|

Report from

Europe

Tropical wood continues to lose share in European

flooring market

European consumption of real wood flooring (i.e.

excluding laminates) remains flat and the role of tropical

timber in this sector is declining. This is apparent from

combined analysis of Eurostat trade data and the latest

market report by the FEP (European Federation of the

Parquet Industry) released on 16 June 2017 at the

Federation*s annual general meeting in Budapest,

Hungary.

Prior to the global financial crises, nearly 20 million sq.m

of the 100 million sq.m of real wood flooring

manufactured in Europe was faced with tropical

hardwood. Another 20 million sq.m was imported directly

from the tropics.

However, in the last decade a host of factors have

conspired to drastically reduce the role of tropical wood in

this sector, including the shift to engineered flooring

products, intense competition from Eastern European and

Chinese manufacturers for market share, a progressive

switch to oak at the expense of all other hardwoods, a glut

in supply of cheaper laminates and non-wood alternatives,

the development of new and improved look-alike surfaces,

and an increasing focus on legality due diligence and

certification.

Drawing on information from member companies and

affiliated national associations, FEP provides detailed data

on real wood consumption and production in 16 European

countries covered by the FEP.

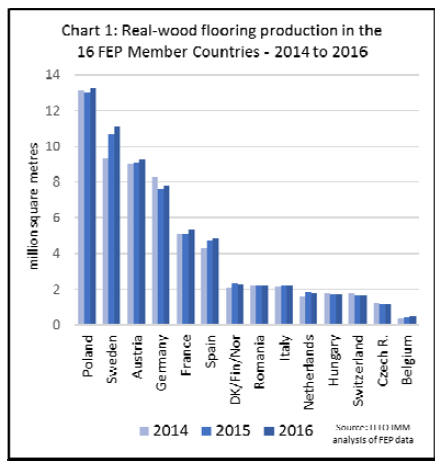

This data shows that consumption increased 1.7% in 2016

to 77 million sq.m in the 16 FEP countries, building on a

0.5% gain in 2016. It also shows that production in these

countries increased 2.5% to 65.6 million sq.m, with

notable gains in Poland, Sweden, Austria, Germany,

France and Spain (Chart 1).

According to FEP, in 2016 multilayer parquet floors

accounted for 80% of wood floors manufactured in the 16

FEP countries, up from 79% in 2015 (the majority

comprising three-layer parquet). Solid wood flooring

accounted for 18% of production, down from 19% in

2015, while mosaic accounted for 2%.

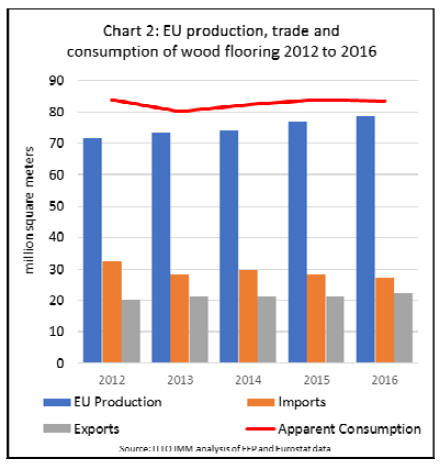

Data in the FEP annual report also indicates that total realwood

flooring production in the EU28 as a whole

increased 2.4% from 76.9 million sq.m in 2015 to 78.7

million sq.m in 2016.

Combining this with Eurostat trade data, which shows a

3.9% decline in imports and a 5.5% rise in exports by the

EU in 2016, consumption within the trading block appears

to have declined slightly, by 0.5%, during the year (Chart

2).

The combination of FEP and Eurostat data shows that the

share of all real-wood flooring supplied into the EU single

market by domestic manufacturers was 74.4% in 2016, up

from 73.2% in 2015 and from 68.6% in 2012.

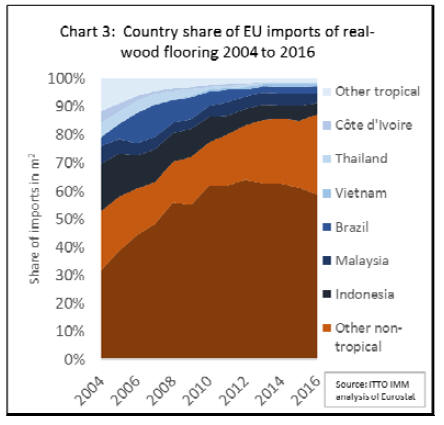

This analysis confirms that external suppliers into the EU

continue to lose share in the wood flooring sector. Eurostat

data also reveals that, amongst external suppliers to the

EU, tropical countries are rapidly losing share to temperate

countries.

EU28 imports of real wood flooring from the tropics

declined 18% to 3.46 million sq.m in 2016. Imports from

China also fell in 2016, by 8% to 15.9 million sq.m.

In contrast, imports from Ukraine increased 28% to 3.99

million sq.m, 21% from Switzerland to 1.28 million sq.m

and 25% to 1.2 million sq.m from Bosnia. The continuous

shift away from tropical suppliers of real-wood flooring is

made apparent in Chart 3.

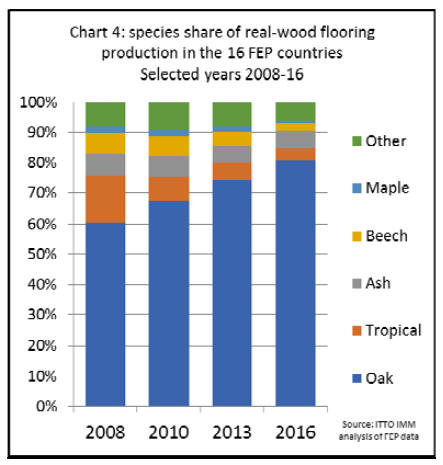

FEP data highlights the increasing reliance on oak in the

EU wood flooring sector, a factor which is both a result of,

and serves to reinforce, the dominance of domestic

suppliers in the EU market. The share of oak surfaces in

European real-wood flooring production increased from

77.7% in 2015 to 80.8% in 2016.

Meanwhile the share of tropical timber fell from 4.5% to

only 4.1%. Beech also fell from 3.8% to 2.5% and maple

from 1% to 0.6%. In fact, the only timber other than oak to

increase share was ash, rising from 5.6% in 2015 to 5.7%

in 2016, mainly because it is regarded as a cheap oak

substitute. (Chart 4).

The dominance of oak in flooring and the wider market for

interior furnishings is now acknowledged to be a serious

problem for the European hardwood sector. FEP observed

in their annual report that ※the growing shortage of oak as

primary raw material source remains a major concern and

has to be stressed once again§.

Similarly, the American Hardwood Export Council

(AHEC) in their report of the Interzum show in Cologne,

Germany, during May noted that ※for some importers, oak

(mostly from European sources) has increased from 50-

60% of their hardwood business to 80% or more in recent

years. Most of the hardwood traders AHEC spoke to

expressed concern about the unhealthy nature of the

situation and would like to see more demand for other

species§.

Laminates share of European flooring sector on the

rise

Another issue touched on in the FEP report is the

challenge for real wood flooring from laminates and nonwood

substitutes. The sheer scale of this challenge was

made clear from data published in May 2017 for the

Annual General Meeting (AGM) of the Federation for

European Producers of Laminate Flooring (EPLF).

Laminate flooring composed of HDF with a high

resolution printed image and embossed to provide texture

has been substituting for hardwood flooring now for well

over a decade.

However, the surface finishes continue to improve and

have become so convincing that, as the FEP comments; ※it

is becoming increasingly difficult for consumers to

differentiate parquet from competitive flooring alternatives

with a wood look surface.§

In contrast to the generally static market for real wood

flooring, EPLF members reported a 5.5% increase in sales

in 2017. Sales by European laminate manufacturers, at 477

million sq.m last year, now dwarf those of the real wood

flooring sector.

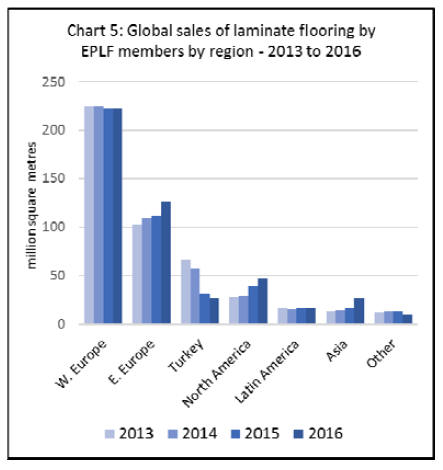

While EPLF members sales in Western Europe increased

by only 0.5% in 2016, to 223 million m2, they increased

14% to 126 million m2 in Eastern Europe, with strong

growth in Poland (+11%), Russia (+17%), Ukraine

(+20%) and Romania (+27%). (Chart 5).

European panels sector creates challenges for tropical

wood.

Of the wide range of panel products used in Europe, only

plywood is sourced in any volume from outside the region.

For this reason, the wood panels sector in Europe is

mainly of interest to tropical countries for the important

role it has played to drive development of tropical wood

substitutes.

In addition to the competition to hardwood flooring from

HDF-based laminate flooring referred to in the previous

section, OSB is an important competitor for construction

plywood while MDF has taken a rising share of the EU

interior decorative mouldings market, often replacing

lighter tropical hardwoods such as wawa/ayous.

The EU panels sector also remains a key source of

innovation in the international forest products sector and

continues to extend applications into new areas, often at

the expense of tropical wood products.

For example, a new process launched in 2011 to acetylate

MDF has created a product that can be used for exterior

applications, with a 50-year guarantee above ground and

25 years in ground, which now competes directly with

tropical hardwood products in exterior applications.

A less direct impact of the European panels sector on the

tropical wood trade, but perhaps just as important, is the

central role it plays to promote the wider sustainability

agenda in European market.

As a product based on wood fibre either from certified

forests in Europe or from off-cuts and other waste

material, Europe*s panel manufacturers have had a strong

incentive to promote the FSC and PEFC labels.

They have also been at the heart of European policy

initiatives to improve waste efficiency and promote the

circular economy and cascaded use of wood.

All these various themes were featured at the European

Panel Federation (EPF) AGM held in Porto, Portugal, on

29/30 June 2017. The EPF is one of the more influential

wood industry associations in Europe. The organisation

represents members in 25 countries including the

manufacturers of particleboard, MDF, OSB, hardboard,

softboard and plywood. The industry has an annual

turnover of about 22 billion Euros, employs over 100,000

people directly and includes more than 5,000 enterprises in

Europe.

In a review of the industry delivered to the event, the EPF

Managing Director reported that production in European

wood-based panels continued to recover slowly from the

downturn following the global financial crises.

Total production increased by 1.8% in 2016, to 55.6

million cu.m, still well below the level in excess of 70

million cu.m recorded in 2008 before the global financial

crises.

Production increased in 2016 across all the main product

categories including particleboard (+0.8% to 30.2 million

cu.m), MDF (+2.0% to 12 million cu.m), OSB (+6.9% to

5.4 million cu.m), softboard (+4% to 4.6 million cu.m),

and plywood (+2.5% to 2.9 million cu.m).

The only panel for which production did not increase in

2016 was hardboard which declined 5.6% to 0.5 million

cu.m.

At the AGM, members of the EPF endorsed priority areas

for future action to strengthen the market for European

panels and secure the future of the association:

E1 Compulsory 每 to seek EU legislation that endorses the

E1 standard for formaldehyde emissions as the minimum

requirement for panels placed on the EU market (E1

adhesives are required to have less than 0.75 formaldehyde

parts per million).

New Standard 每 to lead a project to define a single low

formaldehyde emission standard to arrest the proliferation

of different limit levels around the world and to facilitate

trade.

Image 每 to profile the wood-based panels industry as a

leader in Europe*s drive towards a circular economy and

resource efficiency, especially focusing on the Cascade

Use of Wood and its benefits.

Construction 每 to increase the use of wood-based panels in

construction, thereby growing the market whilst helping to

mitigate climate change due to wood*s carbon storage

qualities.

Africa 每 to share European experience of the production,

certification and marketing of wood-based panels with the

leaders of this growing market, thereby becoming a future

reference point.

Communications 每 to develop a new communications

model, including a new website, to bring EPF*s messages

and activities to members, internal and external

stakeholders, and to the general public.

Certification 每 to add the voice of EPF members to the call

for wood to come from certified and sustainable sources,

with no associated unnecessary bureaucracy and cost.

Biomass 每 existing industries to be safeguarded via a level

playing field, free from market distortions, allowing the

EU*s Circular Economy and Renewable Energy Directive

to work in harmony.

Federations 每 EPF to maintain and increase its profile

towards EU and national institutions working with

members, related wood-working industry federations and

NGOs.

Safe Finances 每 to achieve all of the above within a

balanced budget, ensuring the member contributions and

additional income cover expenses.

Acetylated wood strives to gain European market

foothold

The latest financial report of Accsys Technologies plc

suggests that acetylated wood, often cited as a competitor

to tropical wood in high exposure applications, is making

slow headway in the European market. The Dutch-based

modified wood producer recorded an 18% sales volume

increase in the year ended March 31, 2017, but also a loss

before tax of €4.4m (2016: €0.5m loss).

The 18% sales growth of Accoya acetylated wood saw

volumes increase to 39,790 m3 in the year, with a 31%

rise in the second half of the period. Sales by Medite of

Tricoya panels increased by 32% to 5,806 m3 last year.

Given the level of ambition for the accoya and tricoya

products, these volumes are still quite restricted. Accsys

claims that the potential market for Accoya and Tricoya

exceeds 2.6 million m3 annually 每 a very large figure

which implies the company has ambitions to capture a

large share of the existing European market for timber in

external applications and to expand into other regions.

Accsys observes that "Accoya captures the market share in

those applications which require rot, insect and water

resistance, i.e. primarily outdoor products. The Group is

focused on the higher-value end of these applications,

where the dual qualities of durability and dimensional

stability offered by Accoya are most highly valued.§

Target applications for Accoya include windows, doors,

decking and cladding and for Tricoya include facades and

cladding, soffits and eaves, exterior joinery, wet interiors,

door skins, flooring, signage and marine uses.

ATIBT planning one-stop tropical wood website

The ATIBT (International Tropical Timber Technical

Association) is building a one-stop website giving

performance and other use and specification data for

tropical timber species. This complements the ITTO LUS

species database launched in 2015.

See:

http://www.tropicaltimber.info/

The organisation, which has won support for the initiative

as a project of the Sustainable Tropical Timber Coalition

(STTC), says the goal is to make it easier for the trade to

sell tropical hardwood, and for end users and specifiers to

select the right material for the job. The aim is also to

broaden application of tropical wood by increasing market

confidence in using it in more areas and more ambitious

projects.

ATIBT has asked national European trade federations to

back the site, to support translation and provide

&catalogues* of popular species in their market. Most have

agreed.

The site is modelled on www.boistropicaux.org, which is

operated by French trade association Le Commerce du

Bois.

The ATIBT site will incorporate pictures of species and

applications, underpinned with technical specification data

from the Tropix database of French-based agricultural

research organisation CIRAD.

The new facility will also provide links to complementary

online sources, including the joint ETTF/ATIBT

www.timbertradeportal.com legality assurance and

business link website, which is sponsored by ITTO, and

the species specification guide at

www.houtdatabase.nl .

The new ATIBT site should be complete by the end of

July.

|