|

Report from

North America

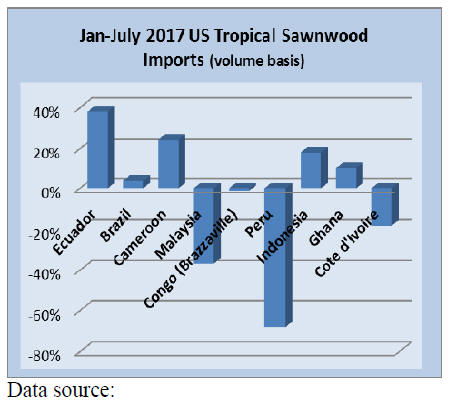

Lower sapelli imports from Cameroon and Congo

The volume of tropical sawnwood imports fell 16% in

July, but the value of imports was unchanged from the

previous month due to increased imports of higher value

species. 18,821 cu.m. of tropical sawnwood were imported

in July, worth US$21.6 million. US imports of temperate

sawnwood declined in July.

A slowdown in sapelli imports accounted for much of the

July drop in tropical imports, affecting mainly shipments

from Cameroon and Congo (Brazzaville). Sapelli imports

fell 56% month-over-month to 2,076 cu.m. in July. Balsa,

acajou d¡¯Afrique and cedro imports were also down from

June. Malaysian exporters benefitted from higher keruing

imports in July, up 63% from June. Year-to-date keruing

imports remained below July 2016 levels.

Ipe imports were slightly up from June at 2,488 cu.m.

Imports of most other species also increased in July,

including imports of jatoba, mahogany, virola and teak.

Teak sawnwood imports, mainly from Myanmar and

India, grew from the previous month. Teak imports were a

relatively small volume in July (485 cu.m.) but high value

(US$2.48 million). Teak imports from Myanmar

accounted for 239 cu.m. in July or US$1.18 million.

Canadian tropical sawnwood imports fall except

mahogany

Canadian imports of tropical sawnwood declined for the

second consecutive month in July to USUS$1.38 million.

Year-to-date imports were slightly lower than in July

2016.

Like in the US market the main decline was in sapelli

imports. Imports of virola, imbuia and balsa (combined)

were also down from June. Imports of mahogany more

than doubled in July to USUS$110,119.

Compliance dates extended for new formaldehyde

emissions standards

The federal Environmental Protection Agency (EPA) is

extending the compliance dates for the formaldehyde

emission standards for composite wood products. The

wood products industry and trade associations had

expressed concerns about meeting the compliance dates

set out in EPA¡¯s rule from December 2016.

A prepublication version of the final rule on formaldehyde

emission standards was published online on September 1,

2017. According to this prepublication rule the following

compliance dates will be extended:

Manufactured-by date for emission

standards, Manufactured-by date for emission

standards,

recordkeeping, and labeling provisions: by one

year to December 12, 2018

Import certification provisions: by

more than one Import certification provisions: by

more than one

year to March 22, 2019

Provisions applicable to producers

of laminated Provisions applicable to producers

of laminated

products: by more than three months to March

22, 2024

The ¡°manufactured-by date¡± of composite wood products

is the reference date for the compliance date for the

emission standards, recordkeeping, and labeling

provisions. Beginning December 12, 2018 all imported

panels and component parts or finished goods subject to

the rule must comply with the emissions standards.

Existing stock of non-certified panels imported into the

US and existing stock of component parts and finished

goods that contain non-certified panels manufactured

internationally may continue to be distributed in

commerce and assembled into products until that stock is

depleted, providing documentation is kept regarding the

date of manufacture or import.

Additionally, composite wood products may be certified

by California Air Resources Board Third Party Certifiers

until March 22, 2019, so long as all aspects of the EPA

final rule on formaldehyde emissions are complied with.

The EPA extended the compliance dates and the

transitional period for California Air Resources Board

Third Party Certifiers to add flexibility for organizations,

reduce compliance burdens, and prevent supply chain

disruptions.

The full compliance date extension rule is available on the

EPA website: https://www.epa.gov/formaldehyde/compliancedate-

extension-formaldehyde-emission-standards-compositewood-

products-0

Steady growth in demand for kitchen cabinets and

office furniture

Cabinet sales were 1.8% higher in July compared to the

same time last year, according to the latest Kitchen

Cabinet Manufacturers Association (KCMA)¡¯s monthly

Trend of Business Survey. Year-to-date cabinet sales

increased 3.7% compared to July 2016.

The strongest growth in year-to-date sales was in stock

cabinets (+4.2%), followed by semi-custom cabinets

(+3.9%). Custom cabinet sales were almost unchanged

from 2016. The survey participants represent

approximately 70% of the US kitchen and bath cabinets

market.

Demand for office and contract furniture is also strong,

according to a quarterly survey of commercial furniture

manufacturers and suppliers (MADA / OFI Trends by

Michael A. Dunlap & Associates). Sales and employment

were up in July. Raw material costs increased from April,

which caused concern to many companies, according to

the survey.

New wood treatment to replace methyl bromide

fumigation

A new wood treatment method has been developed by

researchers at Pennsylvania State University that could

replace methyl bromide fumigation of wood. The US,

along with other countries, restricts the use of methyl

bromide and is phasing it out because the gas depletes the

ozone layer.

The international timber trade and the use of wood

packing and pallets in shipping would be negatively

affected without a cost-effective wood treatment that

controls insects at all stages. The patent-pending heat

treatment developed at Pennsylvania State University uses

radio-frequency waves. The researchers have received

funding to bring the technology to market.

|