|

Report from

Europe

Tropical and Chinese suppliers claw back EU

furniture

market share

Previous ITTO reports have highlighted how European

furniture manufacturers have been taking larger share of

the internal EU market in recent years, gradually

squeezing out overseas competitors.

This trend has been driven partly by increased price

competitiveness at a time when the euro and other

European currencies have been weak relative to the US

dollar.

There are also more enduring factors, including the

underlying strength of European furniture manufacturers

and their brands in terms of innovation and design; the

obstacles to overseas suppliers complying with complex

EU technical and environmental standards; and the

expansion of furniture manufacturing in Eastern Europe, a

location which combines ready access to raw materials,

relatively cheap labour, and the internal EU market.

The latest Eurostat data shows that European

manufacturers share of the EU internal market increased

even more sharply last year than indicated by preliminary

estimates. However, there are also signs that suppliers in

China and South-East Asia are clawing back some market

share in 2017.

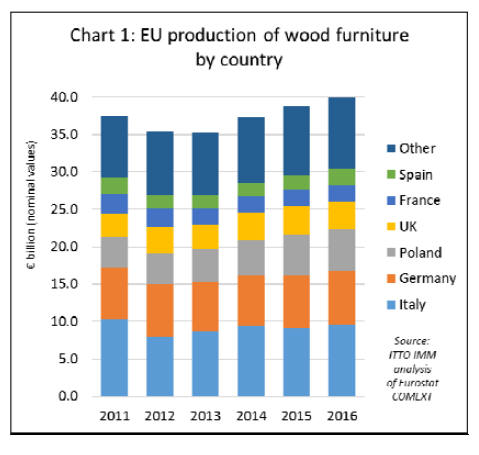

Analysis of official Eurostat manufacturing production

data for 2016, just released in August, shows that wood

furniture production value in the EU increased by 3.3% to

Euro40.1 billion last year (Chart 1).

That is the highest level of production since 2008. It is

also greater than the preliminary estimate of 2016

production of Euro39.6 billion reported in the previous

ITTO TTM report on the EU wood furniture market

published in May 2017 (based on analysis of EU trade

flow volumes and other indices of furniture business

activity).

Economic stimulus in Italy behind rise in furniture

consumption

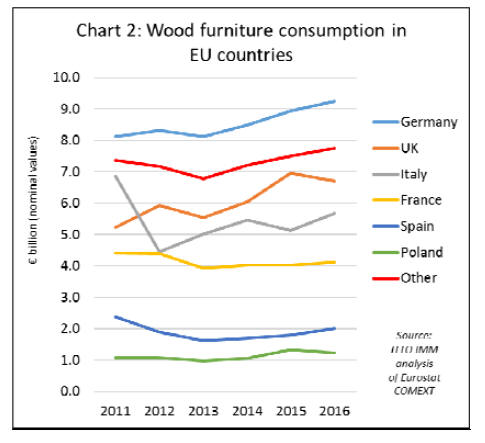

According to the latest Eurostat data, EU wood furniture

consumption increased 3% to Euro36.7 billion in 2016.

This compares to the preliminary estimate of Euro36.1

billion reported in the ITTO TTM report in May.

The latest Eurostat data reveals that wood furniture

consumption in Italy increased by more than 10% in 2016,

to Euro5.7 billion, recovering ground lost the previous

year (Chart 2). This is a much larger increase than initially

predicted given widespread reports of slow economic

growth and weak consumer confidence in the country.

However, Italian furniture consumption last year was

boosted by the Italian Stability law implemented in

January 2016 to support the national economy. The law

included tax credits for building renovation work,

including a bonus for new furniture, and direct public

support for the ¡°Made in Italy¡± brand.

In addition to Italy, wood furniture consumption increased

in several other key EU markets in 2016 including

Germany (rising 4% to Euro9.2 billion), France (rising 2%

to Euro4.1 billion) and Spain (rising 12% to Euro2

billion).

These gains offset a 4% decline in consumption in the UK,

a trend widely forecast owing to the economic uncertainty

and weakness of the British pound following the Brexit

vote.

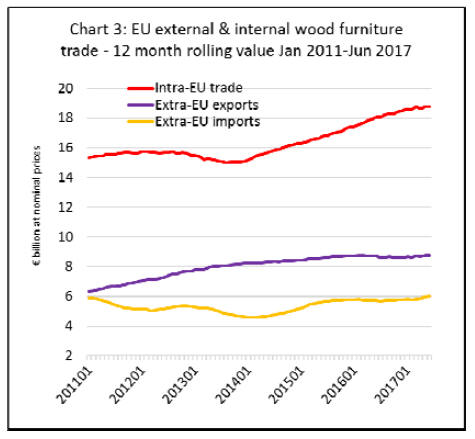

Intra-EU furniture trade continues to rise

Analysis of Eurostat trade data reveals that internal EU

trade in wood furniture, which increased 4% to Euro16.2

billion in 2016, continued to rise in 2017. This trend is

driven both by the slow rise in EU consumption and by

rising dependence of the internal EU market on

manufacturers located in lower cost member states of

Eastern Europe, particularly Poland, Romania, and

Lithuania.

The EU has maintained a trade surplus in wood furniture

since 2011 when exports to non-EU countries overtook

imports from outside the EU. This surplus remained

broadly flat between the start of 2015 and the first quarter

of 2016 (averaging close to Euro3 billion per annum), as

both imports and exports were stable.

However, there were some early signs of a slight

narrowing in the trade surplus in the second quarter of

2017 (to around Euro2.8 billion per annum) as imports

began to pick up. (Chart 3).

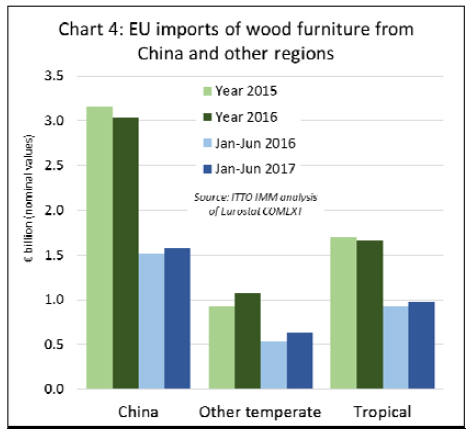

Biggest gains in EU imports of wooden furniture are

from temperate countries

After slipping back last year, EU wood furniture imports

from tropical countries and China recovered some lost

ground in the first 6 months of 2017. EU imports from

tropical countries increased 4.5% to Euro970 million,

while imports from China increased nearly 5% to

Euro1.58 billion.

However, the biggest gains in EU imports of wood

furniture this year are from other temperate countries,

mainly bordering the EU such as Bosnia, Turkey,

Switzerland and Ukraine. EU imports from these countries

increased 20% to Euro630 million in the first 6 months of

2017, building on a 14% gain recorded the previous year.

(Chart 4).

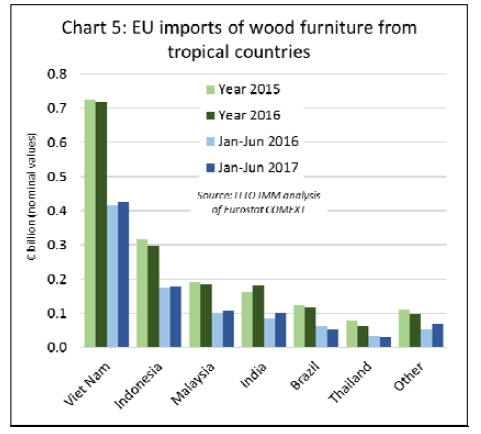

The share of the various tropical countries in supply of

wood furniture to the EU has varied quite widely this year.

After falling 2% to Euro716 million in 2016, EU imports

from Viet Nam rebounded 3% to Euro427 million in the

first six months of 2017.

Imports from Indonesia also increased during the period,

but by only 1% to 178 million m3, not sufficient to

recover ground lost in 2016. Imports from Malaysia

recovered more strongly in the first half of this year, rising

nearly 8% to Euro108 million.

Imports from India have also continued to rise, up 18% to

Euro103 million during the six-month period. (Chart 5).

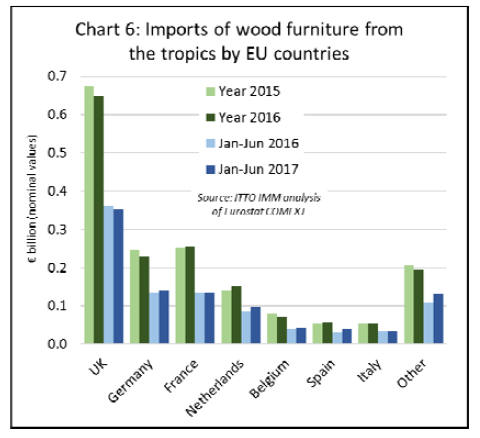

There were also significant shifts in the destinations for

furniture exported into the EU from tropical countries in

the first half of 2017. The UK imported Euro353 million

of wood furniture from tropical countries between January

and June 2017, 2% less than the same period in 2016.

Imports of tropical wood furniture in Italy also declined,

by 4% to just Euro33 million, a sign that the recent surge

in Italian furniture consumption has not been to the benefit

of tropical suppliers.

However, all other leading EU furniture markets imported

more furniture from tropical countries in the first 6 months

of 2017 compared to the same period the previous year.

Imports increased 3% to Euro139 million in Germany, 1%

to Euro134 million in France, 16% to Euro99 million in

the Netherlands, 4% to Euro43 million in Belgium, and

30% to Euro42 million in Spain. (Chart 6).

European destinations for wood furniture imported from

individual tropical countries have shifted this year. A

significant decline in UK trade with Viet Nam in the first

half of 2017 was offset by rising Viet Nam trade with a

wide range of other EU markets including Sweden, Spain,

France, Poland, Denmark, Ireland, Greece and Austria.

A decline in UK, French and Swedish imports from

Indonesia, was compensated by a rise in Indonesian trade

with Spain, Netherlands and Ireland during the six-month

period. Malaysia exported less to Sweden and Germany,

but increased sales to the UK, Poland and Ireland. The rise

in EU imports from India this year is mainly concentrated

in the UK, Netherlands and Germany.

¡®Top 200¡¯ account for nearly a quarter of world

furniture production

Of the world¡¯s 200 top furniture manufacturers, 40% are

headquartered in the EU, 22% in North America, 31% in

Asia Pacific, 2% in South America, and 2% in central

Eastern Europe, Russia and Turkey.

The ¡°Top 200¡± account for around 23% of total world

furniture production, indicating a relatively low degree of

concentration in a sector which continues to be dominated

by smaller enterprises.

These are key conclusions of a new report on the Top 200

published by CSIL, the Italian furniture industry research

organisation.

The report also highlights that around 65% of the Top 200

are involved only in manufacturing and the remaining

35% operate both as manufacturers and retailers.

The share of companies that directly manage retailing

activities increases with the size of the company.

The share is highest in the upholstered market segment

and lowest in the office and kitchen segments which tend

to be more dependent on other channels such as contract

sales and direct sales to building companies.

The Top 200 have an average turnover per employee of

USD178,000 per year, with the larger companies generally

having higher levels of productivity. This is due partly to

their greater investment in R&D and production

machinery, and a greater propensity to operate via

subcontracting and specialist production units.

The report notes that total world furniture production was

worth about USD 400 billion in 2016, a slight gain on

2015, but marginally down on 2014. However, in recent

years, world furniture trade has been growing faster than

production with greater concentration in low-cost

manufacturing hub locations.

The Top 200 are gradually increasing their share of global

production and sales. In 2016, the turnover of the Top 200

was 17% higher than in 2011, rising year-on-year more

rapidly than the market as whole.

See CSIL: ¡®Top 200 Furniture Manufacturers Worldwide¡¯ report

available at www.worldfurnitureonline.com

|