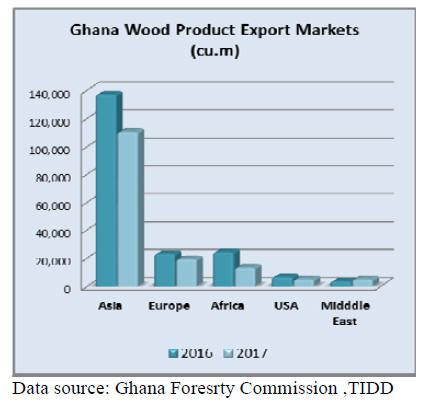

2. GHANA

First half export round-up

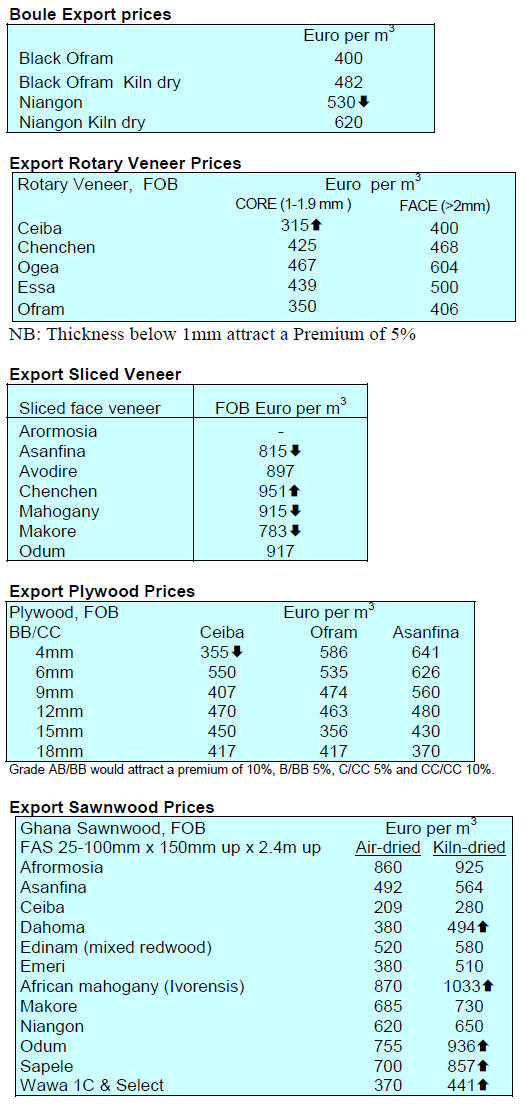

Ghana earned euro 82.9 million from the export of

152,652 cu.m of wood products in the first half of 2017.

This represented an 25% decline in export earnings and a

21% decline in export volumes compared to the first half

of 2016.

June exports totalled 35,700 cu.m, down almost 6% year

on year. June primary product exports, comprising poles

and billets, earned euro 3,779,262 from 12,462 cu.m,

representing 8% of total wood product export volumes in

the first half of the year.

June exports of secondary wood products comprising

sawnwood, plywood, boules, veneer and kindling formed

the bulk of wood product exports and earned euro

76,301,287 from a volume of 134,140 cu.m.

In Ghana, tertiary wood products are defined as processed

mouldings, flooring, dowels and furniture parts and June

export earnings totaled euro 2,814,038.

State finances get a boost as oil production ramped up

A report from the Bank of Ghana shows that oil revenues

more than doubled between the second half of 2016 and

the first half of this year as production was increased.

Output levels have risen steadily since the start of a new

well in August 2016.

The rises in output and revenue have allowed the

government to expand contributions to the Petroleum

Holding Fund, the Ghana Stabilisation Fund and the

Ghana Heritage Fund which serves as a savings pool for

future generations.

For more see: http://www.oxfordbusinessgroup.com/economicnews-

updates?country=54035

Private sector confidence at new high

The Association of Ghana Industries (AGI) newsletter for

the second quarter of this year points to rising business

confidence. The AGI business barometer for the second

quarter of 2017 jumped to the highest since 2012

reflecting a significant change in confidence.

Behind the rise was the easing of the tax burden on

businesses which lowered the cost of doing business. Also

the drop in interest rates help push the index higher.

Expectations of Government’s One-District-One-Factory

initiative aided by US$1.5 billion Chinese financing also

boosted expectations in the private sector.

For more see:

http://agighana.org/uploaded_files/document/1ecb3d37056e8d2b

38c57cac38086646.pdf

3.

SOUTH AFRICA

Business will remain quiet

until housing market

recovers

Consumer confidence is at an all-time low in South Africa

as near zero economic growth, high unemployment and

political uncertainty weighs on sentiment. Against this

backdrop it is not surprising that the housing market is

severely depressed.

Recently released data shows the extent of the problem;

year on year, approved plans for homes over 80 sq.m are

down 27%. There has been a sharp drop (26%) in

approvals for apartments and an over 50% decline in

approvals for other residential buildings.

On top of this, approvals for non-residential

buildings as

well as for renovations are both down from a year earlier.

The collapse of the housing market is impacting the timber

and hardware sectors.

Meranti windows face tough competition in lowmedium

income home segment

It is no surprise that domestic pine mills are seeing stock

levels rise beyond anything they have experienced and

sales prices are coming under pressure. The woodbased

panel market is suffering the same as the sawnwood

market and there has been a fair amount of discounting as

producers try and rebalance stocks.

In contrast, demand for American hardwoods has been

surprisingly steady with good demand for white oak and

ash. There has also been some demand for walnut. Also,

traders report good business in European timbers

especially spruce and larch including engineered beams.

Of concern is the falling demand for meranti due to the

drop in housing activity. Meranti windows are mainly for

the high end of the housing market where construction has

slowed. While the slowdown in building has affected the

lower end of the market to a lesser degree, demand in this

segment is for aluminum windows not meranti.

The perennial problem of supply continuity for African

timbers continues. Until this can be addressed South

African importers remain reluctant to commit if they

cannot be assured of a consistent supply.

Timber products to reduce the environmental impact

of buildings

“South Africa was the first African country to develop a

‘green’ building rating system and today has a number of

rated green building projects” according to authors of a

new life-cycle study.

A recent investigation reported in the South African

Journal of Science compares the environmental impact of

different roof truss systems in South Africa. More than

70% of all sawnwood in South Africa is used in buildings,

especially in roof structures where light steel is a

competitor.

Using a simplified life-cycle assessment approach a team

compared several roof truss systems used in low to

medium-income homes in South Africa. The results show

that the two timber systems had overall the lowest

environmental impact.

See: http://www.sajs.co.za/potential-south-african-timberproducts-

reduce-environmental-impact-buildings/philip-lcrafford-

melanie-blumentritt-c-brand-wessels

4.

MALAYSIA

Restrictions on foreign workers lifted

The Malaysian media has reported that Deputy Home

Minister, Nur Jazlan Mohamed, has said a decision has

been taken on allowing export oriented manufacturers to

employ more foreign workers. However, the press

coverage is contradictory with some saying the

government policy on restricting foreign workers has been

lifted while others say a change in the regulation is being

considered.

The rational for change is based on a World Bank report

which it is claimed says a 10% net increase in low-skilled

foreign workers would raise real gross domestic product

by 1.1% as the wages for these workers keep overall

wages down which, in turn, lowers prices and production

costs and boosts exports.

For more see:

https://www.themalaysianinsight.com/s/18051/

In related news the World Bank has revised up Malaysia's

gross domestic product growth forecast for this year to

5.2% from the 4.9% in June.

Faris Hadad-Zervosof the World Bank said the Bank

expected growth in Malaysia to trend higher as long as the

economy remains open and as long as global economic

growth continues.

Clean Air Regulations to impact new companies

Malaysia’s Environmental Quality (Clean Air)

Regulations 2014 or CAR 2014 sets out to control

emissions of air pollutants from various industrial

operations and timber industries are included in CAR 2014

depending on the operations and processes it adopts as

well as the type and amount of pollutants it produces.

Existing factories were given a five-year grace period

(until June 2019)to comply but new enterprises and new

installations in existing factories must comply with CAR

2014 immediately.

Analysts report the timber industry will face many

challenges in complying with this regulation. To help

address this the Malaysian Timber Council has organised a

seminar to enable stakeholders to better understand CAR

2014 and sharing industry best practices.

Idea for a pulp mill in Sarawak raised once again

After leading a Sarawak delegation to visit a factory at

Kunda in Estonia, Deputy Chief Minister, Awang Tengah

Ali Hasan, said Sarawak has the potential to develop a

mechanical pulp mill to utilise forest plantations.

The idea for a pulp mill in Sarawak has been raised over

the past several years but this latest visit to a chemithermomechanical

pulpmill has rekindled interest in

Sarawak.

Aim to end illegal logging by 2020

The Sarawak Forest Department hopes to eliminate illegal

logging by 2020, said its Deputy Director, Jack Liam.

However, he said this was a challenging task due to the

state’s vastness and the fact that the perpetrators were

getting very smart in avoid detection.

The Forest Department was collaborating with other

government agencies especially the Marine Police,

General Operations Force (GOF), Sarawak Forestry

Corporation (SFC) as well as the Malaysian Maritime

Enforcement Agency (MMEA) to achieve its target.

Until the end of September, 9,093 cubic metres of logs

with an estimated royalty value of RM591,370 had been

seized along with assets including a ship, trucks,

excavators and tractors.

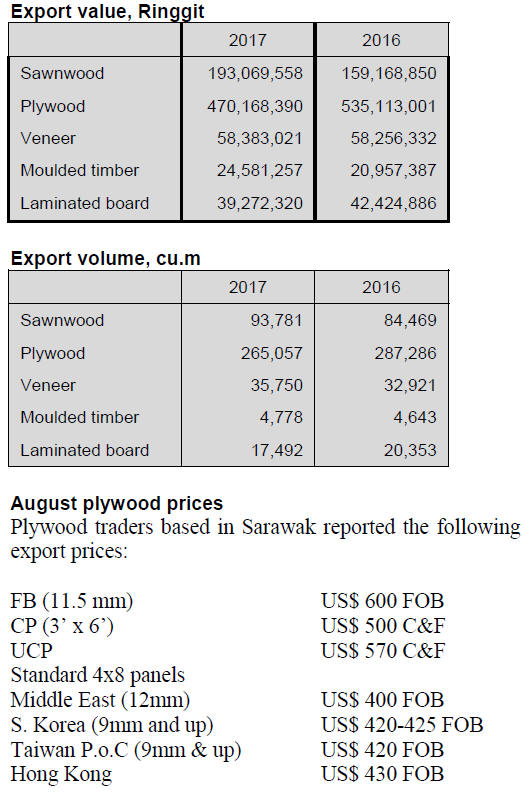

Sabah exports

The Sabah Department of Statistics released data which

showed export of timber products dropped by 3.7% in first

half of 2017 as compared to the same period last year.

This year the value first half exports was RM785,474,320

compared to RM815,920,456 last year.

5. INDONESIA

SVLK implementation needs to

take account of

realities faced by small craftsmen

Furniture makers in Jepara, Central Java recently met to

discuss the constraints faced by small and medium

enterprises in implementing the SVLK timber legality

verification system.

The meeting was was facilitated by the Center for

International Forestry Research (CIFOR) and the Head of

the Sub Directorate of Wood Legality Verification

Information in the Ministry of Environment and Forestry,

Mariana Lubis, was present.

The chairman of the Jepara Wood Crafts Association,

Margono, pointed out the many problems faced by

furniture craftsmen. The main problems identified were

access to investment capital, the availability and cost of

raw materials, inadequate human resources, the lack of

marketing know-how and SVLK enforcement. Margono

said most of these problems have been around for a long

time but compliance with the SVLK is a new and

troublesome issue.

He said the application of SVLK for furniture craftsmen is

complex. First, most SMEs do not have the management

capacity to handle the new requirements. Secondly,

compliance is a major expense for SMEs. Another

problem is that enterprises see no direct benefit in

becoming V-legal.

In response, Mariana Lubis said SVLK compliance is the

only path to access to the EU markets but she

acknowledged SMEs face serious problems with

implementation of the SVLK and that implementation

needs to take account of the real conditions faced by small

craftsmen.

In related news President Joko Widodo has called on the

various ministries and agencies to modernise the

handicraft industry from upstream to downstream so that

the sector can expand.

He said efforts need to be made to address raw material

supply, manufacturing technology as well as finishing and

packaging to marketing.

Talks started on rattan export regulations

The government and the private sector are discussing the

recent changes to the rattan export restrictions and will

begin by analysing supply and demand. Recent changes in

the rules on rattan exports allows the export of semiprocessed

rattan.

The ministry is discussing the issue with the private sector

in the Indonesian Rattan Businessmen Association (Apri)

and the Indonesian Furniture and Craft Association

(Himki).

To advance the discussion Apri is calculating the

supply

and Himki the demand. According to Enggartiasto Lukita

of the Ministry of Trade, the final data will be compiled by

PT Perusahaan Perdagangan Indonesia (PPI), the only

Indonesian state-owned trading house. If a surplus is found

then PPI alone can export rattan in semi-processed form.

Others wishing to export must fully process the rattan into

final products.

In related news, the Director of Forest and Plantation

Products Industry in the Ministry of Industry, Edy Sutopo,

has said manufacturers of rattan products need to pay more

attention to creating designs which have appeal in

international markets. He said his impression is that

manufacturers launch new designs without first

researching what designs are in demand.

He said designers tend to speculate rather investigate with

buyers what is suitable for a particular market.

Indonesia's competitiveness rises

This year Indonesia's global competitiveness according to

the World Economic Forum Global Competitiveness

Index 2017-2018 improved to 36th position out of 137

countries. This was up five ranks compared to the previous

assessment.

Airlangga Hartarto, the Minister of Industry said

Indonesia’s improving global competitiveness is good for

investment flows but more must be done in terms of

strengthening innovation in the industrial sector.

Social forestry should improve livelihoods

The Minister of Environment and Forestry, Siti Nurbaya,

has encouraged managers of social forestry programmes to

strengthen the family economies of the people involved

through the creation of new business opportunities at the

grass roots level. She said social forestry is not just about

access to the forests but also about improving incomes.

Jakarta exhibition showcases latest technologies

The International Furniture Components Exhibition

(IFMAC) and Woodworking Machinery Exhibition

(WOODMAC) themed “Global Technologies to Boost

Indonesia's Furniture Industry” was held recently in

Jakarta.

Speaking during the event, Abdul Sobur, Vice Chairman

of HIMKI said to improve the competitiveness of

Indonesian furniture industry companies must embrace the

latest production technologies appropriate to their needs to

accelerate efficiency. He applauded the arrangement of the

IFMAC/WOODMAC event as this supports the domestic

industry to advance productivity and competitiveness.

Indonesia's wood furniture and handicraft industry

currently supports a direct work force of around 500,000

as well an estimated 2 million indirect workers in

subcontractors and service providers.

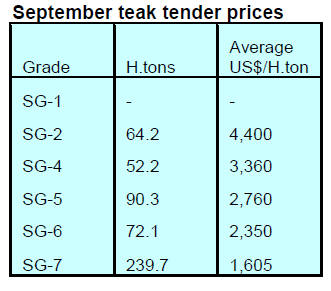

6. MYANMAR

Is high value sawn teak for

international markets an

‘added value’ product? – the debate continues

As of September total foreign investment in energy,

agriculture, livestock and fishery, manufacturing, transport

and communication, hotel and tourism, real estate,

industrial development and other services sectors has

reached just over US$4 billion (5.4 trillion kyat).

The oil and gas sector has seen the biggest foreign

investments while the construction sector the lowest.

However, Myanmar Forest Products Merchants Federation

(MFPMF) Deputy Chairman, U Thein Win, questioned the

value to the economy of foreign investment in the timber

sector since most companies concentrate on non-finished

products but consume huge quantities of raw material.

In response, analysts challenge this negative opinion and

point out that Myanmar’s main timber export, sawn teak,

is a high value product with high international demand and

as such is a value-added product.

The price of top quality and large section sawn teak in

international markets is very high and earnings for the

country from teak sawnwood exports, cubic metre for

cubic metre, are higher than from exports of teak furniture.

On the other hand, the reverse is true for non-teak timber

where furniture manufacturing is a better option.

However, to take advantage of the opportunities for

furniture production from non-teak hardwoods efforts

need to be directed to improving supportive infrastructure

and ensuring the availability of supplies of non-teak logs

at stable prices to raise the competiveness of domestic

products.

One executive from a furniture manufacturer said the

industry would expand faster if the Forestry Department

was more flexible in application of regulations and noted

that illegal felling and smuggling remains a major

challenge for the Forestry Department.

Earnings from timber just a fraction of

total exports

Between April and September this year Myanmar

exported US$6.469 billion of which agricultural products

accounted for most at US$1.435 billion. Timber exports

were just US$107 million.

Myanmar’s trade deficit for the first six months of the

2017-18 fiscal year has widened to US$2.2 billion

compared to US$1.8 billion during the same period in the

previous financial year according to the Ministry of

Commerce.

MTE to open sanctuary for retired working elephants

According to Dr Zaw Min Oo of the Myanma Timber

Enterprise (MTE) an Elephant hospital/sanctuary for

retired, sick and injured elephants will be established in a

forest area of about 2,500 hectares close to Oaktwin

Township, Taungoo District.

A retired MTE General Manager said that it is very

expensive for MTE to care for aging and sick elephants

adding that there are many who criticised MTE for the

slow progress of reform but that few have offered

to assist MTE in such a task.

The new project is being supported by the US based Asian

Elephant Support (AES) a non-profit foundation dedicated

to the care and conservation of Asian elephants in their

range countries and the people whose lives are intertwined

with this magnificent animal.

Minimum wage hike discussed

The National Minimum Wage Committee has tentatively

suggested Myanmar’s new minimum wage should be reset

to somewhere between 4,000 and 4,800 kyats (US$2.93 to

$3.53) for an eight-hour working day. The current rate is

3600 Kyats.

After consultations with representatives of workers and

employers the new rate will be proposed to parliament for

approval.

7. INDIA

Indian real estate in 2017 and beyond –

new report

from CREDAI

CREDAI, in association with its partner CBRE, has

released a report “Indian Real Estate in 2017 and

Beyond”. The report covers the major policy related

disruptions resulting from government policy changes

which have challenged the traditional way the real estate

sector operates.

According to the report new regulations will increase the

share of the ‘organised’ segment of the real estate sector

which will help improve the ease of doing business in the

country.

The report anticipates major changes in regulation,

finance, the customer base and technology which should

have positive impact and create a new operating

environment in the sector.

The report also provides insights into changing customer

preferences in office, retail, residential and warehousing

space. For instance, the traditional thinking on office

spaces are being disrupted by a younger generation of

workers. Many young office workers in India feel the

quality of ‘office design’ impacts their productivity to a

large extent.

The press release from CREDAI says “The real estate

sector in India is one of the key contributors and mainstays

for India’s development as a nation. Real estate in India

continues to be in a dynamic phase and the pace at which

the four cornerstones – Regulation, Finance, Customers

and Technology are evolving, a more than incremental

transformation in the sector is expected in the coming

years.

In this report we have dwelled on how a strong foundation

for this change has already been laid with a conducive

operating environment, the future growth of the sector will

be determined by many other factors”.

See: https://credai.org/press-releases/credai---cbre-released-ajoint-

report-indian-real-estate-in-2017-and-beyondat-thecredai17thnatcon-

2017-london

In related news, Jim Yong Kim, the World Bank President

has said the Indian economy is experiencing temporary

disruptions as the new Goods and Service Tax (GST) is

rolled out but will get back on track soon.

In the first quarter there was a sharp deceleration in

growth but as companies adjust the overall impact of the

changes in tax will have a positive effect on the economy.

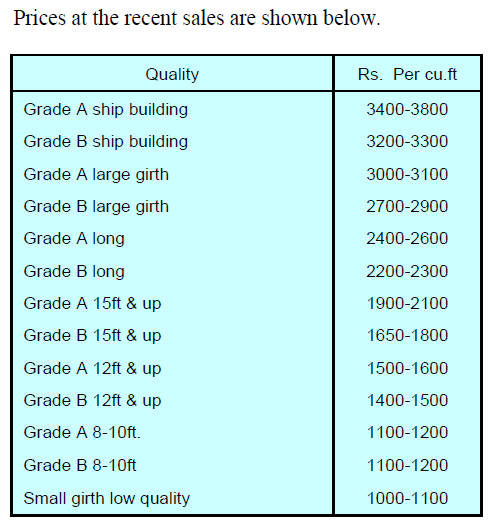

Teak auction in Western India

Auctions at various forest depots in the North and South

Dangs Divisions have been concluded. Approximately

9,000 cubic metres of mainly teak logs were on offer.

Other hardwoods sold included mainly Adina cordifolia,

Gmelina arborea, Pterocarpus marsupium, Acacia catechu

and Mitragyna parviflora.

Since imported teak logs are mostly of small girth,

buyers

attending the domestic auctions are interested in

purchasing larger sized logs.

Another advantage from buying domestic teak is that the

logs are sold with the bark and much of the sapwood

removed whereas for imported plantation teak logs the sap

is intact.

Top quality non-teak hardwood logs 3-4m long having

girths 91cms & up of haldu (Adina cordifolia), laurel

(Terminalia tomentosa), kalam (Mitragyna parviflora) and

Pterocarpus marsupium attracted prices in the range of

Rs.800-1000per cu.ft. Medium quality hardwood logs

were sold at between Rs.600-700 and low grade logs sold

for Rs.300-400 per cu.ft.

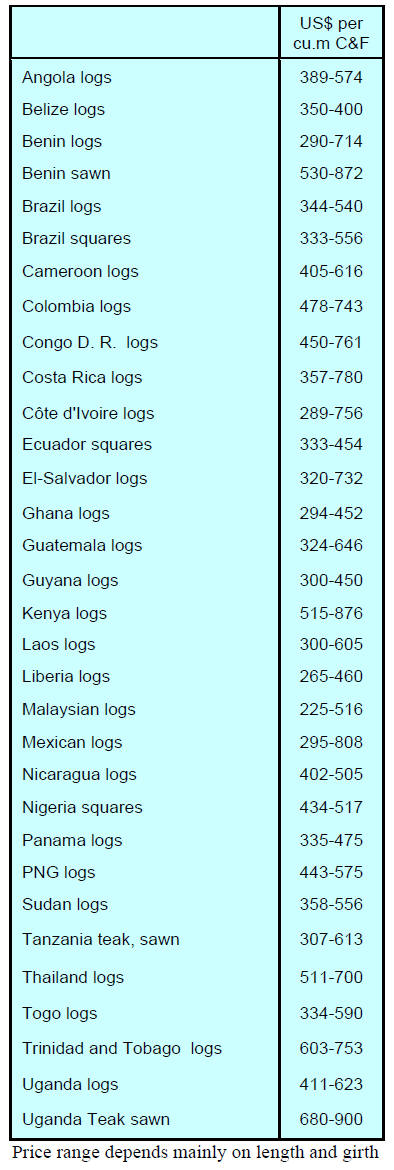

Imported plantation teak

Demand for imported logs remains steady despite some

weakness in the rupee exchange rate against the US dollar.

Against this background C&F prices are unlikely to

change in the short-term.

Pressure for revision of the GST on wood and wood

products continues. The next meeting of GST Council is

set for 24 of October when it is anticipated the issue will

be considered.

Current prices for imported plantation teak continue to be

in the range previously reported.

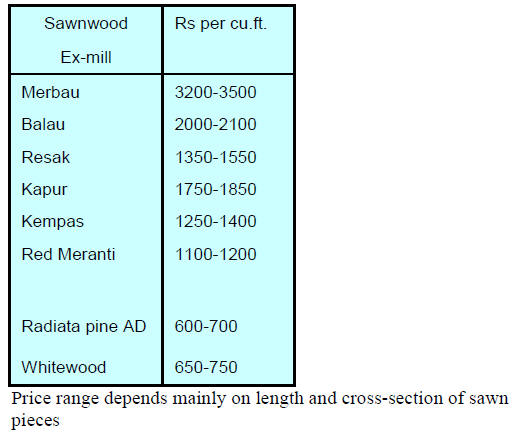

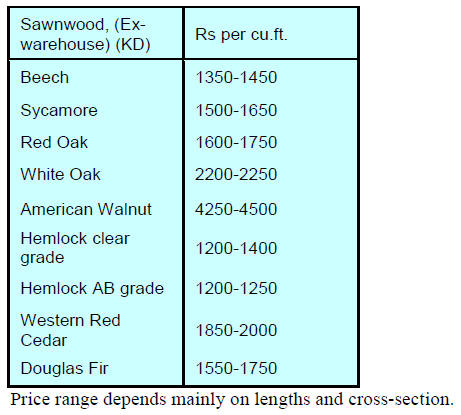

Locally sawn hardwood prices

Exmill prices for hardwoods are unchanged but are subject

to an 18% GST.

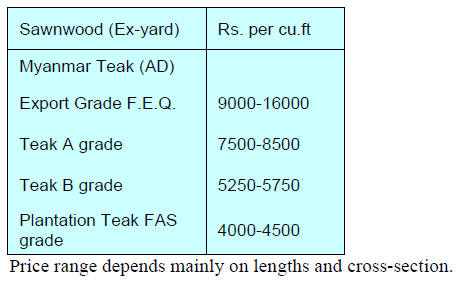

Myanmar teak prices

There were no changes in prices over the past two weeks.

Wholesalers report that business is slow as buyers

consider the prices are high.

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

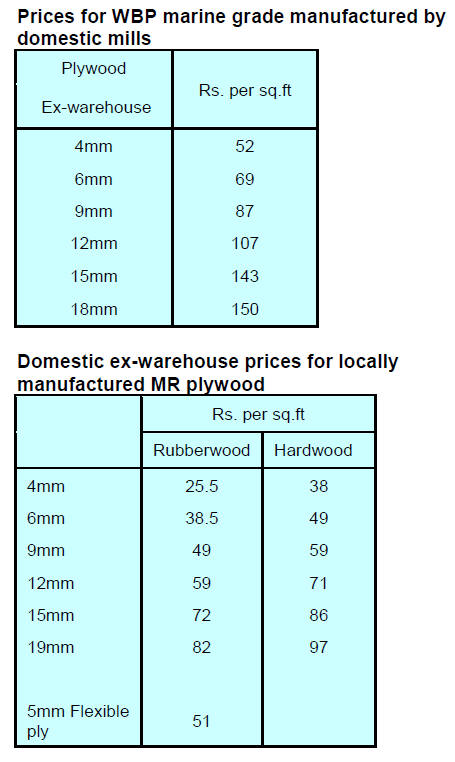

Pressure for plywood price increase eases as

local

taxes eliminated

Plywood manufacturers complain that rising transportation

costs and rising costs for raw materials such as logs,

veneers, and resins means that they need to raise prices by

around 5% to maintain profitability.

However, manufacturers have benefitted from the

elimination of some state taxes as well as many of the

octroy taxes (a local tax collected on products brought into

a district for consumption) such that the pressure for an

increase in price has eased.

Plywood prices continue as previously reported.

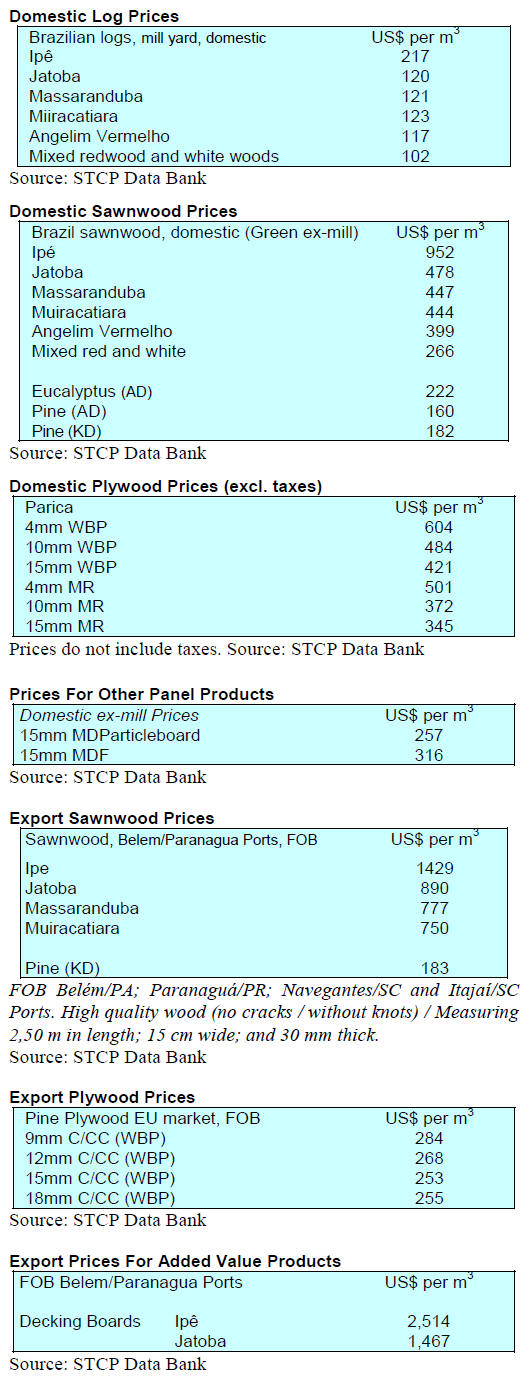

8. BRAZIL

Hint of a recovery in

domestic construction sector

Expectation of an economic recovery in 2018 with GDP

forecast at 2% is good news for the Brazilian construction

sector and the timber industry. Prospects have also

brightened as investment in housing is set to expand as the

Federal Government will launch a programme which aims

at delivering 6 million new homes.

According to the Technical Division of the Civil

Construction Industry Union in Paraná State

(SINDUSCON-PR) while prospects are looking good for

it to become a reality for the industry it will be necessary

for the country to promote structural reforms.

Among the risk factors behind a resumption of civil

construction looms the issue of long-term financing and

the housing policy of the government.

But, as pointed out by SINDUSCON, one of the major

challenges to be overcome in the construction sector is the

hesitance of consumers when it comes to wooden frame

homes. This must be addressed through active promotion.

The Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI) has pointed out that

acceptance of a construction system using wooden frames

will generate demand for wood products and through this

the industry can contribute more to addressing the housing

shortage. But, for this to happen the wooden frame system

needs to be recognized so home financing opportunities

are available.

Production and export of forest products in early 2017

Production and exports by the planted forest sector in the

first eight months of 2017 were positive. Compared to the

same period of last year pulp exports grew 4.9%, wood

panel exports were up 30% and paper pulp exports

expanded almost 1%.

For the woodbased panel industry the good news was that

domestic demand picked up, rising 1% year on year.

Between January to August 2017 revenues from all

exports totalled US$5.5 billion (+ 9.6%) of which US$191

million was derived from the export of wood panels.

Woodbased panel exports amounted to 840,000 cu.m,

between January and August of this year. During the same

period, domestic sales of wood panels amounted to 4.2

million cu.m.

Wood panel and laminate flooring output

In 2016, Brazilian production of reconstituted woodbased

panels dropped 2.4% compared to 2015, ending the year at

7.3 million cu.m. Production of MDF/HDF and HB fell

8.8% and 8.9%, respectively while production of MD

particleboard increased 9%.

Part of the decline in sales of MDF/HDF and HB panels

was the result of reduced household spending on mainly

furniture, a major segment of woodbased panel market in

Brazil.

In 2016 sales in the furniture sector fell 12% leading to a

decline in sales of reconstituted wood panels in the

domestic market. In order to compensate for sales

reduction in the domestic market, the industry directed

production to international markets and exports topped 1.1

million cu.m 64% higher than in 2015.

Meanwhile, laminate flooring production totalled 11.8

million sq.m in 2016 which represented a 7% reduction

compared to 2015.

9.

PERU

Two million hectares of concessions

to be reallocated

According to the National Forestry and Wildlife Authority

(Serfor), of the 7.5 million hectares of timber forest

concessions allocated in Peru, only around 4.3 million

hectares are operational.

Some 3.2 million hectares of concessions have been

returned to the State. Of those that were returned at least 2

million hectares in Loreto and Ucayali could be

reallocated before the end of this year according to Serfor.

Serfor executive Director John Leigh Vetter has indicated

that concessions in Ucayali would be ready for

reallocation by the end of October while those in Loreto

are in the process of review.

In the case of Madre de Dios, where concessions have also

been returned to the State, reallocation will follow the new

abbreviated granting procedure through which a Regional

Government Commission will prequalify bidders based on

their technical and financial capacity following the Serfor

guidelines.

Law on promoting forest plantations ready for

Congress

Serfor has announced that the law on the Promotion of

Forest Plantations, a legislative initiative promoted by the

Ministry of Agriculture (Minagri), is to be presented to

Congress in the second half of October.

This law aims to boost private investment in establishment

of forest plantations for the production of wood and nonwood

products. The law provides for economic and

financial incentives as well as tax incentives and the

easing of import duties on machinery and equipment. This

new initiative is totally different from the Forestry and

Wildlife Law that regulates this activity.

Traceability as a tool to raise competitiveness and

improve image of timber industry

A recent workshop on ‘Traceability as a Tool for

Management and Responsible Timber Trade’, organised

by Serfor attracted experts and entrepreneurs from six

countries.

The aim of the workshop was to share experiences on the

traceability process which consists of tracking timber from

its origin, through transport and processing for export in

order to improve the management of the forest industry

and raise competitiveness and access in international

markets.

The Serfor Executive Director said this initiative seeks to

contribute to a common vision between the State and the

private sector. The aim is to develop transparent

mechanisms to guarantee the legal origin of timber and its

products, to improving the competitiveness of companies,

enhance the image of the country in international markets

and improve the welfare of the people of Peru.

Experts from governmental institutions, international

organisations and private companies from the United

States, Chile, Guatemala, Mexico, Colombia and Bolivia

discussed the forest regulations, the traceability of timber

from natural and plantation forests and the importance of

domestic processing and trade.

The seminar was supported by international institutions

such as the World Resources Institute, German GIZ

Cooperation and national institutions such as the

Association of Exporters (ADEX), WWF and local

businesses.