US Dollar Exchange Rates of 12th July 2017

China Yuan 6.7878

Report from China

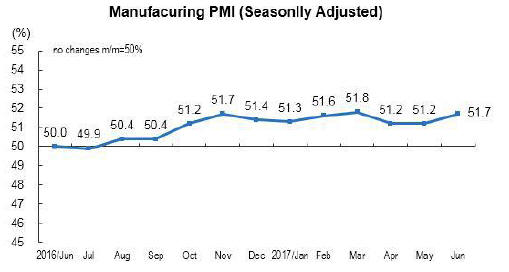

Manufacturing output continues to expand

China's manufacturing purchasing managers index (PMI)

moved higher in June touching almost 52 points, an

increase from the previous month. In releasing the June

PMI the National Bureau of Statistics (NBS) said the pace

of expansion in manufacturing had accelerated.

It is now more than 12 months since the PMI was above

50, the threshold separating expansion from contraction.

The NBS data tracks mainly larger and primarily stateowned

enterprises.

The PMI for large-sized enterprises was 52.7 points, up

1.5 points from May and continued to be higher than the

threshold. The PMI for medium-sized enterprises was 50.5

percent, down almost 1 point from the previous month but

managed to stay in the expansion range. Small sized

enterprises are still finding it tough as reflected in a PMI

of just 50.1points.

Reduction in VAT

As of 1 July 2017 the value-added tax rate structure as

determined in the State Council has been simplified from

the previous 4 rates 17%, 13%, 11% and 6%.

The four VAT rates have resulted in many practical and

compliance problems for taxpayers as they need to

properly classify their supplies to ensure that they charge

the correct VAT rate. The standardisation of the VAT rate

will help to partially relieve taxpayers from these

difficulties.

Value-added tax rates on agricultural products (including

logs) and natural gas will fall from 13% to 11%.

Rise in total output value of China¡¯s forestry industry

According to the State Forestry Administration (SFA), in

the first half of 2017 the total output value of China¡¯s

forest industry rose 7.4% to RMB 2.77 trillion. The total

value of China¡¯s foreign trade in wood product rose 11%

to US$71 billion.

The increase has been put down to recent policy changes

which promoted the national forestry and forest industries.

In the first half of 2017, in compliance with the 13th Five-

Year Plan for Forest Industry Development, regional plans

have been released by 11 national departments.

National policies promote optimising the structure and

productive capacity of enterprises in the sector. In the

forestry sector an emphasis has been placed on forest

tourism. In the first half of 2017 the numbers of tourist

visiting forest areas rose 17% to 700 million and this

generated an income of around RMB550 billion.

In the second half of 2017 the SFA will continue to

accelerate the development of the wood processing

industries through providing macro-economic guidance

and support.

In addition, timber industry demonstration zones for

leading enterprises will be further promoted. In terms of

specific measures, the SFA will speed up the

establishment of the national forestry industry investment

fund and the so-called emerging forestry strategic

industries development fund projects.

The SFA will promote the establishment of China forest

products exchanges, tackle negative market access issues,

launch a national timber/environmental product

development project and strengthen major forest products

brand development.

Timber transportation from Manzhouli

A train with 3,500 cubic metres of timber recently made

its first trip from Manzhouli Station directly to Jiangxi

Ganzhou Station. Imported timber from Russia can now be

transported directly to Jiangxi, Ganzhou. Point to point the

train takes about 3 days from Manzhouli to Ganzhou,

around half the time taken by trucks and at a much lower

cost.

It is anticipated that timber from Manzhouli will

eventually be transported by train to Shandong paving the

way for Russian timber to cost effectively reach inland and

coastal China. Transport by train has the added advantage

that delivery schedules can more accurately be established,

an issue that has caused confusion when trck transport has

been used.

Trends in China¡¯s domestic demand for wooden

flooring

The demand for wooden flooring in China has increased in

recent years to become a significant market for producers.

However, the development of the domestic market for

wooden flooring has been hampered by a persistent

shortage of timber raw material for manufacturing and this

has led to sharp price increases in the domestic market.

Analysts in China have assessed the likely future trends in

China¡¯s domestic flooring market.

Development, research and innovation

Many enterprises have begun to manufacture wooden

flooring utilising new materials and are promoting their

products as environmentally-friendly, comfortability and

suitable for recycling.

Popularity of formaldehyde free flooring

Formaldehyde free flooring is becoming increasingly

demanded and the importance of this will grow.

Promotion of bamboo flooring

As a renewable resource, timber and bamboo grow fast

and can be manufactured into first rate flooring. Currently

bamboo flooring is not very popular because of a lack of

consumer awareness and weak promotion efforts.

Qulaity

Chinese consumers have expressed concerns over cracking

and mould growth, problems that arise if the flooring is

inadequately dried and processed. This is a technical issue

that can be overcome and efforts are needed on promotion.

Rise in prices for wood panel

The authorities in China are working to improve air

quality through monitoring and control of industrial

enterprises.

Currently, inspection teams from the Ministry of

Environmental Protection have been assigned to Beijing

and Tianjin and 26 other cities in Hebei, Shandong, Shanxi

and Henan Provinces.

Inspection and monitoring will be carried out in each city

during 2017 according to information provided in the Air

Pollution Prevention and Supervision Scheme. Inspections

of wood based panel producers are underway and the

sector is expected to undergo a major transformation as it

moves to meet national environment standards and realise

green development.

The downside to the strict environmental regulations is

that panel prices have started to rise as factory output falls

and as some factories are forced to close.

|