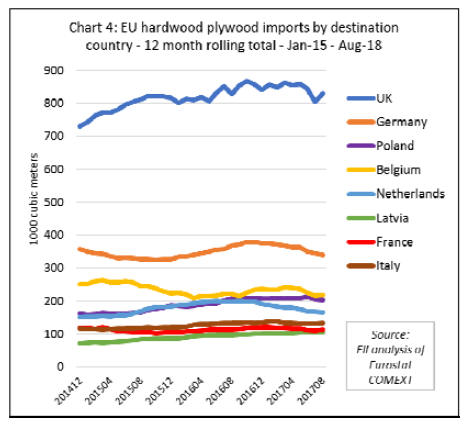

In terms of destination countries, imports of hardwood

plywood in the UK were broadly flat at an annualised

level of 860,000 cu.m in the 12 months prior to June 2017,

but then slowed sharply to 810,000 cu.m during summer

this year.

Imports in Germany, Belgium, and the Netherlands have

fallen more gradually since the start of 2017, and have

remained stable in Poland and France. (Chart 4).

Regulatory factors appear to have had a significant impact

on the EU hardwood plywood trade this year. EUTR has

encouraged greater concentration of trade into a few larger

suppliers with resources required to meet the due diligence

requirements.

Indonesian plywood appears to have received a boost

since issue of the first FLEGT licenses in November 2016

which allows import of Indonesian product without any

further due diligence.

EUTR coupled with increased technical demands of the

EU Construction Product Regulation has also increased

the trade¡¯s awareness of the importance of accurate

identification of species content for any product placed on

the EU market.

The apparent rise in imports of tropical hardwood

plywood into the EU from China may be at least partly

due to more accurate identification of the actual species

content.

This trend may also be partly due to a greatly increased

range of named species being specifically listed as

¡°tropical non-coniferous¡± rather than ¡°other nonconiferous¡±

following an amendment to the Harmonised

System (HS) of product codes used to compile trade data

from January 2017.

|