Japan

Wood Products Prices

Dollar Exchange Rates of 25th

October

2017

Japan Yen 113.74

Reports From Japan

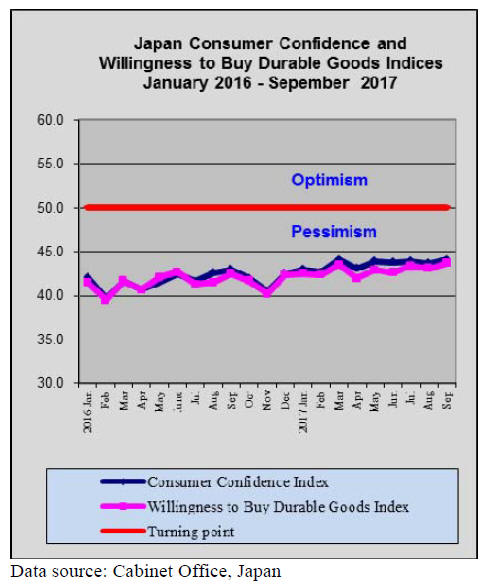

Growth in domestic consumption

remains illusive

In its October economic report the Cabinet Office

maintained optimism that exports and industrial output

will continue to drive growth. The report continues to say

that consumption is picking up and that capital

expenditure is also on the rise.

The Bank of Japan (BoJ) has pushed forward its target for

2% inflation to 2020 but this is looking increasingly

optimistic say analysts.

This year the Japanese economy has performed well

largely due to rising international demand but this has not

spurred inflation as companies have not passed on bigger

earnings as wage improvements. Only a rise in domestic

spending can underpin inflation.

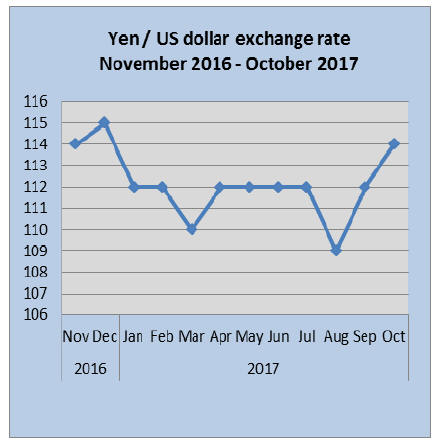

Continuing with the weak yen policy

With the election success of the Liberal Democratic Party

(LDP) the country is expecting the government to continue

with the economic policies established over the past 3-4

years dubbed ¡®Abenomics¡¯ which has three pillars for

reviving the Japanese economy; loose monetary policy,

fiscal flexibility and structural reforms.

Analysts have been quick to point out that the prospects

for structural reform remain limited.

However, the LDP election win means the consumption

tax is most likely to be raised to 10% from the current 8%

in 2019. Financial markets welcomed the election result as

signaling continuity and strong export growth built around

the weak yen.

In late October the yen fell to its weakest level against the

US dollar since July because of expectations that the loose

monetary policy of the BoJ will be sustained.

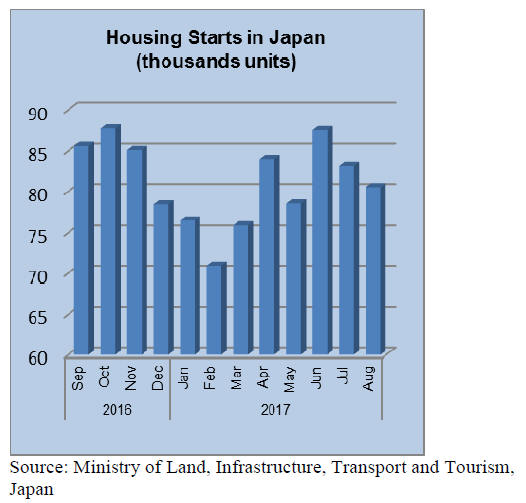

Holiday season a quiet month for housing

starts

Data from Japan¡¯s Ministry of Land, Infrastructure,

Transport and Tourism show that August housing starts

dropped 2% year on year, an increase had been forecast.

The decline in August marks the second straight drop

since the high in June this year. Because of the August

drop prospects for annual housing starts fell to 942,000

down from the 974,000 in July.

Other statistics show that orders received by the major

builders fell by almost 11% in August, traditionally a quiet

month because of the holidays.

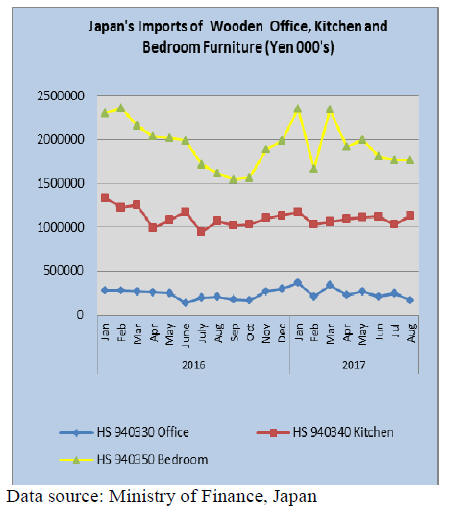

Japan¡¯s wooden furniture imports

There was little in the August furniture import data to

suggest the downward trend has come to an end. Month on

month import values were flat for wooden bedroom

furniture, down for wooden office furniture and up

moderately for wooden kitchen furniture.

It should be remembered that August is holiday season in

Japan so a more accurate picture of the underlying trend

should become apparent when full third quarter data is

available.

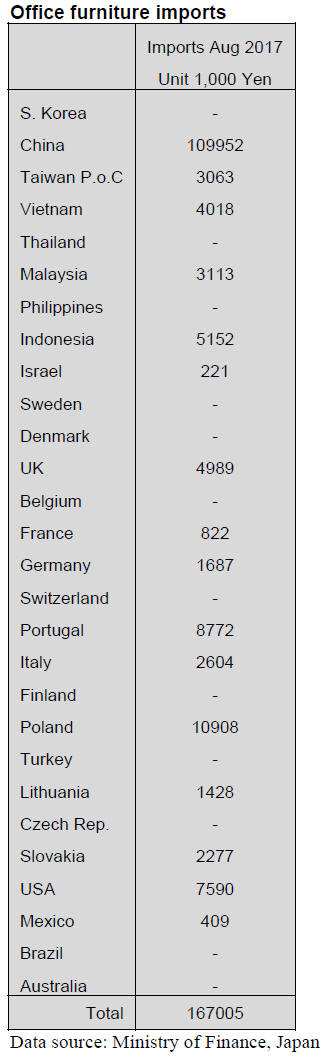

Office furniture imports (HS 940330)

Japan¡¯s imports of wooden office furniture are small

compared to the value of wooden bedroom and kitchen

furniture imports.

August data shows that year on year imports fell 21%

while month on month imports were down over 30%.

Three suppliers, China Poland and Portugal account

for

just over 75% of all wooden office furniture imports.

China tops the list at 66% and the combined supply from

EU member states makes up most of the balance. Shippers

in SE Asia account for only a small part of Japan¡¯s

wooden office furniture imports.

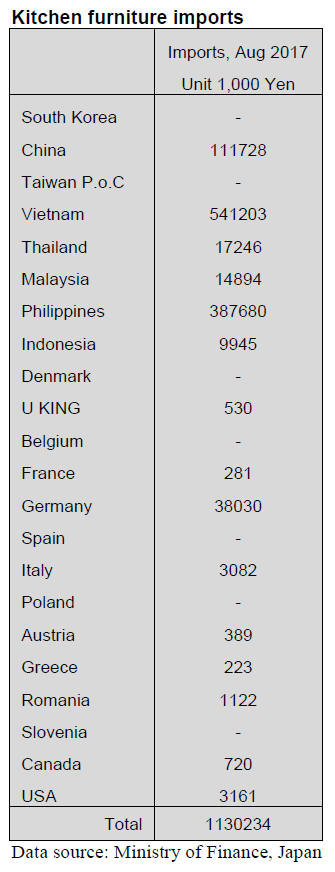

Kitchen furniture imports (HS 940340)

The slight correction in the value of wooden kitchen

furniture imports in July following 4 months of a steady

upward trend was reversed in August as import values

rose. Year on year imports of wooden kitchen furniture

are up 5% with Vietnam (48%) the Philippines (34%) and

China (10%) accounting for over 90% of all wooden

kitchen furniture imports.

Amongst the other suppliers to Japan only Germany stands

out accounting for 3.5% of Japan¡¯s August imports of this

category of wooden furniture.

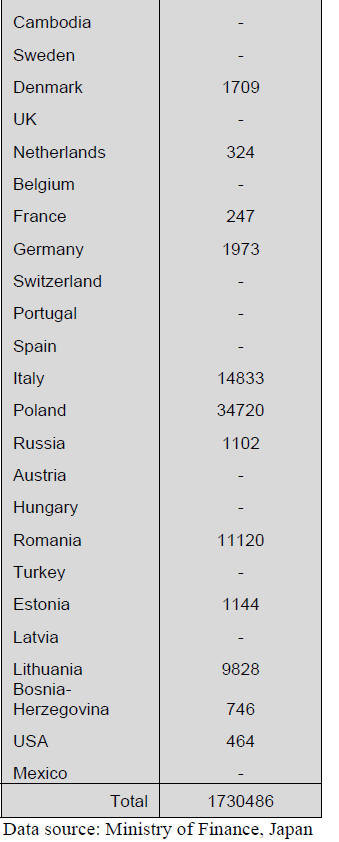

Bedroom furniture imports (HS 940350)

A staggering 90% of Japan¡¯s imports of wooden bedroom

furniture come from shippers in just three countries,

China, Vietnam and Thailand. Between China and

Vietnam over 85% of Japan¡¯s bedroom furniture imports

are accounted for.

Year on year, imports of wooden bedroom furniture were

up 9% in August and data for past 3-4 months seems to

indicate that the downward trend in wooden bedroom

furniture imports is bottoming out.

The Japan Lumber Reports (JLR), a subscription trade

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Wood demand and supply projection for 2017

The Forestry Agency held the second meeting for wood

demand and supply in 2017. Supply forecast of domestic

logs for lumber manufacturing is difficult because of

damages by several heavy rain. Demand projection for the

second half of the year would slightly decline.

Demand for domestic lumber in the third and fourth

quarter last year was very active so the supply was on

short side so if the demand this year would be the same as

last year, lumber supply would get tight again.

For housing starts forecast by the Japan Federation of

Housing Organization, detached units during the second

quarter this year declined by 13 points. By forecast by

eleven private think tanks, average housing starts in 2017

are 969,000 units compared to 974,000 units in 2016.

Therefore, if this forecast is correct, domestic lumber

demand would be less than last year so tightness may not

be so bad.

As compared to log demand for lumber, log demand for

plywood would exceed that of last year as new plant will

start up next year and log purchase would start this year.

So the demand would increase and the supply would

follow, which does not include any negative factor of

damages by heavy rain.

North American Douglas fir log supply for the fourth

quarter would stay about the same as last year based on

assumption that the demand for lumber would stay firm so

that log inventories would decrease. For the first quarter

next year, log supply in the North America would recover

but the arrivals would decline by about 2.1%.

North American lumber supply would increase toward the

year end so the supply would be about the same as the

fourth quarter last year.

Third quarter supply of laminated lumber would increase

by 5.8%. Import would decrease by 3.4% but domestic

supply would increase by 11.0%. The domestic supply for

the second half of the year would be more than last year.

Forecast of the import for the fourth quarter would be the

same as last year but that for the first quarter next year

would be down by 10.7%. The demand would also be

down so supply tightness is unlikely.

European lumber import for the fourth quarter would

increase by 6.8% by aggressive purchase of lamina then

for the first quarter, the supply would decline by 6.3% by

purchase curtailment of small size common lumber.

Radiata pine logs and lumber from Chile and New Zealand

for the third and fourth quarter this year are more than last

year but the fourth quarter supply would decline as the

demand would be less than last year. The supply of logs in

2017 would be 15.3% less than last year while that of

lumber would be 2.7% more.

South Sea (Tropical) logs and lumber

There is some change in South Sea hardwood log supply.

India, which is leading buyer, eases log purchase after

rush-in purchase was over before GST tax hike. Malaysian

meranti log prices are unchanged because of tight harvest

control but the log prices in PNG and Solomon Islands are

weakening after India stopped pushing log prices.

Malaysian meranti regular prices are about US$300 per

cbm FOB. In Sarawak, Malaysia, royalty will be raised

since late this year so log prices would go higher again.

Some comment that royalty increase is minor issue

compared to aggressive purchase by India and total log

harvest volume.

Movement of laminated free board in Japan in September

slowed down.

Domestic users purchased more volume ahead of time to

have more inventories since supply reduction was

expected in last spring with Islamic New Year holidays

and log supply dropping with higher prices but the

inventories did not move as expected so the Japanese

buyers place very little future orders.

Indonesian merkusii pine laminated free board prices in

Japan were close to 120,000 yen up until last summer but

now it is down to less than 120,000 yen.

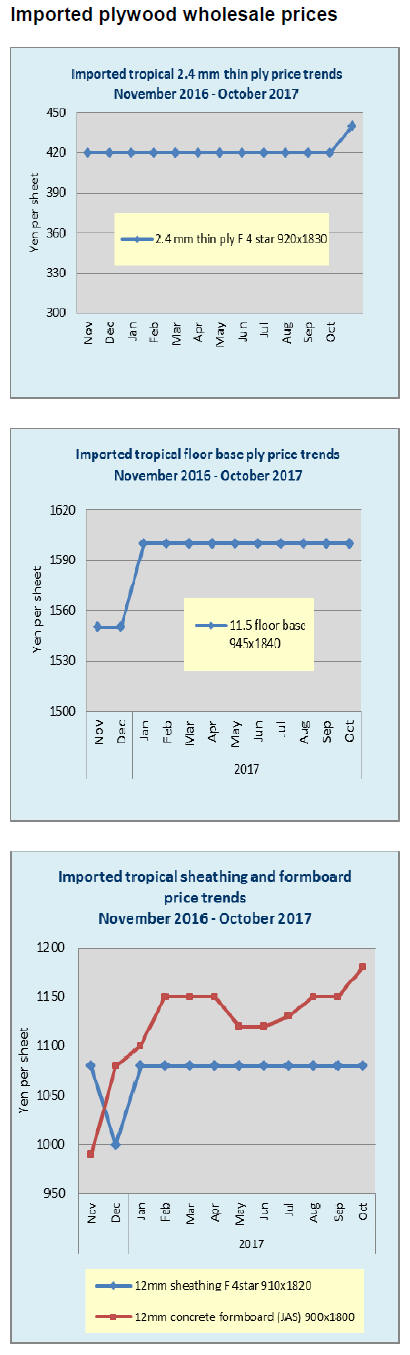

Plywood market

In Tokyo market, demand for softwood plywood continues

firm mainly by precutting plants. Since they experienced

supply shortage last year, they place orders way ahead of

time to make sure the supply would last through the fourth

quarter.

The market prices of 12 mm 3x6 are 1,030 yen per sheet

delivered among wholesalers but the prices for direct

delivery to precutting plants are 1,020-1,010 yen. Price

hike plywood mills proposed in September is generally

accepted by the market.

In Osaka market, with tight inventories by precutting

plants, the prices are firming. Plywood manufacturers in

the Western Japan raised the sales prices together with

price hike by the manufacturers in the Eastern Japan and

the prices are up after seven months.

Supply of softwood structural plywood in Osaka region

continues tight due to busy operations of precutting plants

supported, by active housing starts. By tight supply, the

prices of 12 mm 3x6 structural panel prices are up by 30

yen per sheet among wholesalers but the prices for direst

delivery to precutting plants are only by 10-20 yen up ike

Tokyo market.

Domestic plywood price hike is demand pull type but

imported plywood price increase is cost push type hike.

Imported plywood supply is tight by log supply shortage

in manufacturing regions in Malaysia and Indonesia.

Supply of thin panel is getting short and the inventories in

Japan is scarce so that the importers have to keep buying

even with higher proposed prices by the suppliers. The

prices of thin panel of 2.5 mm 3x6 are unchanged at 450

yen per sheet but the prices seem to go higher because of

weak yen.

Prices of coated concrete forming panel are also climbing

so that price gap between imports and domestic product is

getting narrower. Domestic softwood plywood

manufacturers are anxious to grab market share of this

product.

Wood use by local governments

The Japan Forest Products Journal made survey through

all the local governments in Japan to find out how much

wood they have used in 2016. The central government has

been encouraging local governments for use of wood for

public businesses.

Total is 49,919 cbms for public buildings except for

Hokkaido, Okinawa and Fukuoka and 191,401 cbms for

public engineering works.

Problems of use of wood for public buildings are shortage

of engineers, instability of log supply, difficulty to obtain

JAS certified products, increasing cost for maintenance

and insufficient understanding of fire proof standard.

By prefecture, wood use for public buildings by

Fukushima and Kumamoto is by far the largest as

Fukushima built public housing for the earthquake

restoration and Kumamoto built many emergency

temporary housing after the earthquake. These demands

are temporary.

As large wooden buildings, Kyoto has the most for

lodging and athletic facilities. The most large one used

760 cbms of wood. Police boxes are the most easy one for

small low level wooden buildings.

In three prefectures, wood is used for interior of concrete

school buildings with 200-300 cbcms, which is equivalent

to medium size wooden buildings. For public engineering

works, Hokkaido takes about 50% of total Japan.

Main uses are maintenance of coast lines, wind barriers

and sand barriers. In the cities, main wood use is wooden

board walks in the parks, supporting post for trees lining

street and benches.

The central government has set basic policy and local

governments follow with the promotion policy.

|