US Dollar Exchange Rates of 10th

May 2017

China Yuan 6.9038

Report from China

Sawn softwood import volumes

Four timber groups dominated China¡¯s sawn softwood

imports in 2016, korean and Scots pine (8.3 million cu.m,

47%), spruce and fir (8.11 million cu.m, 45%), radiata

pine (1.19 million cu.m, 7%) and Douglas fir (0.23 million

cu.m, 1%).

The volume of korean and scots pine, spruce and fir,

douglas fir and radiata pine imports rose 41%, 11%, 9%,

and 1% respectively year on year.

Main sawn hardwood imports

The main sawn hardwood species imported into China in

2016 were oak (1,380,000 cu.m, 10%), American ash

(508,000 cu.m, 3.54%), beech (503 000 cu.m, 3.51%),

cherry (150,000 cu.m, 1.06%) and merbau (130,000 cu.m,

0.93%).

The volumes of cherry, ash, oak and merbau rose 55%,

14%, 11%, and 3% respectively, but, overall, North

America hardwoods and beech imports fell 11% and 1%

year on year respectively.

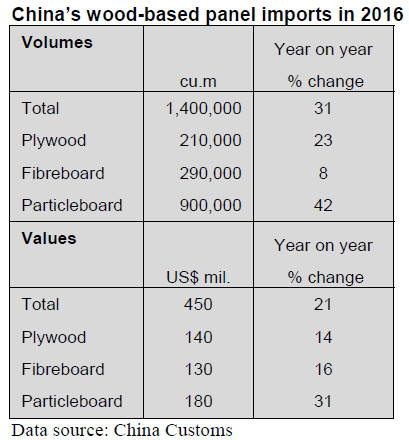

Particleboard dominated wood-base panel imports

China¡¯s wood-based panel imports in 2016 were 1.4

million cubic metres valued at US$450 million, a year on

year increase of 31% in volume and a 21% increase in

value. Particleboard dominated China¡¯s wood-based panel

imports accounting for 65% of the total wood-based panel

imports. Particleboard imports were 900,000 cubic metres

valued at US$180 million, up 42% and 31% respectively.

China¡¯s particleboard imports were mainly from Thailand

(290,000 cu.m), Malaysia (220,000 cu.m) and Romania

(150,000 cu.m), a year on year increase of 115%, 13% and

6% respectively. 72% of China¡¯s particleboard imports

were from the above-mentioned three countries.

Particleboard imports to China were shipped mainly

through Tianjin (220,000 cu.m), Shanghai (180,000 cu.m),

Huangpu (140,000 cu.m) and Shenzhen Customs (120,000

cu.m).

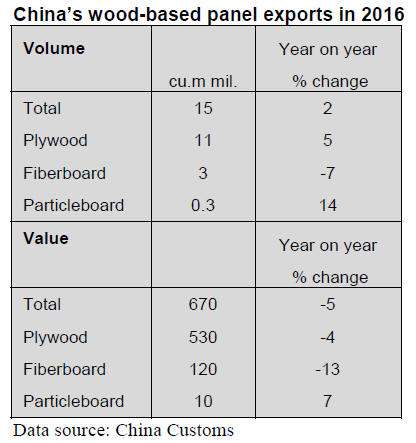

Plywood dominated wood-based panel exports

China¡¯s wood-based panel exports in 2016 totalled 15

million cubic metres valued at US$670 million, a year on

year increase of 2% in volume but decrease of 5% in

value.

Plywood dominated wood-based panel exports in 2016

and accounted for 76.5% of the total wood-based panel

exports. Plywood exports totaled 11 million cubic metres

in 2016 valued at US$530 million, up 5% in volume but

down 4% in value.

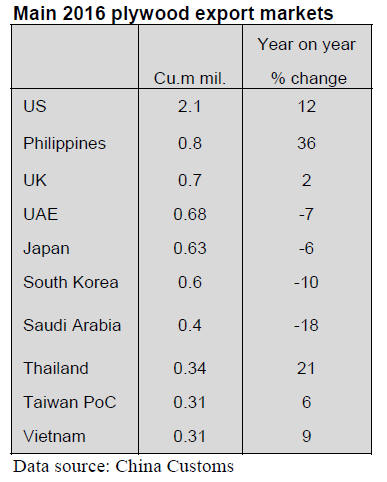

Most of China¡¯s plywood exports were destined for the US

market (2.1 million cu.m), a year on year increase of 12%.

Shipments of plywood from China to international markets

were mainly through Qingdao (4.47 million cu.m) and

Nanjing (4.33 million cu.m), a year on year increase of

16% and 1% respectively. 78% of China¡¯s plywood

exports were through the above-mentioned two ports.

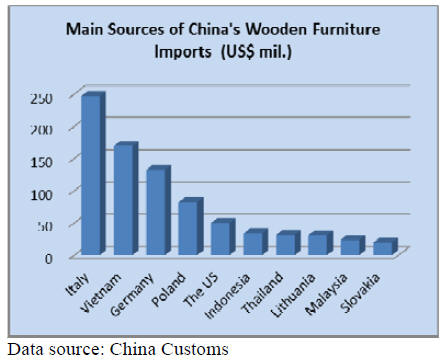

China¡¯s wooden furniture imports

The value of China's wood furniture imports was US$964

million in 2016, a year on year increase of 9%. Over 70%

was imported from five countries; Italy (US$247 million,

26%), Vietnam (US$169 million, 18%), Germany

(US$132 million, 14%), Poland (US$82 million, 8.5%)

and the US (US$50 million, 5.2%).

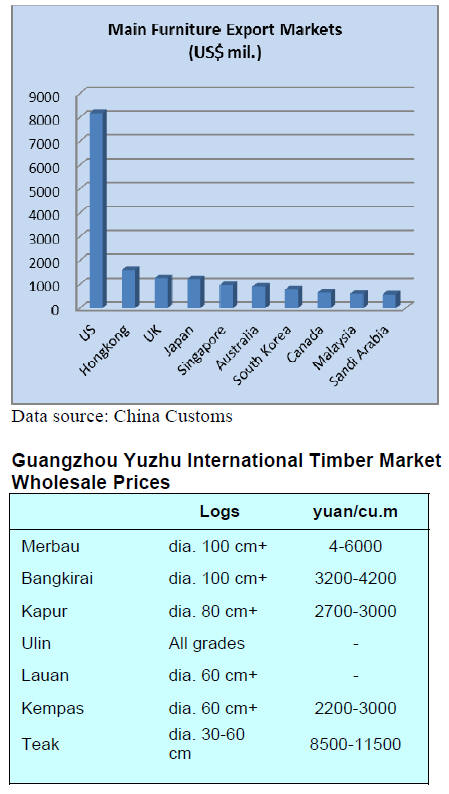

US the main destination for wooden furniture exports

The value of China¡¯s wooden furniture exports (including

wooden seats) was US$22.3 billion in 2016, a year on year

decline of 3%. The US was the main destination for

China¡¯s wooden furniture exports and was worth US$8.2

billion, up 4% year on year, and accounted for 37% of all

wooden furniture exports in 2016. The 10 countries shown

below accounted for around 75% of China¡¯s wooden

furniture exports in 2016.

|