US Dollar Exchange Rates of 25th

April 2017

China Yuan 6.8882

Report from China

Supply and consumption of wood products 2015

According to the 2016 China Forestry Development

Report, total timber supply (domestic resources and

imports) in 2015 rose 2.3% to 552 million cubic metres

(RWE).

Of the domestic timber supply, 13% was for commercial

processing, 7% farm use and fuelwood, and 27% for

fibreboard and particleboard. Timber imports accounted

for a further 53% of the total timber supply which include

logs, sawnwood, veneer, wood-based panel, wooden

furniture, wood pulp, wood chips, paper and paper

products, waste paper, as well as other wood products. The

Forestry Development Report also says China¡¯s timber

consumption rose.

Domestic timber resources are mainly consumed in

construction 30%, 1.7% in the coal industry, 29% in paper

making, 12% in wooden furniture, 3.5% in the transport

sector and 5.5% timber consumption for farmer use and

fuelwood with the balance being for other purposes.

Timber exports account for around 18% of timber supply

and comprised mainly wooden furniture, wood-based

panels, wooden doors, window and flooring, paper and

paper products.

Forest products trade of growing importantance

According to statistics from China Customs, the value of

the country¡¯s commodity trade in 2016 fell 0.9% to

US$3.685 trillion. Of the total, the value of exports

dropped 2% to US$2.097 trillion while the value of

commodity imports rose 0.6% to US$1.587 trillion.

The proportion of forest products trade to the total

commodity trade in 2016 was 3.86%, a year on year

increase of 0.22%. The proportion of forest products

exports to the total commodity exports came to 3.72%, a

year on year increase of 0.27%.

The proportion of forest products imports to total

commodity imports amounted to 4.04%, a year on year

increase of 0.15% percentage points.

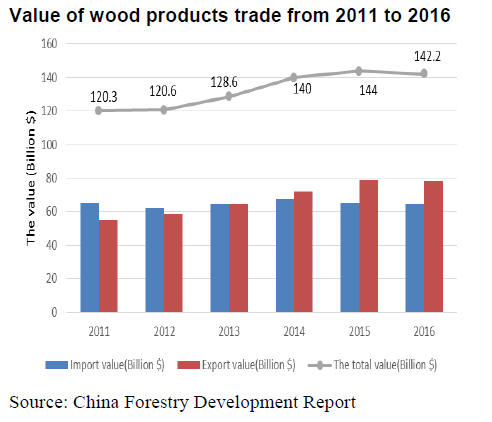

Value of wood products trade

The total value of China¡¯s wood products trade in 2016

fell 1.28% to US$142.2 billion. Of the total, the value of

forest products exports dropped 0.72% to US$78.12

billion, the value of forest products imports declined

1.95% to US$64.09 billion.

Softwood log imports volumes

The main imported softwood log species in 2016 were

radiata pine (14.09 million cu.m, 41%), spruce and fir

(5.55 million cu.m, 16%), Korean pine and Scots pine

(4.64 million cu.m, 14%), larch (2.41 million cu.m, 7%)

and Douglas fir (1.87 million cu.m, 6%).

The volume of Douglas fir, spruce and fir, radiata pine,

Korean pine and Scots pine imports rose 17%, 16%, 15%,

and 3%, but larch imports fell 5% year on year. The

above-mentioned species accounted for 84% of total

softwood log imports.

Main hardwood log imports

The main imported hardwood log species in 2016 were

okoume (852,000 cu.m, 5.79%), oak (849,000 cu.m,

5.77%), redwood (800,000 cu.m, 5.4%), beech (600 000

cu.m, 4%), North America hardwood (430,000 cu.m, 3%)

and Merbau (250,000 cu.m, 2%).

The volumes of North America hardwoods, merbau,

okoume and redwood rose 38%, 36%, 33%, and 7%

respectively, but beech and oak imports fell 16% and 5%

year on year respectively.

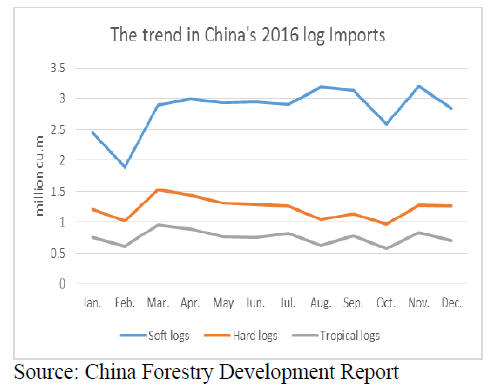

Monthly change in China¡¯s log imports

China¡¯s timber importers reduced log inventories around

the 2016 Chinese New Year celebrations in February and

at the time of the National Day Holiday in October 2016.

As will be seen in the graphic below there was a fall in log

deliveries in February and October.

The average monthly volume of softwood log imports in

2016 rose 13% to 283 million per cubic metres.

The average monthly volume of hardwood log imports

rose 2% to 123 million cubic metres per cubic metres.

Softwood log imports were largest at 3.2 million cu.m in

November and lowest in February at 1.9 million cu.m. A

similar trend can be seen between hard log imports and

tropical log imports.

Hardwood log imports and tropical log imports were

largest at 1.53 million cu.m and 0.96 million cu.m

respectively in March and lowest at 970, 000 cu.m and

580, 000 cu.m respectively in October 2016.

¡¡

|