|

Report from

Europe

Slow-down in EU tropical timber imports

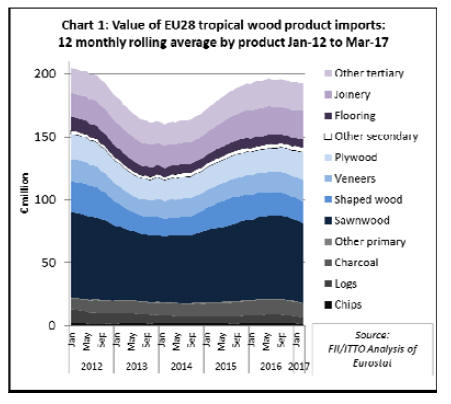

The slowdown in EU imports of tropical timber products

registered in the second half of 2016 continued into the

first quarter of 2017. Twelve monthly rolling average

imports, which peaked at just below €196 million in June

2016, had slipped to €193 million by March 2017.

Most of the rise and subsequent slowdown in EU tropical

imports in the 24 months prior to 2017 was driven by sawn

wood. Imports of other product groups remained relatively

more stable during this period (Chart 1).

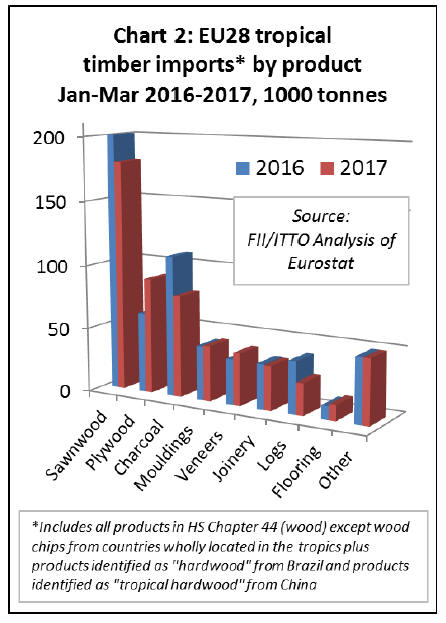

In the first quarter of 2017 compared to the same period in

2016, total EU imports of tropical timber products (all

those listed in HS Chapter 44) declined 5% to 553,000

metric tonnes (MT).

There was a 10% decline in EU imports of tropical sawn

to 180,000 MT, a 28% decline in imports of tropical

charcoal to 79,000 MT, and a 39% fall in imports of

tropical logs to 25,000 MT.

These losses were partially offset by a 45% rise in imports

of tropical plywood to 90,000 MT, a 2% rise in imports of

tropical mouldings (including decking) to 43,000 MT, a

15% rise in imports of tropical veneers to 40,000 MT, and

a 16% rise in imports of tropical flooring to 12,000 MT

(Chart 2).

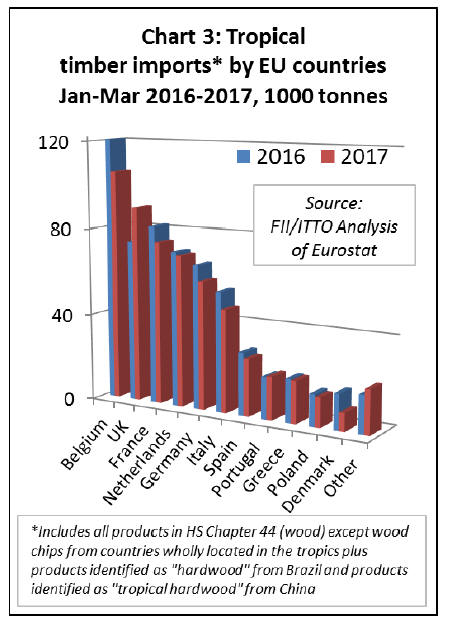

Tropical timber imports down in nearly all EU markets

After rising strongly in 2016, imports of tropical timber

products in Belgium declined 12% to 106,000 MT in the

first quarter of 2017. Imports of tropical timber products

into France, Germany and Italy, which have been slipping

in recent years, also had a slow start to 2017.

In the first quarter, imports declined 8% to 75,000 MT into

France, 11% to 59,000 MT into Germany and 14% to

47,000 MT into Italy.

After showing signs of recovery last year, imports of

tropical timber products into the Netherlands and Spain

weakened again in the first quarter of 2017. During the

period, imports fell 2% to 70,000 MT into the Netherlands

and 9% to 26,000 MT into Spain. (Chart 3).

The UK was the only large EU market for tropical timber

products registering an increase in imports in the first

quarter of 2017. UK imports increased 21% to 90,000 MT

during the period, although a significant part of this gain

was due to a rise in imports of tropical-hardwood-faced

plywood from China rather than an increase in direct

imports from the tropics.

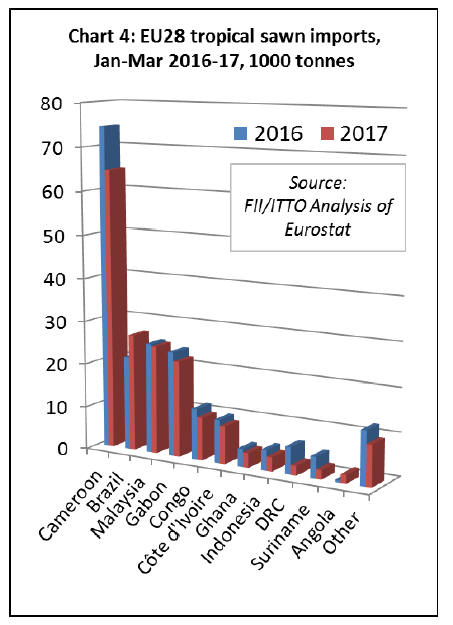

10% decline in EU imports of tropical sawn wood

EU imports of tropical sawn wood decreased by 10% to

180,000 MT in the first quarter of 2017. After a significant

rise in trade with Cameroon last year, EU imports of

tropical sawn wood from the central African country

declined 13% to 64,700 MT in the first three months of

2017.

Imports also fell from Malaysia (down 2% to 24,900 MT),

Gabon (down 8% to 22,100 MT), Congo (down 16% to

9,900 MT), Côte d'Ivoire (down 13% to 8,800 MT), Ghana

(down 18% to 3,400 MT), DRC (down 64% to 2,200 MT)

and Suriname (down 57% to 2,100 MT).

However, after a decline in 2016, EU imports of tropical

sawn wood from Brazil increased 25% to 27,000 MT in

the first quarter of 2017. Imports from Angola, which were

negligible in 2016, increased to 2,000 MT during the

period (Chart 4).

In the first quarter of 2017, tropical sawn hardwood

imports declined 15% to 62,100 MT into Belgium, 14% to

20,900 tonnes into France, 37% to 14,600 tonnes into

Italy, 21% to 10,400 MT into Spain, and 9% to 7,100 MT

into Germany. These losses were partially offset by a 10%

rise to 14,600 MT into the UK and a 33% rise to 8,100 MT

into Portugal.

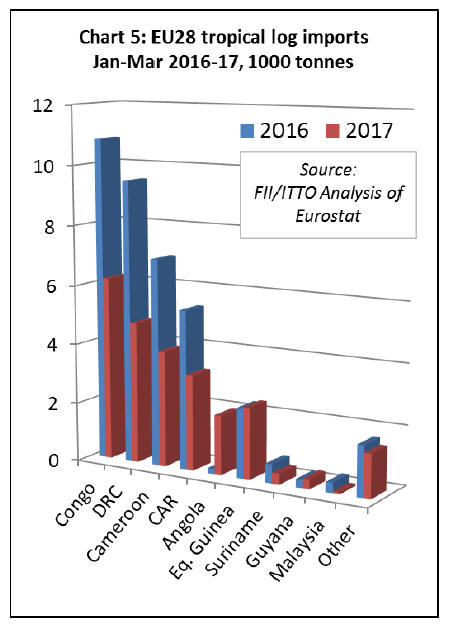

Downward trend in EU imports of tropical logs

After a brief recovery in 2015 and stasis in 2016, the

downward trend in EU imports of tropical logs resumed in

the first quarter of 2017. Imports were only 24,700 MT,

35% less than the same period in 2016.

EU imports of tropical logs decreased from all the leading

suppliers including Congo (down 43% to 6,200 MT), DRC

(down 50% to 4,750 MT), Cameroon (down 44% to 3,900

MT) and CAR (down 40% to 3,200 MT).

Imports from Equatorial Guinea were level during the

period at 2,400 MT and imports from Angola increased

from negligible levels to 2,000 MT. (Chart 5).

Most of the decline in EU imports of tropical logs in the

first quarter of 2017 was concentrated in France, Belgium

and Italy. Imports of tropical logs into Portugal were

stable during the period.

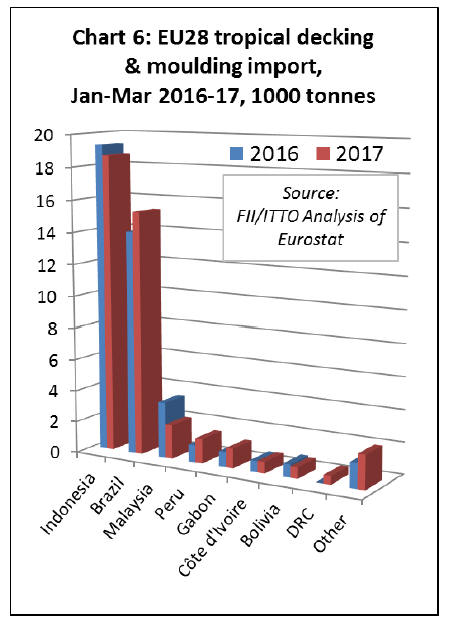

Stability in EU tropical decking imports

EU imports of tropical mouldings (which includes both

interior mouldings and exterior decking products)

increased 2% to 43,000 MT in the first quarter of 2017. A

9% rise in imports from Brazil to 15,300 MT was

sufficient to offset a 3% decline in imports from Indonesia

to 18,700 MT, and a 39% decline in imports from

Malaysia to 2,100 MT. (Chart 6).

Imports of tropical decking increased into France, were

stable into Germany and Belgium, but declined into the

Netherlands and UK in the first quarter of 2017.

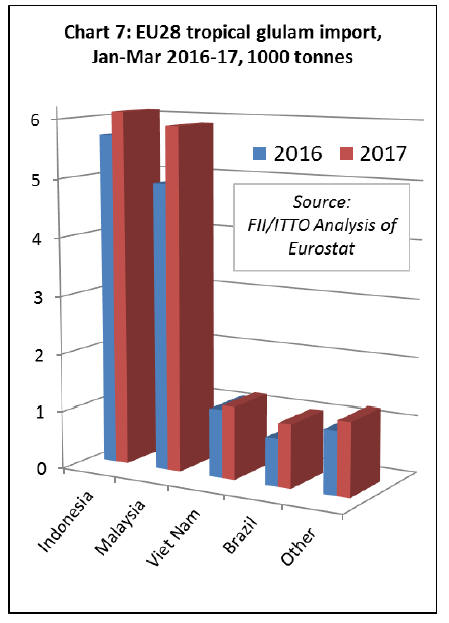

Rising EU imports of tropical glulam

EU imports of tropical glulam, mainly laminated window

scantlings, increased 14% to 15,600 MT in the first quarter

of 2017. Imports increased from both the leading

suppliers, rising 7% to 6,100 MT from Indonesia and 20%

to 5,900 MT from Malaysia. (Chart 6).

In the first quarter of 2017 EU imports of tropical glulam

increased into all the main EU markets for this

commodity, including the Netherlands, Belgium and

Germany.

Note that EU import data for the first quarter of 2017 for

tropical veneer, plywood, flooring, and wood furniture

will be included in the next market report.

Gradual recovery in EU construction forecast to

continue

Recovery of the European economy is boosting

construction output, although the overall growth rate is

forecast to remain slow in the next 2 years. These are the

main conclusions of the 83rd Euroconstruct Conference

hosted in Amsterdam on 8-9 June 2017.

Euroconstruct reported that European construction output

expanded by 2.5% in 2016, half a percentage point higher

than forecast at the previous Euroconstruct Conference

held in Barcelona in November 2016.

Euroconstruct now expect the volume of construction

output to increase by 2.9% this year and by 2.4% in 2018,

both above the previous projections in Barcelona (+2.1%

in 2017 and +2.2% in 2018).

The upgraded forecast reflects an economic upswing

stronger than expected half a year ago, greatly improved

consumer confidence and the continuing loose monetary

policy. Overall construction output is expected to increase

by 8% in 2016-2018 compared to the 6.5% forecast in

Barcelona. Thereafter growth is expected to moderate in

2019 (+2%), slightly below the Barcelona figure (+2.1%).

GDP growth of 1.5% to 2.0% per annum in the period

2017-2019 is projected for the 19 Euroconstruct countries.

According to Euroconstruct, the European economy is set

to follow a moderate growth path, stimulated by still

relatively low oil prices, the weaker euro exchange rate

and the Euopean Central Bank¡¯s stimulus policy

(quantitative easing).

In most European countries, domestic consumer demand is

increasing, stimulated by declining unemployment.

Investment has started to pick up, particularly since

households and companies can still secure inexpensive

financing, and foreign demand is developing favourably.

However, the pace of recovery remains relatively

moderate due to the sluggish implementation of economic

reforms as well as long-standing weak growth trends. In

general, the European economic growth potential is lower

than it was before the financial crisis, due to the

population ageing and declining productivity growth.

Euroconstruct estimate that residential construction in

Europe expanded by 5% in 2016. In the coming years

growth in this market segment is projected to become less

strong, expanding by 3.7% in 2017, 2.3% in 2018 and

1.7% in 2019. At present, output in the sector is boosted

by demographic trends, increasing household income and

low mortgage rates.

New residential construction expanded by 8.8% in 2016,

and growth this year will also remain very strong (+6.8%).

However, a significant slowdown in new residential

construction is expected in 2018 and 2019. Growth in

residential renovation and maintenance has been slower

but is expected to remain consistent at about 1.5% per

year.

Non-residential construction is forecast to grow only

modestly in the coming years; by 2.3% in 2017, 1.8% in

2018 and 1.2% in 2019. Despite the positive impulse from

the growth of consumer demand and relatively high

corporate profits, expansion in this sector is hindered in

many countries by lack of external financing and the poor

financial situation of public authorities.

Subsectors where public financing is particularly

important ¨C such educational building ¨C is generally

lagging other sectors.

Output in civil engineering, after contracting 1.8% in

2016, is forecast to increase by 2% this year and by 3.6%

in both 2018 and 2019. Much growth in civil engineering

will be concentrated in Eastern Europe, largely due to a

new round of EU structural funds.

Construction activity in most European countries is

growing consistently at around 2% per year during the

2017-19 period. However, activity is forecast to grow

much more rapidly in a few countries, notably Hungary

(14.9%), Ireland (7.7%), Poland (5.5%), Czech Republic

(4.3%) and Portugal (4.1%).

|