|

Report from

North America

US ipe imports remain strong

The US imported 66,772 cu.m. of sawn temperate and

tropical hardwood in May, down 19% from April. The

value of imports declined by 9% to US$42.0 million.

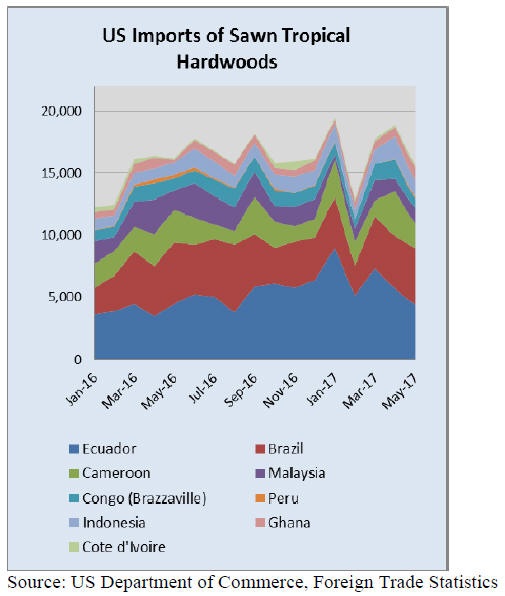

Tropical sawn hardwood imports decreased 14% from

April to 19,170 cu.m. The value of tropical imports was

US$21.3 million and accounted for just over half of all US

sawn hardwood imports in May. The year-to-date volume

of imports was up 13% compared to May 2016.

Imports of most major tropical species were down in May

with the exception of ipe (3,640 cu.m.), keruing (1,119

cu.m.) and mahogany (698 cu.m.). Sapelli sawnwood

imports almost halved from April to 2,176 cu.m., but yearto-

date imports were higher than in May 2016.

US imports from Brazil increased to 4,586 cu.m. in May,

mainly due to higher ipe imports. Over 3,000 cu.m. of ipe

worth US$6.9 million were sold to the US market in May.

Indonesia and Malaysia each exported around 1,260 cu.m.

of sawnwood to the US in May. Keruing and meranti

imports from Malaysia increased from the previous month,

while imports from Indonesia declined. Imports from

Cameroon fell to 1,930 cu.m. in May due to lower

volumes of sapelli and acajou d¡¯Afrique.

Cameroon expands sapelli sawnwood exports to

Canada

Canadian imports of tropical sawnwood were worth

USUS$2.18 million in May, up 12% from April. Year-todate

imports increased 5% from May 2016.

The import growth was almost entirely in sapelli

sawnwood. While US imports of sapelli were down,

Canadian sapelli imports more than doubled from April to

USUS$783,259. Cameroon was the main source of sapelli

imports at USUS$675,939. The remainder of the sapelli

came to Canada via the US.

The second-largest import was virola, imbuia and balsa

combined, imported mainly from the US and a smaller

share from Brazil. No balsa sawnwood was imported

directly from Ecuador in May.

Canadian mahogany imports increased significantly in

May to USUS$145,435. The mahogany sawnwood came

from Mexico, Brazil and Cameroon.

Canada raises interest rates

Following the US Federal Reserve¡¯s interest rate hike in

June, Canada¡¯s central bank raised its rate for the first time

in seven years. The overnight lending rate was raised from

0.5% to 0.75%.

The central bank is optimistic about the Canadian

economy, which suffered after the oil price plunged in

2014 and 2015. Business investments, employment and

Canadian exports are up despite uncertainty around trade

negotiations with the US, including on sawn softwood.

The IMF¡¯s latest assessment of Canada¡¯s economy warned

of significant risks to Canada¡¯s economy, including a

sharp downturn in the housing market, high household

debt, US protectionism and a further decline in oil prices.

Preliminary anti-dumpting duties announced for Chinese

hardwood plywood

In June the US Department of Commerce announced its

affirmative preliminary determination in the antidumping

duty investigation of imports of hardwood plywood from

China.

The preliminary antidumping rates are 114.72% for

Shandong Dongfang Bayley Wood Co. Ltd., no duties for

Linyi Chengen Import and Export Co. Ltd., 57.36% for the

non-selected respondents eligible for a separate rate, and

114.72% for all other producers and exporters in China.

Cash deposits based on these preliminary rates are now

required, except for Linyi Chengen Import and Export Co.

Ltd.

The petitioners for the antidumping investigation are six

US hardwood plywood producers who form the Coalition

for Fair Trade in Hardwood Plywood. The American

Alliance for Hardwood Plywood criticized the duties, their

effect on American jobs, and the method by which the

duties were calculated. The Alliance represents American

importers, distributors and manufacturers of hardwood

plywood, along with other US companies.

In 2012 an investigation into dumping to hardwood

plywood from China was terminated. The termination was

appealed by the Coalition, but a federal judge upheld the

decision.

EPA withdraws formaldehyde emission rule for

extended compliance dates

The Environmental Protection Agency (EPA) has

withdrawn a rule that would have extended several dates

for wood composite producers to comply with

formaldehyde emission standards for composite wood

products.

The EPA had published the compliance extension rule in

May, but after receiving negative feedback from industry

the rule was withdrawn in July. The original, tighter

compliance dates published in the December 2016 final

rule on formaldehyde emissions will remain in effect.

The EPA also published a rule in July that would remove a

provision prohibiting early labeling of products compliant

with the formaldehyde emission standards.

The proposed rule would allow companies to voluntarily

label standard-compliant products as soon as compliance

is achieved. The rule will become effective in August,

unless negative feedback is received during the public

comment period.

https://www.epa.gov/formaldehyde/formaldehyde-emissionstandards-

composite-wood-products

|