US Dollar Exchange Rates of 10th June 2017

China Yuan 6.7987

Report from China

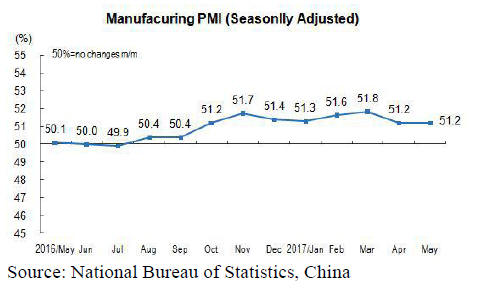

Manufacturing activity flat in May

Official data from the National Bureau of Statistics (NBS)

show that in May, China's manufacturing purchasing

managers index (PMI) stood at 51.2, the same as in April.

Since August last year the official index has been above

the negative threshold. However, the May Caixin/Markit

PMI dipped. This index, based on small and medium-sized

manufacturers, is suggesting that smaller firms are under

more pressure than the large state enterprises.

The Caixin PMI is a closely-watched gauge of nationwide

manufacturing activity, which focuses on small and

medium-sized companies, addressing a niche not covered

by NBS data.

See:

http://www.stats.gov.cn/english/PressRelease/201706/t20170601

_1499131.html

Chinese flooring makers hail recent anti-dumping

decision

Relief was expressed in China after the US Department of

Commerce announced its final determination of antidumping

duties made for the fourth annual administrative

review of China¡¯s multi-layered wood composite flooring

enterprises.

Customs codes for the products involved are 412.31.0520,

4412.31.0540, 4412.31.0560 and 4412.31.2510.

The average duties for all Chinese flooring shipments has

been set a zero except for Dalian Penghong Floor Products

Co., Ltd. (0.23%). This is an encouraging result from the

review and will encourage exports of China¡¯s multilayered

wood flooring to the USA.

See: https://www.gpo.gov/fdsys/pkg/FR-2017-06-05/pdf/2017-

11561.pdf

and

https://www.federalregister.gov/documents/2017/05/31/2017-

11202/multilayered-wood-flooring-from-the-peoples-republic-ofchina-

notice-of-correction-to-the-final

Formaldehyde emission standards set to improve

The Chinese national formaldehyde emission standard

(GB18580-2017) has been released by the General

Administration of China National Quality Supervision,

Inspection and Quarantine Bureau and China National

Standards Administration.

The standard will enter into force on 1 May 2018. In the

new standard, the formaldehyde emission limit will be

lowered to 0.124 mg/m3 and the test method for detection

of formaldehyde emission has been unified.

Analysts say that the revised standard will enhance

product quality and market acceptance and will profoundly

alter the structure of forest products industry.

Establishment of port system in Jiangsu province

A long term plan for port systems in Jiangsu province has

been prepared by the provincial government.

The aim is to create an advanced port system by 2030

through the development of ¡°One zone and Three ports¡±,

namely river and sea intermodal port zones along the

Yangtze River, the Nanjing regional shipping logistics

centre, Lianyungang port regional international hub port

and the Suzhou Taicang container port.

Currently there are 10 ports in the coastal region of

Jiangsu province. The 5 national ports include

Lianyungang Port, Nanjing Port, Zhenjiang Port, Suzhou

Port and Nantong Port. The main regional ports involve

Yangzhou Port, Jiangyin Port, Taizhou Port and

Changzhou Port.

Currently, there are 5 ports with 10 000 tonnes anchorage

in Nanjing, Zhenjiang, Taizhou, Nantong, Suzhou ports. A

further 48 anchorages will be established by 2030,

including some anchorages with 10,000 tonne capacity,

118 anchorages with 30,000 tonne capacity, 50 anchorages

with 50,000 tonne capacity and 11 anchorages with

100,000 tonne capacity.

Rise in log imports through Haicang port

According to Haicang Entry-Exit Inspection and

Quarantine Bureau in Xiamen City, Fujian province, the

value of log imports through Haicang Port rose 24% to

US$21 million between January and April 2017. The

imported logs were mainly from the USA, Australia, Chile

and New Zealand. The USA accounted for about 20% of

the total log import value through the port.

Soaring in log imports through Taicang Port

According to Taicang Entry-Exit Inspection and

Quarantine Bureau in Jiangsu province, timber (log and

sawnwood) imports amounted to 3.79 million cubic

metresin 2016, a year on year increase of 43%.

Sawnwood imports through the port came to 981,000

cubic metres, a year on year increase of 5%. Overall log

and sawnwood imports through the port totalled 8.88

million cubic metres in 2016, breaking a record high.

For this year up to April sawnwood imports have tended to

be stable but log imports have risen sharply (+64%). Of

total log imports those from Canada surged over 70% to

357,400 cubic metres, those from Australia rose 230%

compared to the same period last year.

Fire at Manzhouli timber market

A recent fire at the Manzhouli timber industrial zone has

affected dozens of companies,

It is estimated that some 250,000 cubic metres of timber

stocks were burnt and that losses will stretch to billions of

dollars.

Analysts forecast that the impact of this fire will cause a

short term shortage of timber and this will result in wide

price fluctuations.

Shanghai manufacturers began to relocate

Traders report that activity in the Shanghai timber markets

is very quiet. Analysts say one reason is that many wood

processing plants have relocated.

As early as March this year wood processing enterprises in

Shanghai without environment impact assessment

certificates were asked to stop production.

Also many wood processing factories began to move to

Zhangjiagang and Taicang Ports due to the increase in rent

and labour costs in Shanghai.

It is estimated that about 1,000 furniture makers have

moved out. As this trend continues the timber markets at

Taicang and Zhangjiagang will play a greater role in

distribution.

|