2. GHANA

Fight against forest crime takes a new direction

At a National Stakeholders Forum on forest conservation

held recently in Accra, the Forestry Commission indicated

that its fight against illegal logging and other forest crimes

is continuing as the problems are immense and the causes

are complex.

Speaking at the forum, Chris Beeko, Director of the

Timber Validation Department of the Commission said the

Commission plans to introduce a wood procurement

policy to help regulate forest harvesting. In combating

forest crimes, said Beeko, the sector needs to adopt a

multi-faceted approach to address the root causes as well

as the control operations undertaken by the rapid response

teams. Such a multi-faceted approach requires a new

policy direction he said.

Beeko indicated that the Commission aims to form

effective collaboration between civil society organisations,

the national security apparatus and the judiciary to take on

the challenges of securing the forest reserves.

At the Forum representatives from civil society, the

security forces and the judiciary assured the forestry sector

of their readiness to assist in battling forest crime and in

tackling the underlying causes of illegal actions.

Private sector asked to get involved in afforestation

initiatives

Stakeholders at an international workshop in Accra called

for the private sector to participate in the development and

strengthening of afforestation initiatives as this could lead

to a revitalisation of the sector.

The workshop focused on forestry developments in

response to climate change and trans-boundary forestry

issues. Contributing to the workshop, the Executive

Secretary of the African Forests Forum, Professor Godwin

Koweri, said “Africa stand a greater chance of profiting

from tree plantation programme if private participation is

encouraged, well-developed and strengthened.”

Experience in Ghana and elsewhere has shown that

sustainable livelihoods is best achieved when there is a

private-public partnership development approach as this

strengthens private sector involvement in addressing social

inequalities.

AGI welcomes China loan

In a press release, James Asare-Adjei, president of the

Association of Ghana Industries (AGI), welcomed the

Ghana government engagement with China to secure a

US$15 billion loan for its economic development drive.

The AGI president was a member of a delegation that

recently travel to China to promote trade and investment.

Asare-Adjei commented that Ghana needs to advance

industrialisation at a faster pace and he applauded the

vision of the government in trying to rebuild a solid

industrial base in Ghana.

The press release points out that many companies in

Ghana have collapsed due to unfavourable policies of the

previous which led to high operating costs, burdensome

interest rates, currency depreciation and power shortages.

3.

SOUTH AFRICA

Business confidence still very low

There is still little or no evidence of the proposed

government infrastructure spending and reports show that

state owned enterprises are borrowing at an alarming rate

which is constraining the government’s plan for its

R800bn infrastructure programme.

One of the major aluminium producers in S. Africa

has

said local demand for window, door and ceiling extrusions

is very low and customers are only ordering what they

need for immediate use.

Massmart, one of the biggest retailers in S. Africa has a

building division (Massbuild) which as reported zero sales

growth this year.

Building in the Cape Town area has been affected by the

drought as builders do not have enough water, several

builders have halted construction multi-unit projects

entirely until they can get enough water .

Unemployment crisis - solved only when economy

picks up

The Reserve Bank lowered the prime rate by 0.25% in mid

July and is forecasting just 0.5% growth for this year.

Unfortunately this means the country will not be able to

tackle the unemployment crisis.

The most recent OECD report on South Africa says the

unemployment rate was at a 14-year high of almost 28%

in the first quarter of 2017. The report continues, “growth

has to be driven higher in order to absorb all the young

men and women who are seeking opportunities.”

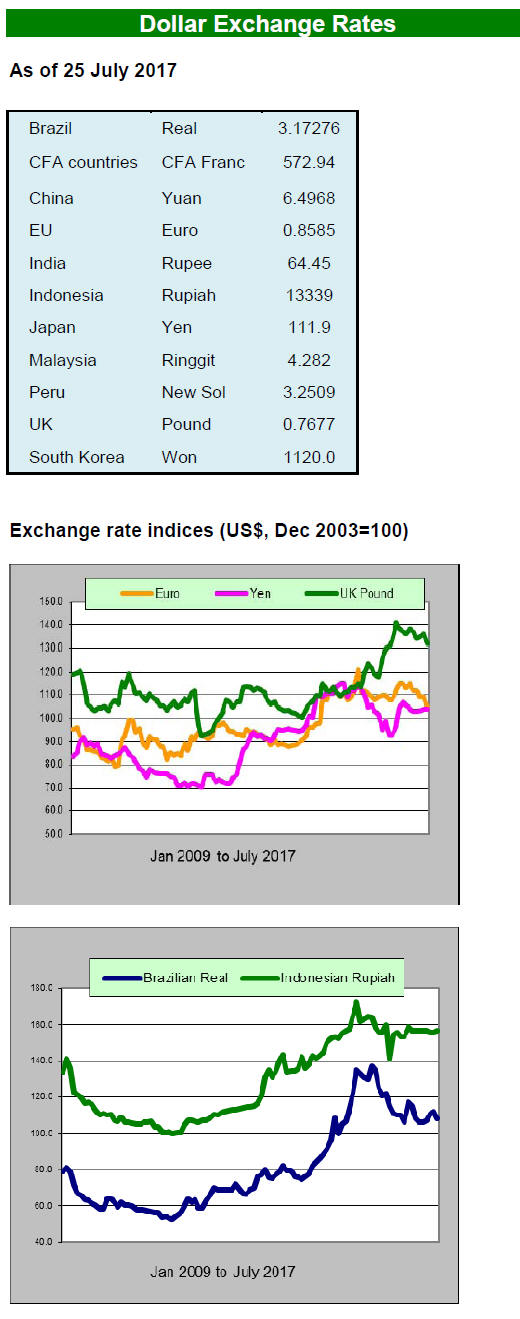

Importers face tough times

Importers are having a tough time not only because of the

local demand but also because the Rand has been very

volatile in the past few weeks, it has been as weak as

R13.50=US$1 and is currently trading at R12.90=US$1

which makes purchasing decisions very tricky.

There have been some reports of retailers getting new

business since the interest rate drop but there are no signs

of improvement in the residential building market which

remains depressed.

The anticipated shopfitting renovations as some stores in

the malls have changed hands has not materialised as the

new tenants are delaying committing to the rents.

Market sector round-up

The decking market is steady but there is no strong

demand and some customers are preferring local

eucalyptus and pine rather than imported species.

Domestic pine mills are still building up stock levels there

have been instances of price discounting. In the current

market the plan to raise prices has been postponed.

The American hardwood market has been reasonably

steady with most of the demand being for white oak with

some demand also for ash.

There has been some movement of European beech and

douglas fir but the strong Euro is holding back sales.

The board market is under pressure. PG Bison

(manufacturer of wood-based panel products founded in

1987 and based in Sandton, South Africa) has

commissioned their new plant which has added 13,000

sq.m per day to their overall production. They have also

installed a high gloss line.

The market for African species is also patchy, mainly due

to erratic delivery problems. There have been reports of

Zambian authorities halting the export of logs brought into

the country from DRC for onward shipment to mainly

China. The problem appears to be that Zambia does not

allow log exports and the process for transshipment is not

clear. Analysts write it is there could be as much as 45,000

cu.m held up in Zambia.

4.

MALAYSIA

Timber import regulations enter

into force

The MTIB website has reminded Malaysian importers of

timber that implementation of the timber import legality

regulations under the Timber Legality Assurance System

came into effect on 1 July 2017.

Applications for import licenses for logs, baulks,

sawntimber, plywood, veneered panels and similar

laminated wood (HS 4403, 4407 and 4412) from MTIB

must be accompanied by evidence of legality from the

supplier.

It is compulsory for all importers to submit: (i) CITES

Permit / Certificate (if products are under CITES lists),

and (ii) Copy of the Certificate of Origin, including any

one of the following to verify legality:

FLEGT licenses

FLEGT licenses

Certificate issued by a recognised

timber

Certificate issued by a recognised

timber

certification body

Certificate of Voluntary Legality Scheme

Certificate of Voluntary Legality Scheme

Legality document issued by recognized

Agency /

Legality document issued by recognized

Agency /

Corporation / Association

Self-declaration documents by the

exporter with

Self-declaration documents by the

exporter with

endorsement by the authorities of the exporting

country

Copy of the Customs Export Declaration

from

Copy of the Customs Export Declaration

from

exporting countries

For the full details see:

http://www.mtib.gov.my/index.php?option=com_content&view=

article&id=2418%3Aimport-legality-regulation-under-timberlegality-

assurance-system-tlas-&catid=1%3Ahighlights&lang=en

Challenges remain in expanding furniture exports

In a statement to the press, Chua Chun Chai, Malaysian

Furniture Council (MFC) president said furniture exports

will expand faster this year and much of the expansion

will be due to the ban on sawn rubberwood export. Chua

expects furniture exports to top RM10 billion this year, up

about 4% from 2016.

If this can be achieved then the sector is well advanced

towards the RM 16 billion target in the Malaysian Timber

Industry Board’s (MTIB) National Timber Industry Policy

projections for the period 2009-2020.

Between January and April this year exports grew 6%

largely on the back of firm demand in the US market.

While the US market is number one for Malaysia’s

furniture, Chua pointed out demand in Australia, Japan,

Singapore, the UK and Middle East is firm. In addition

there has been success in the Indian market, a focus of

attention for the MTIB in recent months.

Despite the good prospects there are challenges, said

Chua, one of which is the shortage of labour which is

holding back growth in the furniture sector.

At issue is the ratio of foreign workers to local workers set

by the government. At present the highest ratio permiited

by government is 3:1 but if this can be lifted to 5:1 then

faster growth can be achieved said Chua.

The other challenge is to encourage companies to move to

greater levels of automation said the MFC president.

Despite the rising costs of doing business in Malaysia

Chua said the furniture sector has a bright future if the

challenges can be addressed with manufacturer friendly

policies.

STA research funding

The Sarawak Timber Association (STA) will invest RM

2.4 million to fund a two year research project on

‘Development and Deployment of Improved Genetic

Materials of Falcataria Moluccana’ (Moluccan albizia).

The STA has been providing funds to universities,

research-based companies and other research agencies

since 2005.

STA Chairman, Wong Kie Yik, said that the latest projects

funded by the association include RM400,000 to

Universiti Malaysia Sarawak for a three-year research on

the production of high quality kelampayan species

(Neolamarckia cadamba) for forest plantations.

Wong added that the STA is currently providing over

RM580,000 to Swinburne University of Technology,

Sarawak Campus, for a project aimed at identifying and

isolating the rhizosphere microorganism in the soil which

could be harnessed to raise plantation productivity.

Export round up

Exports and domestic consumption boosts growth

The International Monetary Fund has upgraded its 2017

growth forecast for Malaysia to 4.8% from 4.5%.

In the first quarter of 2017, Malaysia’s economy grew at a

better-than-expected 5.6% annual rate – the quickest pace

in two years – on robust exports and strong domestic

demand.

The ringgit has also recovered, from being among the

weakest emerging Asian currencies in 2016, following

measures by the central bank.

5. INDONESIA

Delivering benefits of FLEGT to SMEs

A national policy dialogue co-hosted by the Center for

International Forestry Research (CIFOR) and the Ministry

of Environment and Forestry brought together more than

200 policy makers, scientists, business owners, craftsmen

and more to discuss how to deliver the benefits of the

FLEGT license scheme to small and medium enterprises.

Putera Parthama, Director General for Sustainable Forest

Management from the Ministry of Environment and

Forestry, said the FLEGT license will serve to improve

competitiveness, a view shared by Charles-Michel Geurts,

Deputy Head of the European Union Delegation in

Indonesia.

Geurts provided figures on Indonesia’s timber exports to

the EU which have grown significantly. He praised the

success of Indonesian companies in taking advantage of

the FLEGT licenses to expand trade with the EU.

See: http://www.cifor.org/press-releases/eu-timber-license-couldhelp-

indonesian-small-scale-furniture-exporters-access-globalmarkets/

Danish importers raise FLEGT documentation issues

Indonesia’s Ambassador in Copenhagen, Muhammad Ibnu

Said, has reported that Danish importers are facing a

problem because of details on the various FLEGT

documents. He said companies in Denmark have found the

product weight stated in the various Indonesian import

documents do not always correspond.

Despite this issue the Ambassador reported that Danish

importers are happy to see FLEGT licensed wood products

and that there are opportunities for market growth in

Denmark.

Drive down costs of accessories and finishes to boost

competiveness

The Ministry of Industry is aiming to consolidate the

structure of the furniture industry and to drive down the

cost of raw material inputs in furniture making so as to

boost competiveness.

Panggah Susanto, Director General of Agroindustry in the

Ministry of Industry, is aiming to streamline and reduce

the cost of imported accessories for the furniture sector.

Recently the Indonesian Furniture and Handicraft

Association announced a strategy to improve the

competitiveness of the furniture industry. Included was the

need to lower the costs of all raw materials used by

manufacturers, especially the cost of accessories and

finishes.

6. MYANMAR

MTE confirms - Private sector to be

contracted for

logging

The Deputy General Manager of the Extraction

Department in the Myanmar Timber Enterprise (MTE) has

reaffirmed that the private sector will be contracted to

undertake log harvesting and transport this year. Analysts

report that MTE may rent out its workable heavy

machinery and elephants to contractors.

MTE suspended harvesting and extraction for one year but

will resume in fiscal 2017-18 except Bago Yoma (also

known as Pegu Yoma) a range of low mountains between

the Irrawaddy and the Sittaung Rivers in central Myanmar.

It is understood that that potential contractors will be

required to submit proposals to regional MTE officials

who would decide on contract allocations after consulting

with the MTE HQ.

Almost US$2 billion into Thilawa Special Economic

Zone

Myanmar’s Investment Commission has created a network

between 8 Ministries to provide a ‘one-stop’ information

centre for potential investors. Foreign investment in the

Thilawa Special Economic Zone (SEZ) has grown to

almost US$2 billion in the four years the Zone has been

open. Most investment went into manufacturing followed

by trade, logistics, services and the hospitality sector.

Teak tender sale

On 28 July MTE offered 38.8 HT of grade SG-6 and 685.7

HT of SG-7 ex-site Chin Dwin in Upper Myanmar. prices

secured for SG-6 ranged between US$2,222-2,340 per HT

and between US$1,500-1,736 for SG-6.

7. INDIA

Record low inflation boost hopes for rate

cut

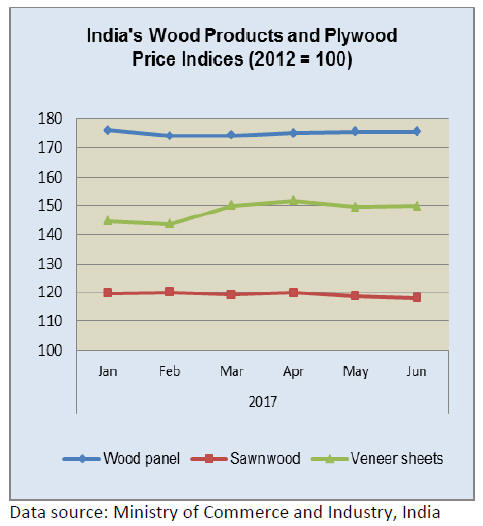

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for June 2017 released by the Office

of the Economic Adviser to the government (OEA)

declined by 0.1% from 112.8 (provisional)in May to

112.7.

The annual rate of inflation, based on monthly WPI, stood

at 0.90% (provisional) for June 2017 compared to 2.17%

for the previous month. Inflation for this financial year so

far was -0.44% compared to a rate of 3.71% in the

corresponding period last year.

The price index for 'Manufactured Wood and of Products

of Wood and Cork ' group declined by 0.1 percent to 130.5

(provisional) from 130.6 (provisional) for the previous

month due to lower price of wooden boards (2%) and

wood cutting, processed/sized, particleboard, wooden

box/crate and timber/wooden sawnwood (1% each).

However, the price of plywood moved up.

The press release can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Andhra Pradesh Forest Development Corporation to

sell red sanders for export

Red Sanders (Pterocarpus santalinus) is a highly valuable

hardwood species that is found exclusively in the Forests

located in Andhra Pradesh State of India. The State

Government of Andhra Pradesh has absolute rights over

the management, possession and sale of red sanders.

Recently the Government of Andhra Pradesh authorised its

corporate subsidiary, Andhra Pradesh Forest Development

Corporation Limited (APFDC), a wholly owned State

Enterprise, to conduct the sale of red sanders stocks held

by the government.

Accordingly, APFDC has announced the sale of over

900

tonnes of graded red sanders logs. The sale will take place

at the Central Warehousing Corporation warehouse in

Renigunta, Chittoor District, Andhra Pradesh. The

government’s Director General of Foreign Trade has

authorised the export of these logs as CITES approved the

sale and export.

Details are available at:

http://www.forests.ap.gov.in/rsv_2017.htm

and

http://www.mstcindia.co.in and I or http://

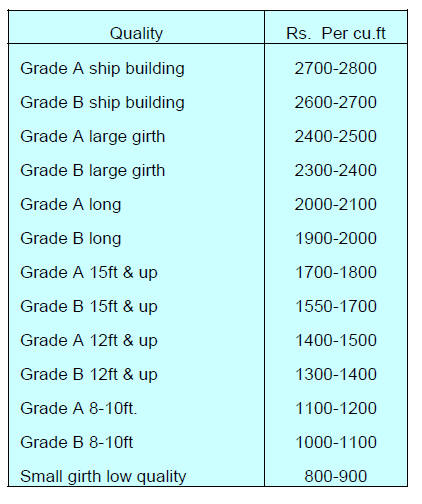

Surat and Vyara Divisions log auctions

Auctions at various Forest Depots in the Surat and Vyara

Divisions have been concluded. Around 3,300 cubic

metres mostly teak was available.

Other hardwoods sold included Adina cordifolia, Gmelina

arborea, Pterocarpus marsupium, Acacia catechu and

Mitragyna parviflora.

Good quality non-teak hard wood logs also attracted

prices

similar to those in auction at Forest Department Depots in

the North and South Dangs. Top quality non-teak

hardwood logs 3-4m long having girths 91cms & up of

haldu (Adina cordifolia), laurel (Terminalia tomentosa),

kalam (Mitragyna parviflora) and Pterocarpus marsupium

attracted prices in the range of Rs.800-1000per cu.ft.

Medium quality hardwood logs were sold at between

Rs600-700 and low grade logs sold for Rs.300-400 per

cu.ft.

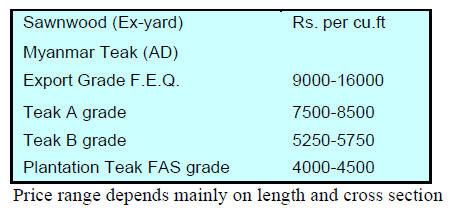

Imported plantation teak prices

Demand for imported logs is steady supported by the

strong Rupee. The application of import duty, GST and

surcharges has pushed prices around 24% higher so

importers are looking for an opportunity to pass on the

higher costs. At the same time, as passing on the higher

prices may not succeed, importers are negotiating with

exporters to secure price discounts.

The Indian trade is trying to get the government to

review

the GST for wood products.

C&F prices remain unchanged but now there is an 18%

GST.

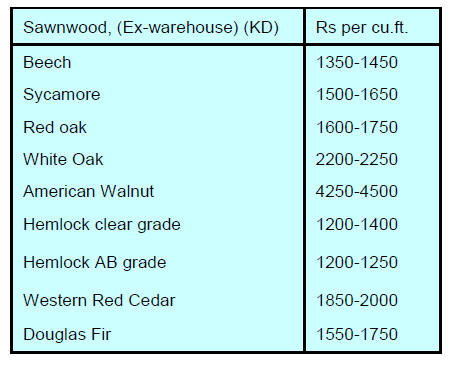

Locally sawn hardwood prices

Prices for hardwoods milled from imported logs are

unchanged.

Myanmar teak prices

There were no reports of price movements over the past

two weeks.

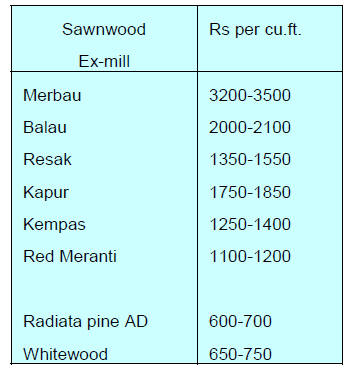

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

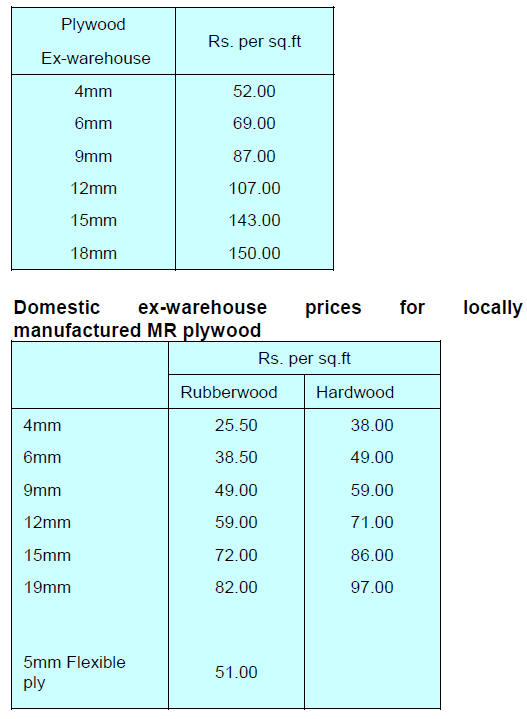

Plywood prices

After adjusting to current tax levels plywood prices have

been raised.

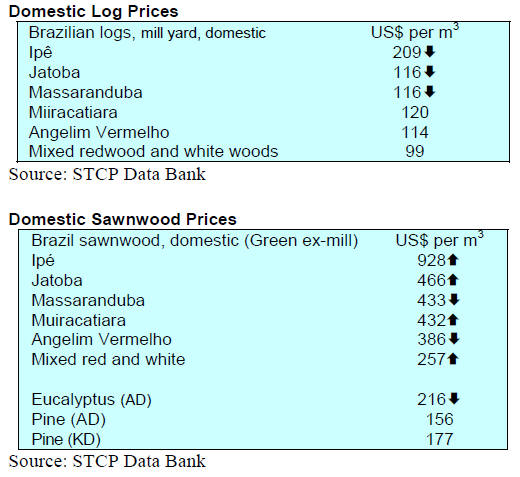

8. BRAZIL

First signs of deflation

For the first time in 11 years the country recorded

deflation of -0.23% in June.

As the economy shows signs of stabilising the Central

Bank Monetary Policy Committee (Copom) felt confident

to again lower the basic interest rate from 11.25% to

10.25% per year.

The World Trade Organization has forecast the Brazilian

economy will gradually recover in 2017 but growth will

continue to be weak. This view was reinforced by an IMF

report that says the international community is of the

opinion that Brazil’s economic woes may be coming to an

end despite the current political turbulence.

Throughout the extended period of recession foreign direct

investment has poured into Brazil. The country received

US$78.93 bil.in FDI during the height of the recession in

2016, the seventh highest global inflow according to the

World Bank.

New transport checks a burden to companies says

CIPEM

The Center for Timber Producers and Exporters of Mato

Grosso State (CIPEM) has raised concerns on the new

requirement for the issuance of the Timber Identification

Certificate (Certificado de Identificação de Madeira -

CIM) by the Mato Grosso State Agriculture and Livestock

Defense Institute (INDEA). These certificates are required

to clear checkpoints during the transport of forest

products.

Under the new rule all trucks carrying wood products have

to divert to a central INDEA check point. CIPEM has

pointed out that this will delay transportation and add to

the cost of delivery.

CIPEM is arguing that prior to transportation the timber

undergoes checks by the State Secretariat for the

Environment (SEMA), the Federal Highway Police (PRF)

and the Brazilian Institute for Environment and Renewable

Natural Resources so the new system is a duplication of

effort and is unnecessary.

This new development Says CIPEM, undermines

competitiveness, disrupts logistics and affects the

profitability of enterprises. CIPEM advocates greater

intensification of inspection throughout the state by

INDEA not additional checks.

Innovation, development and productivity in the

forestry sector

A recent workshop organised by the Paraná State Forest

Based Companies Association and the Brazilian

Agricultural Research Corporation discussed innovation,

development and productivity in the forestry sector. The

main theme was on the "Perspectives and models for

forest industry of the future".

Two approaches were discussed:

First, management for commodity item production

It was determined that success in markets for commodity

products demands high productivity, homogeneity, low

costs, high efficiency and economies of scale.

Second, management for niche market products

In niche markets, diversification, added value, high

efficiency, smaller daily produ

ction and top quality are the

primary requirements.

In order to improve profitability several companies are

being encouraged to combine operations bringing together

forest operations, logistics, residue utilisation and

marketing.

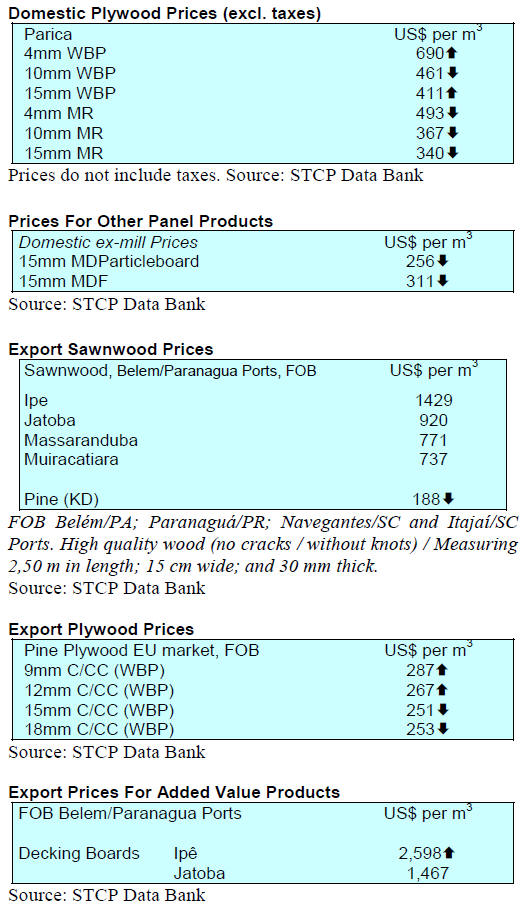

Export update

In June 2017, Brazilian exports of wood-based products

(except pulp and paper) increased 6.2% in value compared

to June 2016, from US$201.5 million to US$213.9

million. The value of June pine sawnwood exports

increased 14.5% year on year from US$29.7 million to

US$34.0 million.

In terms of volume, exports increased 6.8% over the same

period from 156,000 cu.m to 166,600 cu.m.

The volume of tropical sawnwood exports increased 4.7%

in volume, from 32,200 cu.m in June 2016 to 33,700 cu.m

in June 2017, from US$14.6 million to US$15.1 million.

June 2017 pine plywood exports increased 6.3% in value

from US$35.0 million to US$37.2 million. However, in

volume terms exports declined 3.6% (from 134,200 cu.m

to 129,400 cu.m). This signals a sharp drop in average

prices.

On the other hand, tropical plywood, export volumes and

value increased in June 2017 compared to June 2016

(8.2% in volume and 10.8% in value).

On the negative side there was a drop in furniture export

values in June this year. Export values dropped from

US$39.5 million in June 2016 to US$36.9 million in June

2017.

Woodbased panel exports rising

The trade balance in the Brazilian forest plantations sector

reached US$2.9 billion between January and May 2017,

up 4.9% over the same period last year according to the

Brazilian Tree Industry (IBA).

The sector registered total exports of US$3.3 billion, 3.2%

more than in the same period of 2016 with international

sales of woodbased panels totalling US$113 million

(+25.6%).

In 2016, woodbased panel exports topped 91,000 cu.m. In

2017, there was a 25.3% increase pushing exports to

114,000 cu.m.

Latin American markets remain the destinations for

Brazil’s woodbased panels generating revenues of US$62

million in 2017. The second tier market was the US at

US$ 26 million and then Asia, US$16 million.

9.

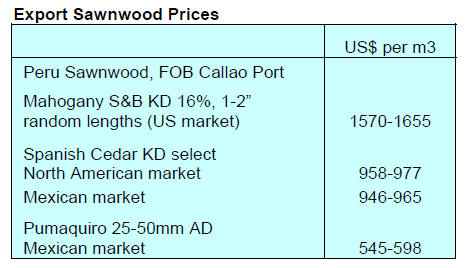

PERU

Peruvian imports of composite boards

Peruvian imports of composite boards in the first half of

2017 remained stable at US$37.07 million, an increase of

0.7% compared to the first half of 2016. The surprise was

the fall of first half shipments from the main supplier,

Ecuador (-17%).

Ecuador, despite the fall, remained the main supplier of

particleboard (PB) to the Peruvian market, with shipments

worth US$14.17 million in the first half of this year.

Imports of PB from Chile, the second ranked supplier rose

slightly (0.7%) to US$12.88 million. Spain was also a

significant supplier in the first half at US$5.14 million and

this was some 23% higher than in the same period in 2016.

In the first half of 2017 shipments from Brazil grew the

fastest and topped US$4.78 million, just over double the

US$2.38 million shipped in the first half of 2016.

Benefits of monitoring forests in the fight

against

deforestation

The National Forest Conservation Program for the

Mitigation of Climate Change (Forest Program) of the

Ministry of the Environment (Minam) and its function in

monitoring deforestation in Peru was recently explained in

the context of the Organization of the Amazon

Cooperation Treaty (ACTO).

Cásar Calmet, the Executive Coordinator of the Minam

Forests Program, explained the Amazon forest monitoring

system developed by the Minam Forests Program provides

regular updates on the forest cover and loss in Peru’s

Amazon rainforests and the information is disseminated

through the Geo-bosques platform.

See (http://geobosques.minam.gob.pe).

Protocol to standardise criteria for timber forest

resources assessment

The National Forestry and Wildlife Service (SERFOR) has

presented a protocol to standardize the criteria for

evaluating forest resources. This details specific technical

procedures for the formulation, approval, inspection,

verification, supervision and control of forest management

plans and is to be applied nationally.

The protocol was elaborated by Serfor, the Forest and

Wildlife Resources Supervision Agency (Osinfor), the

Regional Forest and the Wildlife Authorities of the Loreto,

Madre de Dios and Ucayali regions.

In addition, support was provided by the Faculty of

Forestry Sciences, National University of the Peruvian

Amazon (UNAP) and the Research Institute for the

Peruvian Amazon (IIAP), the National Forest

Confederation of Peru (Conafor Peru). Technical input

was provided by representatives of the Peruvian Forestry

Sector Initiative (PFSI).