|

Report from

North America

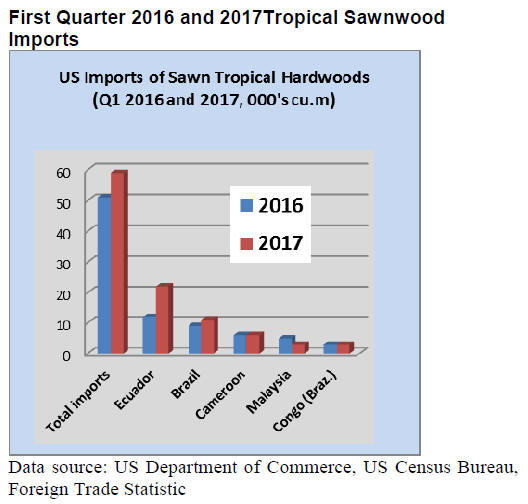

Sawnwood imports rebound

US sawn hardwood imports rebounded in March following

a 24% drop in February. March imports of sawn hardwood

were 75,114 cu.m., up 41% from the previous month. The

volume share of tropical sawnwood in total hardwood

imports declined in March compared previous months, but

tropical species accounted for over half of the value of

imports.

Tropical sawnwood imports increased 24% in March to

19,978 cu.m. and year-to-date imports were also up from

the same time in 2016.The value of imports grew 36%

from February. Ipe sawnwood imports were 2,780 cu.m. in

March, up 14% year-to-date from March 2016.

Ipe imports from Brazil were valued US$5.8 million, in

addition to small import volumes from Guyana and Spain.

Balsa sawnwood imports from Ecuador recovered in

March. Balsa imports were 7,352 cu.m., a 76% increase in

year-to-date imports compared to the same time last year.

Imports of sapelli sawnwood were down from February,

but year-to-date imports increased 11% from March 2016.

Cameroon exported 922 cu.m. of sapelli sawnwood to the

US in March, followed by Congo/Brazzaville with 604

cu.m.

Hardwood imports from Malaysia were down compared to

the same time last year due low imports in January, but in

March imports grew to 1,631 cu.m. Keruing sawnwood

accounted for the majority of Malaysian shipments in

March (1,218 cu.m.).

Imports from Indonesia were 1,145 cu.m. in March and

year-to-date imports grew 21% from the same time in

2016.

Canada doubled mahogany imports in March

Canadian imports of tropical sawnwood increased slightly

in March to US$1.95 million (all import values in US

dollars). The value of year-to-date imports was up 6%

from March 2016. Imports of mahogany sawnwood

doubled in March to US$138,948.

Compared to March 2016 year-to-date imports of

mahogany quadrupled. The growth was in mahogany

imports from Bolivia which shipped US$77,167 worth of

sawnwood, according to Statistics Canada.

Cameroon also expanded mahogany exports to Canada in

March, while sapelli imports from Cameroon declined to

US$188,431. Canada¡¯s overall sapelli imports fell to

US$294,636 in March, down one third year-to-date

compared to March 2016.

Sawnwood imports from Brazil more than doubled in

March to US$414,194. The bulk of the imports from

Brazil are classified ¡°nes¡± (not elsewhere specified).

Balsa imports from Ecuador were up in March

(US$419,422). Canadian hardwood imports from

Myanmar and Peru rose in March, while imports from

Gabon, Malaysia and Thailand declined.

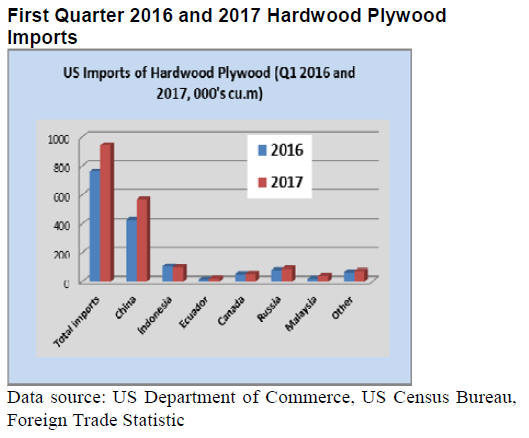

Malaysia and Ecuador expand share in hardwood

plywood imports

Hardwood plywood imports declined in March to 285,656

cu.m., but year-to-date imports were 25% above March

2016 levels. The value of plywood imports increased 19%

year-to-date. Plywood imports from most countries went

up in the first quarter 2017 with the exception of

Indonesia.

Imports from Malaysia and Ecuador had higher than

average growth. China expanded its share in total year-todate

plywood imports to just over 60%.

Among the smaller suppliers, Cambodia increased

plywood exports to the US in March (5,335 cu.m.).

Imports from Vietnam also grew in March (3,065 cu.m.),

but their value declined from the previous month.

Tropical veneer imports continue to fall

Tropical hardwood veneer imports grew 30% in March to

US$2.0 million, but year-to-date veneer imports remain

small compared to last year. Year-to-date the US has

imported US$6.2 million worth of tropical veneer,

compared to US$209 million at the same time last year.

Little change in moulding imports in March

Hardwood moulding imports were almost unchanged in

March at US$14.2 million. Year-to-date imports were 3%

down from March 2016. Moulding imports from Brazil

recovered in March (US$2.8 million), but year-to-date

Brazil shipped 17% less than in March last year.

China remains the largest supplier of hardwood moulding

to the US despite a one-third decline in March to US$4.4

million.

Indonesia and Vietnam expand assembled flooring

exports to US

Hardwood flooring imports fell 38% in March from the

previous month to US$2.7 million. Year-to-date imports

remain significantly up from last year. Indonesia and

China had the strongest year-to-date gain along with

smaller suppliers like Brazil. Hardwood flooring imports

from Brazil increased to US$238,520 cu.m. in March.

Malaysian shipments to the US fell by more than half

compared to March 2016.

Imports of assembled flooring panels (including

engineered hardwood flooring) increased 11% in March to

US$10.3 million. Year-to-date imports of assembled

flooring were up from March last year with most gains in

imports from Indonesia and Vietnam.

Assembled flooring imports from Vietnam were worth

US$1.1 million in March, compared to US$1.2 million

from Indonesia and US$2.5 million from China.

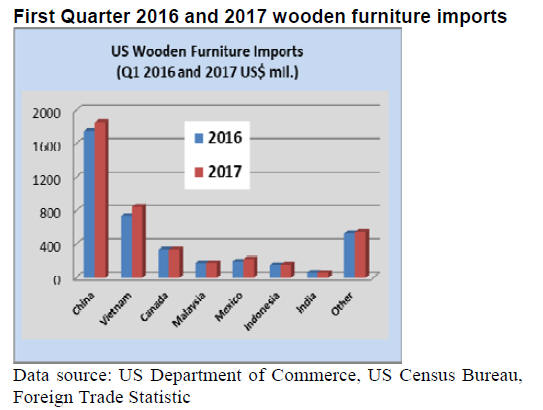

Wooden furniture imports from China down

The value of US wooden furniture imports declined for the

second consecutive month in March to US$1.24 billion.

Year-to-date imports were still 7% higher than in March

2016.

As in February, the month-on-month decline was mainly

in imports from China (-17%) and Vietnam (-15%). Yearto-

date imports from Vietnam however, were 15% higher

than in March last year.

Wooden furniture imports from most other countries

increased in March. Imports from Mexico grew 16% to

79.4 billion. Furniture imports from Indonesia were

US$60.7 million, up 29% from February. Much of the

March decline in wooden furniture imports was in kitchen

furniture. Imports of most other types of wooden furniture

changed little from February.

GDP growth slows in US but consumer confidence

high

GDP growth slowed to 0.7% in the first quarter of 2017,

according to the advance estimate by the US Department

of Commerce. Lower spending by governments at all

levels and higher imports contributed to the lower growth

in GDP compared to the 2.1% growth rate in the previous

quarter.

However, investment in non-residential and residential

construction was up in the first quarter. Economic activity

in the manufacturing sector expanded in April, according

to the latest survey by the Institute for Supply

Management. Furniture manufacturing reported higher

output in April, while activity in the wood products

industry was unchanged from the previous month.

Consumer confidence in the economy has remained strong

since the election of President Trump, according to the

University of Michigan¡¯s survey of consumers. Even

before the election consumer sentiment was positive as

household incomes grew and inflation remained low.

Buying plans for household durables such as furniture

increased in May to its highest in a decade. Overall

personal consumption expenditures are expected to grow

2.3% in 2017.

|