US Dollar Exchange Rates of 10th November 2017

China Yuan 6.6415

Report from China

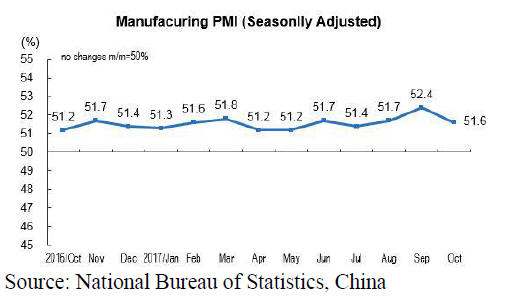

First hint of slowing consumption

The economy in China is on track to meet targets set by

government but many analysts have expressed concern

over rising debt levels. Domestic consumption is strong

but China¡¯s official manufacturing Purchasing Managers'

Index (PMI) for October was lower than expected.

The October PMI for large-sized enterprises was 53.1

(down 0.7 points) but still in an expansionary mode. The

PMI for medium-sized and small-sized enterprises came in

at 49.8 and 49.0 points signaling decline.

Among the five sub-indices composing PMI the raw

materials inventory index, employed person index and

supplier delivery time index were lower than the positive

threshold.

The official data suggest that both production and demand

fell in October, a decline put down to reduced output as

companies, especially those in the NE of the country,

complied with environmental regulations and the long

holiday in October.

For the year to October the manufacturing sector has

achieved solid growth on the back of consumer spending

and expenditure on infrastructure developments.

For more see:

http://www.stats.gov.cn/english/PressRelease/201710/t201

71031_1548112.html

First half 2017 softwood log imports

In the first half of 2017 China¡¯s softwood log imports

were 17.51 million cubic metres. The main imported

softwood log species in the first half of 2017 were radiata

pine (7.56 million cu.m, 43%), spruce and fir (2.51 million

cu.m, 14%), Korean and Scots pine (2.04 million cu.m,

12%), larch (1.20 million cu.m, 7%) and douglas fir (0.88

million cu.m, 5%).

The volume of radiata pine and douglas fir imports rose

14% and 6%, but Korean pine and scots pine, spruce, fir

and larch imports fell 18%, 5% and 2% respectively.

These species accounted for 81% of total softwood log

imports.

China¡¯s radiata pine log imports were from New Zealand

(78%) and Australia (21%). Minor amounts were from

South Africa and Chile. Over 90% of spruce and fir logs

were imported from Russia (61%), Canada (16%) and the

USA (15%) while pine logs (Korean and scots pine) were

imported from Russia (86%) and Ukraine (6%).

China¡¯s larch log imports were from Russia and New

Zealand while douglas fir logs were imported from the

USA (55%), Canada (28%) and New Zealand (17%).

Small amounts were from France, Australia, Denmark and

Russia.

First half hardwood log imports

In the first half of 2017 China¡¯s hardwood log imports

totalled 8.38 million cubic metres. The main imported

hardwood log species were birch (1,041,100 cu.m, 12.4%),

beech (676,000 cu.m, 8.1%), oak (554,800 cu.m, 6.6%),

okoume (512,500 cu.m, 6.1%), North America hardwood

(434,800 cu.m, 5.2%), redwood (419,800 cu.m, 5.0%),

poplar (315,200 cu.m, 3.8%), eucalyptus (284,000 cu.m,

3.49%) and merbau (112,900 cu.m, 0.3%).

While the volumes of US hardwoods, okoume and

redwood rose, imports of merbau fell.

Recent additions to the Customs code include birch

(4403.9500 sectional dimension equal to or more than

15cm and 4403.9600 sectional dimension less than 15cm),

poplar (4403.9700) and eucalyptus (4403.9800) which will

make analysis more accuate.

Sawn softwood species imports

In the first half of 2017 China¡¯s sawn softwood imports

were 12.41 million cubic metres. The main imported sawn

softwood species in the first half of 2017 were spruce and

fir (4.78 million cu.m, 39%), Korean and scots pine (1.33

million cu.m, 11%), other pines (1.20 million cu.m, 7%),

radiata pine (0.59 million cu.m, 5%) and douglas fir (0.14

million cu.m, 1%).

The volume of douglas fir, spruce and fir, Korean, scots

pine and radiata pine imports rose 26%, 15%, 13% and 8%

respectively. These species accounted for 83% of total

sawn softwood imports.

Most of China¡¯s Korean and scots pine sawnwood were

imported from Russia., Other sources of sawn softwood

included Finland (3.3%), Sweden (1.3%) and Germany

(1.1%).

Imports of radiata pine sawnwood were from Chile (59%)

and New Zealand (32%). Imports of spruce and fir

sawnwood were from Russia (38%), Canada (35%),

Finland (14%) and Sweden (8%).

Sawn hardwood species imports

In the first half of 2017 China¡¯s sawn hardwood imports

were 5.71 million cubic metres. The main sawn hardwood

species imported were oak (740,900 cu.m, 13%), beech

(312 500 cu.m, 5.5%), birch (285 200 cu.m, 5.0%), North

America hardwoods (280,300 cu.m, 4.9%), white ash

(251,000 cu.m, 4.4%).

The volumes of beech, North America hardwoods, oak

and white ash rose 34%, 25%, 18% and 4% respectively.

The Customs code for tropical redwood (4407.2940), birch

(4407.9600) and poplar (4407.9700) sawnwood are newly

added from 2017 so there are no comparative data.

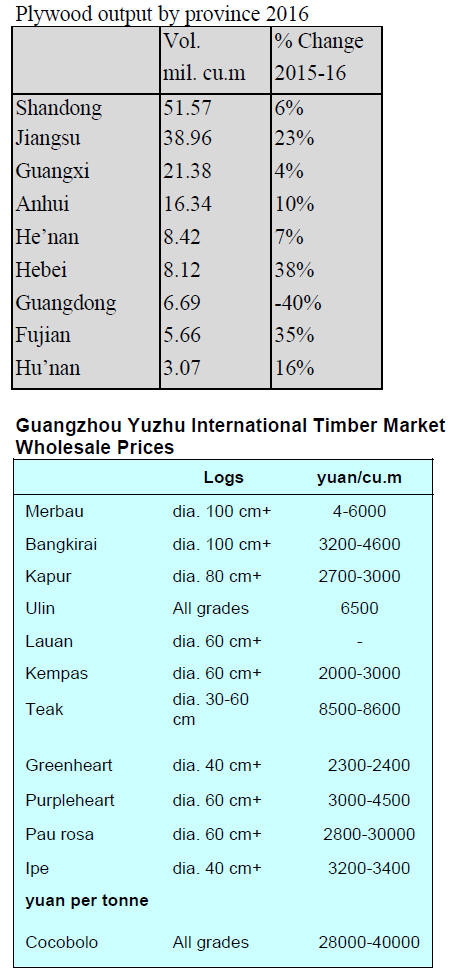

Production of plywood in 2016

In 2016 plywood production rose 7% to 177.56 million

cubic metres accounting for nearly 60% of total

woodbased panel output and was valued at RMB367.5

billion. Of the total, 163.82 million cubic metres were

plain plywood, 7.34 million cubic metres were laminated

or wood/bamboo composite plywood and 6.4 million

cubic metres were bamboo.

The output from mills in Shandong province was the

largest and rose 6% to 51.57 million cubic metres in 2016.

The output in almost all provinces increased in 2016. The

output of Hebei, Fujian, Jiangsu and Hu¡¯nan provinces

grew dramatically by 38%, 35%, 23% and 16%

respectively. However, the output of Guangdong Province

alone fell 4% in 2016.

|