|

Report from

North America

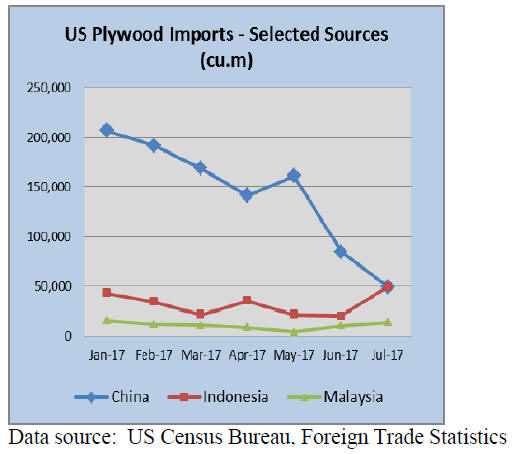

Drop in plywood imports from China

Hardwood plywood imports were almost unchanged in

July at 207,604 cu.m. Year-to-date imports were 6%

higher than in July 2016. The value of plywood imported

in July increased 5% from the previous month to US$146

million.

Plywood imports from China have tumbled since the US

introduced preliminary antidumping duties on Chinese

hardwood plywood. In July only 49,820 cu.m. of

hardwood plywood were imported from China, down 41%

from June. Year-to-date imports from China declined 5%

compared to July 2016.

Plywood imports from Indonesia soared in July. Imports

more than doubled from June to 49,904 cu.m. Malaysian

plywood shipments to the US increased to 14,001 cu.m. in

July. Hardwood plywood imports from smaller suppliers

such as Cambodia and Brazil also grew in July to help

make up for drastically lower imports from China.

Veneer imports recovered in July

Tropical hardwood veneer imports increased 10% in July

to US$2.9 million, but year-to-date imports were only half

of the veneer imports at the same time last year.

Veneer imports from Italy increased month-over-month to

US$1.6 million. Imports from Ghana were also up in July,

while veneer imports from Cote d¡¯Ivoire fell to

US$236,583.

Higher moulding imports from Brazil, Malaysia and

Indonesia

Imports of hardwood moulding were worth US$15.6

million in July, up 4% from June. Year-to-date imports

were approximately the same as in July last year.

Imports from Malaysia, Brazil and Indonesia increased in

July, while China exported less moulding to the US. July

imports from Brazil were US$2.6 million, compared to

US$4.6 million from China.

Moulding imports from Malaysia and Indonesia were

worth US$1.2 million and just over US$900,000,

respectively.

Growth in assembled flooring panel imports from

Vietnam and Thailand

Hardwood flooring imports were slightly down in July at

US$5.2 million, following high imports in June. Year-todate

hardwood flooring imports were up 24% compared to

July 2016.

Canada expanded hardwood flooring shipments to the US,

but imports from most other countries declined in July.

Flooring imports from China were US$1.7 million, down

12% from June. Imports from Indonesia were down 13%

at US$665,126.

Assembled flooring panel imports grew 5% to US$14.1

million in July. However, year-to-date imports of

assembled flooring panels were slightly below July 2016

levels.

China¡¯s share in total assembled flooring imports grew in

July, while imports from Indonesia were down.

Thailand shipped close US$900,000 worth of flooring

panels to the US in July, up one third from June.

Vietnam has become a significant supplier of assembled

flooring panel to the US market. July imports from

Vietnam were worth over US$1 million.

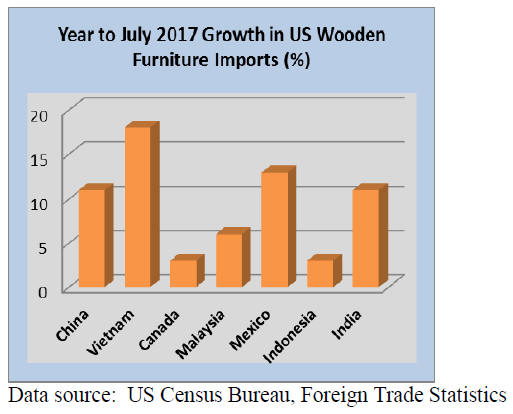

Growth in wooden furniture imports

Wooden furniture imports were up 1% in July from the

previous month. Year-to-date imports increased 11% from

July 2016. Furniture imports from China, Mexico and

India declined in July, while imports from most other

countries increased.

Vietnam¡¯s shipments to the US increased 4% in July to

US$318.9 million. Wooden furniture imports from

Malaysia were worth US$59.5 million in July, up 5% from

June. Imports from Indonesia increased 6% to US$48.0

million.

Imports of all types of wooden furniture imports grew in

July with the exception of upholstered seating.

GDP growth 3% in second quarter

GDP grew at an annual rate of 3% in the second quarter of

2017, according to the second estimate by the Bureau of

Economic Analysis. In the first quarter, real GDP

increased 1.2%. Personal consumption and non-residential

construction investment were higher in the second quarter

than previously estimated.

The unemployment rate was 4.4% in August. After

declining earlier in the year, unemployment has been 4.3

to 4.4% since April.

Consumer confidence declined in September according to

the University of Michigan¡¯s survey of consumers.

Consumers were concerned about the economic effect of

the two hurricanes that devastated large areas of Texas and

Florida. However, gains in income, home and equity

values contributed to an overall positive assessment of

current economic conditions.

Home builders worried about effect of hurricanes on

cost of building materials

Residential construction was almost unchanged in August

at a seasonally adjusted annual rate of 1,180,000,

according to the US Department of Housing and Urban

Development and the Commerce Department. Housing

starts were 1.4% higher than in August 2016.

Single-family home construction was slightly up in

August, while multi-family starts declined from July. In

the next months the building market will be affected by

rebuilding and repairing homes that were damaged by

hurricanes.

Regionally home construction rose in the US Midwest and

West in August. Housing starts fell in the South and

Northeast.

Builders¡¯ confidence in the market for new single-family

homes fell in September, while the August reading was

revised downward. According to the National Association

of Home Builders, the hurricanes have deepened builders¡¯

concerns about the cost of building materials and labour

availability. Once the rebuilding of homes begins

confidence in the housing market is expected to go back

up to the high levels seen earlier this year.

Canadian housing market still booming, CETA now in

force

Home construction in Canada continued at a fast pace

driven by high consumer confidence and strong demand

for housing. In August housing starts increased to 223,232

at a seasonally adjusted annual rate. Earlier this year the

Canadian Housing and Mortgage Corporation (CMHC)

had predicted a more downward trend in new construction

for 2017.

The share of single-family homes in new construction

declined to just 28% in August. The vast majority of

homes built in cities are apartments and attached homes.

Canadian consumer confidence reached its highest level in

ten years, according to the CMHC. At the same time

household debt is at record levels. In the second quarter of

2017 the ratio of debt to disposable income rose to 168%.

Home mortgages account for more than half of the debt.

Canada¡¯s central bank increased the overnight target

interest rate to 1% in early September. Business

investment and exports have improved, according to the

Bank of Canada, but international trade issues may affect

the economy.

Canada is negotiating with the US on sawn softwood

exports to the US and with both Mexico and US to revise

the North American Free Trade Agreement.

The Canada-EU agreement CETA (Comprehensive

Economic and Trade Agreement) came into effect

September 21. CETA could increase bilateral trade

between the EU and Canada by 20% annually, according

to a joint study.

Chinese company to build office furniture component

plant in Michigan

A Chinese office furniture manufacturer has announced an

investment of US$4.9 million in Michigan to build a new

plant. J-Star Motion Corp. will produce linear motion and

lifting systems for the office furniture industry.

The company already opened office and warehouse

facilities in Michigan earlier this year. Its parent company

is Jiecang Linear Motion Technology Co. in Xinchang,

China.

Another notable recent investment was a plant in Oregon

for custom cabinet boxes. Cabinotch Innovative Solutions,

owned by Columbia Forest Products, opened a new

factory in August that produces custom frameless cabinet

boxes for custom cabinet shops. US-made hardwood

plywood is utilized for the cabinets.

Cabinotch plans to eventually have ten regional factories

across the US. According to the company, their fast

custom production process help small cabinet shops

compete with mass produced and low-cost cabinet

imports.

Amazon enters retail market for large furniture

Amazon is building warehouses to be able to sell more

large furniture items such as upholstered and bedroom

furniture according to the Woodworking Network portal.

Furniture is one of the fastest-growing product categories

on Amazon based on One Click Retail data. Amazon sold

US$2.3 billion of furniture in 2016, compared to total US

sales of approximately US$70 billion.

Furniture giant La-Z-Boy Inc. reported that it considers

selling through Amazon to reach younger customers. The

company reported a significant decrease in sales in the

first quarter of 2018 compared to last year¡¯s first quarter.

The majority of La-Z-Boy sales is upholstered furniture.

|