Japan

Wood Products Prices

Dollar Exchange Rates of 10th

June 2017

Japan Yen 110.33

Reports From Japan

Consumer confidence indices edge higher but

not the

index on spending

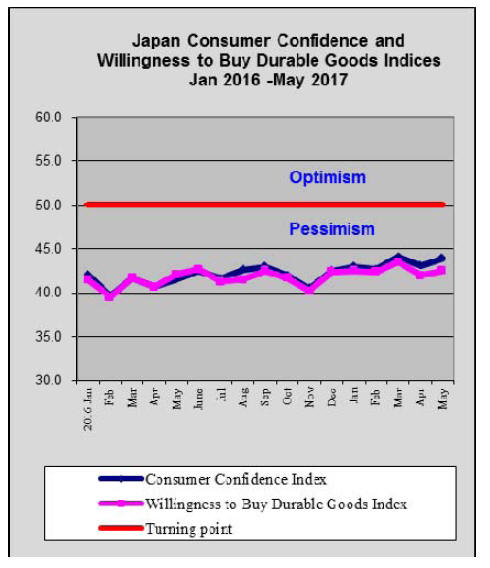

May consumer confidence and perception indices have

been released by the Cabinet Office in Japan. The overall

Consumer Confidence Index for May 2017 rose slightly

month on month but is still below the threshold for

optimism.

The data from the Cabinet Office includes consumer

perceptions and the May survey revealed that in terms of

prospects for overall livelihood, income growth and

employments edged higher but the willingness to buy

durable goods (which includes items such as furniture)

remained flat.

See: http://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

Low unemployment but still consumer spending will

not budge

May heralded the start of the annual recruitment drive by

most companies in Japan. The target is university students

who will graduate in early 2018.

Recent Ministry of Labour data showed the ratio of job

openings to job seekers is now more extreme than the high

seen during the Japanese ¡®bubble economy¡¯ in 1990. The

ratio of job openings to job seekers in April this year rose

to the highest level in more than 40 years.

Unemployment in Japan is at its lowest level for around 20

years but this is not all good news. Analysts are warning

this is mostly due to a shrinking labour force and that high

employment, coupled with low productivity (a serious

issue in Japanese companies) is not good for consumers as

higher than necessary costs are passed on through sales

prices.

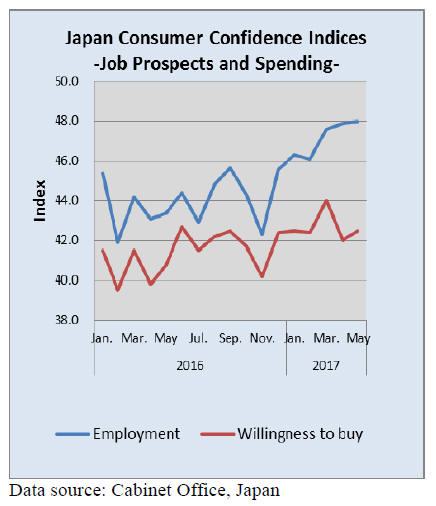

The major challenge in Japan is to stimulate consumer

spending which refuses to budge. An analysis of the latest

consumer confidence data is revealing.

In a situation where consumer perceptions of job prospects

and employment have been rising steadily this should have

translated into consumers having confidence to spend but

this is not happening as can be seen in the following

graphic.

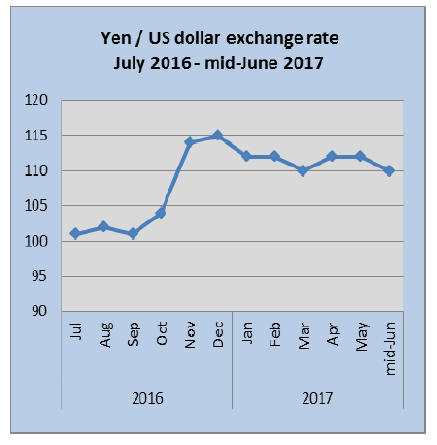

US rate hike already factored into Yen exchange

rate

Better than expected US employment data resulted in a

stronger US dollar in mid June and in Japan an

improvement in industrial output and investment has

brought relief to the government and Bank of Japan.

Despite the improvement in some main economic

indicators, political issues in the US are still swirling and

creating heightened risks for the Japanese economy.

Import round-up

Doors

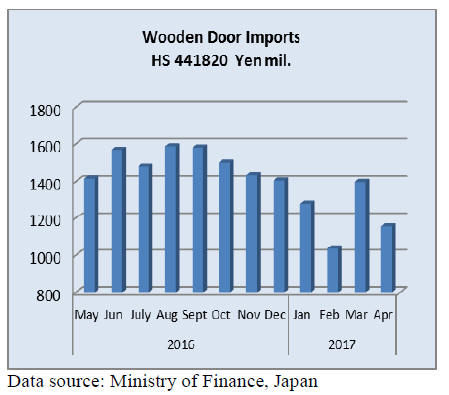

Japan¡¯s April wooden door (HS 441820) imports dropped

17% compared to a month earlier and were down around

8% year on year. The volatility in monthly door imports is

unusual and cannot be explained by either currency

fluctuations or housing start trends.

At 58% of all wooden door imports in April, China was

the main supplier followed by the Philippines (15%),

Malaysia (12%) and Indonesia (8%).

Windows

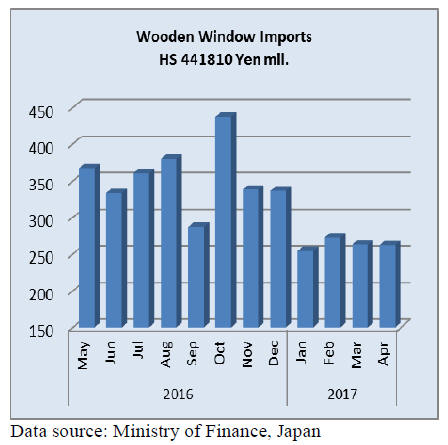

Wooden window (HS441810) imports into Japan for the

first four months of this year are down around 17%

compared to the same period last year. For every month

this year imports of wooden windows have been well

below that of a year ago.

Over 75% of Japan¡¯s wooden window imports come from

China and the US and most of the balance is made up of

shipments from the Philippines.

Assembled flooring

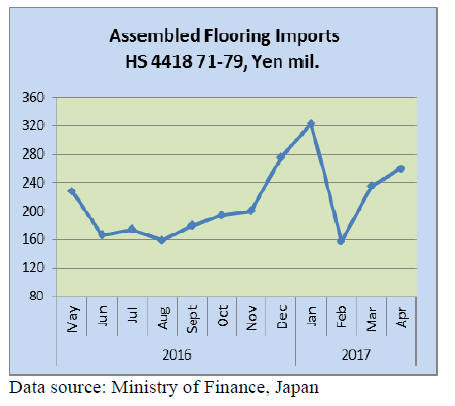

After the unexpected decline in assembled flooring

imports recorded in February this year, there was a

rebound in March and this continued into April.

Japan¡¯s April imports of assembled flooring (HS441871-

79) were 10% up on levels in March and were almost 50%

higher than in April 2016.

Most of Japan¡¯s imports of wooden flooring fall within HS

441875 (65%) and HS441879 (29%). Shippers in China

dominate supplies of HS 441875 but for HS441879

supplies come from China, Thailand and Indonesia.

Because of the unusually high level of imports in

January

this year, there has been an almost 30% increase in arrivals

of wooden floor imports during the first four months of

this year.

Plywood

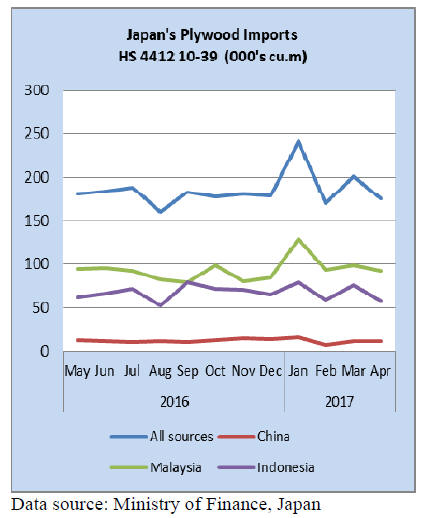

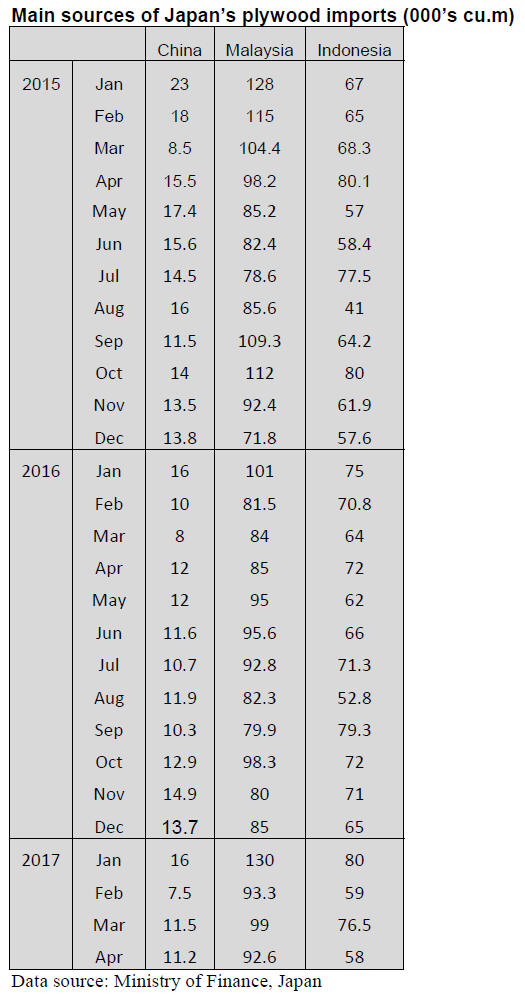

The figure below shows the trend in imports of plywood (

HS 441210/31/32/33/34 and 39).

Three shippers, Malaysia, Indonesia and China continue to

dominate the Japanese market for imported plywood.

Shipments of plywood within HS 441231 account for the

bulk of Japan¡¯s plywood imports and in April this year

amounted to some 86% of all plywood imports. HS441233

and 34 account for another approx. 12% of imports.

In April this year shippers in China supplied around

the

same volume to Japan as was the case in March (approx.

11,000 cubic metres) on the other hand shipments from

both Malaysia and Indonesia were down compared to a

month earlier.

Shipments from Malaysia were down 6.5% in April

while

shipments from Indonesia were down almost 25% from

March.

However, for the first four months of this year shipments

to Japan from Malaysia were up around 18%. On the other

hand shipments from Indonesia in the first four months of

this year were up slightly compared to the same period in

2016.

¡¡

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Clean Wood law promulgated

The Clean Wood law to promote using legally proven

wood products is promulgated on May 1. It is effective

since May 20. This is also titled as the law to promote of

using and distribution of legally harvested wood products.

Purpose of the law is to increase using wood products

proven legally at private industry level.

There are two categories. One is primary handling

industry, which receive logs directly from log harvesters

such as initial processors of sawmill, plywood mill,

exporter or importer from overseas suppliers.

Secondary group is wood industry except for the primary

group, which deals with processing, marketing and

construction.

Objects are all products using wood mainly such as desk,

chair, cabinet, shelf, paper products flooring, siding board

and biomass for power generation.

Regarding registration, application requires type of

category, primary or secondary, type of business such as

wood processor, wood marketer, exporter or importer,

builder, biomass power generator then section to secure

use of legally certified wood products. Volume of wood

use is for one year.

Primary dealers need to register species of wood and

country of origin and region where wood is harvested.

Also what measures are taken to handle legally proven

wood products and who is in charge needs to be registered.

Registration organizations publicize contents of individual

registration by internet. Registered dealers need to report

to the Minister in charge status of handling of legally

proven wood once a year and the

officials can make investigation of office, warehouse and

plant. There is penalty for false report.

Actually registration organizations have not been assigned

yet so that actual registration will be next fall when the

law is actually put into practice. Therefore,

acknowledgment in the industry for the law is low yet.

Once large house builders register, materials suppliers

need to follow the law to procure legally proven or forest

certified wood but such move has not started yet.

Review of 2016 domestic wood demand

Demand for domestic wood in 2016 was 20,629,000 cbms,

3% more than 2015. The demand increased because new

housing starts increased in 2016. In particular, log demand

for plywood was very active with 3,682,000 cbms, 9.7%

more than 2015.

Logs for lumber were 12,180,000 cbms, only 1.5% more.

Logs for wood chip were 4,791,000 cbms, 2.3% more.

Total demand including imported logs was 26,029,000

cbms, 3.7% more. Imported logs were 5,370,000 cbms,

6.4% more in which North American logs were 4,106,000

cbms, 8% more.

In total log demand, share of domestic wood was

79.4%,

0.5 points less than 2015.

Regardless of effort to develop new demand for domestic

wood, last year¡¯s result revealed new housing starts are the

key factor for domestic wood. Except structural materials,

log demand for plywood has largely increased. To expand

demand for housing, new materials are necessary like

strong earthquake resistance or large wooden buildings

like CLT.

According to wood demand statistics of 2015, total wood

demand was 75,160,000 cbms in log scale, 0.8% down

from 2014 but domestic production was 24,918,000 cbms,

5.4% up so share of domestic wood was 33.2%.

Domestic production of industrial wood was 21,580,000

cbms, 1.5% more while logging residue left in the woods

was 217,000 cbms, 6.1% down. Logs for fuel largely

increased with 3,962,000 cbms, 34.8% up because more

biomass power generation plants started operation.

Log export declined in 2016 with about 640,000 cbms

after Chinese economy got shaky and the yen weakened.

This business is largely relied on exchange rate.

As to imported wood, total declined including logs except

for wood chip of 21,023,000 cbms, 2.1% up and for fuel of

1,156,000 cbms, 5.3% up. This trend continues but in

2016, total recovered because of active housing starts in

Japan.

Log production by the regions is over 5 million cbms by

six prefectures in the North East region and nearly 6

million cbms by seven prefectures in Kyushu.

By species, cedar was 11,848,000 cbms, 5.5% up. Cypress

was 2,466,000 cbms, 4.1% more. Larch was 2,312,000

cbms, 0.6% more and fir was 1,013,000 cbms, 4.5% more.

Hardwood species were 2,188,000 cbms, 2.1% less.

Demand for hardwood was down for paper and pulp

manufacturing but the demand as fuel for biomass power

generation is expected to increase.

While demand for domestic wood is increasing, challenge

is how to maintain sustained yield management of the

forest by effective reforestation.

Total wood supply in 2016 by use is 12,182,000 cbms for

lumber, 1.5% more, 3,682,000 cbms for plywood, 9.7%

more and 4,796,000 cbms for wood chip, 2.3% more.

Total was 20,660,000 cbms, 3.0% more. Increase for

lumber is largely due to increase of owner¡¯s units and

units built for sale in housing starts in 2016.

Actually in 2016, supply of both domestic and imported

logs increased so the increase is simply by more housing

starts and there was no remarkable shift from imported

woods to domestic wood.

Imported log supply was 5,370,000 cbms, 6.4% more in

which 4,408,000 cbms, 5.5% more was for lumber and

957,000 cbms, 10.8% more for plywood so increase of

imported logs was more than domestic logs.

As a result, share of domestic logs was 79.4%, 0.5 points

less in which logs for lumber was 73.4%, 0.8 points less

and for plywood was 79.4%, 0.2 points less.

Number of sawmills continues declining with 4,933, 272

less than 2015. Log consumption by mill was 3,356 cbms,

8.4% more because size of mill is getting larger. 69.5% of

log consumption is by large mills with electric power

output of more than 300 kw so share of large mills is

increasing.

Logs consumed by sawmills 12,182,000 cbms by species,

cedar was 8,095,000 cbms, 2.9% more than 2015 and

cypress was 1,983,000 cbms, 2.5% more. Larch was

1,150,000 cbms, 4.0% less. Pine was 128,000 cbms,

16.9% less. The decline is due to less demand by plywood

mills.

Logs for plywood were 4,638,000 cbms, 10.0% more, out

of which domestic logs were 3,628,000 cbms, 9.7% more

and imported logs were 957,000 cbms, 10.8% more but

the share of domestic and imports remains unchanged.

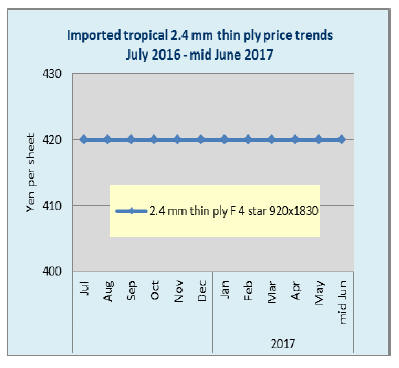

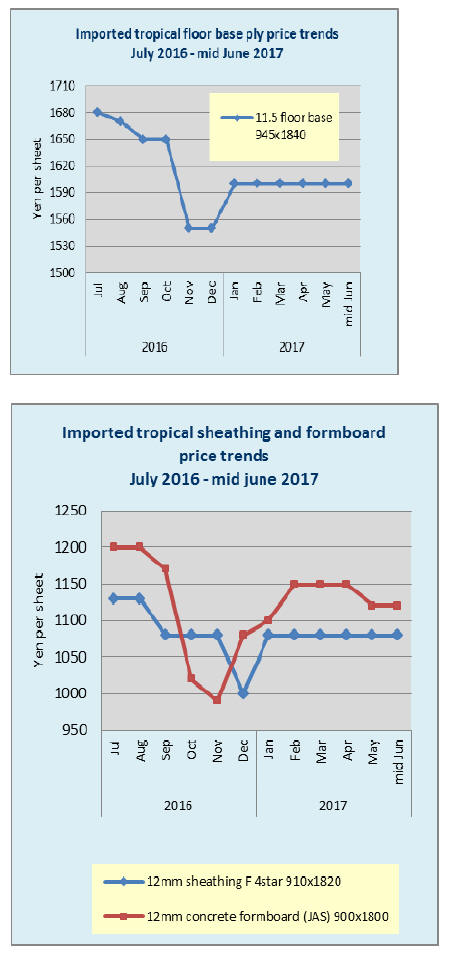

Mid-June wholesale plywood prices

As yet there is no sign of the higher plywood prices being

sought by shippers in Malaysia affecting wholesale prices

in Japan.

|